Your Accounting worksheet adjust interest accrued images are available. Accounting worksheet adjust interest accrued are a topic that is being searched for and liked by netizens today. You can Download the Accounting worksheet adjust interest accrued files here. Get all free photos.

If you’re looking for accounting worksheet adjust interest accrued pictures information connected with to the accounting worksheet adjust interest accrued keyword, you have come to the right site. Our site always provides you with suggestions for downloading the highest quality video and picture content, please kindly surf and locate more enlightening video content and graphics that match your interests.

Accounting Worksheet Adjust Interest Accrued. Interest accrued on the bank loan amounts to 1470. Stockholders equity increases and decreases by the same amount. The accountant records this transaction as an asset in the form of a receivable and as revenue because the company has earned a revenue. Recognition of interest on a note receivable.

Lecture 05 Adjusting Entries Financial Statement Closing Entries From slidetodoc.com

Lecture 05 Adjusting Entries Financial Statement Closing Entries From slidetodoc.com

1 Interest Revenue or Interest Income will be understated by 1000. Prepare a statement of financial performance a statement of owners equity and a as at. Which of the following adjustments decreases net income for the period. Recognition of interest on a note receivable. At the end of period accountants should make sure that they are properly recorded in the books of the company as an expense with. They are commonly known as receivables and payables.

