Your Accounting worksheet periodic cost of goods sold images are ready in this website. Accounting worksheet periodic cost of goods sold are a topic that is being searched for and liked by netizens today. You can Download the Accounting worksheet periodic cost of goods sold files here. Find and Download all royalty-free vectors.

If you’re searching for accounting worksheet periodic cost of goods sold images information related to the accounting worksheet periodic cost of goods sold keyword, you have pay a visit to the ideal site. Our site frequently gives you hints for refferencing the maximum quality video and image content, please kindly surf and find more enlightening video articles and graphics that fit your interests.

Accounting Worksheet Periodic Cost Of Goods Sold. Cost of goods sold was calculated to be 9360 which should be recorded as an expense. Cost of Goods Sold. The answer is FALSE Periodic Inventory System does not include a cost of goods sold journal. Unlike the periodic inventory system the inventory balance under the perpetual system is constantly updated when there is an inventory in or out.

5 Free Income Statement Examples And Templates Income Statement Statement Template Personal Financial Statement From pinterest.com

5 Free Income Statement Examples And Templates Income Statement Statement Template Personal Financial Statement From pinterest.com

The cost of goods sold is the total expense associated with the goods sold in a reporting period. Under the periodic inventory. Prepare an accounting worksheet for merchandisers perpetual and periodic Learning objective 3 Aim is to highlight the differences between the worksheet of a service business. COGS can also inform a proper price point for an item or service. The accounting worksheet for merchandisers Chapter 6 61. The cost of goods sold is subtracted from the reported revenues of a business to arrive at its gross margin.

Lets see how Sunny Sunglasses would calculate inventory cost of goods sold for 2010 using periodic inventory accounting.

Prepare an accounting worksheet for merchandisers perpetual and periodic Learning objective 3 Aim is to highlight the differences between the worksheet of a service business. Ending inventory listed on the accounting balance sheet analysis page at. Lets see how Sunny Sunglasses would calculate inventory cost of goods sold for 2010 using periodic inventory accounting. Goods available for sale Single Line 1980350 Less merchandise inventory December 31 20XX 2386878 Cost of goods sold Single Line 1741663 Gross profit Single Line 807296 Double Line Gross profit 3167. The accounting worksheet for merchandisers Chapter 6 61. Under the periodic inventory.

Source: pinterest.com

Source: pinterest.com

How does the periodic inventory accounting method track inventory and cost of goods sold Show transcribed image text Expert Answer Previous question Next question Transcribed Image Text from this Question O a Calculates. Ending inventory listed on the accounting balance sheet analysis page at. COGS can also inform a proper price point for an item or service. Likewise the company usually records the cost of goods sold. Goods available for sale Single Line 1980350 Less merchandise inventory December 31 20XX 2386878 Cost of goods sold Single Line 1741663 Gross profit Single Line 807296 Double Line Gross profit 3167.

Source: pinterest.com

Source: pinterest.com

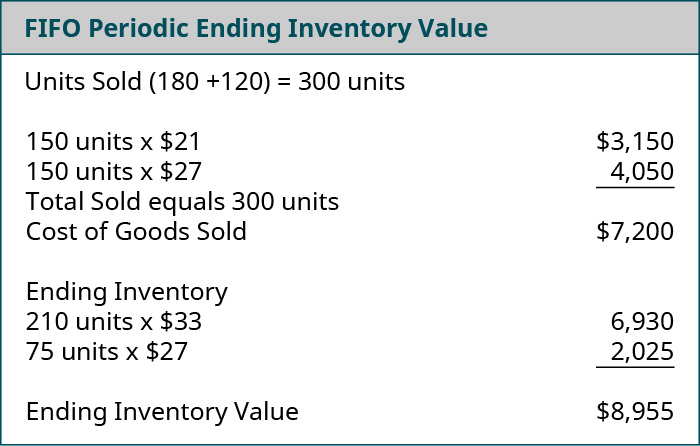

Cost of Goods Sold FIFO 2000 3000 2000 3000 2 0 0 0 3 0 0 0 COGS FIFO 5000 5000 5 0 0 0 FIFO definition FIFO First in First Out means that the inventory which has been received first will be sold. Lets see how Sunny Sunglasses would calculate inventory cost of goods sold for 2010 using periodic inventory accounting. The accounting worksheet for merchandisers Chapter 6 61. The cost of goods sold is subtracted from the reported revenues of a business to arrive at its gross margin. This is one of many videos provided by Clutch Prep to prepare you to succeed in your college classes.

