Your Accounting unearned rent worksheet images are available. Accounting unearned rent worksheet are a topic that is being searched for and liked by netizens now. You can Find and Download the Accounting unearned rent worksheet files here. Download all free photos and vectors.

If you’re looking for accounting unearned rent worksheet images information linked to the accounting unearned rent worksheet interest, you have pay a visit to the ideal blog. Our site always gives you hints for viewing the maximum quality video and image content, please kindly surf and find more informative video articles and graphics that match your interests.

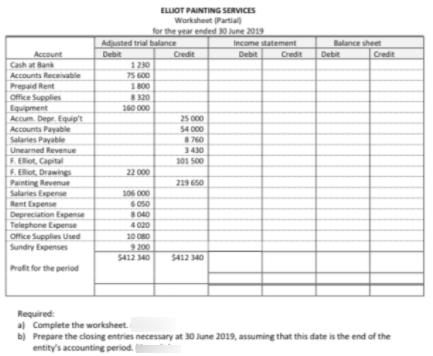

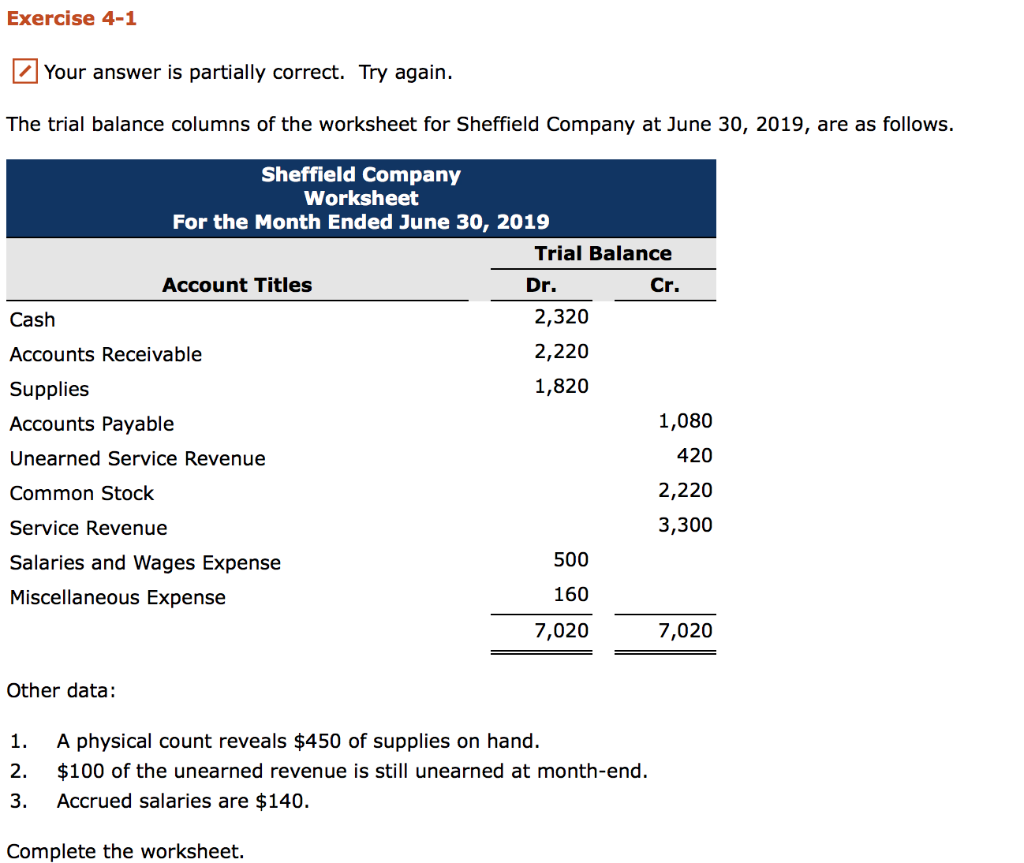

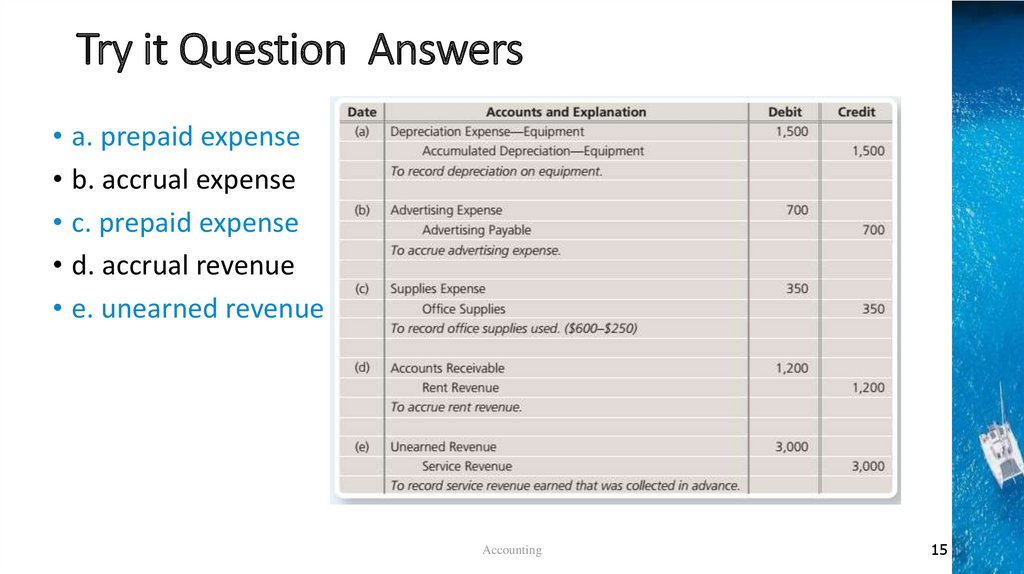

