Your Accounting worksheet example doubtful account adjustment images are ready in this website. Accounting worksheet example doubtful account adjustment are a topic that is being searched for and liked by netizens now. You can Download the Accounting worksheet example doubtful account adjustment files here. Find and Download all free images.

If you’re looking for accounting worksheet example doubtful account adjustment pictures information connected with to the accounting worksheet example doubtful account adjustment interest, you have pay a visit to the ideal site. Our website frequently provides you with hints for viewing the highest quality video and picture content, please kindly surf and find more informative video articles and images that match your interests.

Accounting Worksheet Example Doubtful Account Adjustment. Examples of accounting adjustments are as follows. You are required to prepare trading and profit and loss account for the year ended 31st December. Allowance for doubtful debts is created by forming a credit balance which is netted off against the total receivables appearing in the balance sheet. Apply accounting equation to determine.

Allowance Method I Bad Debts I Examples I Accountancy Knowledge From accountancyknowledge.com

Allowance Method I Bad Debts I Examples I Accountancy Knowledge From accountancyknowledge.com

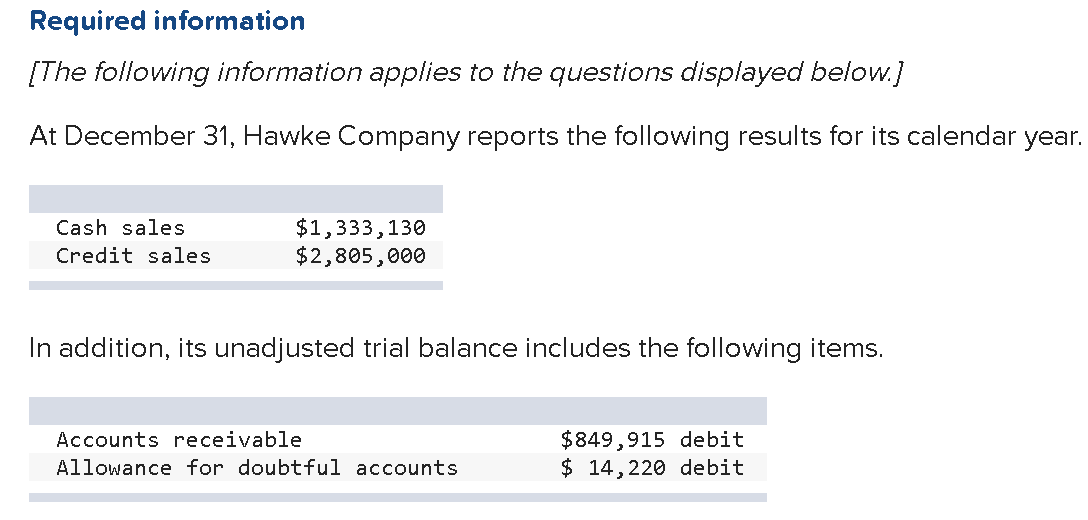

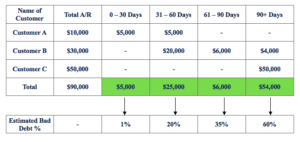

For example if 3 of your sales were uncollectible set aside 3 of your sales in your ADA account. The amount that the company expects it will be able to collect. Next Next post. Generally Accepted Accounting Principles ASC 105 Find posts on Accounting Questions and Answers Search for. Depreciate plant and machinery at 20. The next step for Bobs bookkeeper is to create an accounting worksheet to ensure that all of it ties together.

Businesses usually create a provision for doubtful debt to provide for doubtful debts.

Provision for doubtful debts is to be maintained at 5 on sundry debtors. Use the percentage of bad debts you had in the previous accounting period to help determine your bad debt reserve. For example if 3 of your sales were uncollectible set aside 3 of your sales in your ADA account. Provision for doubtful debts is to be maintained at 5 on sundry debtors. Properly making journal entry for bad debt expense can help the company to have a more realistic view of its net profit as well as making total assets reflect its actual economic value better. Altering the amount in a reserve account such as the allowance for doubtful accounts or the inventory obsolescence reserve.

Source: financialaccountancy.org

Source: financialaccountancy.org

The calendar year is the accounting year. Due to this all businesses provide for possible bad debts arising due to non-payment by creditors in form of provision for doubtful. For example if 3 of your sales were uncollectible set aside 3 of your sales in your ADA account. Properly making journal entry for bad debt expense can help the company to have a more realistic view of its net profit as well as making total assets reflect its actual economic value better. Provision for doubtful debts or allowance for bad debts or un-collectible accounts state the proportion of trade receivables that the business expects but may not be recovered.

Source: pinterest.com

Source: pinterest.com

Concept and Definition of Provision for Doubtful Debts or Allowance for Bad Debts or Allowance for Un-Collectible Accounts. Accounting Worksheet Example We have already covered how Bobs financial statements were prepared and presented. Say you have a total of 70000 in accounts receivable your allowance for doubtful accounts would be 2100 70000 X 3. You are required to prepare trading and profit and loss account for the year ended 31st December. Properly making journal entry for bad debt expense can help the company to have a more realistic view of its net profit as well as making total assets reflect its actual economic value better.

