Your Fiduciary accounting income worksheet images are available in this site. Fiduciary accounting income worksheet are a topic that is being searched for and liked by netizens now. You can Get the Fiduciary accounting income worksheet files here. Get all free photos.

If you’re looking for fiduciary accounting income worksheet pictures information linked to the fiduciary accounting income worksheet interest, you have visit the right blog. Our website frequently gives you suggestions for seeing the highest quality video and picture content, please kindly search and find more informative video content and graphics that fit your interests.

Fiduciary Accounting Income Worksheet. Principal 4 Common law rule. However the trust accounting income can be redefined for On the. Income and principal must be determined for a number of reasons. The course explains the common terminology and complicated income tax rules of estates and trusts fiduciary accounting and an introduction to or refresher on preparing Form 1041.

Free Business Income And Expense Tracker Worksheet Intended For Small Business Expenses Spr Small Business Expenses Business Expense Business Budget Template From pinterest.com

Free Business Income And Expense Tracker Worksheet Intended For Small Business Expenses Spr Small Business Expenses Business Expense Business Budget Template From pinterest.com

Sanger Attorney Sanger Manes Palm Springs CalifSchiff Hardin Chicago Notice ANY TAX ADVICE IN THIS COMMUNICATION IS NOT. 2020 Form NJ-1041 1 2020 New Jersey Income Tax Fiduciary Return What You Need to Know. Taxable Interest x x x Tax Exempt Interest x x US. The course explains the common terminology and complicated income tax rules of estates and trusts fiduciary accounting and an introduction to or refresher on preparing Form 1041. As a trustee you may need to use the Trust Accounting Income TAI formula to calculate the amount of income from the trust that you can distribute to beneficiaries. Enter a 1 in the field Include flow-through K-1 entries.

Accounting income 8 Income for Distribution Purposes First READ THE GOVERNING INSTRUMENT Second be familiar with your states Principal and Income Act Income computed in accordance with the above will be 9.

June 21 2016 Calculating Fiduciary Accounting Income for Trusts Howard L. Lesson 1Fiduciary Accounting and the Allocation of Principal and Income INTRODUCTION The term fiduciary accounting has different meanings depending on the context in which it is used. Fiduciary Accounting 2 Trustee owes a duty to account. The capital gain and principal are usually distributed to the remaining beneficiaries. The trust accounting income includes interests ordinary income and dividends. 2020 Form NJ-1041 1 2020 New Jersey Income Tax Fiduciary Return What You Need to Know.

The course explains the common terminology and complicated income tax rules of estates and trusts fiduciary accounting and an introduction to or refresher on preparing Form 1041. 2 Keep interested parties informed of transactions. 2020 Form NJ-1041 1 2020 New Jersey Income Tax Fiduciary Return What You Need to Know. Accounting income 8 Income for Distribution Purposes First READ THE GOVERNING INSTRUMENT Second be familiar with your states Principal and Income Act Income computed in accordance with the above will be 9. The trust accounting income includes interests ordinary income and dividends.

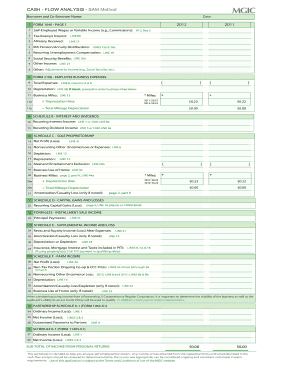

Source: fannie-mae-1037.pdffiller.com

Source: fannie-mae-1037.pdffiller.com

However the trust accounting income can be redefined for On the. IMPORTANT -The fiduciary must account for all funds received on behalf of the beneficiary as VA fiduciary representative payee for SSA benefits or in any other fiduciary capacity. Sanger Attorney Sanger Manes Palm Springs CalifSchiff Hardin Chicago Notice ANY TAX ADVICE IN THIS COMMUNICATION IS NOT. Enter a 1 in the field Include flow-through K-1 entries. However the trust accounting income can be redefined for On the.

