Your Accounting payroll worksheet answers images are ready in this website. Accounting payroll worksheet answers are a topic that is being searched for and liked by netizens now. You can Download the Accounting payroll worksheet answers files here. Get all free photos and vectors.

If you’re looking for accounting payroll worksheet answers pictures information linked to the accounting payroll worksheet answers topic, you have come to the ideal blog. Our site always gives you hints for downloading the highest quality video and image content, please kindly surf and locate more informative video content and images that match your interests.

Accounting Payroll Worksheet Answers. The money paid for employee services a. Double Entry Accounting is surprisingly simple and is built around only a very few concepts a balance between what a business has where the business got what it has and how to organize the answers to those questions. Select the best answer and record the answer on the Scantron provided. Learn vocabulary terms and more with flashcards games and other study tools.

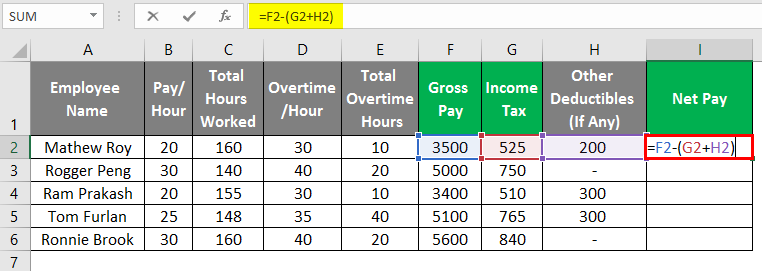

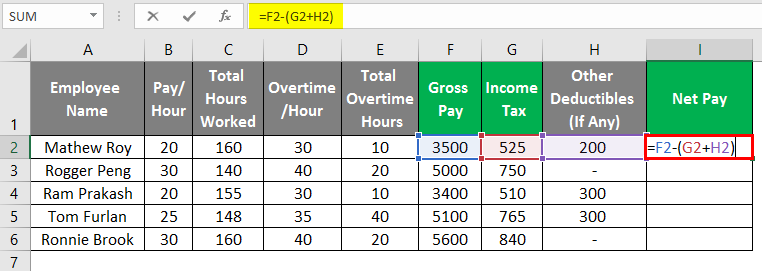

Payroll In Excel How To Create Payroll In Excel With Steps From educba.com

Payroll In Excel How To Create Payroll In Excel With Steps From educba.com

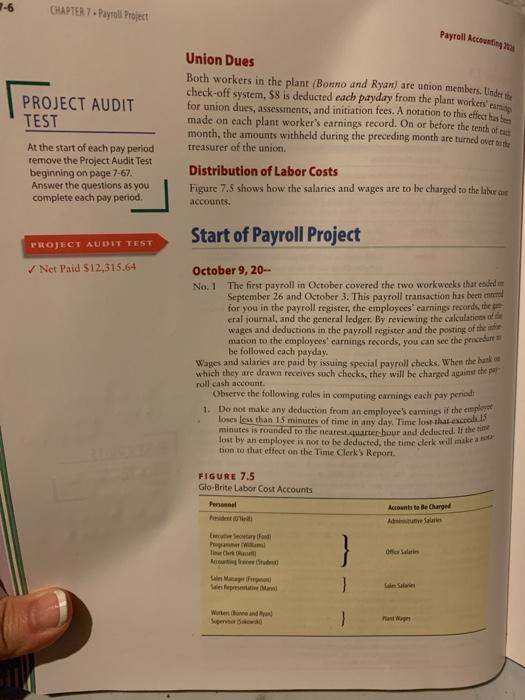

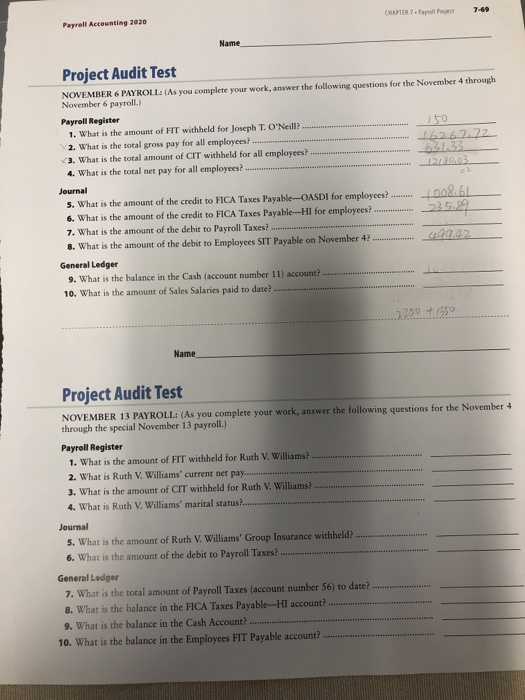

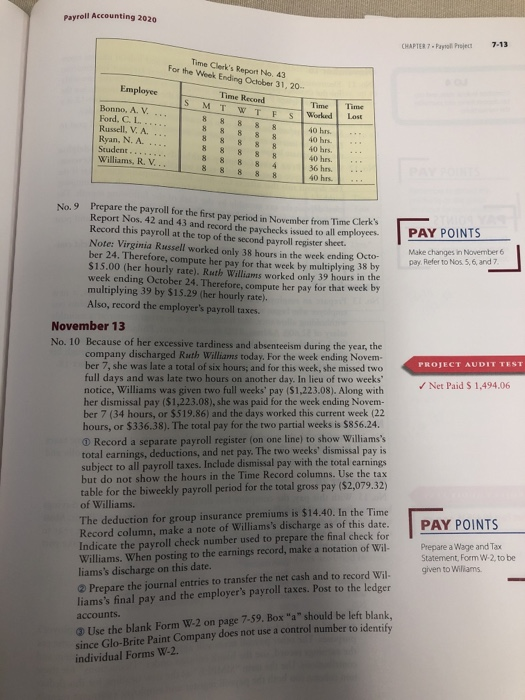

Accrued Payroll Journal Entry It is quite common to have some amount of unpaid wages at the end of an accounting period so you should accrue this expense if it is material. About This Quiz Worksheet Examining what is good for us but not so good for a business this quiz and corresponding worksheet will help you gauge your knowledge of calculating payroll costs. Present Value of an Ordinary Annuity 25. QuestionRefer to the following payroll worksheet for the period January 1-15 2021 in PHPAssume that overtime and night differential charges are incurred to meet production requirements and are not specifically traceable to jobs. A working paper used to collect. Glencoe Accounting Chapter 8 Flashcards Quizlet Start studying Glencoe Accounting Chapter 8.

