Your Adjusting worksheet entries governmental accounting outstanding bonds images are ready. Adjusting worksheet entries governmental accounting outstanding bonds are a topic that is being searched for and liked by netizens today. You can Find and Download the Adjusting worksheet entries governmental accounting outstanding bonds files here. Get all royalty-free photos.

If you’re searching for adjusting worksheet entries governmental accounting outstanding bonds pictures information related to the adjusting worksheet entries governmental accounting outstanding bonds interest, you have pay a visit to the ideal site. Our site frequently provides you with hints for seeing the maximum quality video and picture content, please kindly hunt and locate more enlightening video articles and images that fit your interests.

Adjusting Worksheet Entries Governmental Accounting Outstanding Bonds. City council adopts an annual budget for the general fund with estimated revenues of 1700000 appropriations of 1500000 and approved transfers of 120000. Expenditures 5000 Cash 5000 Governmental Activities. A special assessment project is begun. Accounting for Governmental Operating Activities—-Illustrative Transactions Financial Statements 2 Govtl Funds Review.

Reimbursed Employee Expenses Journal Double Entry Bookkeeping From double-entry-bookkeeping.com

Reimbursed Employee Expenses Journal Double Entry Bookkeeping From double-entry-bookkeeping.com

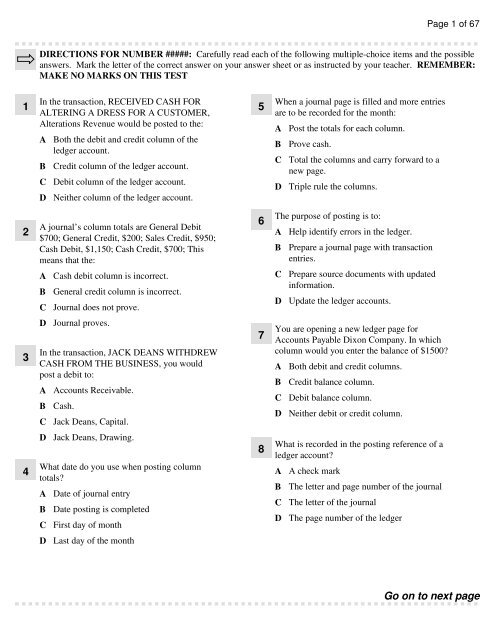

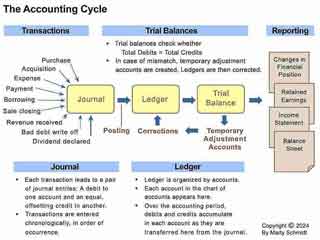

1 GOVERNMENTAL ACCOUNTING All those involved in the oversight or management of government operations and those whose livelihood and interest rely on the finances of local governments needto have a clear understanding of. Start studying Chapter 15 Adjusting Journal Entries. Journal Entries- Fund Based vs. Prepare required schedules reconciling the government-wide and fund-basis financial statements. Record events and transactions related to general fixed assets and general long-term debt and describe required schedules related to long-term debt. Now it is the right time to practice more to gain better knowledge about the exam.

Journal Entries- Fund Based vs.

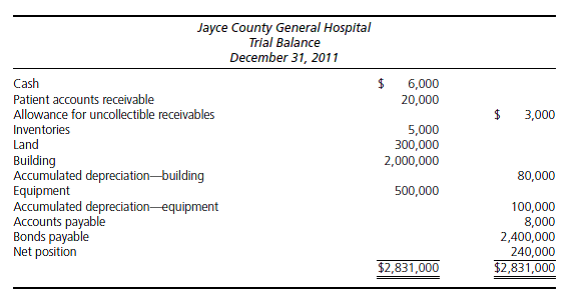

At the fund level entries were also made to close budgetary and operating statement accounts. Accounting for Bonds Definition Bonds Payable is the promissory note which the company uses to raise funds from the investor. Adjusting Journal Entry - To record Series 2019A Debit Credit Debt Service Fund Other financing source Proceeds From Bonds 6 3899973 Debt Service Fund Other financing source Premium On Debt Issuance 8 5764262. Adjust governmental fund records to the economic resource focus are not posted to the general ledger are used to adjust govt funds to the accrual basis of acct must be made for both governmental and. 1 Total fund balances of governmental funds presented in the governmental funds Balance Sheet. 100000 from tax-supported bonds is demolished.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

Ignore closing entries in the government activities journal 6a Serial Bond Debt Service Fund Record the entry to close the budgetary statement account. Record events and transactions related to general fixed assets and general long-term debt and describe required schedules related to long-term debt. On 2010 December 31 Valley issued 10-year 12 per cent bonds with a 100000 face value for 100000. Prepare required schedules reconciling the government-wide and fund-basis financial statements. Expenditures 5000 Cash 5000 Governmental Activities.