Source: pinterest.com

Source: pinterest.com

The Fiduciary Accounting Answer Book is the most detailed reference book on the market for information on how to allocate receipts and disbursements between the income and principal beneficiaries of a trust or. Before preparing Form 1041 the fiduciary must figure the accounting income of the estate or trust under the will or trust instrument and applicable local law to determine the amount if any of income. The capital gain and principal are usually distributed to the remaining beneficiaries. Fiduciary Accounting 2 Trustee owes a duty to account. Lesson 1Fiduciary Accounting and the Allocation of Principal and Income INTRODUCTION The term fiduciary accounting has different meanings depending on the context in which it is used.

Source: pinterest.com

Source: pinterest.com

Sanger Attorney Sanger Manes Palm Springs CalifSchiff Hardin Chicago Notice ANY TAX ADVICE IN THIS COMMUNICATION IS NOT. 2 Keep interested parties informed of transactions. Accounting income 8 Income for Distribution Purposes First READ THE GOVERNING INSTRUMENT Second be familiar with your states Principal and Income Act Income computed in accordance with the above will be 9. Description Portfolio 5202 Accounting for Trusts and Estates explains how to account for income and principal of an estate or trust. The course explains the common terminology and complicated income tax rules of estates and trusts fiduciary accounting and an introduction to or refresher on preparing Form 1041.

Source: signnow.com

Source: signnow.com

Sanger Attorney Sanger Manes Palm Springs CalifSchiff Hardin Chicago Notice ANY TAX ADVICE IN THIS COMMUNICATION IS NOT. Enter a 1 in the field Include flow-through K-1 entries. IMPORTANT -The fiduciary must account for all funds received on behalf of the beneficiary as VA fiduciary representative payee for SSA benefits or in any other fiduciary capacity. June 21 2016 Calculating Fiduciary Accounting Income for Trusts Howard L. Sanger Attorney Sanger Manes Palm Springs CalifSchiff Hardin Chicago Notice ANY TAX ADVICE IN THIS COMMUNICATION IS NOT.

Source: pinterest.com

Source: pinterest.com

However the trust accounting income can be redefined for On the. Accounting income 8 Income for Distribution Purposes First READ THE GOVERNING INSTRUMENT Second be familiar with your states Principal and Income Act Income computed in accordance with the above will be 9. The course explains the common terminology and complicated income tax rules of estates and trusts fiduciary accounting and an introduction to or refresher on preparing Form 1041. Go to Screen 5 Accounting Income. Before preparing Form 1041 the fiduciary must figure the accounting income of the estate or trust under the will or trust instrument and applicable local law to determine the amount if any of income.

Source: pinterest.com

Source: pinterest.com

The fiduciary must keep receipts and other documentation of expenses because VA may need to examine them during the audit of this accounting. The most commonly used definition of. Lesson 1Fiduciary Accounting and the Allocation of Principal and Income INTRODUCTION The term fiduciary accounting has different meanings depending on the context in which it is used. Receipts and disbursements. In some cases you will need to use the Trust Accounting Income formula to prepare Form 1041 the US.

Source: pinterest.com

Source: pinterest.com

The most commonly used definition of. Before preparing Form 1041 the fiduciary must figure the accounting income of the estate or trust under the will or trust instrument and applicable local law to determine the amount if any of income. Do not staple paper clip tape or use any other fastening device. In some cases you will need to use the Trust Accounting Income formula to prepare Form 1041 the US. IMPORTANT -The fiduciary must account for all funds received on behalf of the beneficiary as VA fiduciary representative payee for SSA benefits or in any other fiduciary capacity.

Source: pinterest.com

Source: pinterest.com

To include net income from K-1s for one client file. 1yes 2no located in the Accounting Income Option Note. Principal 4 Common law rule. Fiduciary Accounting 2 Trustee owes a duty to account. The course explains the common terminology and complicated income tax rules of estates and trusts fiduciary accounting and an introduction to or refresher on preparing Form 1041.

