Your Calculate income tax expense 10 column accounting worksheet images are available. Calculate income tax expense 10 column accounting worksheet are a topic that is being searched for and liked by netizens today. You can Download the Calculate income tax expense 10 column accounting worksheet files here. Download all free photos.

If you’re looking for calculate income tax expense 10 column accounting worksheet pictures information related to the calculate income tax expense 10 column accounting worksheet keyword, you have pay a visit to the ideal site. Our site frequently provides you with suggestions for seeing the maximum quality video and picture content, please kindly surf and find more enlightening video articles and images that fit your interests.

Calculate Income Tax Expense 10 Column Accounting Worksheet. Last Updated January 10 2021 Payroll Expense Calculation Worksheets Complete ONE worksheet based on your business type. 1995 Sauk Rapids Forms MPLS MN 55407 TRK-1 TRUCKERS INCOME EXPENSE WORKSHEET YEAR_____ NAME_____ Federal ID. AASB 112 adopts a tax-effect method which is based on the assumption that the income tax expense in financial statements is not equal simply to the current tax liability but is also a function of the entitys deferred tax liabilities. Use worksheet 2 to help calculate the total for income-related add-back items at B Other assessable income item 7 and the total for expense-related add-back items at W Non-deductible expenses item 7.

Real Estate Expenses Spreadsheet Check More At Https Onlyagame Info Real Estate Expenses Spreadsheet From id.pinterest.com

Real Estate Expenses Spreadsheet Check More At Https Onlyagame Info Real Estate Expenses Spreadsheet From id.pinterest.com

Use worksheet 2 to help calculate the total for income-related add-back items at B Other assessable income item 7 and the total for expense-related add-back items at W Non-deductible expenses item 7. Entertainment costs 7 000 10 000 600. The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail. There are numerous versions of the Payroll Deductions Tables to help you calculate CPP contributions EI premiums and the amount of federal provincial except Quebec and territorial income tax. If you take expense on mileage basis complete the following lines Auto 1 Auto 2. AUTO EXPENSE Keep records of mileage for day care meetings shopping for supplies groceries or to events etc.