Source: yumpu.com

Source: yumpu.com

Expenditures 5000 Cash 5000 Governmental Activities. Expenditures 5000 Cash 5000 Governmental Activities. 100000 from tax-supported bonds is demolished. City council adopts an annual budget for the general fund with estimated revenues of 1700000 appropriations of 1500000 and approved transfers of 120000. Adjust governmental fund records to the economic resource focus are not posted to the general ledger are used to adjust govt funds to the accrual basis of acct must be made for both governmental and.

Source: yumpu.com

Source: yumpu.com

In our example there is no accrued interest at the issue date of the bonds and at the end of each accounting year because the bonds pay interest on June 30 and December 31. Journal Entries- Fund Based vs. Adjusting entries problems and solutions are reported in this web page. Governmental fund-basis statements reflect modified accrual accounting and must be adjusted to the accrual basis when preparing the government-wide statements. Prepare worksheet entries to include internal service funds with governmental activities.

Source: business-case-analysis.com

Source: business-case-analysis.com

Prepare worksheet entries to include internal service funds with governmental activities. Governmental activities and prepare appropriate journal entries at both the government-wide and fund levels Prepare adjusting entries at year-end and a pre-closing trial balance Prepare closing journal entries and year-end. A special assessment project is begun. Home Financial Accounting Adjusting Entries Adjusting Journal Entries Problems and Solution We have covered Adjusting Entry topic in great depth. Company sells bonds to the investors and promise to pay the annual interest plus principal.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Journal Entries- Fund Based vs. The entries for 2020 including the entry to record. Record events and transactions related to general fixed assets and general long-term debt and describe required schedules related to long-term debt. At the fund level entries were also made to close budgetary and operating statement accounts. References Mukharji A Hanif M.

Source: double-entry-bookkeeping.com

Source: double-entry-bookkeeping.com

In our example there is no accrued interest at the issue date of the bonds and at the end of each accounting year because the bonds pay interest on June 30 and December 31. City council adopts an annual budget for the general fund with estimated revenues of 1700000 appropriations of 1500000 and approved transfers of 120000. Bonds of 3000 is due on June 1 2011 and December 1 2011 and in decreasing amounts every June 1 and December 1 for the next 19 years after that. Bonds issued at face value on an interest date Valley Companys accounting year ends on December 31. Prepare worksheet entries to include internal service funds with governmental activities.

Source: chegg.com

Source: chegg.com

Governmental fund-basis statements reflect modified accrual accounting and must be adjusted to the accrual basis when preparing the government-wide statements. Start studying Chapter 15 Adjusting Journal Entries. Obligation GO bonds on Dec. Adjusting entries problems and solutions are reported in this web page. Adjusting Journal Entry - To record Series 2019A Debit Credit Debt Service Fund Other financing source Proceeds From Bonds 6 3899973 Debt Service Fund Other financing source Premium On Debt Issuance 8 5764262.

Source: issuu.com

Source: issuu.com

Interest on the GO. It is fully depreciated General Fund. Adjusting entries also known as adjusting journal entries AJE are the entries made in the accounting journals of a business firm to adapt or to update the revenues and expenses accounts according to the accrual principle and. Adjust governmental fund records to the economic resource focus are not posted to the general ledger are used to adjust govt funds to the accrual basis of acct must be made for both governmental and. Adjusting entries were made and uncollected taxes receivable were reclassified as delinquent.

Source: issuu.com

Source: issuu.com

Accounting for Bonds Definition Bonds Payable is the promissory note which the company uses to raise funds from the investor. The entries for 2020 including the entry to record. Adjusting entries are needed for preparing financial statement. Expenditures 5000 Cash 5000 Governmental Activities. Obligation GO bonds on Dec.

