Your Cost method of accounting for investment in subsidiary worksheet images are ready. Cost method of accounting for investment in subsidiary worksheet are a topic that is being searched for and liked by netizens today. You can Find and Download the Cost method of accounting for investment in subsidiary worksheet files here. Find and Download all royalty-free photos and vectors.

If you’re searching for cost method of accounting for investment in subsidiary worksheet pictures information connected with to the cost method of accounting for investment in subsidiary worksheet interest, you have visit the right blog. Our website frequently gives you suggestions for refferencing the maximum quality video and picture content, please kindly surf and find more enlightening video content and images that match your interests.

Cost Method Of Accounting For Investment In Subsidiary Worksheet. On September 24 2015 the AcSB issued an Exposure Draft that proposes to clarify the accounting for a subsidiary and an investment subject to significant influence when the cost method is used. Assume Parent uses the simple equity method of accounting for its investment in Subsidiary. Adjust to fair value and record goodwill consolidation worksheet entries - equity method S. The investment has no easily determinable fair value.

Assume Parent uses the simple equity method of accounting for its investment in Subsidiary. The investor recognises income from the investment only to the extent that the investor receives distributions from retained earnings of the investee arising after the date of acquisition. Subsequently Company A. Equity Method in Separate Financial Statements Amendments to IAS 27 issued. Equity Method of Accounting. Under these circumstances the cost method mandates that the investor account for the investment at its historical cost ie the purchase price.

The amendments are to be applied retrospectively in accordance with IAS 8 Accounting Policies Changes in Accounting.

Subsequently Company A. The amendments are to be applied retrospectively in accordance with IAS 8 Accounting Policies Changes in Accounting. Earlier application is permitted. Eliminate subsidiarys equity account. Equity Method of Accounting. Equity Method in Separate Financial Statements Amendments to IAS 27 issued.