For further information and for instructions on this form see About Form 7200 Advance Payment.

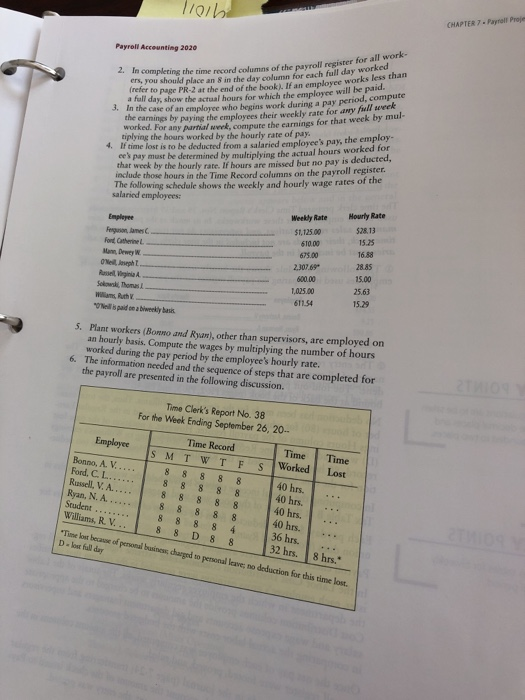

Compute gross pay using different methods. Table of Contents Ch. The Certified Payroll Worksheet is based on the federal Form WH-347 and can be used to fill out any state-specific certified payroll forms. What do you believe are the most valuable skills for a payroll. Home Financial Accounting Work Sheet - 10 Column Work Sheet Accounting Worksheet Problems and Solutions We have covered Worksheet topic in great detail. Payroll Accounting Questions Home Homework Library Business Accounting Payroll Accounting Questions Question 5-2B Yengling Companys payroll for the year is 593150.

Source: chegg.com

Source: chegg.com

Learn vocabulary terms and more with flashcards games and other study tools. Payroll Accounting Questions Home Homework Library Business Accounting Payroll Accounting Questions Question 5-2B Yengling Companys payroll for the year is 593150. PAYROLL ACCOUNTING REGIONAL 2009 PAGE 3 of 13 Multiple Choice. Learn vocabulary terms and more with flashcards games and other study tools. The money paid for employee services a.

Source: bartleby.com

Source: bartleby.com

Because payroll is becoming more complex and more of a specialized field it is difficult to find content that puts it all together in one spot like this course does. This report can help you complete Part 2 of the 7200 form for Advance Payment of Employer Credits Due to COVID-19. For further information and for instructions on this form see About Form 7200 Advance Payment. Table of Contents Ch. Compute and complete payroll tax expense forms.

Source: bartleby.com

Source: bartleby.com

Describe the employers payroll taxes. Payroll Accounting Questions Home Homework Library Business Accounting Payroll Accounting Questions Question 5-2B Yengling Companys payroll for the year is 593150. 4 Fringe Benefits and Voluntary Deductions Ch. Learn vocabulary terms and more with flashcards games and other study tools. Review the different types of questions you may encounter during interviews for payroll jobs along with sample questions and answers to help you prepare.