Accounting Unearned Rent Worksheet. True or False 1. In contrast accrued rent relates to rent that has not yet been paid - but the utilization of. The employee was paid last week but has g The one employee a receptionist works a five-day workweek at 50 per day. The purpose of the worksheet.

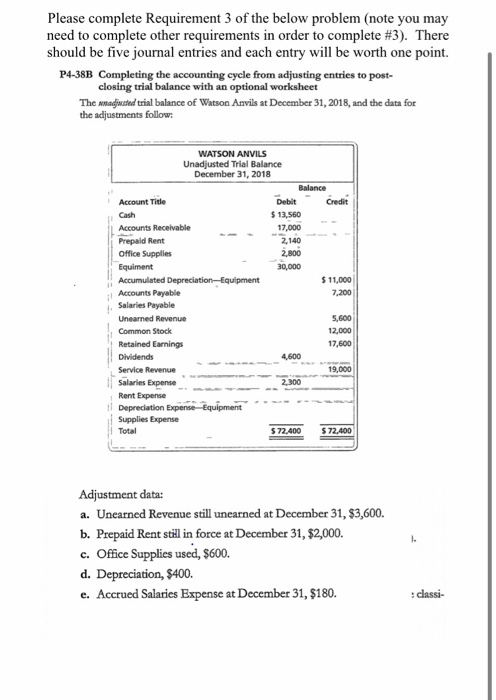

REM Real Estate should make the following adjusting entry on July 31. Debit Sep 2016 30 Unearned Rent 6000 Rent Revenue 30 Insurance Expense 720 Prepaid Insurance 30 Account Receivable 23200 Service Revenue 30 430 30 30. 3 Net Income will be understated by 200. Historia Company Adjustment Entries Date Description Ref. The accounting noted here only applies under the accrual basis of accounting. Accrued Rent Accrued rent is the opposite of prepaid.

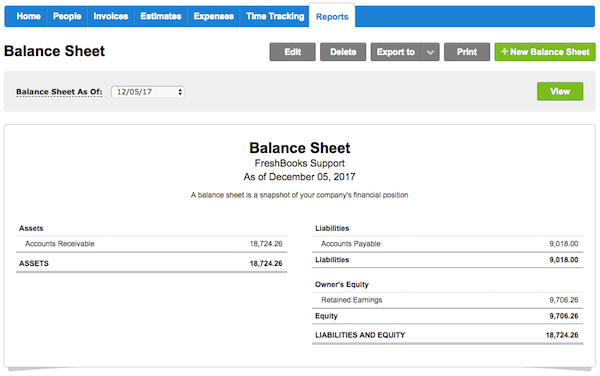

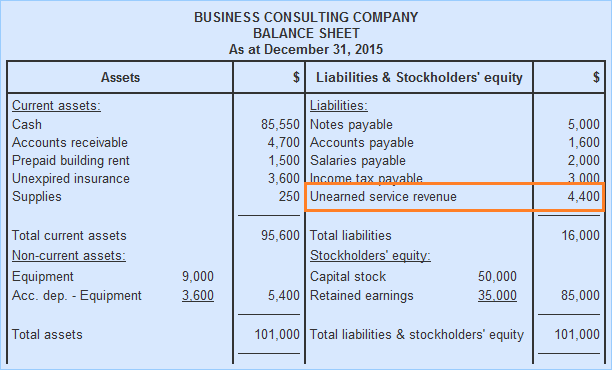

The accounting equation and balance.