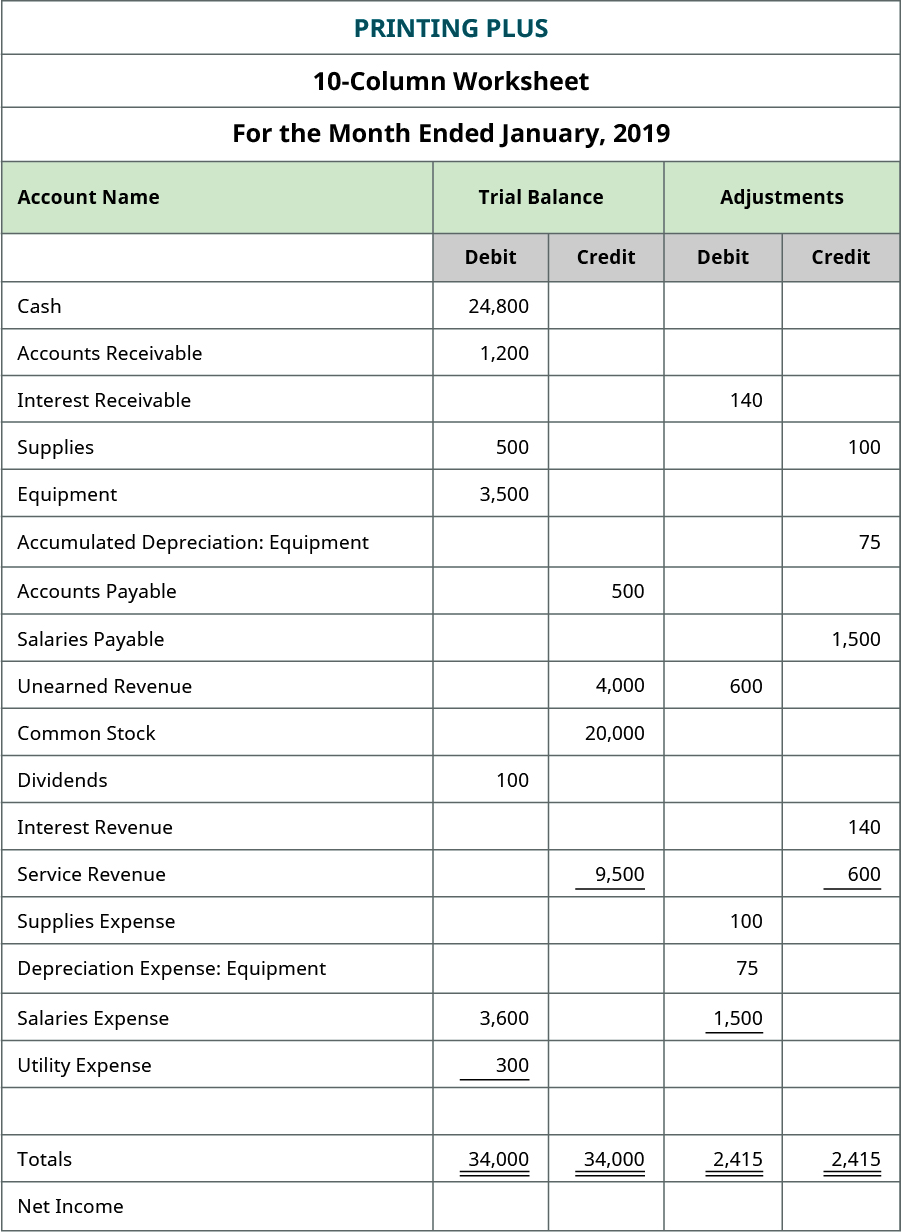

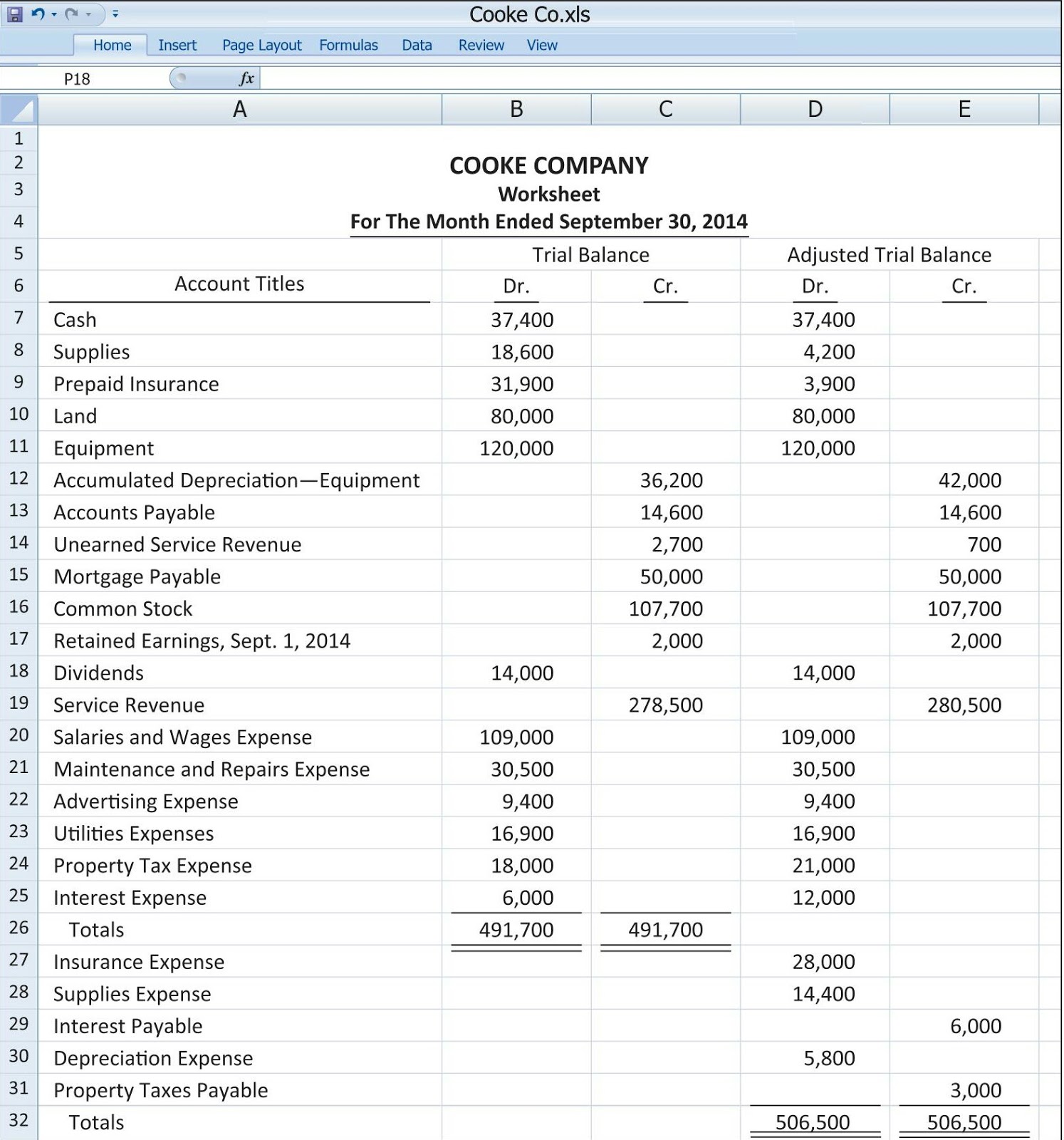

Source: opentextbc.ca

Source: opentextbc.ca

This information appears as an asset on the balance sheet of the investor. Consolidationdescribed in Section 1590 Consolidated financial statements. If the parent uses the cost method to account for its investment in a subsidiary the parent will recognize dividends received from the subsidiary as dividend income. Firms buy stock in other companies as either an investment or to fulfill a strategic positioning. Eliminate subsidiarys equity account.

