Your Accounting worksheet for end of year sale salaries expense images are ready. Accounting worksheet for end of year sale salaries expense are a topic that is being searched for and liked by netizens now. You can Find and Download the Accounting worksheet for end of year sale salaries expense files here. Download all royalty-free photos and vectors.

If you’re searching for accounting worksheet for end of year sale salaries expense images information linked to the accounting worksheet for end of year sale salaries expense interest, you have visit the right site. Our site always gives you suggestions for refferencing the highest quality video and picture content, please kindly hunt and find more informative video content and graphics that fit your interests.

Accounting Worksheet For End Of Year Sale Salaries Expense. Debit Salaries Expense and. 27 行 Accounting Worksheet An accounting worksheet is large table of data which. Transactions 1 Provided 100000 cash as initial investment to the business. WAREN SPORTS SUPPLY YEAR-END WORKSHEET DECEMBER 31 2013 TRANSACTIONS LIST A Accounts with no activity in this worksheet are.

Accounts Receivable Ledger Printable Us Letter A4 A5 Etsy Accounts Receivable Accounting Lettering From pinterest.com

Accounts Receivable Ledger Printable Us Letter A4 A5 Etsy Accounts Receivable Accounting Lettering From pinterest.com

WAREN SPORTS SUPPLY YEAR-END WORKSHEET DECEMBER 31 2022 December 31 2022 Accounts with no activity in this worksheet. Salaries Expense before adjustment at September 30 the end of the fiscal year has a balance of 140000. When services are not paid for until after they have been performed the accrued expense is recorded by an adjusting entry at the end of the accounting period. Well assume that the distributors accounting month and accounting year both end on Saturday December 31. End of Month and End of Year Lets continue with our example of the payroll for the hourly-paid employees. B C D E F G DeeDee Double Entry Incorporated End Of Period Worksheet For The Year Ended December 31 2019 Unadjusted Adjusted 5 Account Title Trial Balance.

