Your Do you put social security on a worksheet in accounting images are ready in this website. Do you put social security on a worksheet in accounting are a topic that is being searched for and liked by netizens now. You can Download the Do you put social security on a worksheet in accounting files here. Download all royalty-free photos and vectors.

If you’re looking for do you put social security on a worksheet in accounting images information connected with to the do you put social security on a worksheet in accounting topic, you have visit the right site. Our website frequently provides you with hints for refferencing the highest quality video and picture content, please kindly surf and find more informative video content and graphics that match your interests.

Do You Put Social Security On A Worksheet In Accounting. How do you record a payment for insurance. Dividends and Social Security Benefits. Once you have satisfied a careful investigation and agree to be a representative payee Social Security pays you the benefits to use on the childs behalf. When you need to fill out the Representative Payee Report you can add the amounts in each column of your worksheet and put the totals on the accounting form.

Spreadsheet Sample For A Boutique Business Google Search Spreadsheet Budget Spreadsheet Tax Time From pinterest.com

Spreadsheet Sample For A Boutique Business Google Search Spreadsheet Budget Spreadsheet Tax Time From pinterest.com

First some Social Security benefits are taxable. All told youre looking at about 18000 of annual income – probably not enough to live on. The Social Security Administration is launching a new initiative to provide expedited processing of disability claims filed by veterans who have a US. Whether or not your Social Security income is taxable depends on your total income including your Social Security plus any other income. What is deferred revenue. Do not use Worksheet 1 in this case.

What is deferred revenue.

Contact Social Security before you spend the money. Social Security number format. Depending on how much you make the government taxes 0 15 or 85 of your social security benefits. What is deferred revenue. When you need additional worksheet space you can call Social Security for another copy of the worksheet. Dont forget Social Security benefits may be taxable.

Source: pinterest.com

Source: pinterest.com

As the payee you will have to manage these benefits. As shown in Figure 3 press Ctrl-1 to display the Format Cells dialog box. Contact Social Security before you spend the money. AccountingWEB is a community site full of useful insights and trend highlights to help tax and accounting professionals improve their practices and better serve their clients. Once you determine the amount of foreign pension that is taxable there are two places you can enter the pension amount.

Source: pinterest.com

Source: pinterest.com

You can begin receiving Social Security benefits as early as age 62 or as late as age 70. The Social Security Administration is launching a new initiative to provide expedited processing of disability claims filed by veterans who have a US. Do not use Worksheet 1 in this case. Taxpayers receiving Social Security benefits may have to pay federal income tax on a portion of those benefits. Once you have satisfied a careful investigation and agree to be a representative payee Social Security pays you the benefits to use on the childs behalf.

Source: pinterest.com

Source: pinterest.com

Depending on how much you make the government taxes 0 15 or 85 of your social security benefits. Your benefits increase every year you delay claiming them up to age 70. Dont forget Social Security benefits may be taxable. Taxpayers receiving Social Security benefits may have to pay federal income tax on a portion of those benefits. Social Security number format.

Source: id.pinterest.com

Source: id.pinterest.com

Your Social Security benefits will be. Whether or not your Social Security income is taxable depends on your total income including your Social Security plus any other income. AccountingWEB is a community site full of useful insights and trend highlights to help tax and accounting professionals improve their practices and better serve their clients. How do I get the full social security number to show on the information worksheet. All told youre looking at about 18000 of annual income – probably not enough to live on.

Source: pinterest.com

Source: pinterest.com

Social Security can affect your taxes in a couple of different ways. First some Social Security benefits are taxable. Your benefits increase every year you delay claiming them up to age 70. Depending on how much you make the government taxes 0 15 or 85 of your social security benefits. Second Social Security income can bump you into a higher marginal tax bracket that translates to a higher tax liability on.

Source: pinterest.com

Source: pinterest.com

Say youre entitled to a Social Security benefit that mimics what the average senior collects today. How do I record a loan payment which includes paying both. The amount you receive each month depends upon your earnings and your age when you first claim payments. 05-10565 July 2017. If you receive more than one form a negative figure in box 5 of one form is used to offset a positive figure in box 5 of another form for that same year.

Source: pinterest.com

Source: pinterest.com

Whether or not your Social Security income is taxable depends on your total income including your Social Security plus any other income. Department of Veterans Affairs Compensation rating of 100 Permanent Total PT. As shown in Figure 3 press Ctrl-1 to display the Format Cells dialog box. They dont include supplemental security income payments which arent taxable. Options Mark Topic as New Mark Topic as Read Float this Topic for Current User Bookmark Subscribe Printer Friendly Page mappp Level 4 12-06.

Source: pinterest.com

Source: pinterest.com

You can begin receiving Social Security benefits as early as age 62 or as late as age 70. According to Social Securitygov a relative friend or other party will be appointed to take on the role of representative payee. What you should have been doing is treating yourselves as employees of the LLCS-Corp paying wages and withholding social security and medicare tax and then reporting that on a W-2. Social Security number format. A special note about SSI beneficiaries To continue receiving SSI a beneficiary must not have resources worth more than 2000 3000 for couples.