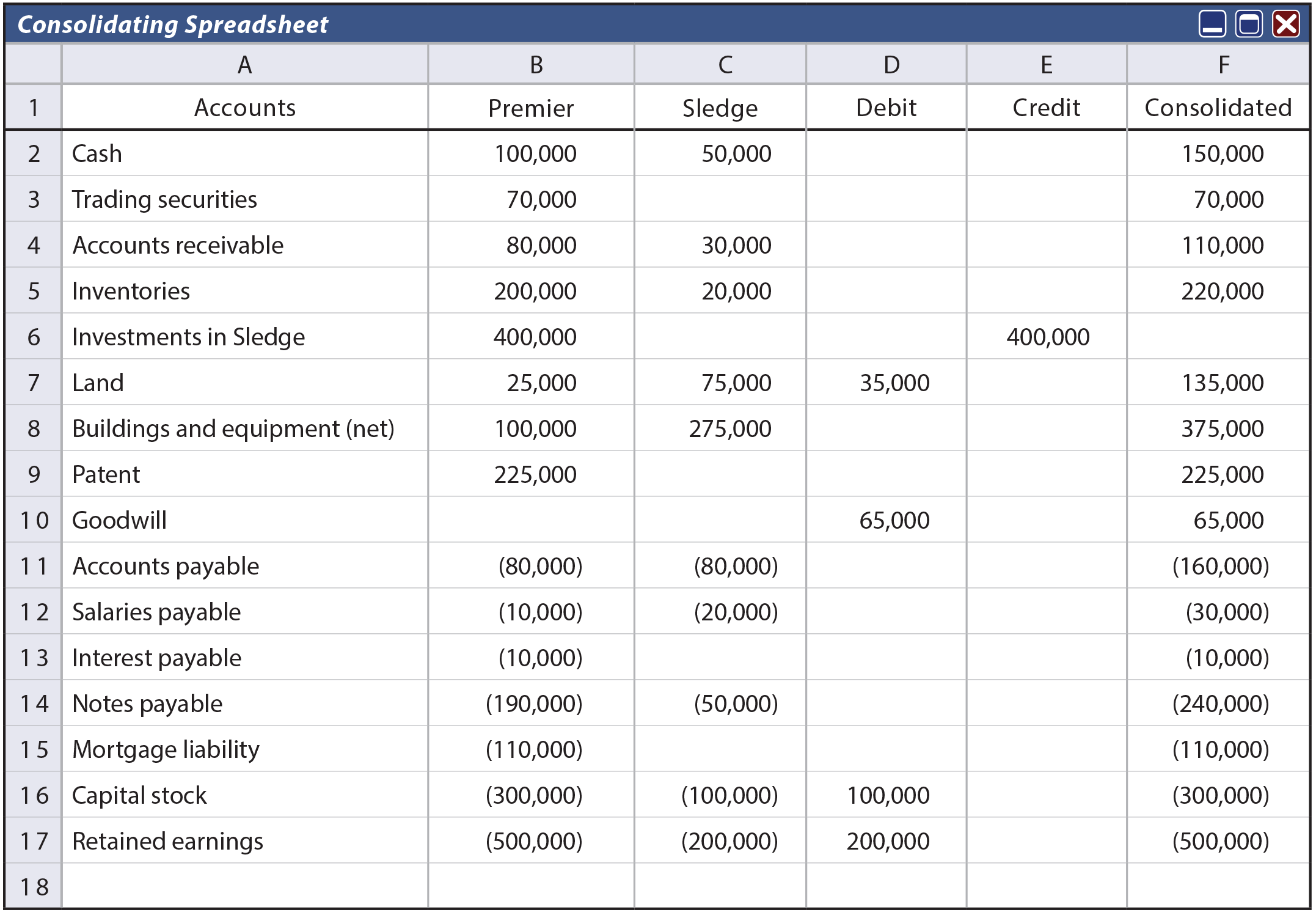

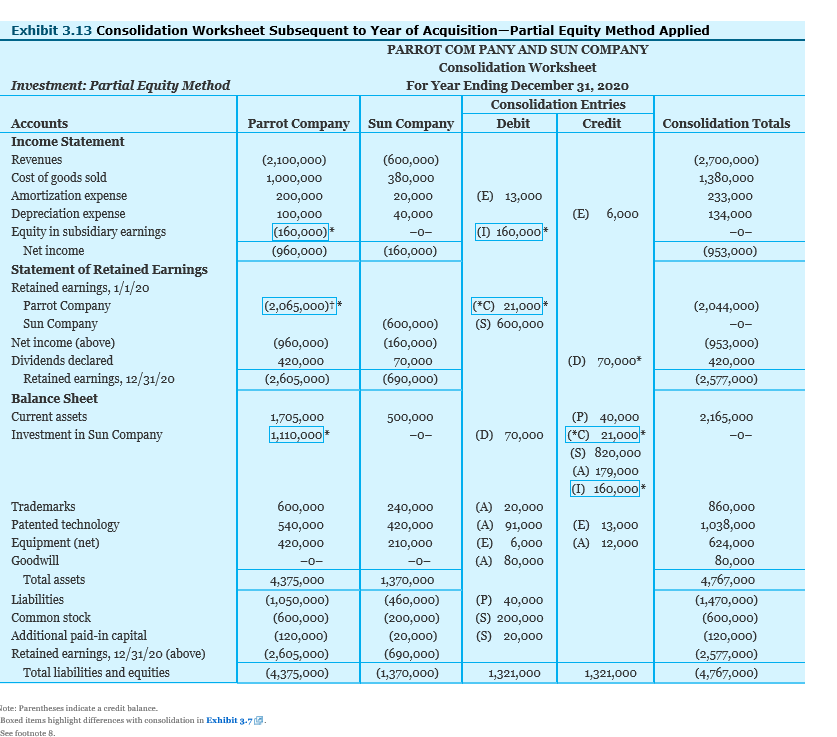

Source: principlesofaccounting.com

Source: principlesofaccounting.com

On September 24 2015 the AcSB issued an Exposure Draft that proposes to clarify the accounting for a subsidiary and an investment subject to significant influence when the cost method is used. Eliminate subsidiarys equity account. Equity Method of Accounting. A method of accounting for an investment whereby the investment is recognised at cost. For example a computer manufacturing firm may buy ownership in a hard drive manufacturer for strategic positioning.

Source: transtutors.com

Source: transtutors.com

If a parent carries an investment in a subsidiary using the equity method the parent will recognize its share of the subsidiarys net income as an increase in its the parents investment in the subsidiary. Record investment in subsidiary 2. This information appears as an asset on the balance sheet of the investor. Company A owns a 40 equity method investment in Company B. For post5K4S 141R combinations the parent records the investment account using its share of the subsidiary fair value recognized at acquisition usually the fair value of the consideration transferred.

Source: pinterest.com

Source: pinterest.com

Once the investor records the initial transaction there is no need. The proposals are intended to provide guidance on how to apply the cost method in Sections 1591 Subsidiaries and 3051 Investments. On September 24 2015 the AcSB issued an Exposure Draft that proposes to clarify the accounting for a subsidiary and an investment subject to significant influence when the cost method is used. To account for the purchase of stock in another company the firm must use either. The cost method of accounting assumes that the value of the currency with which the equity investment was purchased remains constant over time.

Source: pinterest.com

Source: pinterest.com

Company A owns a 40 equity method investment in Company B. This information appears as an asset on the balance sheet of the investor. Firms buy stock in other companies as either an investment or to fulfill a strategic positioning. The investor recognises income from the investment only to the extent that the investor receives distributions from retained earnings of the investee arising after the date of acquisition. A method of accounting for an investment whereby the investment is recognised at cost.

Source: pinterest.com

Source: pinterest.com

The proposals are intended to provide guidance on how to apply the cost method in Sections 1591 Subsidiaries and 3051 Investments. For pre-SFAS 141R combinations the parent recorded the investment account at its cost as measured by the purchase method or the subsidiarys book value for a pooling of interests. Changes in Cost Method of Accounting When we change the recognition of financial instruments from cost to equityrevaluation method or vice versa the same is regarded as changes in accounting policy as per the provisions of IAS-8. To account for the purchase of stock in another company the firm must use either. Adjust to fair value and record goodwill consolidation worksheet entries - equity method S.