2 Service Revenues will be understated by 200. 1 Unearned Revenues will be overstated by 200. Earned revenues of 18000 and incurred expenses of 4000. The accounting equation and balance. There are four closing entries that are numbered below. A 1000 credit entry to Rent Expense in the worksheets adjustments column Martinville Inc.

Source: investopedia.com

Source: investopedia.com

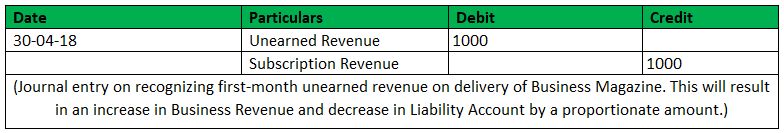

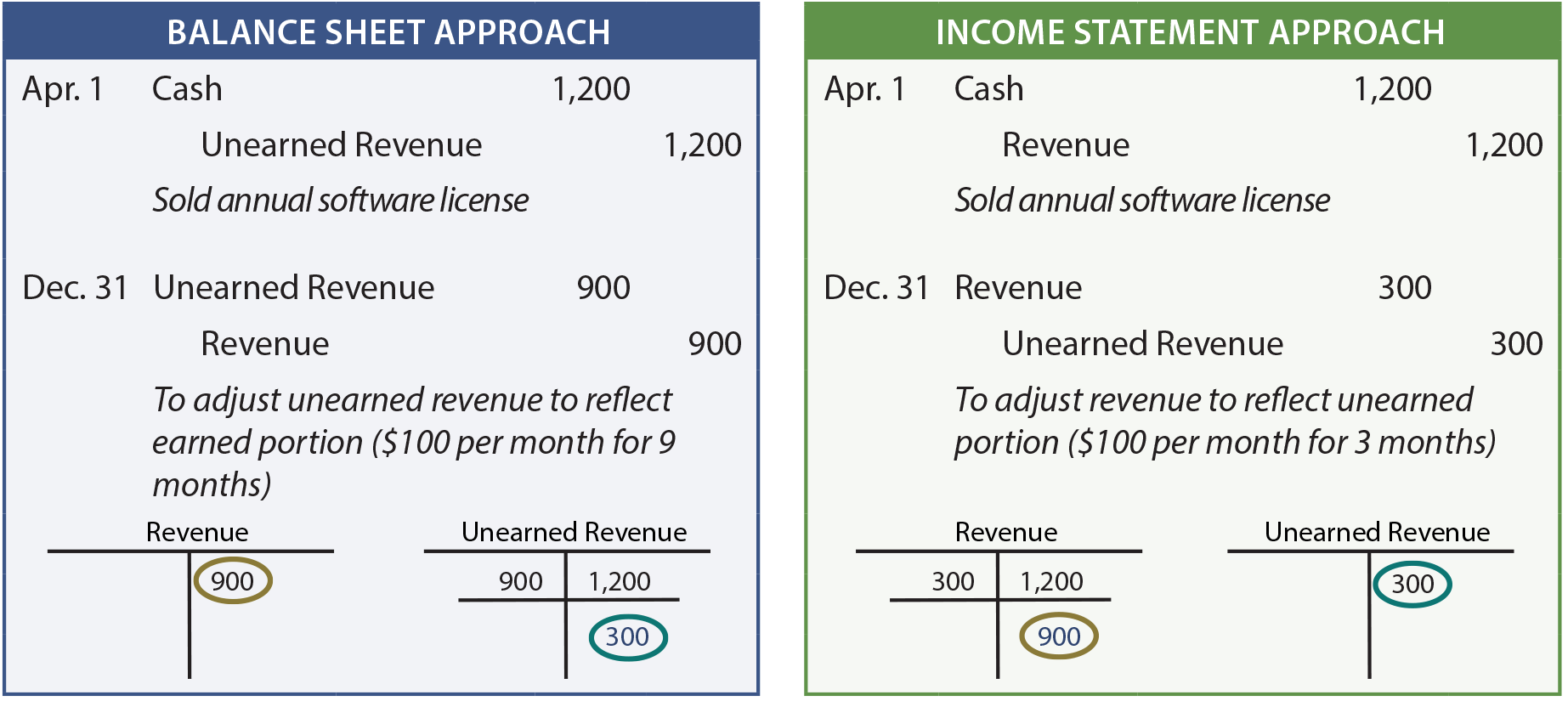

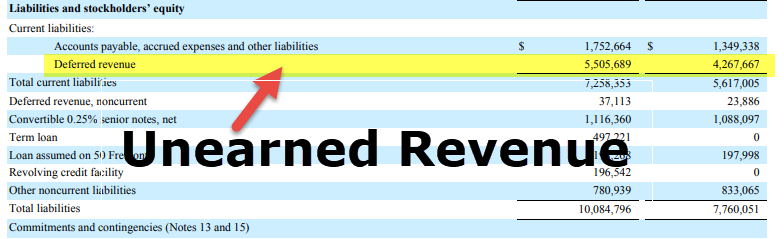

The accounting for the loan on the various dates assume a December year end with an appropriate year-end adjusting entry for the accrued interest would be as follows. Unearned revenue is a liability for the recipient of the payment so the initial entry is a debit to the cash account and a credit to the unearned revenue account. The purpose of the worksheet. Green light a commission agent has received 3600 on July 1 2016 as a commission from a client. If a portion remains unearned at the end of the accounting period it is converted into liability by making the following adjusting entry.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

The accounting equation and balance. REM Real Estate should make the following adjusting entry on July 31. Historia Company Adjustment Entries Date Description Ref. Unearned Rent Revenue was credited for the full 27000. A 1000 credit entry to Rent Expense in the worksheets adjustments column Martinville Inc.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Fees Revenue 190150 Rent Revenue 2000 Income Summary 192150 2. The accounting for the loan on the various dates assume a December year end with an appropriate year-end adjusting entry for the accrued interest would be as follows. The impact of the transaction now appears in the income statement as revenue. Accounting for Unearned Revenue As a company earns the revenue it reduces the balance in the unearned revenue account with a debit and increases the balance in the revenue account with a credit. The accounting noted here only applies under the accrual basis of accounting.

Source: freshbooks.com

Source: freshbooks.com

The accounting noted here only applies under the accrual basis of accounting. F 2800 of the Unearned Rent account balance was still unearned by year-end. The company declared and paid cash dividends of. 4 Owners equity will be understated by 200. True or False 1.

