Your Accounting payroll register worksheet answers images are ready in this website. Accounting payroll register worksheet answers are a topic that is being searched for and liked by netizens today. You can Get the Accounting payroll register worksheet answers files here. Find and Download all free photos and vectors.

If you’re searching for accounting payroll register worksheet answers pictures information connected with to the accounting payroll register worksheet answers topic, you have pay a visit to the ideal blog. Our website always gives you suggestions for refferencing the highest quality video and picture content, please kindly search and locate more enlightening video content and images that fit your interests.

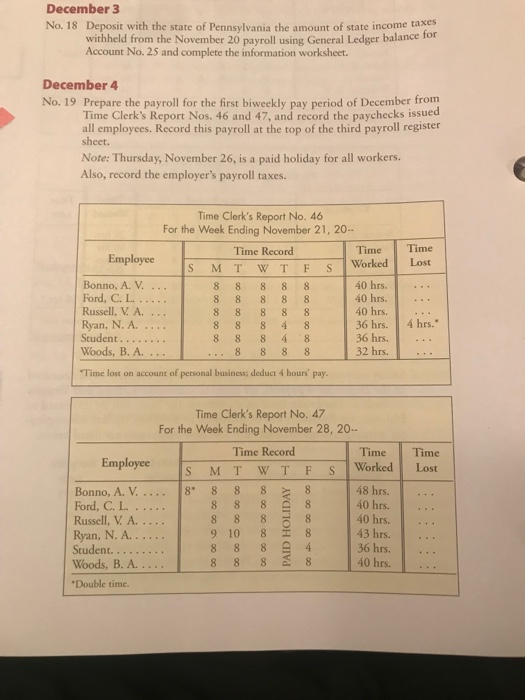

Accounting Payroll Register Worksheet Answers. Name Marital Status No. For Period Ending January 8 20– Regular Earnings Overtime Earnings Time Card No. Gross pay net pay. Deposit with the state of Pennsylvania the amount of state income taxes with-held from the November 20 payroll and complete the information worksheet.

Accounting Class Help Com Accounting Classes Accounting Student Accounting Principles From pinterest.com

Accounting Class Help Com Accounting Classes Accounting Student Accounting Principles From pinterest.com

Name Marital Status No. Present Value of a Single Amount 24. Describe the employers payroll taxes. Payroll 1Introduction 3 Lesson 1. When completing Form I-9 which combination of documents listed below is acceptable. Access study documents get answers to your study questions and connect with real tutors for ACCOUNTING 103.

Present Value of a Single Amount 24.

Future Value of a. Chapter 7 Payroll Accounting Project 2015 START OF SHORT VERSION OF PAYROLL PROJECTCONTINUATION OF PAYROLL PROJECT. HM1030 at Ultimate Medical Academy Clearwater. Gross pay net pay. Payroll Register 39 Lesson 4. Calculating Wages and Salaries 5 Lesson 2.

Source: pinterest.com

Source: pinterest.com

Learn vocabulary terms and more with flashcards games and other study tools. Future Value of a. Payroll Deductions 11 Lesson 3. Access study documents get answers to your study questions and connect with real tutors for ACCOUNTING 103. Present Value of a Single Amount 24.

Source: pinterest.com

Source: pinterest.com

Why is it important for businesses to extend credit to. Compute gross pay using different methods. Olney Company Inc Payroll Register Answers Essay 734 Words 3 Pages Name. Test bank Questions and Answers of Chapter 6. Accounting Cycle Exercises III 15 Problem 4.