Source: issuu.com

Source: issuu.com

Learn vocabulary terms and more with flashcards games and other study tools. Ignore closing entries in the government activities journal 6a Serial Bond Debt Service Fund Record the entry to close the budgetary statement account. Interest on the GO. Prepare required schedules reconciling the government-wide and fund-basis financial statements. Governmental fund-basis statements reflect modified accrual accounting and must be adjusted to the accrual basis when preparing the government-wide statements.

Source: business-case-analysis.com

Source: business-case-analysis.com

Adjusting entries also known as adjusting journal entries AJE are the entries made in the accounting journals of a business firm to adapt or to update the revenues and expenses accounts according to the accrual principle and. Home Financial Accounting Adjusting Entries Adjusting Journal Entries Problems and Solution We have covered Adjusting Entry topic in great depth. A special assessment project is begun. Adjust governmental fund records to the economic resource focus are not posted to the general ledger are used to adjust govt funds to the accrual basis of acct must be made for both governmental and. City council adopts an annual budget for the general fund with estimated revenues of 1700000 appropriations of 1500000 and approved transfers of 120000.

Source: in.pinterest.com

Source: in.pinterest.com

Bonds issued at face value on an interest date Valley Companys accounting year ends on December 31. Prepare worksheet entries to include internal service funds with governmental activities. Cost of demolition was 5000. Record events and transactions related to general fixed assets and general long-term debt and describe required schedules related to long-term debt. Obligation GO bonds on Dec.

Source: issuu.com

Source: issuu.com

The entries for 2020 including the entry to record. Accounting for Governmental Operating Activities—-Illustrative Transactions Financial Statements 2 Govtl Funds Review. When preparing the government-wide statements the adjusting entries are worksheet entries that are never booked. Ignore closing entries in the government activities journal 6a Serial Bond Debt Service Fund Record the entry to close the budgetary statement account. 1 Total fund balances of governmental funds presented in the governmental funds Balance Sheet.

Source: issuu.com

Source: issuu.com

Governmental fund-basis statements reflect modified accrual accounting and must be adjusted to the accrual basis when preparing the government-wide statements. Interest on the GO. Prepare required schedules reconciling the government-wide and fund-basis financial statements. At the fund level entries were also made to close budgetary and operating statement accounts. Journal Entries- Fund Based vs.

Source: issuu.com

Source: issuu.com

At the fund level entries were also made to close budgetary and operating statement accounts. Prepare required schedules reconciling the government-wide and fund-basis financial statements. Adjusting entries also known as adjusting journal entries AJE are the entries made in the accounting journals of a business firm to adapt or to update the revenues and expenses accounts according to the accrual principle and. Record events and transactions related to general fixed assets and general long-term debt and describe required schedules related to long-term debt. Bonds issued at face value on an interest date Valley Companys accounting year ends on December 31.

Source: issuu.com

Source: issuu.com

Expenditures 5000 Cash 5000 Governmental Activities. Adjusting entries problems and solutions are reported in this web page. Record events and transactions related to general fixed assets and general long-term debt and describe required schedules related to long-term debt. Cost of demolition was 5000. Accounting for Governmental Operating Activities—-Illustrative Transactions Financial Statements 2 Govtl Funds Review.

Source: in.pinterest.com

Source: in.pinterest.com

Company sells bonds to the investors and promise to pay the annual interest plus principal. Accounting for Bonds Definition Bonds Payable is the promissory note which the company uses to raise funds from the investor. Prepare required schedules reconciling the government-wide and fund-basis financial statements. Learn vocabulary terms and more with flashcards games and other study tools. Adjust governmental fund records to the economic resource focus are not posted to the general ledger are used to adjust govt funds to the accrual basis of acct must be made for both governmental and.

1 GOVERNMENTAL ACCOUNTING All those involved in the oversight or management of government operations and those whose livelihood and interest rely on the finances of local governments needto have a clear understanding of. References Mukharji A Hanif M. Obligation GO bonds on Dec. Expenditures 5000 Cash 5000 Governmental Activities. Journal Entries- Fund Based vs.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title adjusting worksheet entries governmental accounting outstanding bonds by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.