Source: youtube.com

Source: youtube.com

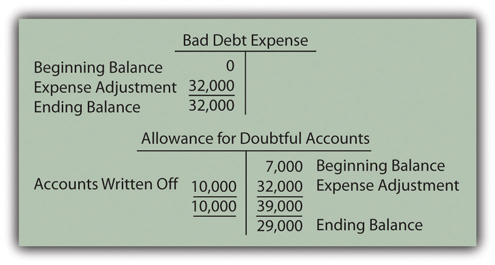

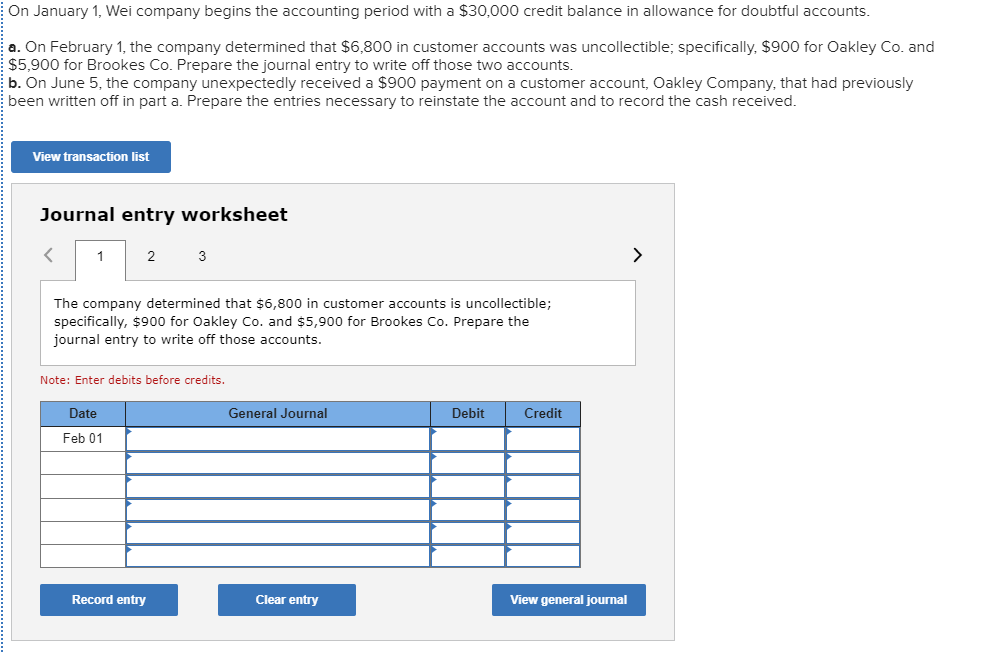

Adjustment of Provision for Doubtful Debts The accounting concept of prudence and conservatism cautions that each business should be ready to absorb all anticipated losses. Deferring the recognition of revenue that has been billed but has not yet been earned. Provision for doubtful debts or allowance for bad debts or un-collectible accounts state the proportion of trade receivables that the business expects but may not be recovered. Allowance for bad debts or allowance for doubtful accounts is a contra-asset account presented as a deduction from accounts receivable. Businesses usually create a provision for doubtful debt to provide for doubtful debts.

Source: slideplayer.com

Source: slideplayer.com

Use the percentage of bad debts you had in the previous accounting period to help determine your bad debt reserve. Recognizing revenue that has not yet been billed. In the next accounting period when an account actually turns out to be uncollectible it is written off from accounts by making the following journal entry. In this example the 85200 total is the net realizable value or the amount of accounts anticipated to be collected. Deferring the recognition of revenue that has been billed but has not yet been earned.

Provision for doubtful debts is to be maintained at 5 on sundry debtors. Generally Accepted Accounting Principles ASC 105 Find posts on Accounting Questions and Answers Search for. Accounting entry to record the allowance for receivable is as follows. Face value of accounts receivable Allowance for doubtful accounts Net realizable value of accounts receivable Journal entry to write off accounts receivable. Provision for doubtful debts is to be maintained at 5 on sundry debtors.

Source: pinterest.com

Source: pinterest.com

Businesses usually create a provision for doubtful debt to provide for doubtful debts. For example the Rent for the month of December 2002 Rs. You are required to prepare trading and profit and loss account for the year ended 31st December. Because the accrued pension cost 46941 is. Generally Accepted Accounting Principles ASC 105 Find posts on Accounting Questions and Answers Search for.

Source: 2012books.lardbucket.org

Source: 2012books.lardbucket.org

Concept and Definition of Provision for Doubtful Debts or Allowance for Bad Debts or Allowance for Un-Collectible Accounts. You are required to prepare trading and profit and loss account for the year ended 31st December. In this example the 85200 total is the net realizable value or the amount of accounts anticipated to be collected. Depreciate plant and machinery at 20. Allowance for bad debts or allowance for doubtful accounts is a contra-asset account presented as a deduction from accounts receivable.