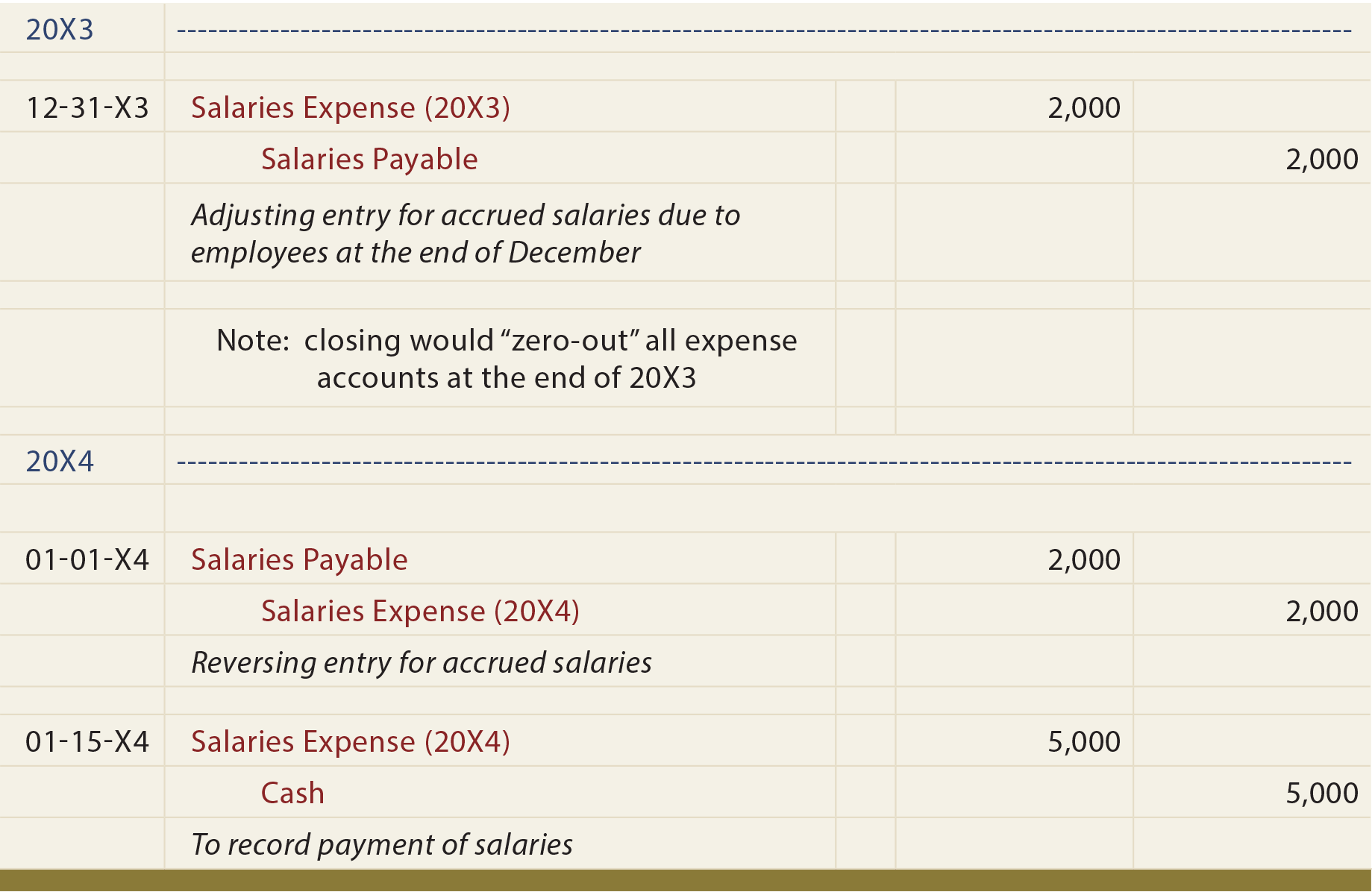

Accrued salaries refers to the amount of liability remaining at the end of a reporting period for salaries that have been earned by employees but not yet paid to them.

View SUA10eWorksheet1xls from ACC 370 at North Central Michigan College. Assuming Jacobs company has a June 30 year end the companys profit for the Jennings job on the June 30 financial 550. Well assume that the distributors accounting month and accounting year both end on Saturday December 31. Jacobs only cost related to the sale was 250 in salaries expense. Must be under the age of 19 at the end of the tax year or under the age of 24 if a full-time student for at least five months of the year or be permanently and totally disabled at any time during the year. 194 ch4 These financial statement items are for Rugen Company at year-end July 31 2016.

Source: pinterest.com

Source: pinterest.com

The closing entry after adjustments would be. Accounting Cycle of a Merchandising Business WORKSHEET AND FINANCIAL STATEMENTS Entity A started operations on November 1 2019. The Difference Between Salaries Payable and Salaries Expense The difference between salaries payable and salaries expense is that the expense encompasses the full amount of salary-based compensation paid during a reporting period while salaries payable only encompasses any salaries not yet paid as of the end of a reporting period. Transactions 1 Provided 100000 cash as initial investment to the business. WAREN SPORTS SUPPLY YEAR-END WORKSHEET DECEMBER 31 2009 TRANSACTIONS LIST A Accounts with no activity in this.

Source: pinterest.com

Source: pinterest.com

View Test Prep - accounting finaldocx from BA 103 at Seoul National. Jacobs paid the salaries on July 3. The closing entry after adjustments would be. The amount of accrued salaries of 3100. Assuming Jacobs company has a June 30 year end the companys profit for the Jennings job on the June 30 financial 550.

Source: ro.pinterest.com

Source: ro.pinterest.com

Salaries Expense before adjustment at September 30 the end of the fiscal year has a balance of 140000. WAREN SPORTS SUPPLY YEAR-END WORKSHEET DECEMBER 31 2013 TRANSACTIONS LIST A Accounts with no activity in this worksheet are. Jacobs only cost related to the sale was 250 in salaries expense. The Difference Between Salaries Payable and Salaries Expense The difference between salaries payable and salaries expense is that the expense encompasses the full amount of salary-based compensation paid during a reporting period while salaries payable only encompasses any salaries not yet paid as of the end of a reporting period. At year-end salaries expense of 21000 has been incurred by the company but is not yet paid to employees.

