Your Accounting worksheet adjust inventory on hand images are ready in this website. Accounting worksheet adjust inventory on hand are a topic that is being searched for and liked by netizens now. You can Get the Accounting worksheet adjust inventory on hand files here. Find and Download all royalty-free photos.

If you’re searching for accounting worksheet adjust inventory on hand pictures information connected with to the accounting worksheet adjust inventory on hand interest, you have come to the right site. Our site always gives you hints for seeking the maximum quality video and image content, please kindly search and locate more informative video articles and images that fit your interests.

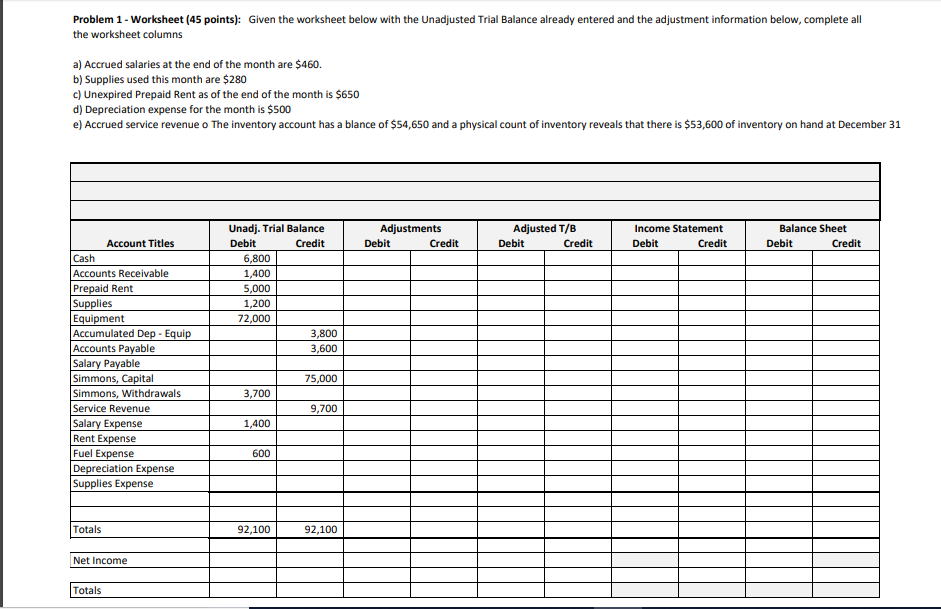

Accounting Worksheet Adjust Inventory On Hand. Merchandise inventory also called Inventory is a current asset with a normal debit balance meaning a debit will increase and a credit will. Complete Adjusting Process Blogger The entries required at the end of an accounting period to record internal transactions are called adjusting entries. This is Determining Inventory on Hand section 85 from the book Business Accounting v. Calculating and Recording Adjustments Chapter 12 Section Objectives 1.

Accounting Class Help Accounting Classes Accounting Student Accounting Principles From pinterest.com

Accounting Class Help Accounting Classes Accounting Student Accounting Principles From pinterest.com

The second adjusting entry debits inventory and credits income summary for the value of inventory at the end of the accounting period. This is Determining Inventory on Hand section 85 from the book Business Accounting v. If that describes your company great. Suppose in the above example the beginning supplies on hand were 1200 and the ending supplies on hand were 900 then the supplies expense for the period would be calculated as follows. This is the starting point for making an adjustment entry for supplies on hand. If everything is working perfectly in your QuickBooks company you wont need to worry about making inventory adjustments.

Notice the amounts in each account.

All activity must cease during the physical inventory count to maintain the integrity of the count. This is Determining Inventory on Hand section 85 from the book Business Accounting v. In a modern computerized inventory tracking system the system generates most of these transactions for you so the precise nature of the journal entries is not necessarily visible. For example a 1500 credit in the cash column should correspond with a 1500 debit in the supplies column. Merchandise inventory also called Inventory is a current asset with a normal debit balance meaning a debit will increase and a credit will. All activity must cease during the physical inventory count to maintain the integrity of the count.