Source: chegg.com

Source: chegg.com

Assume that the ABO at 123100 is 300000. Say you have a total of 70000 in accounts receivable your allowance for doubtful accounts would be 2100 70000 X 3. The amount that the company expects it will be able to collect. Altering the amount in a reserve account such as the allowance for doubtful accounts or the inventory obsolescence reserve. Due to this all businesses provide for possible bad debts arising due to non-payment by creditors in form of provision for doubtful.

Source: bartleby.com

Source: bartleby.com

Search Recent Posts Accounting Questions Video. Examples of accounting adjustments are as follows. You are required to prepare trading and profit and loss account for the year ended 31st December. Properly making journal entry for bad debt expense can help the company to have a more realistic view of its net profit as well as making total assets reflect its actual economic value better. There is one more point about the use of the contra account Allowance for Doubtful Accounts.

Source: opentextbc.ca

Source: opentextbc.ca

Then the unfunded portion of the ABO is 300000-250000 50000. Provision for doubtful debts or allowance for bad debts or un-collectible accounts state the proportion of trade receivables that the business expects but may not be recovered. Provision for doubtful debts is to be maintained at 5 on sundry debtors. Allowance for doubtful debts is created by forming a credit balance which is netted off against the total receivables appearing in the balance sheet. Accounting Worksheet Example We have already covered how Bobs financial statements were prepared and presented.

Source: pinterest.com

Source: pinterest.com

Deferring the recognition of revenue that has been billed but has not yet been earned. Properly making journal entry for bad debt expense can help the company to have a more realistic view of its net profit as well as making total assets reflect its actual economic value better. Next Next post. Adjustment of Provision for Doubtful Debts The accounting concept of prudence and conservatism cautions that each business should be ready to absorb all anticipated losses. The amount that the company expects it will be able to collect.

Source: accountancyknowledge.com

Source: accountancyknowledge.com

Rs1000 To Outstanding Rent ac Rs. Accounting Worksheet Example We have already covered how Bobs financial statements were prepared and presented. For example if 3 of your sales were uncollectible set aside 3 of your sales in your ADA account. The amount that the company expects it will be able to collect. Because the accrued pension cost 46941 is.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Face value of accounts receivable Allowance for doubtful accounts Net realizable value of accounts receivable Journal entry to write off accounts receivable. Next Next post. Businesses usually create a provision for doubtful debt to provide for doubtful debts. A corresponding debit entry is recorded to account for the expense of the potential loss. The calendar year is the accounting year.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Altering the amount in a reserve account such as the allowance for doubtful accounts or the inventory obsolescence reserve. Properly making journal entry for bad debt expense can help the company to have a more realistic view of its net profit as well as making total assets reflect its actual economic value better. Accounting entry to record the allowance for receivable is as follows. Accounting Worksheet Example We have already covered how Bobs financial statements were prepared and presented. Apply accounting equation to determine.

Source: accountancyknowledge.com

Source: accountancyknowledge.com

Next Next post. Deferring the recognition of revenue that has been billed but has not yet been earned. Search Recent Posts Accounting Questions Video. The next step for Bobs bookkeeper is to create an accounting worksheet to ensure that all of it ties together. 27 行 An accounting worksheet is large table of data which may be prepared by.

Source: pinterest.com

Source: pinterest.com

27 行 An accounting worksheet is large table of data which may be prepared by. Properly making journal entry for bad debt expense can help the company to have a more realistic view of its net profit as well as making total assets reflect its actual economic value better. The next step for Bobs bookkeeper is to create an accounting worksheet to ensure that all of it ties together. The company should estimate loss and make bad debt expense journal entry at the end of the accounting period. Altering the amount in a reserve account such as the allowance for doubtful accounts or the inventory obsolescence reserve.

Source: business-case-analysis.com

Source: business-case-analysis.com

Say you have a total of 70000 in accounts receivable your allowance for doubtful accounts would be 2100 70000 X 3. The calendar year is the accounting year. Accounting Worksheet Example We have already covered how Bobs financial statements were prepared and presented. Allowance for bad debts or allowance for doubtful accounts is a contra-asset account presented as a deduction from accounts receivable. Due to this all businesses provide for possible bad debts arising due to non-payment by creditors in form of provision for doubtful.

Source: slideplayer.com

Source: slideplayer.com

Adjustment of Provision for Doubtful Debts The accounting concept of prudence and conservatism cautions that each business should be ready to absorb all anticipated losses. Allowance for bad debts or allowance for doubtful accounts is a contra-asset account presented as a deduction from accounts receivable. Assume that the ABO at 123100 is 300000. Obligation the PBO without any adjustment for future salaries. Depreciate plant and machinery at 20.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title accounting worksheet example doubtful account adjustment by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.