Source: pinterest.com

Source: pinterest.com

The following were the transactions during the period. View SUA10eWorksheet1xls from ACC 370 at North Central Michigan College. View SUA project from ACCT 461 at Indiana University Of Pennsylvania. The amount of accrued salaries of 3100. ACC 321 SUA Project-2 - WAREN SPORTS SUPPLY YEAR-END WORKSHEET TRANSACTIONS LIST AAccounts with no activity in this worksheet are excluded in this WAREN SPORTS SUPPLY STATEMENT OF CASH FLOWS FOR THE YEAR ENDED DECEMBER 31 2013 CASH FLOWS FROM OPERATING ACTIVITIES Net income 12957886 Adjustments to reconcile net income to net cash.

Source: pinterest.com

Source: pinterest.com

Well assume that the distributors accounting month and accounting year both end on Saturday December 31. Jacobs only cost related to the sale was 250 in salaries expense. View SUA10eWorksheet1xls from ACC 370 at North Central Michigan College. WAREN SPORTS SUPPLY YEAR-END WORKSHEET DECEMBER 31 2022 December 31 2022 Accounts with no activity in this worksheet. Notice that on Friday July 7 management would record the recognition of the accrued salaries expense.

Source: pinterest.com

Source: pinterest.com

At year-end salaries expense of 21000 has been incurred by the company but is not yet paid to employees. 1 Acquired equipment for 72000 cash. WAREN SPORTS SUPPLY YEAR-END WORKSHEET DECEMBER 31 2013 TRANSACTIONS LIST A Accounts with no activity in this worksheet are. 194 ch4 These financial statement items are for Rugen Company at year-end July 31 2016. Jacobs only cost related to the sale was 250 in salaries expense.

Source: principlesofaccounting.com

Source: principlesofaccounting.com

B C D E F G DeeDee Double Entry Incorporated End Of Period Worksheet For The Year Ended December 31 2019 Unadjusted Adjusted 5 Account Title Trial Balance. View SUA project from ACCT 461 at Indiana University Of Pennsylvania. The amount of accrued salaries of 3100. WAREN SPORTS SUPPLY YEAR-END WORKSHEET DECEMBER 31 2009 TRANSACTIONS LIST A Accounts with no activity in this. 27 行 Accounting Worksheet An accounting worksheet is large table of data which.

Source: pinterest.com

Source: pinterest.com

Assuming Jacobs company has a June 30 year end the companys profit for the Jennings job on the June 30 financial 550. True The adjusting entry to recognize earned commission revenues not previously recorded or billed will cause total assets to increase. At year-end salaries expense of 21000 has been incurred by the company but is not yet paid to employees. View SUA10eWorksheet1xls from ACC 370 at North Central Michigan College. 1 Acquired equipment for 72000 cash.

Source: pinterest.com

Source: pinterest.com

This information is used to determine the residual compensation liability of a business as of a specific point in time. The Difference Between Salaries Payable and Salaries Expense The difference between salaries payable and salaries expense is that the expense encompasses the full amount of salary-based compensation paid during a reporting period while salaries payable only encompasses any salaries not yet paid as of the end of a reporting period. Notice that on Friday July 7 management would record the recognition of the accrued salaries expense. 1 Acquired equipment for 72000 cash. WAREN SPORTS SUPPLY YEAR-END WORKSHEET DECEMBER 31 2013 TRANSACTIONS LIST A Accounts with no activity in this worksheet are.

Source: pinterest.com

Source: pinterest.com

View Test Prep - accounting finaldocx from BA 103 at Seoul National. WAREN SPORTS SUPPLY YEAR-END WORKSHEET DECEMBER 31 2022 December 31 2022 Accounts with no activity in this worksheet. ACC 321 SUA Project-2 - WAREN SPORTS SUPPLY YEAR-END WORKSHEET TRANSACTIONS LIST AAccounts with no activity in this worksheet are excluded in this WAREN SPORTS SUPPLY STATEMENT OF CASH FLOWS FOR THE YEAR ENDED DECEMBER 31 2013 CASH FLOWS FROM OPERATING ACTIVITIES Net income 12957886 Adjustments to reconcile net income to net cash. 1 Acquired equipment for 72000 cash. View Test Prep - accounting finaldocx from BA 103 at Seoul National.