Source: double-entry-bookkeeping.com

Source: double-entry-bookkeeping.com

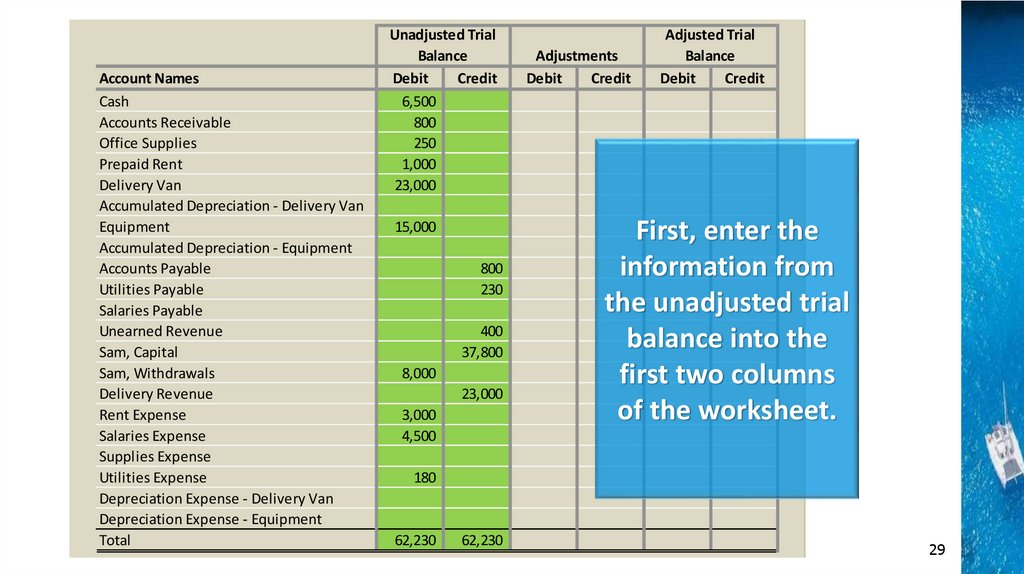

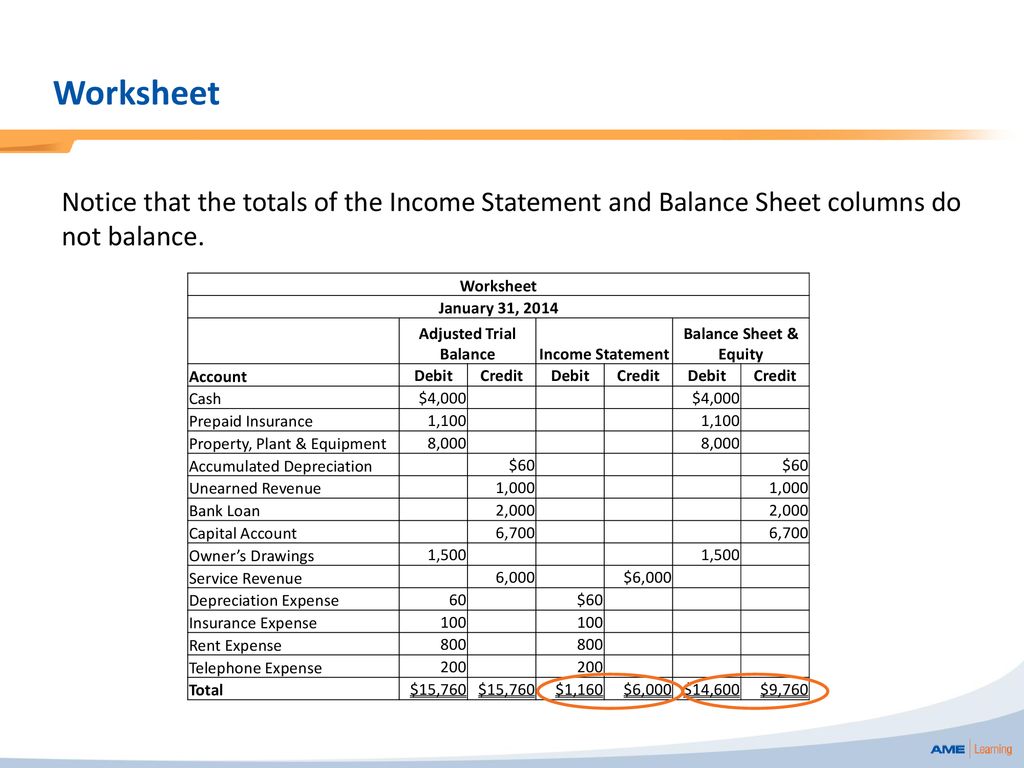

1 Unearned Revenues will be overstated by 200. If a portion remains unearned at the end of the accounting period it is converted into liability by making the following adjusting entry. 3 Net Income will be understated by 200. The accounting equation and balance. Worksheet is used by the accountants or bookkeepers as a working paper for completing the accounting cycle.

Source: slidetodoc.com

Source: slidetodoc.com

Historia Company Adjustment Entries Date Description Ref. REM Real Estate should make the following adjusting entry on July 31. The purpose of the worksheet. F 2800 of the Unearned Rent account balance was still unearned by year-end. Worksheet is used by the accountants or bookkeepers as a working paper for completing the accounting cycle.

Source: ppt-online.org

Source: ppt-online.org

Fees Revenue 190150 Rent Revenue 2000 Income Summary 192150 2. 2 Service Revenues will be understated by 200. The next step for Bobs bookkeeper is to create an accounting worksheet to ensure that all of it ties together. REM Real Estate should make the following adjusting entry on July 31. Track your rental finances by entering the relevant amounts into each itemized category such as rent and fees in the rental income category or HOA dues gardening service and utilities in the monthly expense category.