Source: pinterest.com

Source: pinterest.com

The investor recognises income from the investment only to the extent that the investor receives distributions from retained earnings of the investee arising after the date of acquisition. The proposals are intended to provide guidance on how to apply the cost method in Sections 1591 Subsidiaries and 3051 Investments. The amendments are effective for annual periods beginning on or after 1 January 2016. Company A owns a 40 equity method investment in Company B. On January 1 20X1 Parent Company purchased 80 of the common stock of Subsidiary Company for 316000.

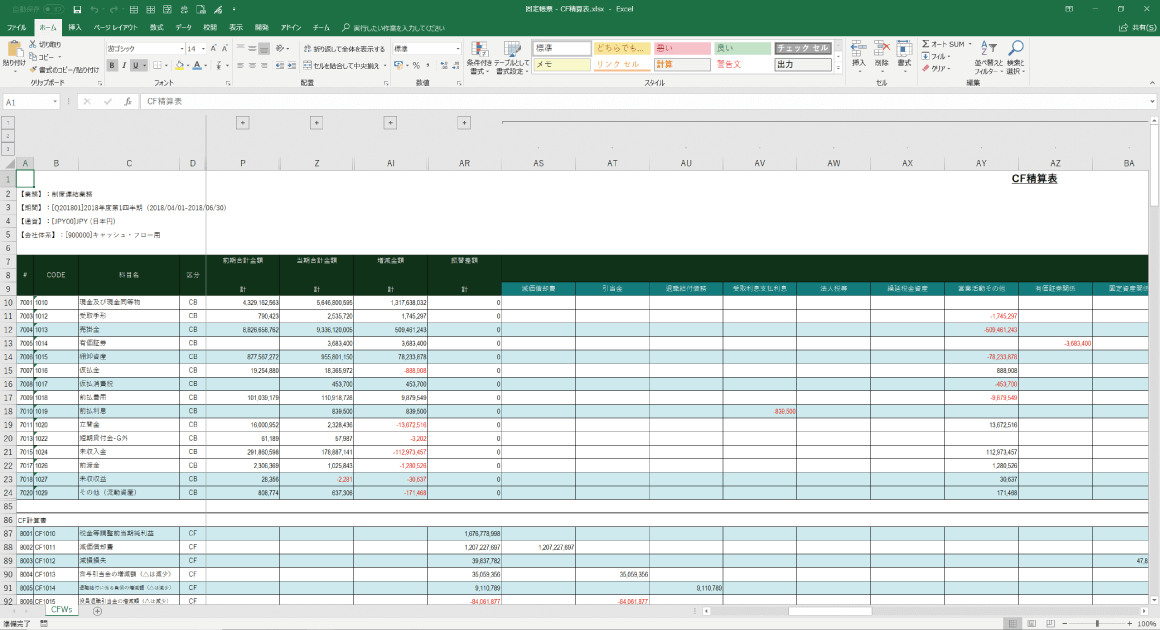

Source: principlesofaccounting.com

Source: principlesofaccounting.com

Equity Method of Accounting. Distributions received in excess of such profits are regarded as a. Assume Parent uses the simple equity method of accounting for its investment in Subsidiary. Adjust to fair value and record goodwill consolidation worksheet entries - equity method S. When a company owns less than 50 of the outstanding stock of another company as a long-term investment the percentage of ownership determines whether to use.

Source: pinterest.com

Source: pinterest.com

Equity Method of Accounting. Equity Method in Separate Financial Statements Amendments to IAS 27 issued. On this date Subsidiary had common stock other paid-in capital and retained earnings of 40000 120000 and 190000 respectively. On September 24 2015 the AcSB issued an Exposure Draft that proposes to clarify the accounting for a subsidiary and an investment subject to significant influence when the cost method is used. For example a computer manufacturing firm may buy ownership in a hard drive manufacturer for strategic positioning.

Source: issuu.com

Source: issuu.com

For post5K4S 141R combinations the parent records the investment account using its share of the subsidiary fair value recognized at acquisition usually the fair value of the consideration transferred. The investment has no easily determinable fair value. The proposals are intended to provide guidance on how to apply the cost method in Sections 1591 Subsidiaries and 3051 Investments. Equity Method of Accounting. Record investment in subsidiary 2.