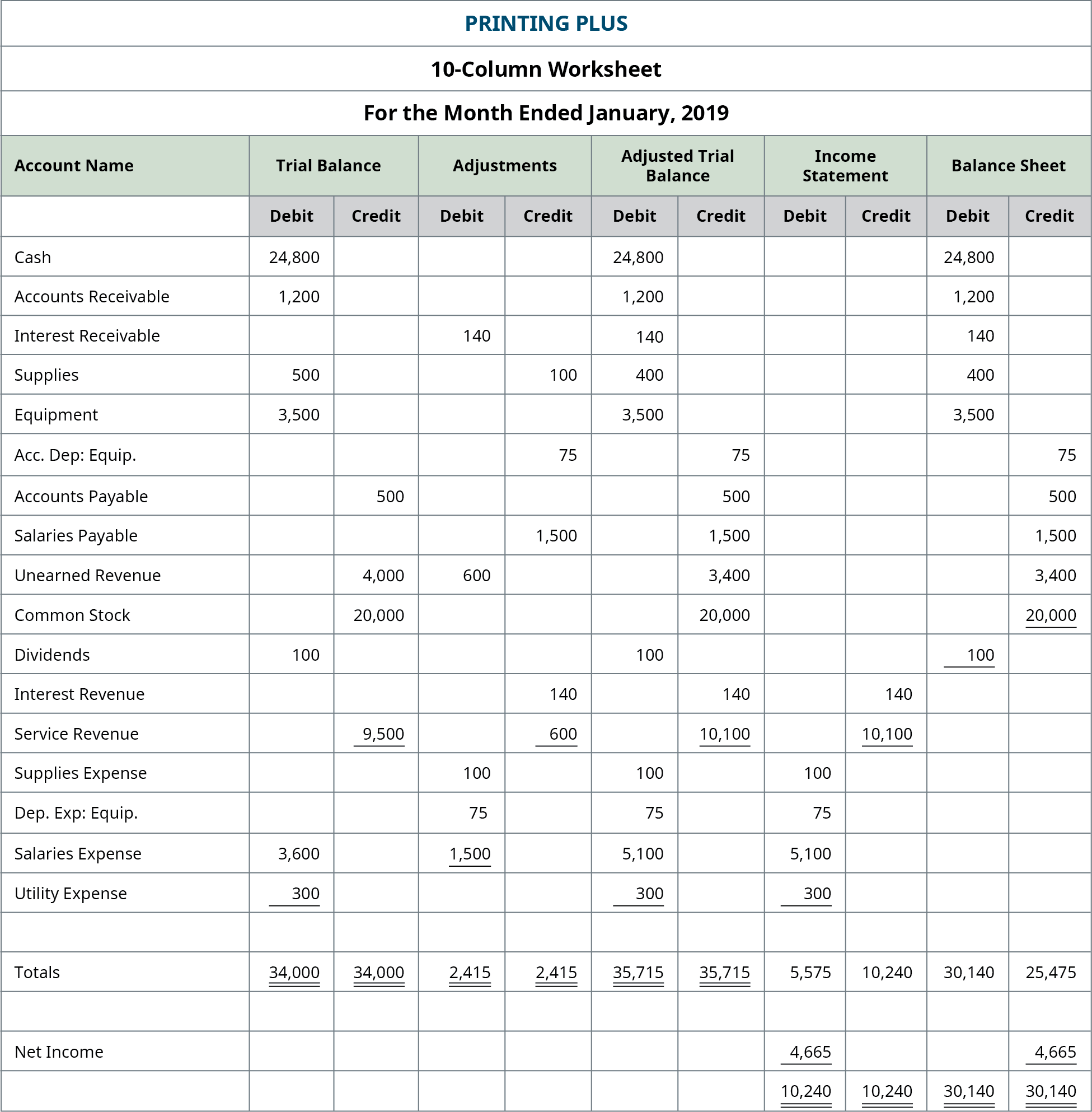

The main purpose of a worksheet is that it reduces the likelyhood of forgeting an adjustment and it reveals arithmatic errors.

Last Updated January 10 2021 Payroll Expense Calculation Worksheets Complete ONE worksheet based on your business type. Do not bring income before tax from. 9 Smart Ways to Increase. Calculate current tax expense deferred tax expense and prepare the tax reconciliation. Income tax expense means the amount of income tax which would be payable on the pre-tax accounting profit adjusted for permanent differences. Tax Adjusting Entry Year-End Accounting Excel Worksheet Build Excel worksheet for adjusting adjusting tax entries reconciling net income calculated on a book and tax.

Source: beginner-bookkeeping.com

Source: beginner-bookkeeping.com

Subtractions from T Total profit or loss item 6 not covered by. There are numerous versions of the Payroll Deductions Tables to help you calculate CPP contributions EI premiums and the amount of federal provincial except Quebec and territorial income tax. A 10-column worksheet is a columnar template that helps accountants and bookkeepers plan and facilitate the end-of-period reporting process. Create a formula in cell F59 on the Yearend Worksheet to calculate income before taxes. Tax Adjusting Entry Year-End Accounting Excel Worksheet Build Excel worksheet for adjusting adjusting tax entries reconciling net income calculated on a book and tax.

Source: pinterest.com

Source: pinterest.com

ASC 740-10-20 defines a tax position as a position in a previously filed tax return or a position expected to be taken in a future tax return that is reflected in measuring current or deferred income tax. It is not a mandatory step in the accounting process but is often completed to help eliminate errors associated with the end-of-period adjustments. Use worksheet 2 to help calculate the total for income-related add-back items at B Other assessable income item 7 and the total for expense-related add-back items at W Non-deductible expenses item 7. One reason this may occur is that on the one hand as per accounting standards companies employ the straight-line depreciation method to determine depreciation for that financial year. A 10-column worksheet is a columnar template that helps accountants and bookkeepers plan and facilitate the end-of-period reporting process.

Source: calamityjanetheshow.com

Source: calamityjanetheshow.com

The main purpose of a worksheet is that it reduces the likelyhood of forgeting an adjustment and it reveals arithmatic errors. Depending on the accounting standards given by GAAP and IFRS often the reported income by companies on their income statements differs from the taxable income as determined by the tax code. The term income tax benefit is used to describe this amount where it is a net. ASC 740-10-20 defines a tax position as a position in a previously filed tax return or a position expected to be taken in a future tax return that is reflected in measuring current or deferred income tax. TACC505 Corporate Accounting Top Education Institute Sydney City School of Business Page 7 of 16 Case 3 Current Tax Worksheet Profit before income tax 5 000 Add.

