Your Basic pension worksheet intermediate accounting images are ready in this website. Basic pension worksheet intermediate accounting are a topic that is being searched for and liked by netizens now. You can Get the Basic pension worksheet intermediate accounting files here. Get all royalty-free photos and vectors.

If you’re looking for basic pension worksheet intermediate accounting pictures information related to the basic pension worksheet intermediate accounting keyword, you have come to the right blog. Our site frequently provides you with hints for downloading the highest quality video and picture content, please kindly surf and locate more enlightening video content and images that match your interests.

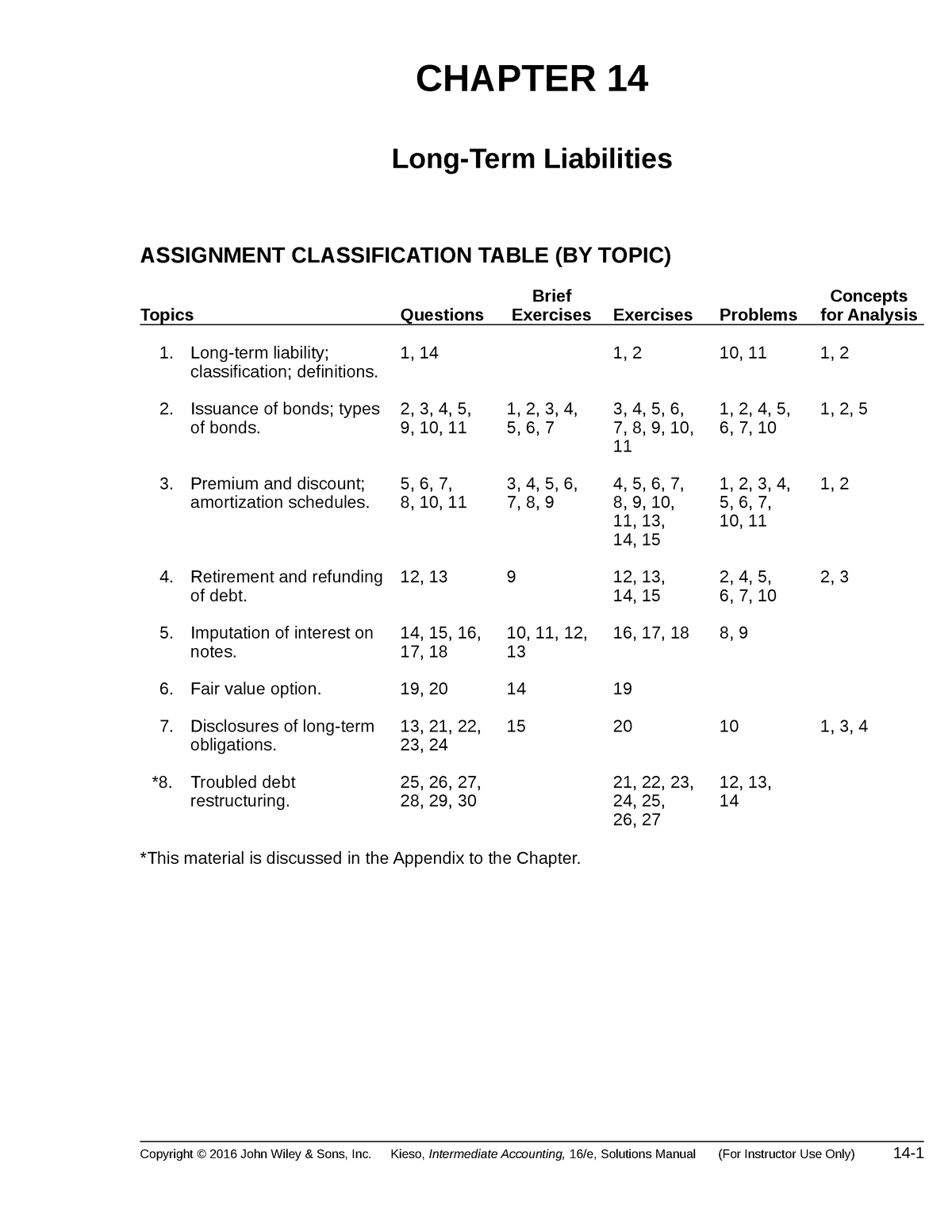

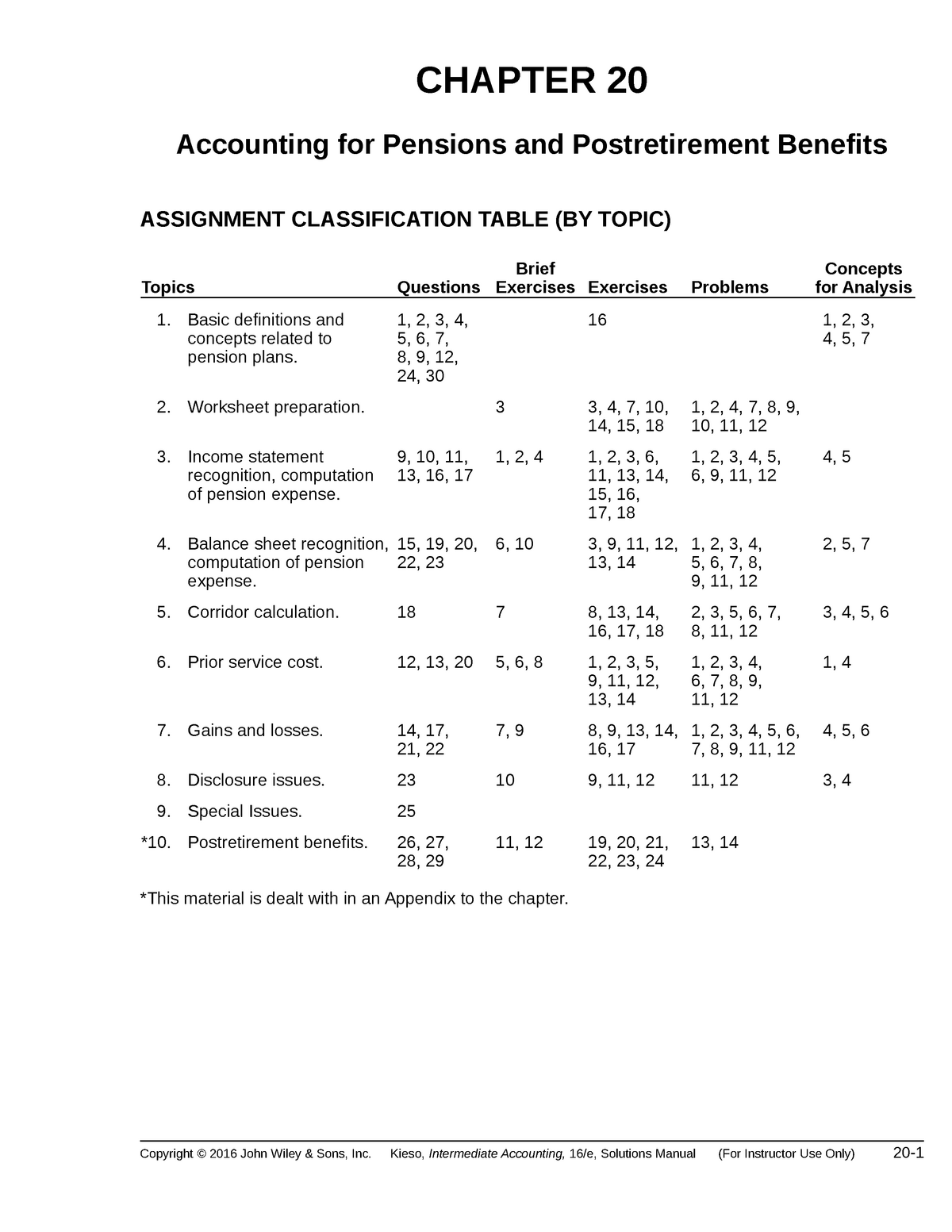

Basic Pension Worksheet Intermediate Accounting. Accounting Worksheet An accounting worksheet is large table of data which may be prepared by accountants as an optional intermediate step in an accounting cycle. Intermediate Accounting IFRS 2nd Edition Kieso Weygandt and Warfield 20 20-4 5. Degree Worksheet 2020-2021 Communications ACCT 2033 Intro to Financial Accounting ENG 1003 Composition I ENG 1013 Composition II ACCT 2133 Intro to Managerial Accounting COMS 1203 Oral Communications ACCT 3003 Intermediate Accounting I Mathematics MATH 1023 College Algebra ACCT 3053 Cost Accounting Sciences ACCT 4013 Tax Accounting I. Prepare income tax journal entries.

