Your Accounting student worksheet depreciation answers images are ready in this website. Accounting student worksheet depreciation answers are a topic that is being searched for and liked by netizens today. You can Download the Accounting student worksheet depreciation answers files here. Find and Download all royalty-free images.

If you’re looking for accounting student worksheet depreciation answers images information related to the accounting student worksheet depreciation answers topic, you have visit the right blog. Our website frequently gives you hints for seeing the maximum quality video and picture content, please kindly hunt and locate more informative video content and graphics that match your interests.

Accounting Student Worksheet Depreciation Answers. MEADOWS SOLICITOR Worksheet for the year ended 31 December 2003 Account title Unadjusted trial. Product L73Z and Product A79B. Worksheet 4 - Chapter 4A Answer Keydocx - Accounting 215 Chapter 4 Part 1 Worksheetu2014Solution In your Chapters 2 and 3 worksheets you helped Austin Accounting 215 Chapter 4 Part 1 WorksheetSolution In your Chapters 2 and 3 worksheets you helped Austin Hirsh update The 2050 Companys books for financing investing and operating transactions. Students have to identify the concept described in the worksheet.

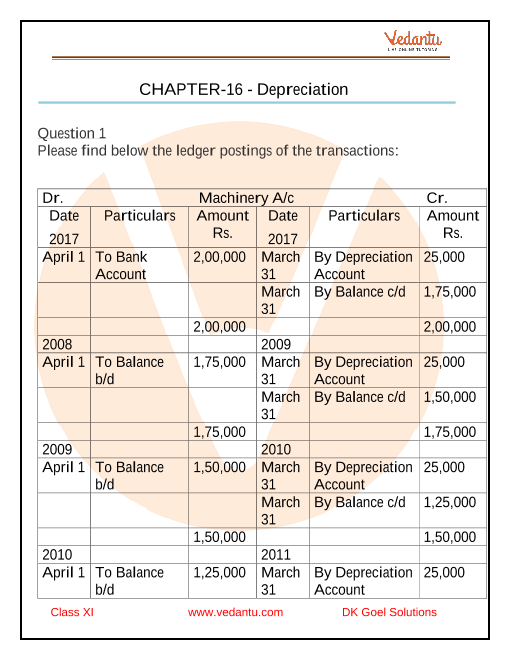

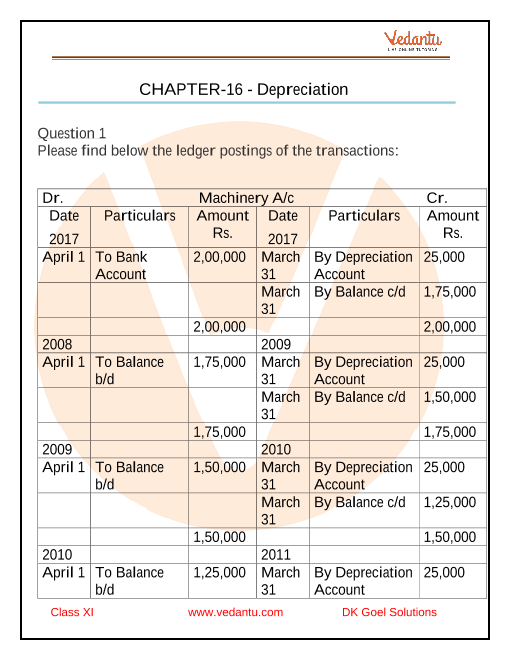

Dk Goel Solutions Class 11 Accountancy Chapter 16 Depreciation From vedantu.com

Dk Goel Solutions Class 11 Accountancy Chapter 16 Depreciation From vedantu.com

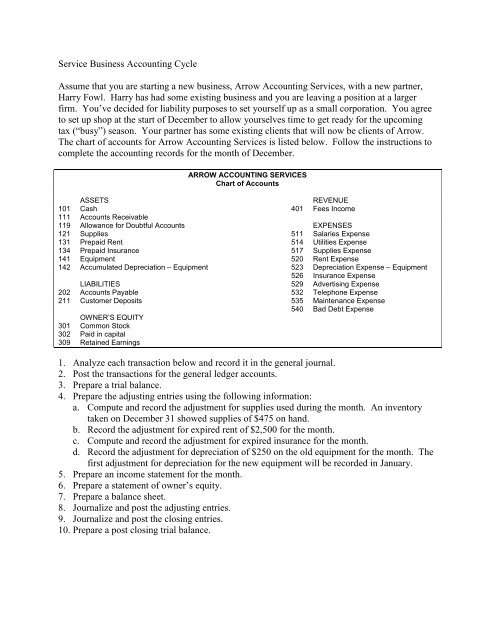

Once you have completed the test click on Submit Answers for Grading to get your results. Workbook has 88 questions and exercises starting from the accounting equation and basic concepts to journal entries T-accounts the trial balance financial statements the cash flow statement. Accounting worksheet - Basic concepts Hits. D Wages earned but not paid as of March 31 110. Accounting Cycle Exercises III 16 Problem 5. At the bottom of this page youll find a link to our income statement quiz 10 multiple-choice questions which you can use to test yourself.

ANSWERS TO QUESTIONS 1.

The worksheet is merely a device used to make it easier to prepare 3. The company uses a plantwide overhead rate based on direct labor-hoursuses. The following practice questions show the straight-line depreciation method in. Accounting Worksheet Problems and Solutions We have covered Worksheet topic in great detail. 31 Depreciation Expense 750 Accumulated Depreciation 750 To record depreciation expense 105000 140. C Depreciation of office equipment 275.

Source: in.pinterest.com

Source: in.pinterest.com