Source: pinterest.com

Source: pinterest.com

If you edit the inventory item look under Quantity on Hand there should be a clickable starting value click that and adjust your starting quantity to 0. This is the starting point for making an adjustment entry for supplies on hand. Determine the adjustment for merchandise inventory and enter the adjustment on the worksheet. There are a number of inventory journal entries that can be used to document inventory transactions. Complete Adjusting Process Blogger The entries required at the end of an accounting period to record internal transactions are called adjusting entries.

Source: pinterest.com

Source: pinterest.com

Instead a parts cost fluctuates according to the current cost of the selected costing method. When we post this adjusting journal entry you can see the ending. In order to be able to do this the accounting records are closed the temporary income and expenses accounts balances are transferred to the income statement and an adjustment is made for the ending inventory. This is the starting point for making an adjustment entry for supplies on hand. If that describes your company great.

Source: pinterest.com

Source: pinterest.com

This is Determining Inventory on Hand section 85 from the book Business Accounting v. At the end of the accounting period the supplies on hand are counted and the movement recorded as an expense item in the income statement. To adjust inventory to match the physical count. Prepare Closing Entries. Combined these two adjusting entries update the inventory accounts balance and until closing entries are made leave income summary with a balance that reflects the increase or decrease in inventory.

Source: pinterest.com

Source: pinterest.com

For details on it including licensing click here. Supplies on hand Hence the adjusting entry required is a debit to Supplies Expense of 520 and a credit to Supplies of 520. This is the starting point for making an adjustment entry for supplies on hand. Combined these two adjusting entries update the inventory accounts balance and until closing entries are made leave income summary with a balance that reflects the increase or decrease in inventory. The second adjusting entry debits inventory and credits income summary for the value of inventory at the end of the accounting period.

Source: pinterest.com

Source: pinterest.com

Go to Vendors then Inventory Activities then select Adjust QuantityValue on Hand. If everything is working perfectly in your QuickBooks company you wont need to worry about making inventory adjustments. You will receive inventory items sell inventory items possibly even build inventory items assemblies and everything will balance out. Combined these two adjusting entries update the inventory accounts balance and until closing entries are made leave income summary with a balance that reflects the increase or decrease in inventory. For the rest of us though there are times when we will.

Source: pinterest.com

Source: pinterest.com

Calculating and Recording Adjustments Chapter 12 Section Objectives 1. If you edit the inventory item look under Quantity on Hand there should be a clickable starting value click that and adjust your starting quantity to 0. Merchandise inventory also called Inventory is a current asset with a normal debit balance meaning a debit will increase and a credit will. All activity must cease during the physical inventory count to maintain the integrity of the count. Complete Adjusting Process Blogger The entries required at the end of an accounting period to record internal transactions are called adjusting entries.

Source: in.pinterest.com

Source: in.pinterest.com

Instead a parts cost fluctuates according to the current cost of the selected costing method. This is the starting point for making an adjustment entry for supplies on hand. You will receive inventory items sell inventory items possibly even build inventory items assemblies and everything will balance out. Suppose in the above example the beginning supplies on hand were 1200 and the ending supplies on hand were 900 then the supplies expense for the period would be calculated as follows. Merchandise inventory also called Inventory is a current asset with a normal debit balance meaning a debit will increase and a credit will.

Source: pinterest.com

Source: pinterest.com

Notice the amounts in each account. Combined these two adjusting entries update the inventory accounts balance and until closing entries are made leave income summary with a balance that reflects the increase or decrease in inventory. If you edit the inventory item look under Quantity on Hand there should be a clickable starting value click that and adjust your starting quantity to 0. Calculating and Recording Adjustments Chapter 12 Section Objectives 1. Accruals Deferrals and the Worksheet Section 1.

Source: pinterest.com

Source: pinterest.com

Determine the adjustment for merchandise inventory and enter the adjustment on the worksheet. Merchandise inventory also called Inventory is a current asset with a normal debit balance meaning a debit will increase and a credit will. Determine the adjustment for merchandise inventory and enter the adjustment on the worksheet. Supplies on hand Hence the adjusting entry required is a debit to Supplies Expense of 520 and a credit to Supplies of 520. To adjust inventory to match the physical count.

Source: pinterest.com

Source: pinterest.com

If that describes your company great. For example a 1500 credit in the cash column should correspond with a 1500 debit in the supplies column. Merchandise inventory is the cost of goods on hand and available for sale at any given time. For the rest of us though there are times when we will. Suppose in the above example the beginning supplies on hand were 1200 and the ending supplies on hand were 900 then the supplies expense for the period would be calculated as follows.