Source: pinterest.com

Source: pinterest.com

Knowing the cost of goods sold can help you calculate your businesss profits. Periodic Inventory for Accounting. COGS can also inform a proper price point for an item or service. Unlike the periodic inventory system the inventory balance under the perpetual system is constantly updated when there is an inventory in or out. If Corner Shelf Bookstore sells the textbook for 110 its gross profit under the periodic average method will be 22 110 - 88.

Source: pinterest.com

Source: pinterest.com

Cost of goods sold was calculated to be 9360 which should be recorded as an expense. Periodic vs perpetual The cost of goods sold under the periodic inventory system Financial statements under the periodic inventory system Appendix 5B. Cost of goods sold was calculated to be 9360 which should be recorded as an expense. Cost of Goods Sold FIFO 2000 3000 2000 3000 2 0 0 0 3 0 0 0 COGS FIFO 5000 5000 5 0 0 0 FIFO definition FIFO First in First Out means that the inventory which has been received first will be sold. Goods available for sale Single Line 1980350 Less merchandise inventory December 31 20XX 2386878 Cost of goods sold Single Line 1741663 Gross profit Single Line 807296 Double Line Gross profit 3167.

Source: pinterest.com

Source: pinterest.com

Cost of Goods Sold decreases the total goods available for sale during the period. Unlike the periodic inventory system the inventory balance under the perpetual system is constantly updated when there is an inventory in or out. Summing ending merchandise inventory and cost of goods sold gives the cost of goods available for sale. The cost of goods sold COGS refers to the cost of producing an item or service sold by a company. The accounting worksheet for merchandisers Chapter 6 61.

Source: pinterest.com

Source: pinterest.com

Video explaining Cost of Goods Sold - Perpetual Inventory vs. The cost of goods sold is the total expense associated with the goods sold in a reporting period. The cost of goods sold is subtracted from the reported revenues of a business to arrive at its gross margin. Cost of Goods Sold decreases the total goods available for sale during the period. If Corner Shelf Bookstore sells the textbook for 110 its gross profit under the periodic average method will be 22 110 - 88.

Source: pinterest.com

Source: pinterest.com

The credit entry to balance the adjustment is for 13005 which is the total amount that was recorded as purchases for the period. Prepare an accounting worksheet for merchandisers perpetual and periodic Learning objective 3 Aim is to highlight the differences between the worksheet of a service business. The answer is FALSE Periodic Inventory System does not include a cost of goods sold journal. Lets see how Sunny Sunglasses would calculate inventory cost of goods sold for 2010 using periodic inventory accounting. Under the periodic inventory.

Source: pinterest.com

Source: pinterest.com

How does the periodic inventory accounting method track inventory and cost of goods sold Show transcribed image text Expert Answer Previous question Next question Transcribed Image Text from this Question O a Calculates. Lets see how Sunny Sunglasses would calculate inventory cost of goods sold for 2010 using periodic inventory accounting. Periodic Inventory for Accounting. Throughout the year Sunny had net purchases of 48825 in total inventory. The accounting worksheet for merchandisers Chapter 6 61.

Source: pinterest.com

Source: pinterest.com

Cost of goods sold and inventories are thus adjusted continuously throughout the year after each and every sale. This is one of many videos provided by Clutch Prep to prepare you to succeed in your college classes. Summing ending merchandise inventory and cost of goods sold gives the cost of goods available for sale. Cost of Goods Sold FIFO 2000 3000 2000 3000 2 0 0 0 3 0 0 0 COGS FIFO 5000 5000 5 0 0 0 FIFO definition FIFO First in First Out means that the inventory which has been received first will be sold. Periodic vs perpetual The cost of goods sold under the periodic inventory system Financial statements under the periodic inventory system Appendix 5B.

Source: pinterest.com

Source: pinterest.com

Periodic Inventory for Accounting. Unlike the periodic inventory system the inventory balance under the perpetual system is constantly updated when there is an inventory in or out. Throughout the year Sunny had net purchases of 48825 in total inventory. Periodic Inventory for Accounting. The cost of goods sold COGS refers to the cost of producing an item or service sold by a company.

