Your 1041 accounting income worksheet images are available. 1041 accounting income worksheet are a topic that is being searched for and liked by netizens now. You can Find and Download the 1041 accounting income worksheet files here. Download all free images.

If you’re looking for 1041 accounting income worksheet images information linked to the 1041 accounting income worksheet keyword, you have pay a visit to the ideal site. Our site always gives you hints for seeking the maximum quality video and picture content, please kindly search and locate more enlightening video content and images that match your interests.

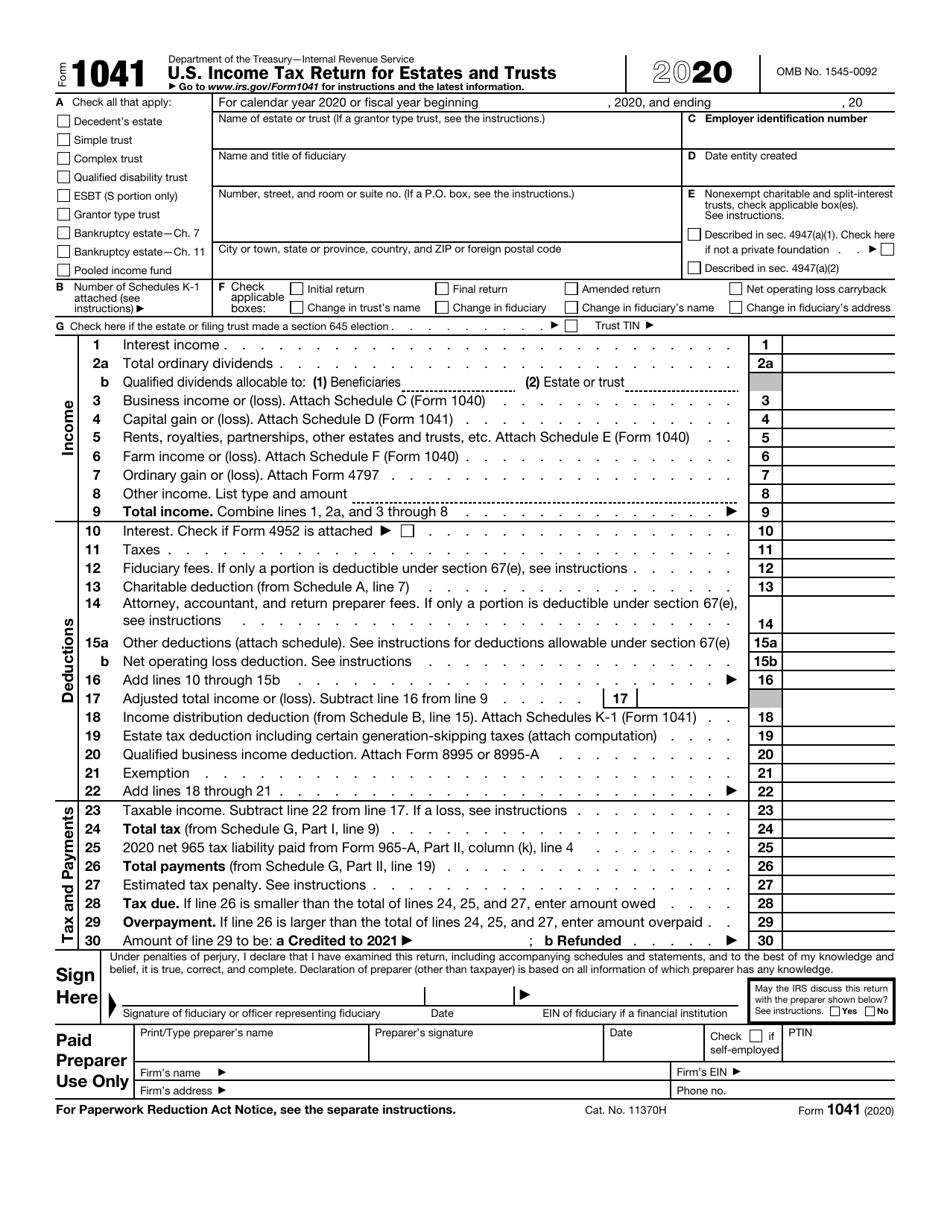

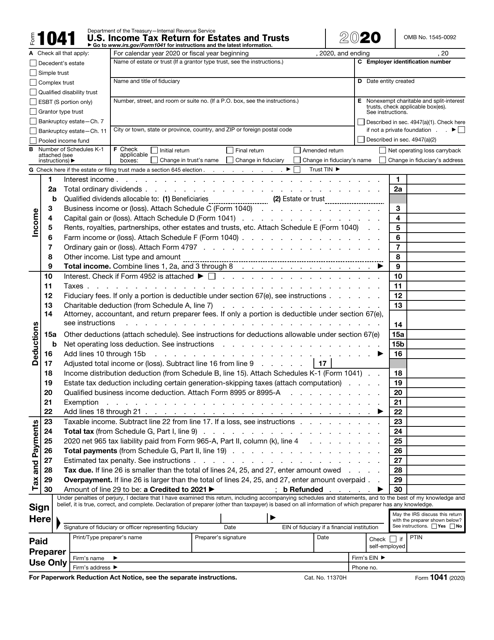

1041 Accounting Income Worksheet. Net income amounts on this worksheet are available for allocation to beneficiaries on Form 1041 Schedule B line 9 as income required to be distributed currently. In that event then generally the trust accounting income displayed 0 2 240. Go to Section 1 - Distribution Options. In some cases you will need to use the Trust Accounting Income formula to prepare Form 1041 the US.

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service From irs.gov

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service From irs.gov

And is reported on the beneficiarys tax return. 1 TaxSlayer Pro through SurveyMonkey surveyed 757 users of TaxSlayer Pro online tax preparation software 4119 through 41719. Worksheet for calculating accounting income FAQ. Rental Real Estate Income and Expenses of a Partnership 8865 only Form 8838-P. FormSchedule Resident Part-year Nonresident 990-T 2020 1041 Forms and Schedules Form 8824. For trust estate returns add a worksheet that shows the calculation of Tentative Trust Accounting Income page 2 line 7 A Distributable Net Welcome back.