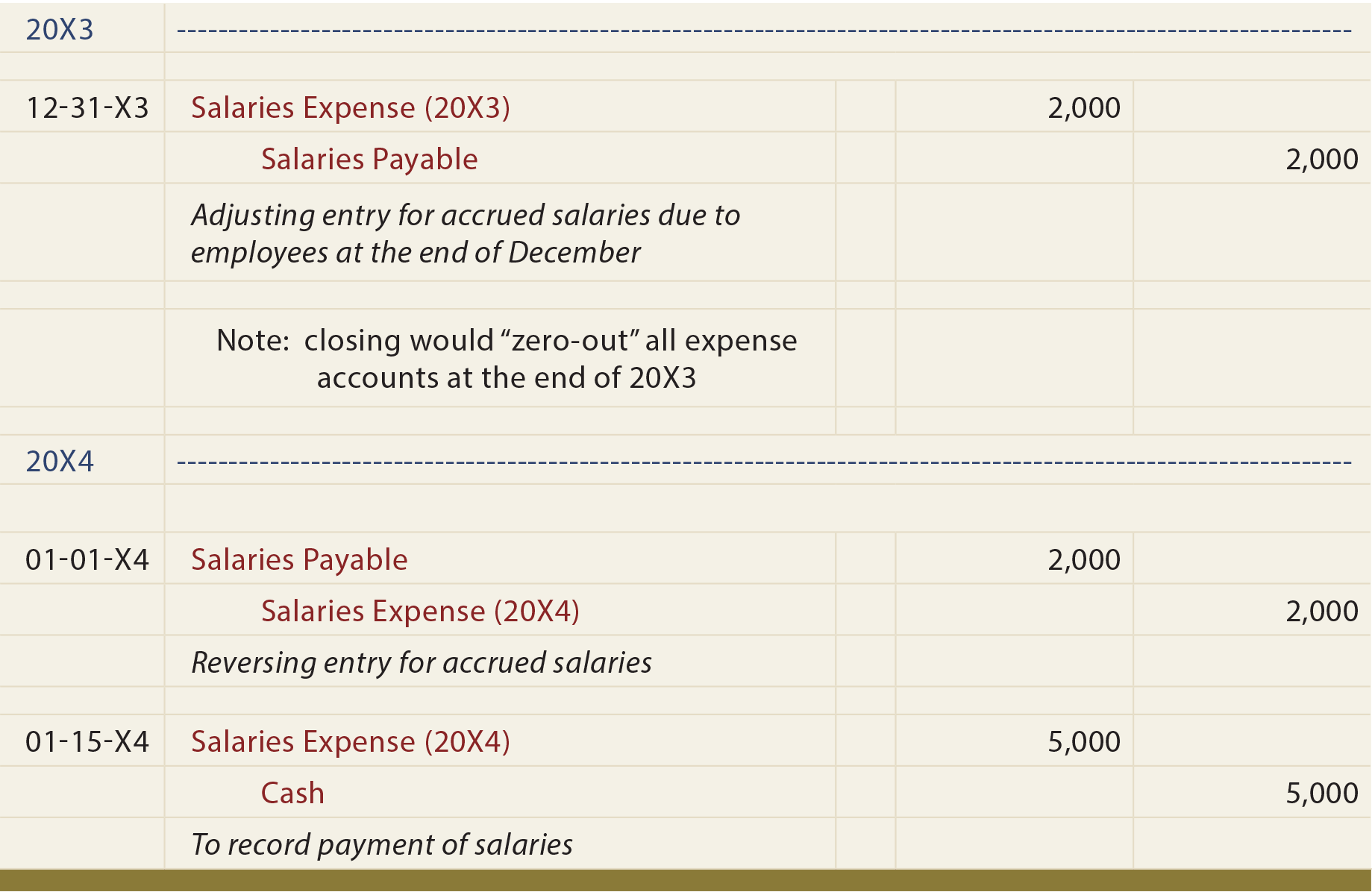

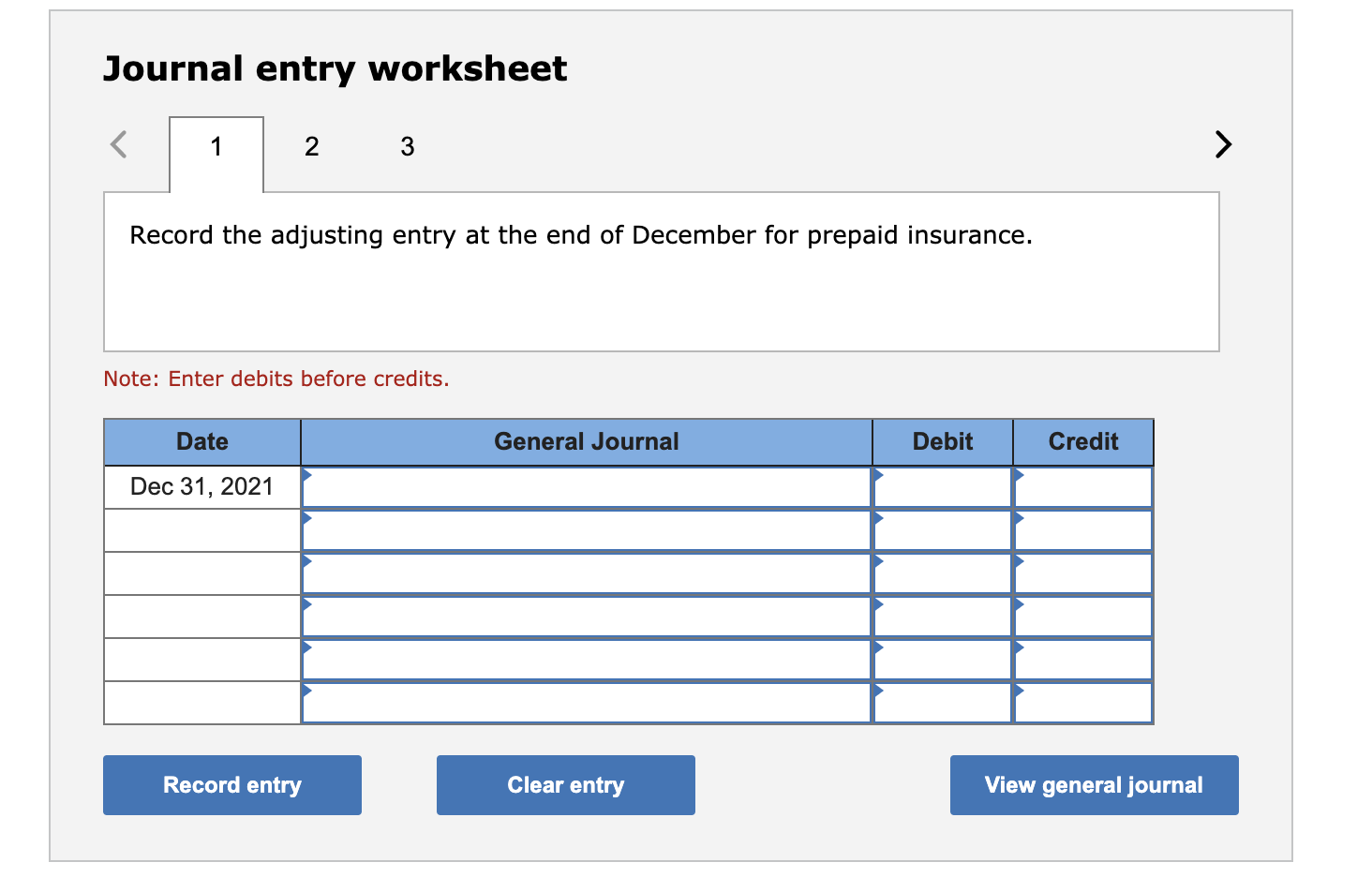

Accrual accounting requires revenues and expenses to be recorded in the accounting period that they are incurred.