Choose an answer and hit next. A worksheet is not a permanent accounting record. The company uses a plantwide overhead rate based on direct labor-hoursuses. Losser Corporation manufactures two products. 31831 Short answer questions - Partnership Accounts Hits.

Source: pinterest.com

Source: pinterest.com

31831 Short answer questions - Partnership Accounts Hits. MEADOWS SOLICITOR Worksheet for the year ended 31 December 2003 Account title Unadjusted trial. Which of the following options in a financial function indicates the interest for a period. Now it is the right time to do practice and get good marks in the exam. 31 Depreciation Expense 750 Accumulated Depreciation 750 To record depreciation expense 105000 140.

Source: pinterest.com

Source: pinterest.com

COMPLETING THE ACCOUNTING CYCLE 52 WILEY Solution to demonstration problem A. Choose an answer and hit next. Quiz Worksheet - Accounting for Natural Resource Assets Quiz Course Try it risk-free for 30 days Instructions. The worksheet is merely a device used to make it easier to prepare 3. Practice is the key to success in Accounting.

Source: pinterest.com

Source: pinterest.com

Now it is the right time to do practice and get good marks in the exam. The company uses a plantwide overhead rate based on direct labor-hoursuses. An accountant uses depreciation is to allocate the cost of a fixed asset over the years of its useful life. A worksheet is not a permanent accounting record. Student Name_____ Managerial Accounting SI Worksheet Chapter 7 WITH ANSWERS 1.

Source: pinterest.com

Source: pinterest.com

It looks at International Accounting Standard 16 on non-current assets how to value assets methods of calculating depreciation how to account for depreciation with practice questions answers and. An accountant uses depreciation is to allocate the cost of a fixed asset over the years of its useful life. Accounting concepts and principles. In this tutorial well learn the purpose of this key accounting report and go over a simple income statement example to learn its format and components. Now it is the right time to do practice and get good marks in the exam.

Source: pinterest.com

Source: pinterest.com

D Wages earned but not paid as of March 31 110. Losser Corporation manufactures two products. Choose an answer and hit next. We use cookies on our website. The worksheet is merely a device used to make it easier to prepare 3.

Source: vedantu.com

Source: vedantu.com

51444 Worksheet - Partnership Accounts Hits. Student Name_____ Managerial Accounting SI Worksheet Chapter 7 WITH ANSWERS 1. Accounting worksheet - Basic concepts Hits. 31831 Short answer questions - Partnership Accounts Hits. D Wages earned but not paid as of March 31 110.