Source: pinterest.com

Source: pinterest.com

The answer is FALSE Periodic Inventory System does not include a cost of goods sold journal. This is one of many videos provided by Clutch Prep to prepare you to succeed in your college classes. Cost of Goods Sold FIFO 2000 3000 2000 3000 2 0 0 0 3 0 0 0 COGS FIFO 5000 5000 5 0 0 0 FIFO definition FIFO First in First Out means that the inventory which has been received first will be sold. The cost of goods sold is subtracted from the reported revenues of a business to arrive at its gross margin. Additionally unlike the periodic system at the end of the year cost of goods sold and inventories do not have to be adjusted at all.

Source: pinterest.com

Source: pinterest.com

Under the periodic inventory. Periodic vs perpetual The cost of goods sold under the periodic inventory system Financial statements under the periodic inventory system Appendix 5B. A physical inventory is usually taken at the end of the accounting period. The answer is FALSE Periodic Inventory System does not include a cost of goods sold journal. Cost of goods sold was calculated to be 9360 which should be recorded as an expense.

Source: pinterest.com

Source: pinterest.com

Periodic vs perpetual The cost of goods sold under the periodic inventory system Financial statements under the periodic inventory system Appendix 5B. A physical inventory is usually taken at the end of the accounting period. Likewise the company usually records the cost of goods sold. The accounting worksheet for merchandisers Chapter 6 61. Cost of goods sold and inventories are thus adjusted continuously throughout the year after each and every sale.

Source: pinterest.com

Source: pinterest.com

Knowing the cost of goods sold can help you calculate your businesss profits. The cost of goods sold is subtracted from the reported revenues of a business to arrive at its gross margin. Lets see how Sunny Sunglasses would calculate inventory cost of goods sold for 2010 using periodic inventory accounting. Prepare an accounting worksheet for merchandisers perpetual and periodic Learning objective 3 Aim is to highlight the differences between the worksheet of a service business. How does the periodic inventory accounting method track inventory and cost of goods sold Show transcribed image text Expert Answer Previous question Next question Transcribed Image Text from this Question O a Calculates.

Source: pinterest.com

Source: pinterest.com

No asset value for consignment inventory with Cost of Goods Sold and Periodic Accounting With this technique you still receive the inventory so it reflects in your sales channels but you give it a zero value to prevent accounting transactions from being made. Summing ending merchandise inventory and cost of goods sold gives the cost of goods available for sale. Video explaining Cost of Goods Sold - Perpetual Inventory vs. The cost of goods sold COGS refers to the cost of producing an item or service sold by a company. Periodic vs perpetual The cost of goods sold under the periodic inventory system Financial statements under the periodic inventory system Appendix 5B.

Source: opentextbc.ca

Source: opentextbc.ca

If Corner Shelf Bookstore sells the textbook for 110 its gross profit under the periodic average method will be 22 110 - 88. Periodic vs perpetual The cost of goods sold under the periodic inventory system Financial statements under the periodic inventory system Appendix 5B. How does the periodic inventory accounting method track inventory and cost of goods sold Show transcribed image text Expert Answer Previous question Next question Transcribed Image Text from this Question O a Calculates. The total of the cost of goods sold plus the cost of the inventory should equal the total cost of goods available 88 352 440. Cost of Goods Sold FIFO 2000 3000 2000 3000 2 0 0 0 3 0 0 0 COGS FIFO 5000 5000 5 0 0 0 FIFO definition FIFO First in First Out means that the inventory which has been received first will be sold.

Source: pinterest.com

Source: pinterest.com

Goods available for sale Single Line 1980350 Less merchandise inventory December 31 20XX 2386878 Cost of goods sold Single Line 1741663 Gross profit Single Line 807296 Double Line Gross profit 3167. Unlike the periodic inventory system the inventory balance under the perpetual system is constantly updated when there is an inventory in or out. Lets see how Sunny Sunglasses would calculate inventory cost of goods sold for 2010 using periodic inventory accounting. Likewise the company usually records the cost of goods sold. Summing ending merchandise inventory and cost of goods sold gives the cost of goods available for sale.

Source: business-accounting-guides.com

Source: business-accounting-guides.com

Goods available for sale Single Line 1980350 Less merchandise inventory December 31 20XX 2386878 Cost of goods sold Single Line 1741663 Gross profit Single Line 807296 Double Line Gross profit 3167. The accounting worksheet for merchandisers 2 1. COGS can also inform a proper price point for an item or service. The cost of goods sold is the total expense associated with the goods sold in a reporting period. If Corner Shelf Bookstore sells the textbook for 110 its gross profit under the periodic average method will be 22 110 - 88.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title accounting worksheet periodic cost of goods sold by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.