On Box 10 - X to distribute capital gains if distribution amounts exceed ordinary income check the box.

Use this field to override the calculated amount. Tax Accounting Home How do I allocate expenses in a 1041 return using interview forms. UltraTax CS automatically calculates Form 1041 Schedule B line 2 using the Allocation of Expenses by Income Type - Tax Basis Worksheet. Rental Real Estate Income and Expenses of a Partnership 8865 only Form 8838-P. This income is then reported to the beneficiary on a Schedule K-1 Form 1041 Beneficiarys Share of Income Deductions Credits etc. Unfortunately the Accounting Income worksheet does not reflect this allocation.

Source: pinterest.com

Source: pinterest.com

Instructions for Form 1041 and Schedules A B G J and K-1 - Introductory Material Future Developments Whats New Excess deductions on termination. Go to the Beneficiaries Distribution Information worksheet. This income is then reported to the beneficiary on a Schedule K-1 Form 1041 Beneficiarys Share of Income Deductions Credits etc. Tax Accounting Home How do I allocate expenses in a 1041 return using interview forms. On Box 10 - X to distribute capital gains if distribution amounts exceed ordinary income check the box.

Source: irs.gov

Source: irs.gov

There are several ways expenses can be allocated to income in a 1041 return. Worksheet for calculating accounting income FAQ. In some cases you will need to use the Trust Accounting Income formula to prepare Form 1041 the US. The separate amount from each unrelated trade or business must be reported in line 4a of Part I of the Schedule A Form 990-T completed for the specific trade or business. UltraTax CS automatically calculates Form 1041 Schedule B line 2 using the Allocation of Expenses by Income Type - Tax Basis Worksheet.

