Your Governmental accounting taxes billed collected recorded worksheet images are ready. Governmental accounting taxes billed collected recorded worksheet are a topic that is being searched for and liked by netizens today. You can Get the Governmental accounting taxes billed collected recorded worksheet files here. Get all royalty-free photos and vectors.

If you’re looking for governmental accounting taxes billed collected recorded worksheet images information related to the governmental accounting taxes billed collected recorded worksheet topic, you have pay a visit to the right site. Our site always provides you with suggestions for downloading the highest quality video and image content, please kindly search and locate more informative video content and images that match your interests.

Governmental Accounting Taxes Billed Collected Recorded Worksheet. This amount was recorded as a liability. Commercial revenue may also be referred to as sales or as turnover. To record transactions accounting system uses double-entry accounting. Government Accounting Accounting is an important function of any business.

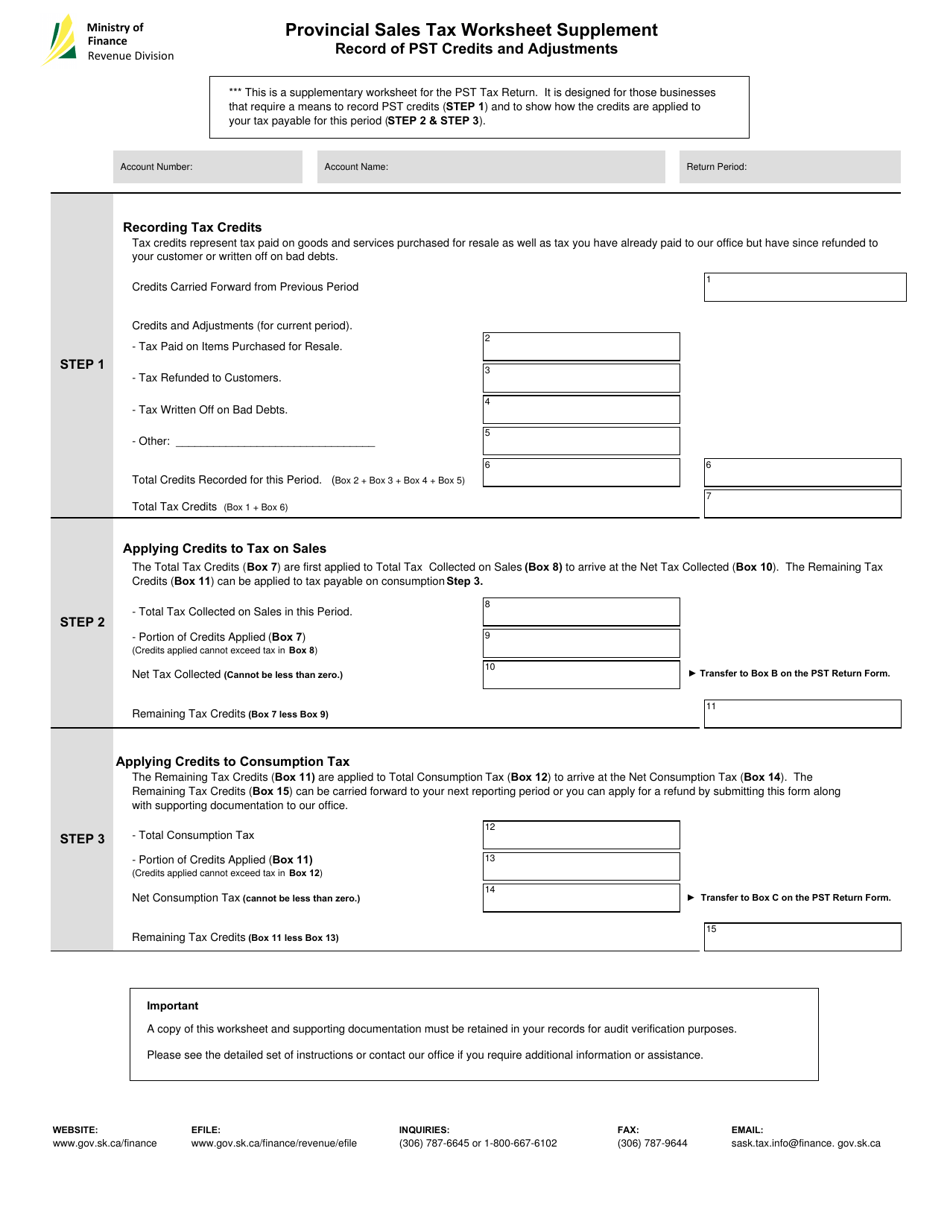

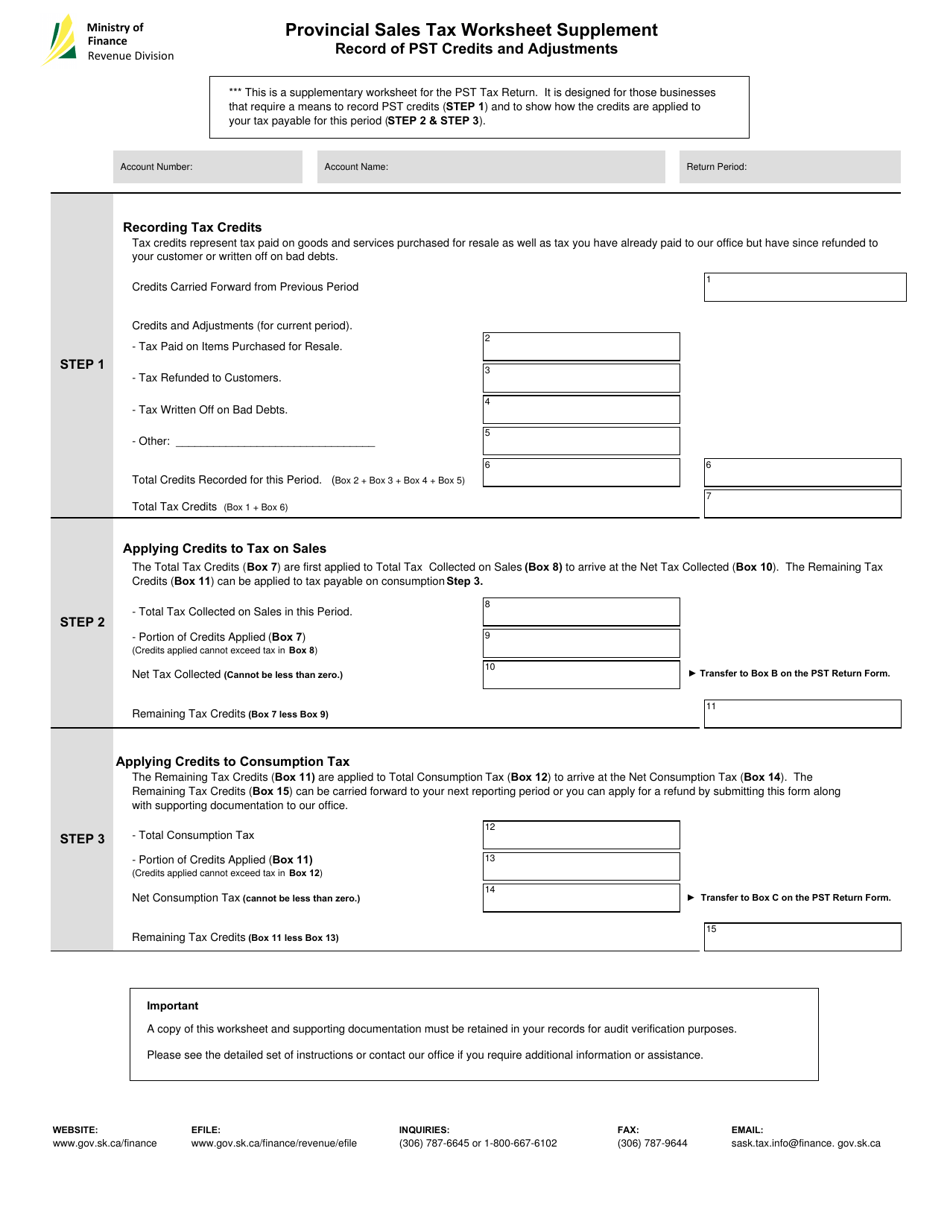

Saskatchewan Canada Provincial Sales Tax Worksheet Supplement Download Printable Pdf Templateroller From templateroller.com