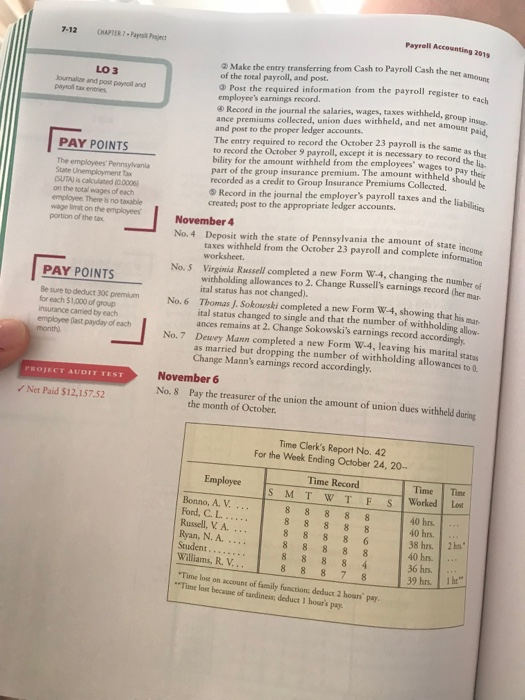

Home Financial Accounting Work Sheet - 10 Column Work Sheet Accounting Worksheet Problems and Solutions We have covered Worksheet topic in great detail. Of this amount 211630 is for wages paid in 5-4B. Accounting exercises for students ranging from tests of double entry bookkeeping principles to general ledger and preparing financial reports Financial Management and Bookkeeping Exercises Click here for Interactive Web-Based. CHAPTER 13 Payroll Liabilities and Tax Records What Youll Learn Record payroll transactions in the general journal. The money paid for employee services a.

Source: chegg.com

Source: chegg.com

Present Value of an Ordinary Annuity 25. Payroll reports 7200 Worksheet - COVID-19. Present Value of an Ordinary Annuity 25. Table of Contents Ch. Chart of Accounts 04.

Source: youtube.com

Source: youtube.com

Debits and Credits 03. 5 Employee Net Pay and Pay Methods Ch. 3 Gross Pay Computation Ch. Present Value of an Ordinary Annuity 25. Of this amount 211630 is for wages paid in 5-4B.

Source: pinterest.com

Source: pinterest.com

Because payroll is becoming more complex and more of a specialized field it is difficult to find content that puts it all together in one spot like this course does. Explain and compute employee-paid withholdings. This report can help you complete Part 2 of the 7200 form for Advance Payment of Employer Credits Due to COVID-19. Chart of Accounts 04. Compute and complete payroll tax expense forms.

Source: chegg.com

Source: chegg.com

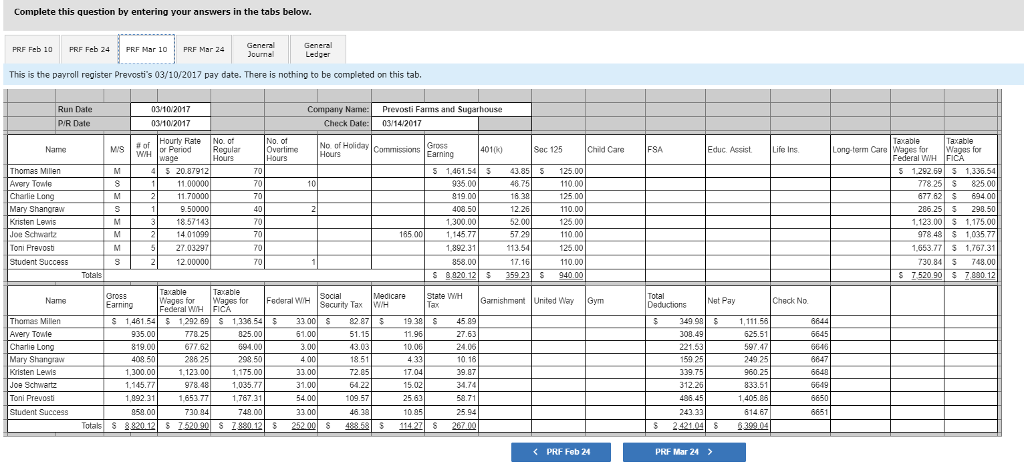

The accrual entry as shown next is simpler than the comprehensive payroll entry already shown because you typically clump all payroll taxes into a single expense account and offsetting liability account. QuestionRefer to the following payroll worksheet for the period January 1-15 2021 in PHPAssume that overtime and night differential charges are incurred to meet production requirements and are not specifically traceable to jobs. A working paper used to collect. Table of Contents Ch. Record the payment of.