Source: irs.gov

Source: irs.gov

That fixes your DNI. This income is then reported to the beneficiary on a Schedule K-1 Form 1041 Beneficiarys Share of Income Deductions Credits etc. September 2018 Department of the Treasury Internal Revenue Service US. This article focuses solely on the entry of the Income items which are found in Box 1 and Box 8 of the Schedule K-1 Form 1041 for a Beneficiary Filing Form 1040. I spent 2 hours on the phone with support yesterday and ultimately sent the return to higher level support and received the following reply.

Source: templateroller.com

Source: templateroller.com

UltraTax CS automatically calculates Form 1041 Schedule B line 2 using the Allocation of Expenses by Income Type - Tax Basis Worksheet. Like-Kind Exchanges 8865 only Form 8825. Unfortunately the Accounting Income worksheet does not reflect this allocation. The accounting income line on the worksheet shows how the distributions were spread across the various income categories. UltraTax CS automatically calculates Form 1041 Schedule B line 2 using the Allocation of Expenses by Income Type - Tax Basis Worksheet.

Source: templateroller.com

Source: templateroller.com

Trusts filing Schedule D Form 1041 with Form 990-T that have more than one unrelated trade or business must compute unrelated business taxable income separately for each trade or business. Distributions in excess of income received is listed in the Ordinary Business column. Go to Section 1 - Distribution Options. Instructions for Form 1041 and Schedules A B G J and K-1 - Introductory Material Future Developments Whats New Excess deductions on termination. 1 TaxSlayer Pro through SurveyMonkey surveyed 757 users of TaxSlayer Pro online tax preparation software 4119 through 41719.

In that event then generally the trust accounting income displayed 0 2 240. That fixes your DNI. Unfortunately the Accounting Income worksheet does not reflect this allocation. For trust estate returns add a worksheet that shows the calculation of Tentative Trust Accounting Income page 2 line 7 A Distributable Net Welcome back. Instructions for Form 1041 and Schedules A B G J and K-1 - Introductory Material Future Developments Whats New Excess deductions on termination.

Source: irs.gov

Source: irs.gov

Ask questions get answers and join our large. There are several ways expenses can be allocated to income in a 1041 return. And is reported on the beneficiarys tax return. In that event then generally the trust accounting income displayed 0 2 240. As a trustee you may need to use the Trust Accounting Income TAI formula to calculate the amount of income from the trust that you can distribute to beneficiaries.

Source: calameo.com

Source: calameo.com

Use this field to override the calculated amount. This article focuses solely on the entry of the Income items which are found in Box 1 and Box 8 of the Schedule K-1 Form 1041 for a Beneficiary Filing Form 1040. Once the deduction amounts are entered in the program they will flow through the program as explained below. Now go to page 2 for the 1041 and in Sch B find the smart worksheet after Line 7 entitled Trust Accounting Income Smart Worksheet and. Like-Kind Exchanges 8865 only Form 8825.

Source: irs.gov

Source: irs.gov

On Box 10 - X to distribute capital gains if distribution amounts exceed ordinary income check the box. There are several ways expenses can be allocated to income in a 1041 return. Instructions for Schedule I Form 1041 - Introductory Material Future Developments Whats New Complete Parts I and II if the estate or trust is required to complete Form 1041 Schedule B Income Distribution Deduction. If line 9 page 1 is. Distributions in excess of income received is listed in the Ordinary Business column.

Source: ar.pinterest.com

Source: ar.pinterest.com

In that event then generally the trust accounting income displayed 0 2 240. This worksheet allocates the non-corpus expenses against the portion of income considered part of accounting income. Worksheet for calculating accounting income FAQ. For trust estate returns add a worksheet that shows the calculation of Tentative Trust Accounting Income page 2 line 7 A Distributable Net Welcome back. Now go to page 2 for the 1041 and in Sch B find the smart worksheet after Line 7 entitled Trust Accounting Income Smart Worksheet and.