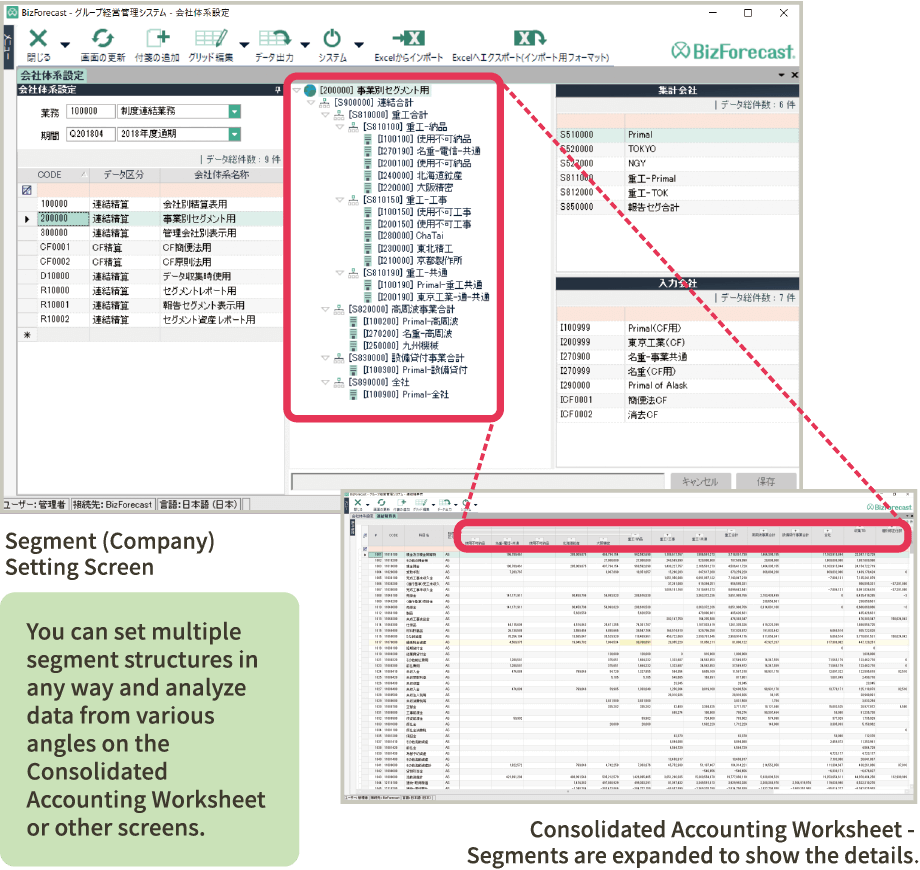

Source: primal-inc.com

Source: primal-inc.com

Consolidationdescribed in Section 1590 Consolidated financial statements. The proposals are intended to provide guidance on how to apply the cost method in Sections 1591 Subsidiaries and 3051 Investments. This information appears as an asset on the balance sheet of the investor. A method of accounting for an investment whereby the investment is recognised at cost. Firms buy stock in other companies as either an investment or to fulfill a strategic positioning.

Source: pinterest.com

Source: pinterest.com

A method of accounting for an investment whereby the investment is recognised at cost. For example a computer manufacturing firm may buy ownership in a hard drive manufacturer for strategic positioning. Learn vocabulary terms and more with flashcards games and other study tools. When a company owns less than 50 of the outstanding stock of another company as a long-term investment the percentage of ownership determines whether to use. Consolidationdescribed in Section 1590 Consolidated financial statements.