Ch15 Kieso Intermediate Accounting Solution Manual From slideshare.net

Ch15 Kieso Intermediate Accounting Solution Manual From slideshare.net

In 2016 the pension expense was 10 million and the company contributed 5 million to the pension plan. Simple 1015 E20-5 Application of years-of-service method. The accounting for a defined contribution plan is to charge its contributions to expense as incurred. Complete a pension worksheet and journal entries. Prepare income tax journal entries. Explain the accounting for 9.

Moderate 1525 E20-8 Application of the corridor approach.

Simple 1015 E20-7 Basic pension worksheet. The Memo Record columns on the right side maintain balances in the defined benefit obligation and the plan assets. 2 FUNDAMENTALS OF CURRENT PENSION FUNDING AND ACCOUNTING FOR PRIVATE SECTOR PENSION PLANS In general pension plan sponsors are concerned with two primary financial issues. Accounting Worksheet An accounting worksheet is large table of data which may be prepared by accountants as an optional intermediate step in an accounting cycle. At the end of 2016 the fair value of the pension assets and liabilities was 10 million. Use a worksheet for employers pension plan entries.

Source: slideshare.net

Source: slideshare.net

Pension Funding the cash contributions that are made to the pension plan. Moderate 1525 E20-4 Basic pension worksheet. Intermediate Accounting IFRS 2nd Edition Kieso Weygandt and Warfield 20 20-4 5. Lets see how pension accounting. Moderate 2025 E20-9 Disclosures.

Source:

Source:

Moderate 2535 E20-10 2025. Explain the accounting and amortization for unexpected gains and losses. The Memo Record columns on the right side maintain balances in the defined benefit obligation and the plan assets. In 2016 the pension expense was 10 million and the company contributed 5 million to the pension plan. Prepare income tax journal entries.

Source: studocu.com

Source: studocu.com

Lets see how pension accounting. Pensions and Other Post Employment Benefits Nature of Pension Plans The chapter focuses on the pension plan accounting in the perspective. At the end of 2016 the fair value of the pension assets and liabilities was 10 million. Complete a pension worksheet and journal entries. Moderate 2535 E20-10 2025.

Source: slideshare.net

Source: slideshare.net

Use a worksheet for employers pension plan entries. Intermediate accounting 2 Preview text Chapter 19. Lets see how pension accounting. Prepare income tax journal entries. Simple 1015 E20-7 Basic pension worksheet.

Source: slideshare.net

Source: slideshare.net

The main purpose of a worksheet is that it reduces the likelyhood of forgeting an adjustment and it reveals arithmatic errors. Intermediate Accounting IFRS 2nd Edition Kieso Weygandt and Warfield 20 20-4 5. Complete a pension worksheet and journal entries. Accounting for pension plan gains losses calculating recording the basic types 1 minimum gain or loss amortization using the Corridor Approach 2 expected vs. Describe the requirements for reporting pension plans in financial statements.

Source: wiley.com

Source: wiley.com

Accounting for pension plan gains losses calculating recording the basic types 1 minimum gain or loss amortization using the Corridor Approach 2 expected vs. At the end of 2016 the fair value of the pension assets and liabilities was 10 million. Simple 1015 E20-7 Basic pension worksheet. Use a worksheet for employers pension plan entries. Intermediate Accounting IFRS 2nd Edition Kieso Weygandt and Warfield 20 20-4 5.

Source: pinterest.com

Source: pinterest.com

Lets see how pension accounting. Simple 1015 E20-5 Application of years-of-service method. The Memo Record columns on the right side maintain balances in the defined benefit obligation and the plan assets. Use a worksheet for employers pension plan entries. Moderate 1525 E20-6.

Source: slidetodoc.com

Source: slidetodoc.com

Pensions and Other Post Employment Benefits Nature of Pension Plans The chapter focuses on the pension plan accounting in the perspective. Simple 1015 E20-5 Application of years-of-service method. 2 FUNDAMENTALS OF CURRENT PENSION FUNDING AND ACCOUNTING FOR PRIVATE SECTOR PENSION PLANS In general pension plan sponsors are concerned with two primary financial issues. The Memo Record columns on the right side maintain balances in the defined benefit obligation and the plan assets. Pension Funding the cash contributions that are made to the pension plan.

Source: pinterest.com

Source: pinterest.com

Complete a pension worksheet and journal entries. Kieso intermediate accounting solution manual kieso intermediate accounting solution manual. Account for various types of leases including complex calculations. Describe the accounting and amortization of prior service costs. Simple 1015 E20-7 Basic pension worksheet.