Source: pinterest.com

Source: pinterest.com

The company uses a plantwide overhead rate based on direct labor-hoursuses. This worksheet covers the first topic of IGCSE accounting ie. A FV b PV c. The worksheet is merely a device used to make it easier to prepare 3. 51444 Worksheet - Partnership Accounts Hits.

Source: tvassignmenthelp.com

Source: tvassignmenthelp.com

A worksheet is not a permanent accounting record. A worksheet is not a permanent accounting record. Student Worksheet p1 Groups will present thei r discussion outcomes. The use of a worksheet is an optional step in the accounting cycle. An accountant uses depreciation is to allocate the cost of a fixed asset over the years of its useful life.

Source: cz.pinterest.com

Source: cz.pinterest.com

The use of a worksheet is an optional step in the accounting cycle. An excellent revision worksheet. Student Name_____ Managerial Accounting SI Worksheet Chapter 7 WITH ANSWERS 1. Accounting Worksheet Problems and Solutions We have covered Worksheet topic in great detail. At the bottom of this page youll find a link to our income statement quiz 10 multiple-choice questions which you can use to test yourself.

Source: pinterest.com

Source: pinterest.com

Worksheet 4 - Chapter 4A Answer Keydocx - Accounting 215 Chapter 4 Part 1 Worksheetu2014Solution In your Chapters 2 and 3 worksheets you helped Austin Accounting 215 Chapter 4 Part 1 WorksheetSolution In your Chapters 2 and 3 worksheets you helped Austin Hirsh update The 2050 Companys books for financing investing and operating transactions. The straight-line depreciation method is the most popular type because it allocates the same amount of depreciation to each year the asset is in use. A FV b PV c. Quiz Worksheet - Accounting for Natural Resource Assets Quiz Course Try it risk-free for 30 days Instructions. C Depreciation of office equipment 275.

Source: slideshare.net

Source: slideshare.net

Click on Working in the Real World and select Chapter 23. Click on Working in the Real World and select Chapter 23. We use cookies on our website. 51444 Worksheet - Partnership Accounts Hits. Practice is the key to success in Accounting.

Source: yumpu.com

Source: yumpu.com

This worksheet covers the first topic of IGCSE accounting ie. The worksheet is merely a device used to make it easier to prepare 3. COMPLETING THE ACCOUNTING CYCLE 52 WILEY Solution to demonstration problem A. The following practice questions show the straight-line depreciation method in. Practice is the key to success in Accounting.

Source: pinterest.com

Source: pinterest.com

An excellent revision worksheet. A worksheet is not a permanent accounting record. Multiple choice questions Try the multiple choice questions below to test your knowledge of the sections of the book indicated below. MEADOWS SOLICITOR Worksheet for the year ended 31 December 2003 Account title Unadjusted trial. The straight-line depreciation method is the most popular type because it allocates the same amount of depreciation to each year the asset is in use.

Source: pinterest.com

Source: pinterest.com

51444 Worksheet - Partnership Accounts Hits. ANSWERS TO QUESTIONS 1. Once you have completed the test click on Submit Answers for Grading to get your results. Students have to identify the concept described in the worksheet. Solution Solution 4 GENERAL JOURNAL Date Accounts Debit Credit Jan.

Source: pinterest.com

Source: pinterest.com

31831 Short answer questions - Partnership Accounts Hits. A FV b PV c. The worksheet is merely a device used to make it easier to prepare 3. Accounting concepts and principles. Which of the following options in a financial function indicates the interest for a period.

You will receive your score and answers at the end. Student Name_____ Managerial Accounting SI Worksheet Chapter 7 WITH ANSWERS 1. Review the work sheet for addition mistakes transpositions and other. An excellent revision worksheet. The straight-line depreciation method is the most popular type because it allocates the same amount of depreciation to each year the asset is in use.

Source: pinterest.com

Source: pinterest.com

ANSWERS TO QUESTIONS 1. The straight-line depreciation method is the most popular type because it allocates the same amount of depreciation to each year the asset is in use. The company uses a plantwide overhead rate based on direct labor-hoursuses. Practice is the key to success in Accounting. ANSWERS TO QUESTIONS 1.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title accounting student worksheet depreciation answers by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.