Source: chegg.com

Source: chegg.com

Workbook has 88 questions and exercises starting from the accounting equation and basic concepts to journal entries T-accounts the trial balance financial statements the cash flow statement. Review the different types of questions you may encounter during interviews for payroll jobs along with sample questions and answers to help you prepare. Accounting exercises for students ranging from tests of double entry bookkeeping principles to general ledger and preparing financial reports Financial Management and Bookkeeping Exercises Click here for Interactive Web-Based. Learn vocabulary terms and more with flashcards games and other study tools. Because payroll is becoming more complex and more of a specialized field it is difficult to find content that puts it all together in one spot like this course does.

Source: studylib.net

Source: studylib.net

Debits and Credits 03. Home Financial Accounting Work Sheet - 10 Column Work Sheet Accounting Worksheet Problems and Solutions We have covered Worksheet topic in great detail. CHAPTER 12Payroll Accounting What Youll Learn Explain the importance of accurate payroll records. Workbook has 88 questions and exercises starting from the accounting equation and basic concepts to journal entries T-accounts the trial balance financial statements the cash flow statement. Select the best answer and record the answer on the Scantron provided.

Source: chegg.com

Source: chegg.com

The Certified Payroll Worksheet is based on the federal Form WH-347 and can be used to fill out any state-specific certified payroll forms. If you want more practice with full accounting questions and answers you should get the official exercise book for this site Volume 2 in the Accounting Basics series. Accounting exercises for students ranging from tests of double entry bookkeeping principles to general ledger and preparing financial reports Financial Management and Bookkeeping Exercises Click here for Interactive Web-Based. Describe the employers payroll taxes. For further information and for instructions on this form see About Form 7200 Advance Payment.

Source: educba.com

Source: educba.com

Record the payment of. Record the payment of. If you want more practice with full accounting questions and answers you should get the official exercise book for this site Volume 2 in the Accounting Basics series. Describe the employers payroll taxes. Select the best answer and record the answer on the Scantron provided.

If you want more practice with full accounting questions and answers you should get the official exercise book for this site Volume 2 in the Accounting Basics series. Describe the employers payroll taxes. Compute and complete payroll tax expense forms. For further information and for instructions on this form see About Form 7200 Advance Payment. Glencoe Accounting Chapter 8 Flashcards Quizlet Start studying Glencoe Accounting Chapter 8.

Source: chegg.com

Source: chegg.com

3 Gross Pay Computation Ch. Compute gross pay using different methods. If you want more practice with full accounting questions and answers you should get the official exercise book for this site Volume 2 in the Accounting Basics series. Debits and Credits 03. The accrual entry as shown next is simpler than the comprehensive payroll entry already shown because you typically clump all payroll taxes into a single expense account and offsetting liability account.

Source: chegg.com

Source: chegg.com

Of this amount 211630 is for wages paid in 5-4B. Workbook has 88 questions and exercises starting from the accounting equation and basic concepts to journal entries T-accounts the trial balance financial statements the cash flow statement. Because payroll is becoming more complex and more of a specialized field it is difficult to find content that puts it all together in one spot like this course does. 3 Gross Pay Computation Ch. Now it is the right time to do practice and get good.

Source: chegg.com

Source: chegg.com

5 Employee Net Pay and Pay Methods Ch. Future Value of a. The Certified Payroll Worksheet is based on the federal Form WH-347 and can be used to fill out any state-specific certified payroll forms. 5 Employee Net Pay and Pay Methods Ch. CHAPTER 12Payroll Accounting What Youll Learn Explain the importance of accurate payroll records.

Source: pinterest.com

Source: pinterest.com

Select the best answer and record the answer on the Scantron provided. Payroll Accounting Questions Home Homework Library Business Accounting Payroll Accounting Questions Question 5-2B Yengling Companys payroll for the year is 593150. The Certified Payroll Worksheet is based on the federal Form WH-347 and can be used to fill out any state-specific certified payroll forms. QuestionRefer to the following payroll worksheet for the period January 1-15 2021 in PHPAssume that overtime and night differential charges are incurred to meet production requirements and are not specifically traceable to jobs. Describe the employers payroll taxes.

Source: chegg.com

Source: chegg.com

CHAPTER 13 Payroll Liabilities and Tax Records What Youll Learn Record payroll transactions in the general journal. Table of Contents Ch. Because payroll is becoming more complex and more of a specialized field it is difficult to find content that puts it all together in one spot like this course does. The Certified Payroll Worksheet is based on the federal Form WH-347 and can be used to fill out any state-specific certified payroll forms. 4 Fringe Benefits and Voluntary Deductions Ch.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title accounting payroll worksheet answers by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.