Source: pinterest.com

Source: pinterest.com

Income Expense Worksheets Templates - A budget spreadsheet is one of the most effective tools that you can make use of to manage your financial resources plan Money Making Ideas. Deferred tax liability is created when the Company underpays the tax which it will have to pay in the near future. The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail. A 10-column worksheet is a columnar template that helps accountants and bookkeepers plan and facilitate the end-of-period reporting process. Accounting Worksheet An accounting worksheet is large table of data which may be prepared by accountants as an optional intermediate step in an accounting cycle.

Source: pinterest.com

Source: pinterest.com

Calculate current tax expense deferred tax expense and prepare the tax reconciliation. The term income tax benefit is used to describe this amount where it is a net. Partners Adjusted Basis Worksheet Name of Partner Jerry Taxit TIN 359-00-0000 Tax Year Ending 123119 Name of Partnership Shout and Jump EIN 41-1234567 1 Adjusted basis from preceding year enter zero if this is the. Use worksheet 2 to help calculate the total for income-related add-back items at B Other assessable income item 7 and the total for expense-related add-back items at W Non-deductible expenses item 7. Accounting Worksheet An accounting worksheet is large table of data which may be prepared by accountants as an optional intermediate step in an accounting cycle.

Source: calamityjanetheshow.com

Source: calamityjanetheshow.com

Deferred tax liability is created when the Company underpays the tax which it will have to pay in the near future. Last Updated January 10 2021 Payroll Expense Calculation Worksheets Complete ONE worksheet based on your business type. Tax Adjusting Entry Year-End Accounting Excel Worksheet Build Excel worksheet for adjusting adjusting tax entries reconciling net income calculated on a book and tax. Partners Adjusted Basis Worksheet Name of Partner Jerry Taxit TIN 359-00-0000 Tax Year Ending 123119 Name of Partnership Shout and Jump EIN 41-1234567 1 Adjusted basis from preceding year enter zero if this is the. AUTO EXPENSE Keep records of mileage for day care meetings shopping for supplies groceries or to events etc.

Source: pinterest.com

Source: pinterest.com

Partners Adjusted Basis Worksheet Name of Partner Jerry Taxit TIN 359-00-0000 Tax Year Ending 123119 Name of Partnership Shout and Jump EIN 41-1234567 1 Adjusted basis from preceding year enter zero if this is the. Business Type Complete the worksheet on Corporation C Corporation or S Corporation or. One reason this may occur is that on the one hand as per accounting standards companies employ the straight-line depreciation method to determine depreciation for that financial year. The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit card bank and other financial accounts. Do not bring income before tax from.

Calculate current tax expense deferred tax expense and prepare the tax reconciliation. ASC 740-10-20 defines a tax position as a position in a previously filed tax return or a position expected to be taken in a future tax return that is reflected in measuring current or deferred income tax. 9 Smart Ways to Increase. Calculate current tax expense deferred tax expense and prepare the tax reconciliation. Last Updated January 10 2021 Payroll Expense Calculation Worksheets Complete ONE worksheet based on your business type.

Source: pinterest.com

Source: pinterest.com

ASC 740-10-20 defines a tax position as a position in a previously filed tax return or a position expected to be taken in a future tax return that is reflected in measuring current or deferred income tax. AUTO EXPENSE Keep records of mileage for day care meetings shopping for supplies groceries or to events etc. AASB 112 adopts a tax-effect method which is based on the assumption that the income tax expense in financial statements is not equal simply to the current tax liability but is also a function of the entitys deferred tax liabilities. A 10-column worksheet is a columnar template that helps accountants and bookkeepers plan and facilitate the end-of-period reporting process. This example is a bit more complex because you need to understand the tax reconciliation in the context of the financial statements tax returns and other information.

Source: pinterest.com

Source: pinterest.com

One reason this may occur is that on the one hand as per accounting standards companies employ the straight-line depreciation method to determine depreciation for that financial year. AASB 112 adopts a tax-effect method which is based on the assumption that the income tax expense in financial statements is not equal simply to the current tax liability but is also a function of the entitys deferred tax liabilities. ASC 740-10-20 defines a tax position as a position in a previously filed tax return or a position expected to be taken in a future tax return that is reflected in measuring current or deferred income tax. The main purpose of a worksheet is that it reduces the likelyhood of forgeting an adjustment and it reveals arithmatic errors. The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail.