Source: principlesofaccounting.com

Source: principlesofaccounting.com

This would be helpful for the preparation of the year-end reports. The company declared and paid cash dividends of. A 1000 credit entry to Rent Expense in the worksheets adjustments column Martinville Inc. The purpose of the worksheet. REM Real Estate should make the following adjusting entry on July 31.

Source: bartleby.com

Source: bartleby.com

Unearned revenue is a liability for the recipient of the payment so the initial entry is a debit to the cash account and a credit to the unearned revenue account. View Accounting 201 review problemsdocx from BABA 1420251 at University of St. Accounting Worksheet Example We have already covered how Bobs financial statements were prepared and presented. La Salle - Bacolod City. True or False 1.

Source: investopedia.com

Source: investopedia.com

Unearned Rent Revenue was credited for the full 27000. 27 行 Accounting Worksheet An accounting worksheet is large table of data which. There are four closing entries that are numbered below. In contrast accrued rent relates to rent that has not yet been paid - but the utilization of. Accounting Worksheet Example We have already covered how Bobs financial statements were prepared and presented.

Source: chegg.com

Source: chegg.com

The next step for Bobs bookkeeper is to create an accounting worksheet to ensure that all of it ties together. F 2800 of the Unearned Rent account balance was still unearned by year-end. This would be helpful for the preparation of the year-end reports. To download the free rental income and expense worksheet template click the green button at the top of the page. Under the cash basis of accounting the landlord does not have any unearned rent.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

View Accounting 201 review problemsdocx from BABA 1420251 at University of St. The impact of the transaction now appears in the income statement as revenue. View Accounting 201 review problemsdocx from BABA 1420251 at University of St. Fees Revenue 190150 Rent Revenue 2000 Income Summary 192150 2. If a portion remains unearned at the end of the accounting period it is converted into liability by making the following adjusting entry.

Green light a commission agent has received 3600 on July 1 2016 as a commission from a client. Instead any rent payments received are recorded as income at once. True or False 1. Accrued rent is the opposite of the prepaid rent discussed earlier. If a portion remains unearned at the end of the accounting period it is converted into liability by making the following adjusting entry.

Source: chegg.com

Source: chegg.com

Fees Revenue 190150 Rent Revenue 2000 Income Summary 192150 2. Debit Sep 2016 30 Unearned Rent 6000 Rent Revenue 30 Insurance Expense 720 Prepaid Insurance 30 Account Receivable 23200 Service Revenue 30 430 30 30. The accounting for the loan on the various dates assume a December year end with an appropriate year-end adjusting entry for the accrued interest would be as follows. There are four closing entries that are numbered below. In contrast accrued rent relates to rent that has not yet been paid - but the utilization of.

Source: freshbooks.com

Source: freshbooks.com

There are four closing entries that are numbered below. Unearned revenue is a liability for the recipient of the payment so the initial entry is a debit to the cash account and a credit to the unearned revenue account. View Accounting 201 review problemsdocx from BABA 1420251 at University of St. Track your rental finances by entering the relevant amounts into each itemized category such as rent and fees in the rental income category or HOA dues gardening service and utilities in the monthly expense category. 3 Net Income will be understated by 200.

Source: en.ppt-online.org

Source: en.ppt-online.org

The accounting for the loan on the various dates assume a December year end with an appropriate year-end adjusting entry for the accrued interest would be as follows. Track your rental finances by entering the relevant amounts into each itemized category such as rent and fees in the rental income category or HOA dues gardening service and utilities in the monthly expense category. Accrued rent is the opposite of the prepaid rent discussed earlier. The purpose of the worksheet. Financial statements will be prepared on July 31.

Source: bookstime.com

Source: bookstime.com

Accounting for Unearned Revenue As a company earns the revenue it reduces the balance in the unearned revenue account with a debit and increases the balance in the revenue account with a credit. The purpose of the worksheet. The following closing entries are based on the previous worksheet. There are four closing entries that are numbered below. This would be helpful for the preparation of the year-end reports.

Source: slideplayer.com

Source: slideplayer.com

View Accounting 201 review problemsdocx from BABA 1420251 at University of St. There are four closing entries that are numbered below. Accounting for Unearned Revenue As a company earns the revenue it reduces the balance in the unearned revenue account with a debit and increases the balance in the revenue account with a credit. The accounting equation and balance. Under the cash basis of accounting the landlord does not have any unearned rent.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title accounting unearned rent worksheet by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.