Source: pinterest.com

Source: pinterest.com

Accounting Cycle of a Merchandising Business WORKSHEET AND FINANCIAL STATEMENTS Entity A started operations on November 1 2019. 1 Acquired equipment for 72000 cash. True The adjusting entry to recognize earned commission revenues not previously recorded or billed will cause total assets to increase. Accounting Cycle of a Merchandising Business WORKSHEET AND FINANCIAL STATEMENTS Entity A started operations on November 1 2019. View Notes - SUA_version_A_worksheet from ACCT 307 at San Francisco State University.

Source: pinterest.com

Source: pinterest.com

End of Month and End of Year Lets continue with our example of the payroll for the hourly-paid employees. Debit Salaries Expense and. Jacobs paid the salaries on July 3. WAREN SPORTS SUPPLY YEAR-END WORKSHEET DECEMBER 31 2022 December 31 2022 Accounts with no activity in this worksheet. This information is used to determine the residual compensation liability of a business as of a specific point in time.

Source: pinterest.com

Source: pinterest.com

End of Month and End of Year Lets continue with our example of the payroll for the hourly-paid employees. True The adjusting entry to recognize earned commission revenues not previously recorded or billed will cause total assets to increase. Jacobs only cost related to the sale was 250 in salaries expense. The following were the transactions during the period. When services are not paid for until after they have been performed the accrued expense is recorded by an adjusting entry at the end of the accounting period.

Source: pinterest.com

Source: pinterest.com

Notice that on Friday July 7 management would record the recognition of the accrued salaries expense. Notice that on Friday July 7 management would record the recognition of the accrued salaries expense. When services are not paid for until after they have been performed the accrued expense is recorded by an adjusting entry at the end of the accounting period. True The adjusting entry to recognize earned commission revenues not previously recorded or billed will cause total assets to increase. WAREN SPORTS SUPPLY YEAR-END WORKSHEET DECEMBER 31 2013 TRANSACTIONS LIST A Accounts with no activity in this worksheet are.

Source: pinterest.com

Source: pinterest.com

The closing entry after adjustments would be. True The adjusting entry to recognize earned commission revenues not previously recorded or billed will cause total assets to increase. View SUA10eWorksheet1xls from ACC 370 at North Central Michigan College. Transactions 1 Provided 100000 cash as initial investment to the business. Assuming Jacobs company has a June 30 year end the companys profit for the Jennings job on the June 30 financial 550.

Source: pinterest.com

Source: pinterest.com

True The adjusting entry to recognize earned commission revenues not previously recorded or billed will cause total assets to increase. WAREN SPORTS SUPPLY YEAR-END WORKSHEET DECEMBER 31 2009 TRANSACTIONS LIST A Accounts with no activity in this. The amount of accrued salaries of 3100. WAREN SPORTS SUPPLY YEAR-END WORKSHEET DECEMBER 31 2013 TRANSACTIONS LIST A Accounts with no activity in this worksheet are. Assuming Jacobs company has a June 30 year end the companys profit for the Jennings job on the June 30 financial 550.

Source: pinterest.com

Source: pinterest.com

WAREN SPORTS SUPPLY YEAR-END WORKSHEET DECEMBER 31 2009 TRANSACTIONS LIST A Accounts with no activity in this. The following were the transactions during the period. The closing entry after adjustments would be. View SUA10eWorksheet1xls from ACC 370 at North Central Michigan College. At its December 31 year-end the company owes 525 of interest on a line-of-credit loan.

Source: pinterest.com

Source: pinterest.com

True The adjusting entry to recognize earned commission revenues not previously recorded or billed will cause total assets to increase. Jacobs only cost related to the sale was 250 in salaries expense. View Notes - SUA_version_A_worksheet from ACCT 307 at San Francisco State University. View SUA project from ACCT 461 at Indiana University Of Pennsylvania. This is the salaries that have accrued over the three days which can be found through some math.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title accounting worksheet for end of year sale salaries expense by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.