Source: pinterest.com

Source: pinterest.com

As shown in Figure 3 press Ctrl-1 to display the Format Cells dialog box. How do you record a payment for insurance. They dont include supplemental security income payments which arent taxable. Once you have satisfied a careful investigation and agree to be a representative payee Social Security pays you the benefits to use on the childs behalf. When do you put parentheses around a number.

Source: pinterest.com

Source: pinterest.com

All told youre looking at about 18000 of annual income – probably not enough to live on. Your benefits increase every year you delay claiming them up to age 70. Join your peers and be in the know. If you earn 10000 you. What you should have been doing is treating yourselves as employees of the LLCS-Corp paying wages and withholding social security and medicare tax and then reporting that on a W-2.

Source: pinterest.com

Source: pinterest.com

05-10565 July 2017. Say youre entitled to a Social Security benefit that mimics what the average senior collects today. According to Social Securitygov a relative friend or other party will be appointed to take on the role of representative payee. AccountingWEB is a community site full of useful insights and trend highlights to help tax and accounting professionals improve their practices and better serve their clients. If you receive more than one form a negative figure in box 5 of one form is used to offset a positive figure in box 5 of another form for that same year.

Source: pinterest.com

Source: pinterest.com

What is deferred revenue. Contact Social Security before you spend the money. In a few instances based on treaties the pension benefits can be entered as Social Security benefits. Social Security can affect your taxes in a couple of different ways. Your Social Security benefits will be.

Source: pinterest.com

Source: pinterest.com

If you receive more than one form a negative figure in box 5 of one form is used to offset a positive figure in box 5 of another form for that same year. If you earn 40000 you have earned 22360 above the annual earnings limit so 11180 in benefits would be withheld. Do not use Worksheet 1 in this case. How do I record a loan payment which includes paying both. Choose Special and then double-click on Social Security number.

Source: in.pinterest.com

Source: in.pinterest.com

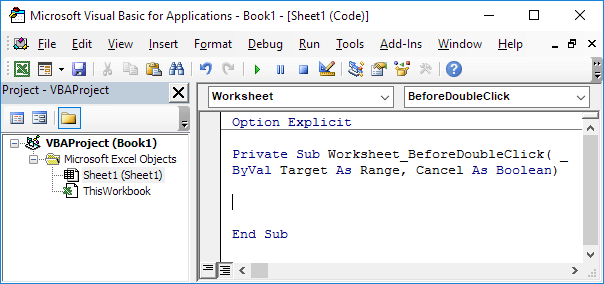

When do you put parentheses around a number. The values in the worksheet cells are numbers but Excel displays them as if they were text with dashes in between the three sets of numbers. Once you have satisfied a careful investigation and agree to be a representative payee Social Security pays you the benefits to use on the childs behalf. AccountingWEB is a community site full of useful insights and trend highlights to help tax and accounting professionals improve their practices and better serve their clients. Department of Veterans Affairs Compensation rating of 100 Permanent Total PT.

Source: pinterest.com

Source: pinterest.com

We dont count all for an. Second Social Security income can bump you into a higher marginal tax bracket that translates to a higher tax liability on. Social Security number format. Calculating Taxes on Social Security Benefits Uncle Sam can tax up to 85 of your Social Security benefits if you have other sources of income such as earnings from work or. Your benefits increase every year you delay claiming them up to age 70.

Source: pinterest.com

Source: pinterest.com

Options Mark Topic as New Mark Topic as Read Float this Topic for Current User Bookmark Subscribe Printer Friendly Page mappp Level 4 12-06. Choose Special and then double-click on Social Security number. If you earn 10000 you. If you receive more than one form a negative figure in box 5 of one form is used to offset a positive figure in box 5 of another form for that same year. Calculating Taxes on Social Security Benefits Uncle Sam can tax up to 85 of your Social Security benefits if you have other sources of income such as earnings from work or.

Source: freshbooks.com

Source: freshbooks.com

A special note about SSI beneficiaries To continue receiving SSI a beneficiary must not have resources worth more than 2000 3000 for couples. However the most common place to enter foreign pension benefits is on the worksheet FEC Foreign Employer Compensation. How do you record a payment for insurance. The values in the worksheet cells are numbers but Excel displays them as if they were text with dashes in between the three sets of numbers. Once you determine the amount of foreign pension that is taxable there are two places you can enter the pension amount.

Source: freshbooks.com

Source: freshbooks.com

Join your peers and be in the know. Dividends and Social Security Benefits. Whether or not your Social Security income is taxable depends on your total income including your Social Security plus any other income. Join your peers and be in the know. Your benefits increase every year you delay claiming them up to age 70.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title do you put social security on a worksheet in accounting by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.