Your Accounting process worksheet debit credit t accounts images are available. Accounting process worksheet debit credit t accounts are a topic that is being searched for and liked by netizens now. You can Get the Accounting process worksheet debit credit t accounts files here. Find and Download all royalty-free images.

If you’re looking for accounting process worksheet debit credit t accounts images information linked to the accounting process worksheet debit credit t accounts topic, you have visit the right blog. Our site always provides you with hints for downloading the maximum quality video and picture content, please kindly surf and locate more informative video articles and images that match your interests.

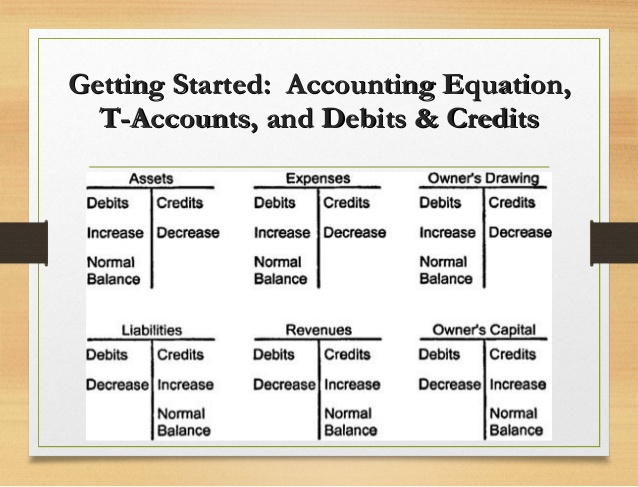

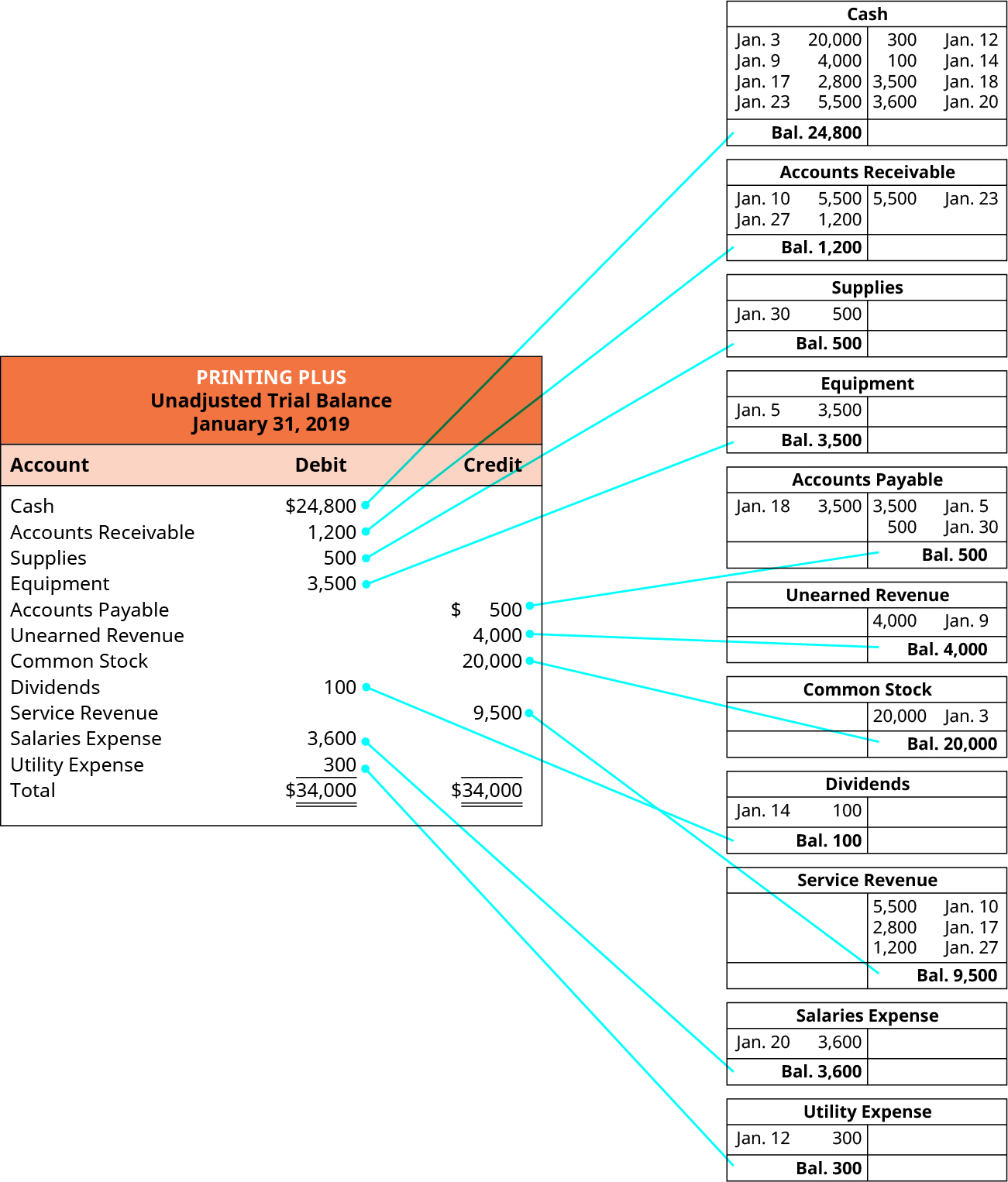

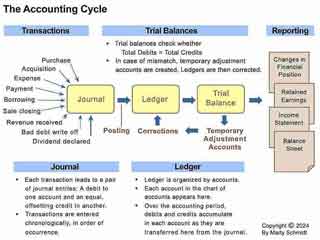

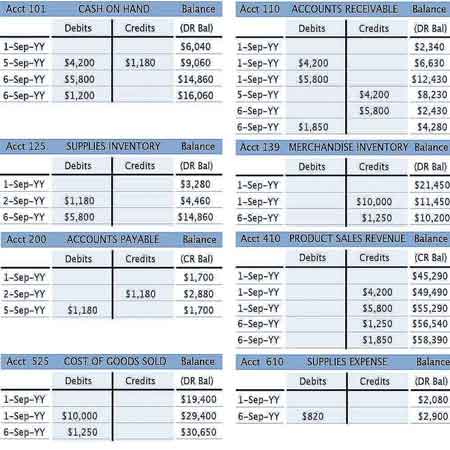

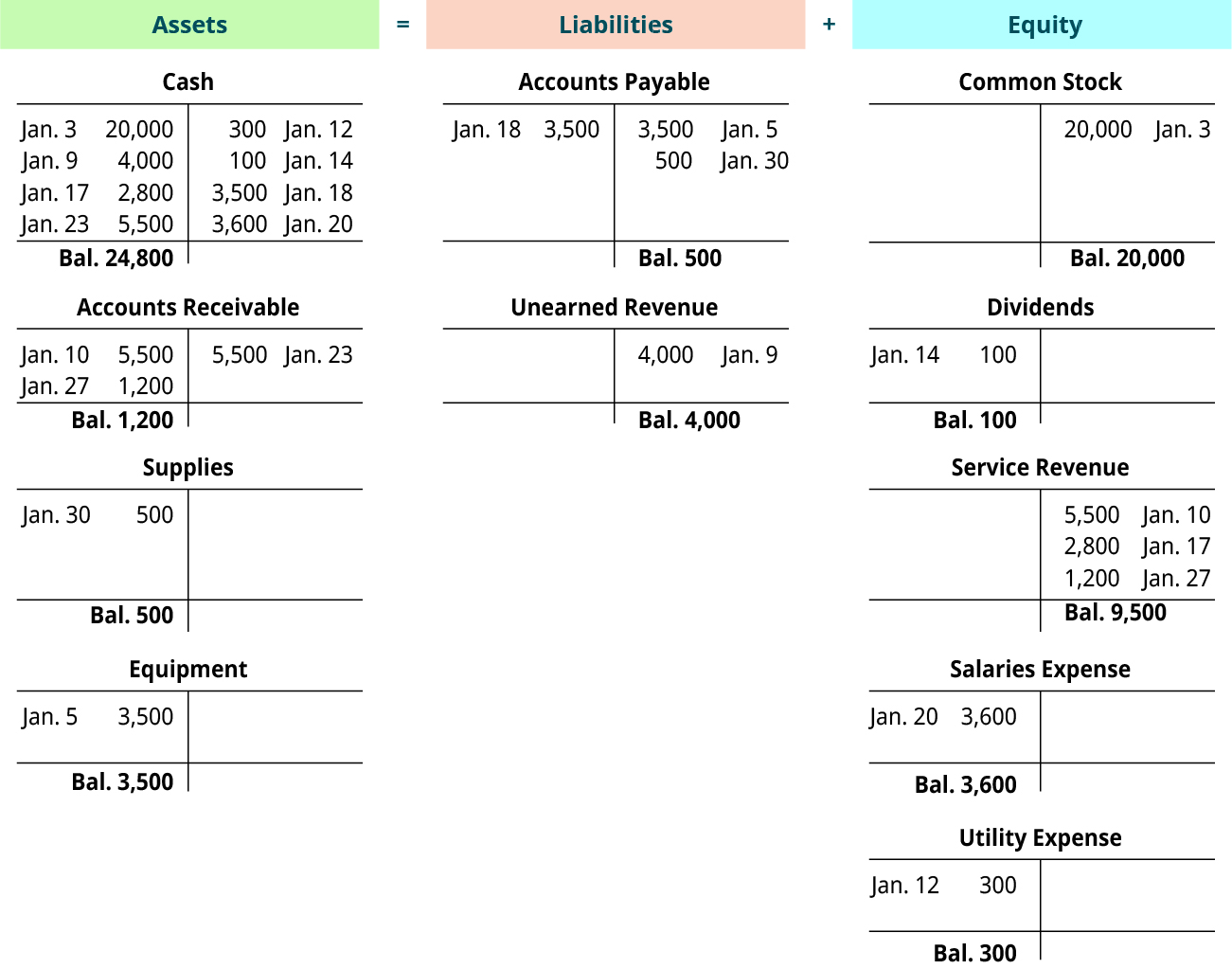