Source: id.pinterest.com

Source: id.pinterest.com

The liability is created not due to Company defaulting on its tax liabilities but due to timing mismatch or accounting provisions which causes less tax. Income tax expense means the amount of income tax which would be payable on the pre-tax accounting profit adjusted for permanent differences. The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit card bank and other financial accounts. Use worksheet 2 to help calculate the total for income-related add-back items at B Other assessable income item 7 and the total for expense-related add-back items at W Non-deductible expenses item 7. Last Updated January 10 2021 Payroll Expense Calculation Worksheets Complete ONE worksheet based on your business type.

Source: pinterest.com

Source: pinterest.com

ASC 740-10-20 defines a tax position as a position in a previously filed tax return or a position expected to be taken in a future tax return that is reflected in measuring current or deferred income tax. Partners Adjusted Basis Worksheet Name of Partner Jerry Taxit TIN 359-00-0000 Tax Year Ending 123119 Name of Partnership Shout and Jump EIN 41-1234567 1 Adjusted basis from preceding year enter zero if this is the. Tax Adjusting Entry Year-End Accounting Excel Worksheet Build Excel worksheet for adjusting adjusting tax entries reconciling net income calculated on a book and tax. AASB 112 adopts a tax-effect method which is based on the assumption that the income tax expense in financial statements is not equal simply to the current tax liability but is also a function of the entitys deferred tax liabilities. ASC 740-10-20 defines a tax position as a position in a previously filed tax return or a position expected to be taken in a future tax return that is reflected in measuring current or deferred income tax.

Source: pinterest.com

Source: pinterest.com

AUTO EXPENSE Keep records of mileage for day care meetings shopping for supplies groceries or to events etc. Create a formula in cell F59 on the Yearend Worksheet to calculate income before taxes. The main purpose of a worksheet is that it reduces the likelyhood of forgeting an adjustment and it reveals arithmatic errors. The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail. Business Type Complete the worksheet on Corporation C Corporation or S Corporation or.

Source: pinterest.com

Source: pinterest.com

Deferred tax liability is created when the Company underpays the tax which it will have to pay in the near future. This information will be in Column 10 of your last years T2125 form or if you used income tax software to complete and file your income tax last year it should already be filled in for you. Partners Adjusted Basis Worksheet Name of Partner Jerry Taxit TIN 359-00-0000 Tax Year Ending 123119 Name of Partnership Shout and Jump EIN 41-1234567 1 Adjusted basis from preceding year enter zero if this is the. If you take expense on mileage basis complete the following lines Auto 1 Auto 2. Calculate current tax expense deferred tax expense and prepare the tax reconciliation.

Source: calamityjanetheshow.com

Source: calamityjanetheshow.com

If you take expense on mileage basis complete the following lines Auto 1 Auto 2. Income tax expense means the amount of income tax which would be payable on the pre-tax accounting profit adjusted for permanent differences. One reason this may occur is that on the one hand as per accounting standards companies employ the straight-line depreciation method to determine depreciation for that financial year. AUTO EXPENSE Keep records of mileage for day care meetings shopping for supplies groceries or to events etc. Entertainment costs 7 000 10 000 600.

Source: pinterest.com

Source: pinterest.com

Income Expense Worksheets Templates - A budget spreadsheet is one of the most effective tools that you can make use of to manage your financial resources plan Money Making Ideas. This example is a bit more complex because you need to understand the tax reconciliation in the context of the financial statements tax returns and other information. If you take expense on mileage basis complete the following lines Auto 1 Auto 2. Entertainment costs 7 000 10 000 600. Income tax expense means the amount of income tax which would be payable on the pre-tax accounting profit adjusted for permanent differences.

Source: pinterest.com

Source: pinterest.com

AASB 112 adopts a tax-effect method which is based on the assumption that the income tax expense in financial statements is not equal simply to the current tax liability but is also a function of the entitys deferred tax liabilities. Accounting Worksheet An accounting worksheet is large table of data which may be prepared by accountants as an optional intermediate step in an accounting cycle. 9 Smart Ways to Increase. Entertainment costs 7 000 10 000 600. Calculate current tax expense deferred tax expense and prepare the tax reconciliation.

Source: opentextbc.ca

Source: opentextbc.ca

Entertainment costs 7 000 10 000 600. The term income tax benefit is used to describe this amount where it is a net. The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit card bank and other financial accounts. Income Expense Worksheets Templates - A budget spreadsheet is one of the most effective tools that you can make use of to manage your financial resources plan Money Making Ideas. Subtractions from T Total profit or loss item 6 not covered by.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title calculate income tax expense 10 column accounting worksheet by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.