Source: id.pinterest.com

Source: id.pinterest.com

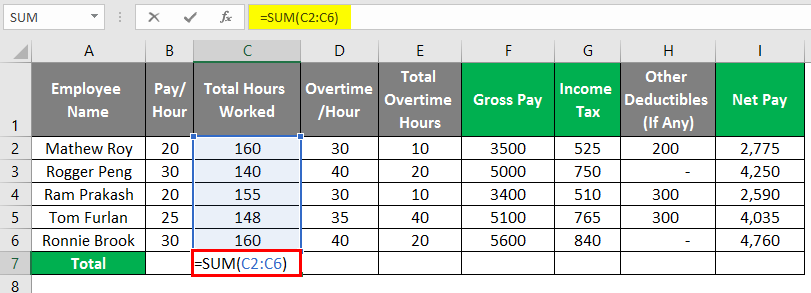

Payroll Deductions 11 Lesson 3. A great spreadsheet for keeping track of your employees payroll. Explain and compute employee-paid withholdings. Payroll liabilities In most business organizations accounting for payroll is particularly important because 1 payrolls often are the largest expense that a company incurs 2 both federal and state governments require maintaining detailed payroll records and 3 companies must file regular payroll reports with state and federal governments and remit amounts withheld or otherwise due. Employee Grosspay Payroll Register Chinson EERF Wayland EERF PeppinicoVarden EERF Hissop EERF Success EERF General Journal General Ledger EERF Complete the General Journal entries for the December 15 Round your answers to 2 decimal places.

Source: pinterest.com

Source: pinterest.com

Worksheet A review of supplies on hand at the end of the month revealed items costing 10500. PAYROLL ACCOUNTING at Independence University. Vi Grade 11 Accounting Essentials Module 8. Why is it important for businesses to extend credit to. Gross pay net pay.

Source: pinterest.com

Source: pinterest.com

Name Marital Status No. Olney Company Inc Payroll Register Answers Essay 734 Words 3 Pages Name. Payroll 1Introduction 3 Lesson 1. These journal entries ensure appropriate income statement and balance. Employee Grosspay Payroll Register Chinson EERF Wayland EERF PeppinicoVarden EERF Hissop EERF Success EERF General Journal General Ledger EERF Complete the General Journal entries for the December 15 Round your answers to 2 decimal places.

Source: pinterest.com

Source: pinterest.com

See round rules in Excel Instructions before calculating OT for slaried employees. CHAPTER 13 Payroll Liabilities and Tax Records What Youll Learn Record payroll transactions in the general journal. The first is used to keep track of all important individual employee information. Present Value of a Single Amount 24. Compute and complete payroll tax expense forms.

Source: pinterest.com

Source: pinterest.com

Employee Grosspay Payroll Register Chinson EERF Wayland EERF PeppinicoVarden EERF Hissop EERF Success EERF General Journal General Ledger EERF Complete the General Journal entries for the December 15 Round your answers to 2 decimal places. There are two sheets in the Excel workbook. Answers Key Payroll Accounting Project Chapter 7zip DOWNLOAD Mirror 1 09d271e77f Payroll Accounting. CHAPTER 12Payroll Accounting What Youll Learn Explain the importance of accurate payroll records. Describe the employers payroll taxes.

Source: pinterest.com

Source: pinterest.com

See round rules in Excel Instructions before calculating OT for slaried employees. Learn vocabulary terms and more with flashcards games and other study tools. Test bank Questions and Answers of Chapter 6. Payroll liabilities In most business organizations accounting for payroll is particularly important because 1 payrolls often are the largest expense that a company incurs 2 both federal and state governments require maintaining detailed payroll records and 3 companies must file regular payroll reports with state and federal governments and remit amounts withheld or otherwise due. Olney Company Inc Payroll Register Answers Essay 734 Words 3 Pages Name.

Source: pinterest.com

Source: pinterest.com

This article explains what is on a typical payroll register. Name Marital Status No. Why is it important for businesses to extend credit to. Start studying Payroll Accounting. A great spreadsheet for keeping track of your employees payroll.

Source: pinterest.com

Source: pinterest.com

Payroll liabilities In most business organizations accounting for payroll is particularly important because 1 payrolls often are the largest expense that a company incurs 2 both federal and state governments require maintaining detailed payroll records and 3 companies must file regular payroll reports with state and federal governments and remit amounts withheld or otherwise due. Why is it important for businesses to extend credit to. Future Value of a. See round rules in Excel Instructions before calculating OT for slaried employees. Learn vocabulary terms and more with flashcards games and other study tools.