Accounting Process Worksheet Debit Credit T Accounts. Basically to understand when to use debit and credit the account type must be identified. You would debit Cash because you received cash and you would need to credit an account because of double entry. As a refresher of the accounting equation all asset accounts have debit balances and liability and equity accounts have credit balances. Therefore instead of saying there has been an increase or a decrease in an account we say there has been a debit movement.

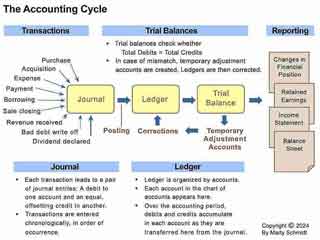

Trial Balance Period In Accounting Cycle Explained With Examples From business-case-analysis.com

Trial Balance Period In Accounting Cycle Explained With Examples From business-case-analysis.com

Balance BF vs Balance CF The Balance bf shown above is the actual closing balance of the bank account a debit balance. Basically to understand when to use debit and credit the account type must be identified. Correcting closing and some adjusting entries. Well help guide you through the process and give you a handy reference chart to use. Some of the worksheets displayed are Learn debits and credits What is accounting Debits and credits memory Bc cheat T accounts debits and credits 2 trial balance and Checking account debit card simulation and student work Double entry accounting workbook Accounting self study guide. Gold Capital are all examples of accounts.

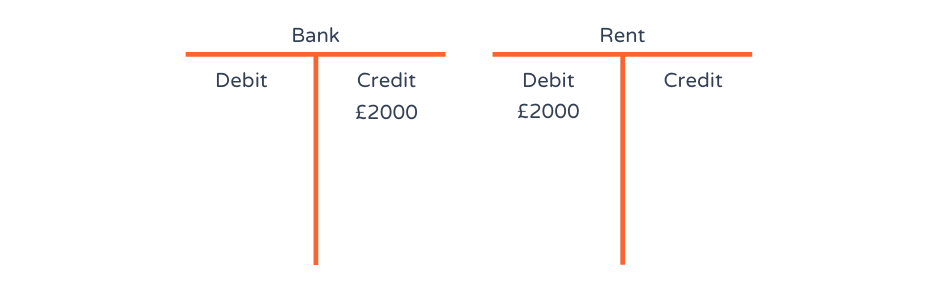

T-accounts form is given as under.

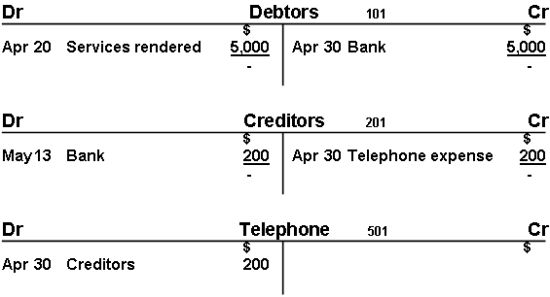

Revenue accounts are almost always CREDITED. Revenue accounts are almost always CREDITED. The process by which this occurs will become clear in the following sections of this chapter. Assets Liabilities Owners Equity 2. Balancing T-Accounts isnt easy but in this basic lesson Ill show you how to do just that - how to balance a T-account. For instance the 10000 debit on January 2 would be offset by a 10000 credit to Accounts Receivable.