Source: slideshare.net

Source: slideshare.net

Degree Worksheet 2020-2021 Communications ACCT 2033 Intro to Financial Accounting ENG 1003 Composition I ENG 1013 Composition II ACCT 2133 Intro to Managerial Accounting COMS 1203 Oral Communications ACCT 3003 Intermediate Accounting I Mathematics MATH 1023 College Algebra ACCT 3053 Cost Accounting Sciences ACCT 4013 Tax Accounting I. Here is a summary of the relevant costs associated with a defined benefit pension plan which sum to the net periodic pension. Explain the accounting for past service costs. Kieso intermediate accounting solution manual kieso intermediate accounting solution manual. Remember me on this computer or reset password.

Source: slideshare.net

Source: slideshare.net

The main purpose of a worksheet is that it reduces the likelyhood of forgeting an adjustment and it reveals arithmatic errors. Here is a summary of the relevant costs associated with a defined benefit pension plan which sum to the net periodic pension. The cash contributions that are made to the pension plan. Moderate 2535 E20-10 2025. Moderate 1525 E20-4 Basic pension worksheet.

Source: issuu.com

Source: issuu.com

Basic Format of Pension Worksheet The General Journal Entries columns of the worksheet near the left side determine the entries to record in the formal general ledger accounts. The main purpose of a worksheet is that it reduces the likelyhood of forgeting an adjustment and it reveals arithmatic errors. Moderate 1525 E20-8 Application of the corridor approach. Moderate 1525 E20-6. Describe the requirements for reporting pension plans in financial statements.

Source: pinterest.com

Source: pinterest.com

The accounting for a defined contribution plan is to charge its contributions to expense as incurred. Moderate 1525 E20-4 Basic pension worksheet. Lets see how pension accounting. Simple 1015 E20-5 Application of years-of-service method. Use a worksheet for employers pension plan entries.

Source: slideshare.net

Source: slideshare.net

Here is a summary of the relevant costs associated with a defined benefit pension plan which sum to the net periodic pension. At the end of 2016 the fair value of the pension assets and liabilities was 10 million. The accounting for a defined contribution plan is to charge its contributions to expense as incurred. Lets see how pension accounting. Degree Worksheet 2020-2021 Communications ACCT 2033 Intro to Financial Accounting ENG 1003 Composition I ENG 1013 Composition II ACCT 2133 Intro to Managerial Accounting COMS 1203 Oral Communications ACCT 3003 Intermediate Accounting I Mathematics MATH 1023 College Algebra ACCT 3053 Cost Accounting Sciences ACCT 4013 Tax Accounting I.

Source: pinterest.com

Source: pinterest.com

The cash contributions that are made to the pension plan. Account for various types of leases including complex calculations. Accounting for pension plan gains losses calculating recording the basic types 1 minimum gain or loss amortization using the Corridor Approach 2 expected vs. The main purpose of a worksheet is that it reduces the likelyhood of forgeting an adjustment and it reveals arithmatic errors. Moderate 1525 E20-6.

Source: pinterest.com

Source: pinterest.com

The main purpose of a worksheet is that it reduces the likelyhood of forgeting an adjustment and it reveals arithmatic errors. Explain the accounting and amortization for unexpected gains and losses. Moderate 1525 E20-6. Accounting Worksheet An accounting worksheet is large table of data which may be prepared by accountants as an optional intermediate step in an accounting cycle. Moderate 2535 E20-10 2025.

Source: studocu.com

Source: studocu.com

Use a worksheet for employers pension plan entries. Remember me on this computer or reset password. Simple 1015 E20-5 Application of years-of-service method. Here is a summary of the relevant costs associated with a defined benefit pension plan which sum to the net periodic pension. Moderate 1525 E20-6.

Source: pinterest.com

Source: pinterest.com

Moderate 1525 E20-8 Application of the corridor approach. At the end of 2016 the fair value of the pension assets and liabilities was 10 million. In 2016 the pension expense was 10 million and the company contributed 5 million to the pension plan. Here is a summary of the relevant costs associated with a defined benefit pension plan which sum to the net periodic pension. Accounting Worksheet An accounting worksheet is large table of data which may be prepared by accountants as an optional intermediate step in an accounting cycle.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title basic pension worksheet intermediate accounting by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.