Source: educba.com

Source: educba.com

Chapter 7 Payroll Accounting Project 2015 START OF SHORT VERSION OF PAYROLL PROJECTCONTINUATION OF PAYROLL PROJECT. When completing Form I-9 which combination of documents listed below is acceptable. A picture example is provided. CHAPTER 12Payroll Accounting What Youll Learn Explain the importance of accurate payroll records. Access study documents get answers to your study questions and connect with real tutors for ACCOUNTING PAYROLL BANKING ACCOUNTING SYSTEMS 1030.

Source: pinterest.com

Source: pinterest.com

Record the payment of. These journal entries ensure appropriate income statement and balance. While the second is your payroll register and. Compute and complete payroll tax expense forms. Record the payment of.

Source: pinterest.com

Source: pinterest.com

Payroll RegisterEmployee Earning Recordsand Accounting System Entries Sign up Sign in Topics topic Business study-set Payroll Accounting 2016 Previous Quiz Quiz 6 72 62. For Period Ending January 8 20– Regular Earnings Overtime Earnings Time Card No. Payroll RegisterEmployee Earning Recordsand Accounting System Entries Sign up Sign in Topics topic Business study-set Payroll Accounting 2016 Previous Quiz Quiz 6 72 62. Chapter 7 Payroll Accounting Project 2015 START OF SHORT VERSION OF PAYROLL PROJECTCONTINUATION OF PAYROLL PROJECT. Record the payment of.

Source: pinterest.com

Source: pinterest.com

A great spreadsheet for keeping track of your employees payroll. Record the payment of. There are two sheets in the Excel workbook. Payroll Deductions 11 Lesson 3. Payroll RegisterEmployee Earning Recordsand Accounting System Entries Sign up Sign in Topics topic Business study-set Payroll Accounting 2016 Previous Quiz Quiz 6 72 62.

Source: pinterest.com

Source: pinterest.com

Olney Company Inc Payroll Register Answers Essay 734 Words 3 Pages Name. CHAPTER 12Payroll Accounting What Youll Learn Explain the importance of accurate payroll records. Access study documents get answers to your study questions and connect with real tutors for ACCOUNTING PAYROLL BANKING ACCOUNTING SYSTEMS 1030. PAYROLL ACCOUNTING at Independence University. Calculating Wages and Salaries 5 Lesson 2.

Source: in.pinterest.com

Source: in.pinterest.com

Present Value of an Ordinary Annuity 25. Vi Grade 11 Accounting Essentials Module 8. The accrual entry as shown next is simpler than the comprehensive payroll entry already shown because you typically clump all payroll taxes into a single expense account and offsetting liability account. CHAPTER 13 Payroll Liabilities and Tax Records What Youll Learn Record payroll transactions in the general journal. This article explains what is on a typical payroll register.

Source: pinterest.com

Source: pinterest.com

CHAPTER 13 Payroll Liabilities and Tax Records What Youll Learn Record payroll transactions in the general journal. Payroll RegisterEmployee Earning Recordsand Accounting System Entries Sign up Sign in Topics topic Business study-set Payroll Accounting 2016 Previous Quiz Quiz 6 72 62. Page 7 Worksheet And W 4 Form Business MathExcel Chapter 3 Notes PAYROLL Page 8. Describe the employers payroll taxes. Payroll Accounting Payroll journal entries are used to record employer-related compensation expenses and employee deductions.

Source: chegg.com

Source: chegg.com

When completing Form I-9 which combination of documents listed below is acceptable. Calculating Wages and Salaries 5 Lesson 2. The 7200 balance in. Record the payment of. When you run payroll theres a lot of information to keep track of.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title accounting payroll register worksheet answers by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.