Source: brixx.com

Source: brixx.com

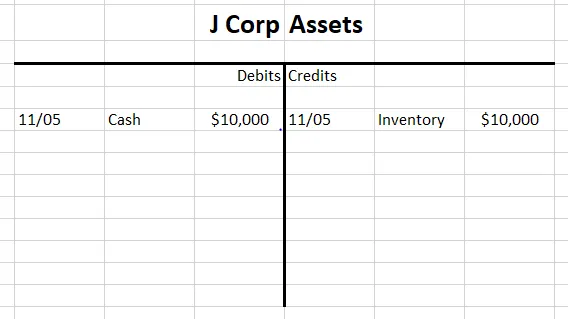

T-ACCOUNTS FORMS OF ACCOUNTS. View P35 WORKSHEETxlsx from ACCOUNTING 4160 at California State University Stanislaus. Actual debit and credit transactions will be recorded in the general ledger which accumulates all of the transactions by account. In Accounting accounts can be identified in five categories. Assets An Increase creates Debit Decrease - creates Credit.

Source: studyfinance.com

Source: studyfinance.com

View P35 WORKSHEETxlsx from ACCOUNTING 4160 at California State University Stanislaus. Revenue accounts are almost always CREDITED. 4 - Chapter 4 Notes - T-accounts and the Ledger Debit Credit Theory Double-Entry System of Accounting Trial Balance Section 41 - Accounts Bank Accounts Receivable Supplies Bank Loan Mortgage Payable and B. Once all ledger accounts and their balances are recorded the debit and credit columns on the adjusted trial balance are totaled to see if the figures in each column match. T-Account Template This t-account T Accounts Guide If you want a career in accounting T Accounts may be your new best friendThe T Account is a visual representation of individual accounts template helps you organize and balance the debits and credits for your transactions and journal entries Journal Entries Guide Journal Entries are the building blocks of accounting from reporting to.

Source: studyfinance.com

Source: studyfinance.com

Benefits of use the debit and credit cheat sheet There are numbers of benefits to using the cheat sheet typically for the learning process of basic accounting process. Basically to understand when to use debit and credit the account type must be identified. Once all ledger accounts and their balances are recorded the debit and credit columns on the adjusted trial balance are totaled to see if the figures in each column match. While a company doesnt need to prepare an accounting worksheet it is still a useful process and it is highly recommended to prepare one. The final total in the debit column must be the same dollar.

Source: brixx.com

Source: brixx.com

All contra accounts have opposite balances. Next Step The next step in the accounting cycle is to create closing entries. T-Accounts are named so because it shapes like the English Word T. Balance BF vs Balance CF The Balance bf shown above is the actual closing balance of the bank account a debit balance. 4 - Chapter 4 Notes - T-accounts and the Ledger Debit Credit Theory Double-Entry System of Accounting Trial Balance Section 41 - Accounts Bank Accounts Receivable Supplies Bank Loan Mortgage Payable and B.

Source: freshbooks.com

Source: freshbooks.com

Gold Capital are all examples of accounts. Showing top 8 worksheets in the category - Accounting Debit And Credit. If you want a career in accounting Accounting Public accounting firms consist of accountants whose job is serving business individuals governments nonprofit by preparing financial statements taxes T Accounts may be your new best friend T Accounts may be your new best friend. While a company doesnt need to prepare an accounting worksheet it is still a useful process and it is highly recommended to prepare one. Next Step The next step in the accounting cycle is to create closing entries.

Source: wikihow.com

Source: wikihow.com

The cheat sheet may focus on basic accounting rules mostly double-entry as well. T-Accounts are named so because it shapes like the English Word T. All contra accounts have opposite balances. While a company doesnt need to prepare an accounting worksheet it is still a useful process and it is highly recommended to prepare one. A above rules are also called as golden rules of accounting.

Source: online-accounting.net

Source: online-accounting.net

If youre using double-entry accounting you need to know when to debit and when to credit your accounts. Gold Capital are all examples of accounts. Correcting closing and some adjusting entries. Assets Liabilities Owners Equity 2. For instance the 10000 debit on January 2 would be offset by a 10000 credit to Accounts Receivable.