The company incurred interest expenses from 152018 to 3062018 ie for two months and the remaining un-incurred and unpaid interest expense will adjust in the next accounting period. At the end of period accountants should make sure that they are properly recorded in the books of the company as an expense with. Stockholders equity increases and decreases by the same amount. The concept is typically used to compile the amount of unpaid interest that is either receivable to or payable by a business at the end of an accounting period so that the transaction is recorded in the correct period. This account could be written as Accrued Wage Expense or Wages Payable. Two adjusting journal entries are referred to as accrued or unrecorded expense and revenue.

Source: pinterest.com

Source: pinterest.com

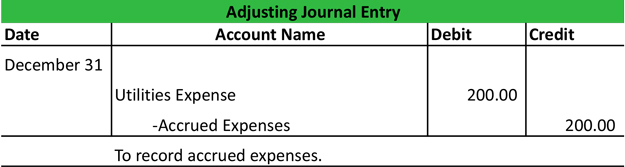

The account titles for Accrued Expenses can be written two ways. Adjusting Entry for Accrued Expenses. Recognition of depreciation on plant assets. This account could be written as Accrued Wage Expense or Wages Payable. The incurred expense will adjust the income statement and the balance sheet as follows.

Source: pinterest.com

Source: pinterest.com

Prepare a statement of financial performance a statement of owners equity and a as at. Again we see that there is a debit of interest payable Interest Payable Interest Payable is a liability account shown on a companys balance sheet that represents the amount of interest expense that has accrued along with a debit of interest expense. At first this may seem confusing because there may be several sets of journal. Recognition of services that had been provided to customers but the cash has. The company incurred interest expenses from 152018 to 3062018 ie for two months and the remaining un-incurred and unpaid interest expense will adjust in the next accounting period.

Source: pinterest.com

Source: pinterest.com

Example 1 Revenue Goes From Accrued Asset to Accrued Revenue An asset revenue adjustment may occur when a company performs a service for a customer but has not yet billed the customer. As an example lets use wages earned by an employee but not paid yet. Since accrued expenses are expenses incurred before they are paid they become a companys liabilities for cash payments in the future. Example 1 Revenue Goes From Accrued Asset to Accrued Revenue An asset revenue adjustment may occur when a company performs a service for a customer but has not yet billed the customer. Which of the following adjustments decreases net income for the period.

Source: br.pinterest.com

Source: br.pinterest.com

The account titles for Accrued Expenses can be written two ways. This account could be written as Accrued Wage Expense or Wages Payable. They are commonly known as receivables and payables. Example 1 Revenue Goes From Accrued Asset to Accrued Revenue An asset revenue adjustment may occur when a company performs a service for a customer but has not yet billed the customer. Accrual Interest in Accounting Under accrual accounting accrued interest is the amount of interest from a financial obligation that has been incurred in a reporting period Reporting Period A reporting period also known as the accounting period is a discrete and uniform span of time for which the financial performance and while the cash payment has not been made yet in that period.

Source: pinterest.com

Source: pinterest.com

Again we see that there is a debit of interest payable Interest Payable Interest Payable is a liability account shown on a companys balance sheet that represents the amount of interest expense that has accrued along with a debit of interest expense. Recognition of interest on a note receivable. 2 Net Income will be understated by 1000. Which of the following adjustments decreases net income for the period. Prepare a statement of financial performance a statement of owners equity and a as at.

Source: pinterest.com

Source: pinterest.com

They are commonly known as receivables and payables. Recognition of services that had been provided to customers but the cash has. Accrued expenses refer to expenses that are already incurred but have not yet been paid. Adjusting Entry for Accrued Expenses. Recognition of interest on a note receivable.

Source: pinterest.com

Source: pinterest.com

3 Owners equity will be understated by 1000. Stockholders equity increases and decreases by the same amount. Again we see that there is a debit of interest payable Interest Payable Interest Payable is a liability account shown on a companys balance sheet that represents the amount of interest expense that has accrued along with a debit of interest expense. They are commonly known as receivables and payables. Example 1 Revenue Goes From Accrued Asset to Accrued Revenue An asset revenue adjustment may occur when a company performs a service for a customer but has not yet billed the customer.

Source: pinterest.com

Source: pinterest.com

Stockholders equity increases and decreases by the same amount. Example 1 Revenue Goes From Accrued Asset to Accrued Revenue An asset revenue adjustment may occur when a company performs a service for a customer but has not yet billed the customer. At first this may seem confusing because there may be several sets of journal. Accrual accounting requires revenues and expenses to be recorded in the accounting period that they are incurred. The concept is typically used to compile the amount of unpaid interest that is either receivable to or payable by a business at the end of an accounting period so that the transaction is recorded in the correct period.