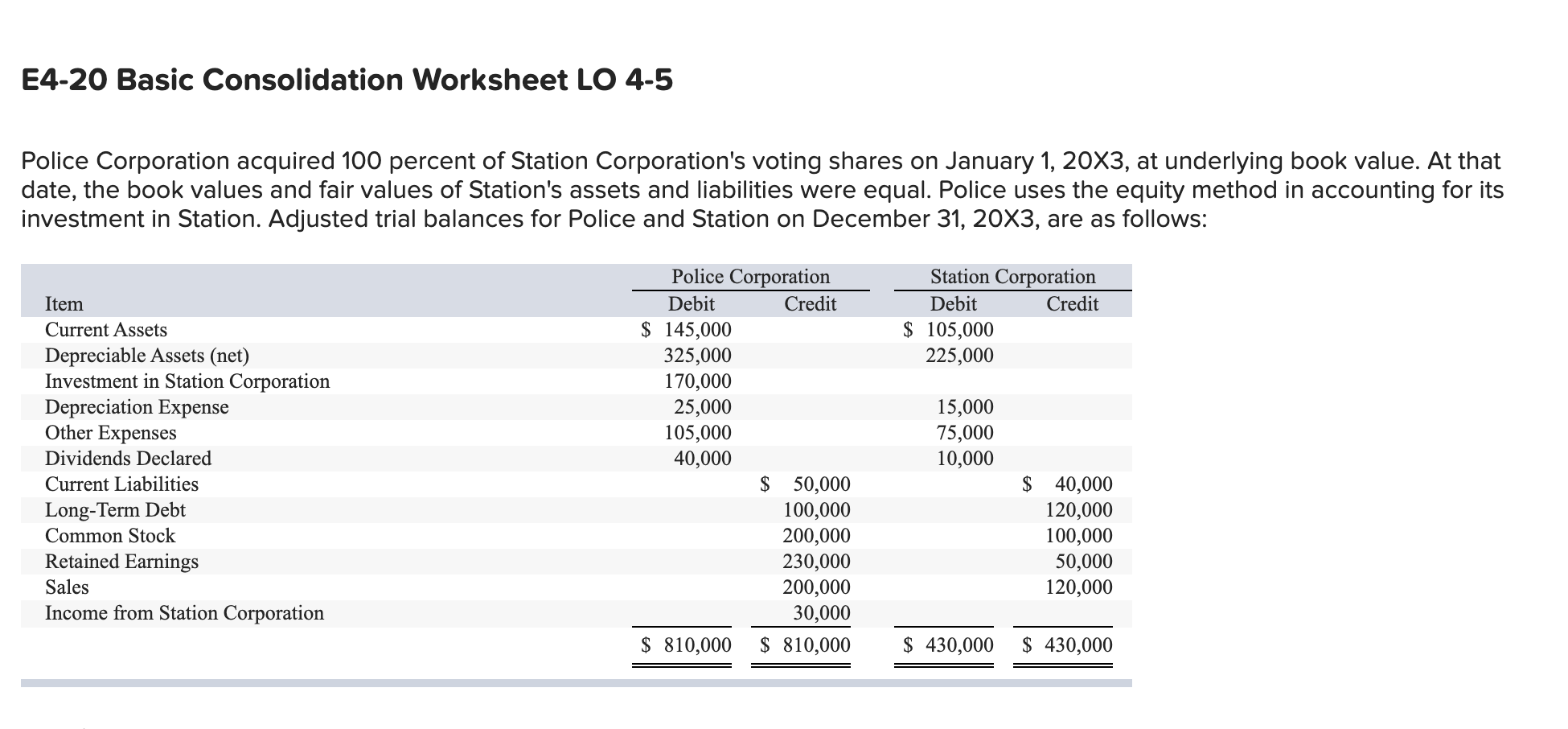

Source: chegg.com

Source: chegg.com

Equity Method of Accounting. Cost method The entity must use the same accounting policy choice for all subsidiaries. Adjust to fair value and record goodwill consolidation worksheet entries - equity method S. Firms buy stock in other companies as either an investment or to fulfill a strategic positioning. This information appears as an asset on the balance sheet of the investor.

Source: solveaccounting.blogspot.com

Source: solveaccounting.blogspot.com

Company A owns a 40 equity method investment in Company B. On this date Subsidiary had common stock other paid-in capital and retained earnings of 40000 120000 and 190000 respectively. Under these circumstances the cost method mandates that the investor account for the investment at its historical cost ie the purchase price. Record investment in subsidiary 2. Cost method The entity must use the same accounting policy choice for all subsidiaries.

Source: chegg.com

Source: chegg.com

Accounting for short-term stock investments and for long-term stock investments of less than 20 percent. Subsequently Company A. Eliminate subsidiarys equity account. The cost method of accounting assumes that the value of the currency with which the equity investment was purchased remains constant over time. Accounting for short-term stock investments and for long-term stock investments of less than 20 percent.

Source: primal-inc.com

Source: primal-inc.com

On this date Subsidiary had common stock other paid-in capital and retained earnings of 40000 120000 and 190000 respectively. Company A owns a 40 equity method investment in Company B. If the parent uses the cost method to account for its investment in a subsidiary the parent will recognize dividends received from the subsidiary as dividend income. The amendments are effective for annual periods beginning on or after 1 January 2016. A method of accounting for an investment whereby the investment is recognised at cost.