Source: online-accounting.net

Source: online-accounting.net

The process by which this occurs will become clear in the following sections of this chapter. All the debit accountsamounts involving in a transaction are recorded on the left side of while credit effects are reflected on. In Accounting accounts can be identified in five categories. You would debit Cash because you received cash and you would need to credit an account because of double entry. Assets An Increase creates Debit Decrease - creates Credit.

Source: investopedia.com

Source: investopedia.com

Revenue accounts are almost always CREDITED. T-ACCOUNTS FORMS OF ACCOUNTS. The cheat sheet may focus on basic accounting rules mostly double-entry as well. If you want a career in accounting Accounting Public accounting firms consist of accountants whose job is serving business individuals governments nonprofit by preparing financial statements taxes T Accounts may be your new best friend T Accounts may be your new best friend. A above rules are also called as golden rules of accounting.

Source: opentextbc.ca

Source: opentextbc.ca

The process by which this occurs will become clear in the following sections of this chapter. Actual debit and credit transactions will be recorded in the general ledger which accumulates all of the transactions by account. The cheat sheet may focus on basic accounting rules mostly double-entry as well. 4 - Chapter 4 Notes - T-accounts and the Ledger Debit Credit Theory Double-Entry System of Accounting Trial Balance Section 41 - Accounts Bank Accounts Receivable Supplies Bank Loan Mortgage Payable and B. Next Step The next step in the accounting cycle is to create closing entries.

Source: business-case-analysis.com

Source: business-case-analysis.com

T-Accounts are named so because it shapes like the English Word T. In Accounting accounts can be identified in five categories. A above rules are also called as golden rules of accounting. If you want a career in accounting Accounting Public accounting firms consist of accountants whose job is serving business individuals governments nonprofit by preparing financial statements taxes T Accounts may be your new best friend T Accounts may be your new best friend. T-accounts help both students and professionals understand accounting adjustments which are.

Source: pinterest.com

Source: pinterest.com

The process by which this occurs will become clear in the following sections of this chapter. Balance BF vs Balance CF The Balance bf shown above is the actual closing balance of the bank account a debit balance. Assets An Increase creates Debit Decrease - creates Credit. Account Title Left Side debit Right Side credit for. Benefits of use the debit and credit cheat sheet There are numbers of benefits to using the cheat sheet typically for the learning process of basic accounting process.

Source: business-case-analysis.com

Source: business-case-analysis.com

The process by which this occurs will become clear in the following sections of this chapter. In Accounting accounts can be identified in five categories. While a company doesnt need to prepare an accounting worksheet it is still a useful process and it is highly recommended to prepare one. Balancing T-Accounts isnt easy but in this basic lesson Ill show you how to do just that - how to balance a T-account. Assets An Increase creates Debit Decrease - creates Credit.

Source: opentextbc.ca

Source: opentextbc.ca

All contra accounts have opposite balances. Think of performing a service for cash. Revenue accounts are almost always CREDITED. T-accounts help both students and professionals understand accounting adjustments which are. A above rules are also called as golden rules of accounting.

Source: studyfinance.com

Source: studyfinance.com

T-Accounts are named so because it shapes like the English Word T. A above rules are also called as golden rules of accounting. As a refresher of the accounting equation all asset accounts have debit balances and liability and equity accounts have credit balances. Correcting closing and some adjusting entries. The final total in the debit column must be the same dollar.

Source: slideplayer.com

Source: slideplayer.com

All the debit accountsamounts involving in a transaction are recorded on the left side of while credit effects are reflected on. Think of performing a service for cash. For instance the 10000 debit on January 2 would be offset by a 10000 credit to Accounts Receivable. Revenue accounts are almost always CREDITED. Gold Capital are all examples of accounts.

Source: pinterest.com

Source: pinterest.com

Account Title Left Side debit Right Side credit for. All the debit accountsamounts involving in a transaction are recorded on the left side of while credit effects are reflected on. Basically to understand when to use debit and credit the account type must be identified. While a company doesnt need to prepare an accounting worksheet it is still a useful process and it is highly recommended to prepare one. As a refresher of the accounting equation all asset accounts have debit balances and liability and equity accounts have credit balances.

Source: investopedia.com

Source: investopedia.com

Next Step The next step in the accounting cycle is to create closing entries. Revenue accounts are almost always CREDITED. Heres an example of how each T-account is. Well help guide you through the process and give you a handy reference chart to use. All contra accounts have opposite balances.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title accounting process worksheet debit credit t accounts by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.