Source: pinterest.com

Source: pinterest.com

3 Owners equity will be understated by 1000. Therefore accrued expenses are also known as accrued liabilities. The account titles for Accrued Expenses can be written two ways. As an example lets use wages earned by an employee but not paid yet. 3 Owners equity will be understated by 1000.

Source: pinterest.com

Source: pinterest.com

Stockholders equity increases and decreases by the same amount. 1 Interest Revenue or Interest Income will be understated by 1000. Prepare a statement of financial performance a statement of owners equity and a as at. The last entry represents the payment of the note along with all interest that has accrued over the life of the note. Example 1 Revenue Goes From Accrued Asset to Accrued Revenue An asset revenue adjustment may occur when a company performs a service for a customer but has not yet billed the customer.

Source: freshbooks.com

Source: freshbooks.com

Interest accrued on the bank loan amounts to 1470. The accountant records this transaction as an asset in the form of a receivable and as revenue because the company has earned a revenue. 2 Net Income will be understated by 1000. At the end of period accountants should make sure that they are properly recorded in the books of the company as an expense with. Adjusting Entry for Accrued Expenses.

Source: principlesofaccounting.com

Source: principlesofaccounting.com

The account titles for Accrued Expenses can be written two ways. Again we see that there is a debit of interest payable Interest Payable Interest Payable is a liability account shown on a companys balance sheet that represents the amount of interest expense that has accrued along with a debit of interest expense. As an example lets use wages earned by an employee but not paid yet. Accrual Interest in Accounting Under accrual accounting accrued interest is the amount of interest from a financial obligation that has been incurred in a reporting period Reporting Period A reporting period also known as the accounting period is a discrete and uniform span of time for which the financial performance and while the cash payment has not been made yet in that period. Two adjusting journal entries are referred to as accrued or unrecorded expense and revenue.

At first this may seem confusing because there may be several sets of journal. Accrual Interest in Accounting Under accrual accounting accrued interest is the amount of interest from a financial obligation that has been incurred in a reporting period Reporting Period A reporting period also known as the accounting period is a discrete and uniform span of time for which the financial performance and while the cash payment has not been made yet in that period. At first this may seem confusing because there may be several sets of journal. The company incurred interest expenses from 152018 to 3062018 ie for two months and the remaining un-incurred and unpaid interest expense will adjust in the next accounting period. The accountant records this transaction as an asset in the form of a receivable and as revenue because the company has earned a revenue.

Source: pinterest.com

Source: pinterest.com

Interest accrued on the bank loan amounts to 1470. The company incurred interest expenses from 152018 to 3062018 ie for two months and the remaining un-incurred and unpaid interest expense will adjust in the next accounting period. This account could be written as Accrued Wage Expense or Wages Payable. As an example lets use wages earned by an employee but not paid yet. Stockholders equity increases and decreases by the same amount.

Source: slidetodoc.com

Source: slidetodoc.com

The last entry represents the payment of the note along with all interest that has accrued over the life of the note. 1 Interest Revenue or Interest Income will be understated by 1000. The company incurred interest expenses from 152018 to 3062018 ie for two months and the remaining un-incurred and unpaid interest expense will adjust in the next accounting period. Therefore accrued expenses are also known as accrued liabilities. Recognition of interest on a note receivable.

Source: slidetodoc.com

Source: slidetodoc.com

Prepare a statement of financial performance a statement of owners equity and a as at. At the end of period accountants should make sure that they are properly recorded in the books of the company as an expense with. As an example lets use wages earned by an employee but not paid yet. Which of the following adjustments decreases net income for the period. Recognition of services that had been provided to customers but the cash has.

Source: pinterest.com

Source: pinterest.com

Accrued expenses refer to expenses that are already incurred but have not yet been paid. Recognition of services that had been provided to customers but the cash has. Prepare a 10-column worksheet for the year ended 30 June 2003. Interest accrued on the bank loan amounts to 1470. Which of the following adjustments decreases net income for the period.

Source: chegg.com

Source: chegg.com

They are commonly known as receivables and payables. Prepare a statement of financial performance a statement of owners equity and a as at. Stockholders equity increases and decreases by the same amount. Which of the following adjustments decreases net income for the period. Two adjusting journal entries are referred to as accrued or unrecorded expense and revenue.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title accounting worksheet adjust interest accrued by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.