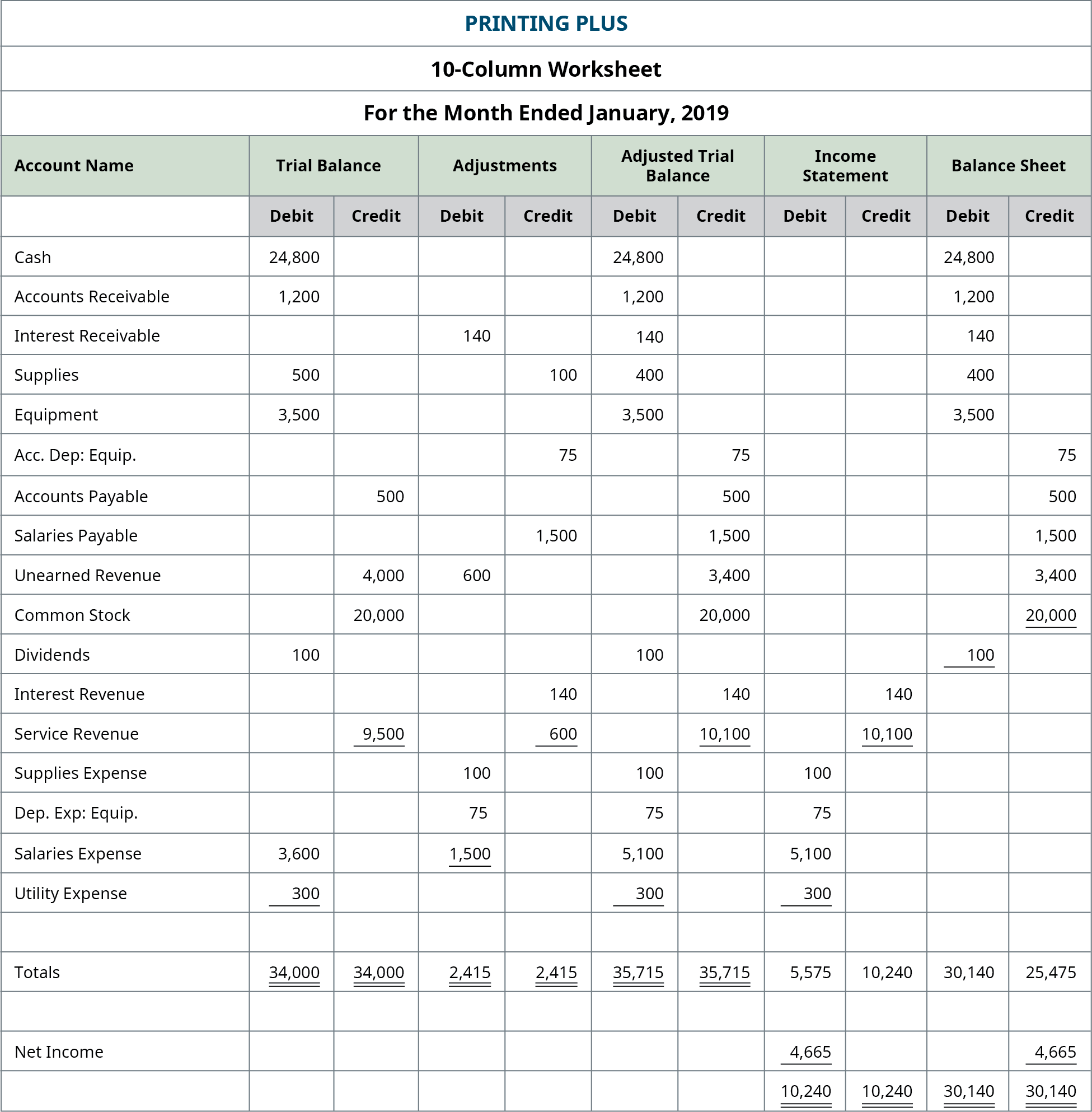

Source: opentextbc.ca

Source: opentextbc.ca

The cost method of accounting assumes that the value of the currency with which the equity investment was purchased remains constant over time. Distributions received in excess of such profits are regarded as a. Start studying Advanced Accounting - Chapter 4 SB. The amendments are effective for annual periods beginning on or after 1 January 2016. The amendments are to be applied retrospectively in accordance with IAS 8 Accounting Policies Changes in Accounting.

Source: pinterest.com

Source: pinterest.com

Firms buy stock in other companies as either an investment or to fulfill a strategic positioning. The amendments are to be applied retrospectively in accordance with IAS 8 Accounting Policies Changes in Accounting. Once the investor records the initial transaction there is no need. Recognize share of subsidiarys income 4. Subsequently Company A.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title cost method of accounting for investment in subsidiary worksheet by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.