Source: pinterest.com

Source: pinterest.com

Enter the name of the expense account where you track inventory loss and shortages in the Adjustment Account field. Suppose in the above example the beginning supplies on hand were 1200 and the ending supplies on hand were 900 then the supplies expense for the period would be calculated as follows. When inventory leaves Fishbowl sold scrapped etc the cost that is exported to the accounting system will rarely match the individual cost of that item when it entered inventory. Merchandise inventory is the cost of goods on hand and available for sale at any given time. If everything is working perfectly in your QuickBooks company you wont need to worry about making inventory adjustments.

Source: pinterest.com

Source: pinterest.com

Merchandise inventory also called Inventory is a current asset with a normal debit balance meaning a debit will increase and a credit will. Merchandise inventory is the cost of goods on hand and available for sale at any given time. Inventory adjustments require a physical inventory count to take place so that the accountant can compare it to the inventory balance recorded in the system. If everything is working perfectly in your QuickBooks company you wont need to worry about making inventory adjustments. Supplies on hand Hence the adjusting entry required is a debit to Supplies Expense of 520 and a credit to Supplies of 520.

Source: pinterest.com

Source: pinterest.com

The second adjusting entry debits inventory and credits income summary for the value of inventory at the end of the accounting period. This is Determining Inventory on Hand section 85 from the book Business Accounting v. Notice the amounts in each account. Merchandise inventory is the cost of goods on hand and available for sale at any given time. This is the starting point for making an adjustment entry for supplies on hand.

Source: pinterest.com

Source: pinterest.com

Ending Inventory and Cost of Goods Sold At the month end a business needs to be able to calculate how much profit it has made. For example a 1500 credit in the cash column should correspond with a 1500 debit in the supplies column. Combined these two adjusting entries update the inventory accounts balance and until closing entries are made leave income summary with a balance that reflects the increase or decrease in inventory. To adjust inventory to match the physical count. If you need to assign the expense to more than one account enter a separate adjustment for each account.

Source: pinterest.com

Source: pinterest.com

Prepare Adjusting Journal Entries 9. If everything is working perfectly in your QuickBooks company you wont need to worry about making inventory adjustments. There are a number of inventory journal entries that can be used to document inventory transactions. At the end of the accounting period the supplies on hand are counted and the movement recorded as an expense item in the income statement. For details on it including licensing click here.

Source: chegg.com

Source: chegg.com

This is Determining Inventory on Hand section 85 from the book Business Accounting v. Go to Vendors then Inventory Activities then select Adjust QuantityValue on Hand. Suppose in the above example the beginning supplies on hand were 1200 and the ending supplies on hand were 900 then the supplies expense for the period would be calculated as follows. In a modern computerized inventory tracking system the system generates most of these transactions for you so the precise nature of the journal entries is not necessarily visible. Supplies on hand Hence the adjusting entry required is a debit to Supplies Expense of 520 and a credit to Supplies of 520.

Source: id.pinterest.com

Source: id.pinterest.com

Determine the adjustment for merchandise inventory and enter the adjustment on the worksheet. If you edit the inventory item look under Quantity on Hand there should be a clickable starting value click that and adjust your starting quantity to 0. Select Adjust QuantityValue on Hand in the drop-down list under either Lists or Vendors. In a modern computerized inventory tracking system the system generates most of these transactions for you so the precise nature of the journal entries is not necessarily visible. Then every time you purchase that item and expense it it will add more.

Source: pinterest.com

Source: pinterest.com

Ending Inventory and Cost of Goods Sold At the month end a business needs to be able to calculate how much profit it has made. Complete Adjusting Process Blogger The entries required at the end of an accounting period to record internal transactions are called adjusting entries. In a modern computerized inventory tracking system the system generates most of these transactions for you so the precise nature of the journal entries is not necessarily visible. You will receive inventory items sell inventory items possibly even build inventory items assemblies and everything will balance out. Go to Vendors then Inventory Activities then select Adjust QuantityValue on Hand.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title accounting worksheet adjust inventory on hand by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.