Source: id.pinterest.com

Source: id.pinterest.com

Accounting income 8 Income for Distribution Purposes First READ THE GOVERNING INSTRUMENT Second be familiar with your states Principal and Income Act Income computed in accordance with the above will be 9. Comparison of Trust Accounting Income Distributable Net Income and Taxable Income Trust Accounting Income Distributable Net Income Taxable Income Income. Lesson 1Fiduciary Accounting and the Allocation of Principal and Income INTRODUCTION The term fiduciary accounting has different meanings depending on the context in which it is used. The most commonly used definition of. Why choose Fiduciary Accounting ONESOURCE Fiduciary Accounting software from Thomson Reuters handles virtually every transaction youll ever need for trust and estate financial reporting including dividend and capital gain reinvestment exercise of options spin-offs and taxable and nontaxable exchanges.

Source: pinterest.com

Source: pinterest.com

Fiduciary Accounting 2 Trustee owes a duty to account. The capital gain and principal are usually distributed to the remaining beneficiaries. To include net income from K-1s for one client file. Receipts and disbursements. As a trustee you may need to use the Trust Accounting Income TAI formula to calculate the amount of income from the trust that you can distribute to beneficiaries.

Source: pinterest.com

Source: pinterest.com

The course explains the common terminology and complicated income tax rules of estates and trusts fiduciary accounting and an introduction to or refresher on preparing Form 1041. The most commonly used definition of. Before preparing Form 1041 the fiduciary must figure the accounting income of the estate or trust under the will or trust instrument and applicable local law to determine the amount if any of income. The course explains the common terminology and complicated income tax rules of estates and trusts fiduciary accounting and an introduction to or refresher on preparing Form 1041. Enter a 1 in the field Include flow-through K-1 entries.

Source: pinterest.com

Source: pinterest.com

Before preparing Form 1041 the fiduciary must figure the accounting income of the estate or trust under the will or trust instrument and applicable local law to determine the amount if any of income. The capital gain and principal are usually distributed to the remaining beneficiaries. This practical over 300-page manual is an. Why choose Fiduciary Accounting ONESOURCE Fiduciary Accounting software from Thomson Reuters handles virtually every transaction youll ever need for trust and estate financial reporting including dividend and capital gain reinvestment exercise of options spin-offs and taxable and nontaxable exchanges. Accounting income 8 Income for Distribution Purposes First READ THE GOVERNING INSTRUMENT Second be familiar with your states Principal and Income Act Income computed in accordance with the above will be 9.

Source: pinterest.com

Source: pinterest.com

2 Keep interested parties informed of transactions. The capital gain and principal are usually distributed to the remaining beneficiaries. The most commonly used definition of. Use only blue or black ink when completing your forms. Receipts and disbursements.

Source: pinterest.com

Source: pinterest.com

1yes 2no located in the Accounting Income Option Note. Fiduciary Accounting 2 Trustee owes a duty to account. Description Portfolio 5202 Accounting for Trusts and Estates explains how to account for income and principal of an estate or trust. The Fiduciary Accounting Answer Book is the most detailed reference book on the market for information on how to allocate receipts and disbursements between the income and principal beneficiaries of a trust or. This practical over 300-page manual is an.

Source: pinterest.com

Source: pinterest.com

Comparison of Trust Accounting Income Distributable Net Income and Taxable Income Trust Accounting Income Distributable Net Income Taxable Income Income. Go to Screen 5 Accounting Income. Enter a 1 in the field Include flow-through K-1 entries. Open the Fiduciary return. The fiduciary must keep receipts and other documentation of expenses because VA may need to examine them during the audit of this accounting.

Source: proconnect.intuit.com

Source: proconnect.intuit.com

Lesson 1Fiduciary Accounting and the Allocation of Principal and Income INTRODUCTION The term fiduciary accounting has different meanings depending on the context in which it is used. Fiduciary Accounting 2 Trustee owes a duty to account. However the trust accounting income can be redefined for On the. Do not staple paper clip tape or use any other fastening device. The course explains the common terminology and complicated income tax rules of estates and trusts fiduciary accounting and an introduction to or refresher on preparing Form 1041.

Before preparing Form 1041 the fiduciary must figure the accounting income of the estate or trust under the will or trust instrument and applicable local law to determine the amount if any of income. Income and principal must be determined for a number of reasons. 1 Maintain trust records. 2 Keep interested parties informed of transactions. As a trustee you may need to use the Trust Accounting Income TAI formula to calculate the amount of income from the trust that you can distribute to beneficiaries.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title fiduciary accounting income worksheet by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.