Source: calameo.com

Source: calameo.com

If line 9 page 1 is. 93 of TaxSlayer Pro respondents reported that they continue to use TaxSlayer Pro software after switching. Net income amounts on this worksheet are available for allocation to beneficiaries on Form 1041 Schedule B line 9 as income required to be distributed currently. I presume you are referring to trust accounting income as shown on the Trust Accounting Income Smart Worksheet on the 1041 in TurboTax Business. Includible in distributable net income per trust document.

Source: irs.gov

Source: irs.gov

FormSchedule Resident Part-year Nonresident 990-T 2020 1041 Forms and Schedules Form 8824. Go to the Beneficiaries Distribution Information worksheet. UltraTax CS automatically calculates Form 1041 Schedule B line 2 using the Allocation of Expenses by Income Type - Tax Basis Worksheet. Net operating loss NOL carryback. And is reported on the beneficiarys tax return.

Source: youtube.com

Source: youtube.com

Like-Kind Exchanges 8865 only Form 8825. In some cases you will need to use the Trust Accounting Income formula to prepare Form 1041 the US. This income is then reported to the beneficiary on a Schedule K-1 Form 1041 Beneficiarys Share of Income Deductions Credits etc. Unfortunately the Accounting Income worksheet does not reflect this allocation. Go to the Beneficiaries Distribution Information worksheet.

Source: pinterest.com

Source: pinterest.com

Tax Accounting Home How do I allocate expenses in a 1041 return using interview forms. In some cases you will need to use the Trust Accounting Income formula to prepare Form 1041 the US. If line 9 page 1 is. Estates and Trusts are permitted to take a deduction on their tax return Form 1041 for certain income that is distributed to the beneficiaries. This worksheet allocates the non-corpus expenses against the portion of income considered part of accounting income.

Source: irs.gov

Source: irs.gov

Like-Kind Exchanges 8865 only Form 8825. That fixes your DNI. There are several ways expenses can be allocated to income in a 1041 return. 1 TaxSlayer Pro through SurveyMonkey surveyed 757 users of TaxSlayer Pro online tax preparation software 4119 through 41719. On Box 10 - X to distribute capital gains if distribution amounts exceed ordinary income check the box.

Source: irs.gov

Source: irs.gov

Includible in distributable net income per trust document. Net operating loss NOL carryback. Net income amounts on this worksheet are available for allocation to beneficiaries on Form 1041 Schedule B line 9 as income required to be distributed currently. This article focuses solely on the entry of the Income items which are found in Box 1 and Box 8 of the Schedule K-1 Form 1041 for a Beneficiary Filing Form 1040. Now go to page 1 of the 1041 and on line 8 write in Pass Thru Distribution Income and the enter that Line 19 distribution amount.

Source: irs.gov

Source: irs.gov

Now go to page 1 of the 1041 and on line 8 write in Pass Thru Distribution Income and the enter that Line 19 distribution amount. Now go to page 2 for the 1041 and in Sch B find the smart worksheet after Line 7 entitled Trust Accounting Income Smart Worksheet and. Net income amounts on this worksheet are available for allocation to beneficiaries on Form 1041 Schedule B line 9 as income required to be distributed currently. This article focuses solely on the entry of the Income items which are found in Box 1 and Box 8 of the Schedule K-1 Form 1041 for a Beneficiary Filing Form 1040. 1 TaxSlayer Pro through SurveyMonkey surveyed 757 users of TaxSlayer Pro online tax preparation software 4119 through 41719.

Source: irs.gov

Source: irs.gov

Now go to page 2 for the 1041 and in Sch B find the smart worksheet after Line 7 entitled Trust Accounting Income Smart Worksheet and. That fixes your DNI. This income is then reported to the beneficiary on a Schedule K-1 Form 1041 Beneficiarys Share of Income Deductions Credits etc. Distributions in excess of income received is listed in the Ordinary Business column. Net income amounts on this worksheet are available for allocation to beneficiaries on Form 1041 Schedule B line 9 as income required to be distributed currently.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title 1041 accounting income worksheet by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.