Saskatchewan Canada Provincial Sales Tax Worksheet Supplement Download Printable Pdf Templateroller From templateroller.com

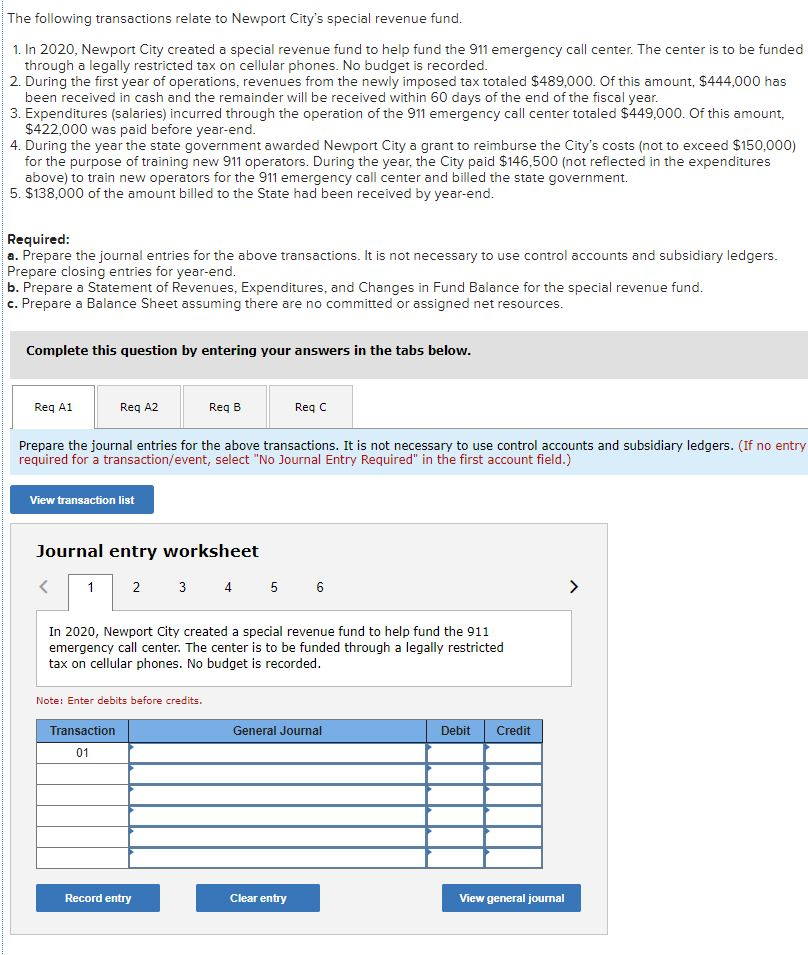

5-a-8 During the year sales taxes were collected in the. Start studying Chapter 5 - Revenue Accounting Governmental Funds. Without that knowledge its. Learn faster with spaced repetition. Record the liability for the final billing in both the Street Improvement Fund and governmental activities journals. Government Accounting Accounting is an important function of any business.

Reported as deferred revenues a deferred inflow.

The County Road Bridge fund is funded by gas taxes whose use. To encourage development the. This entry records the gross wages earned by employees as well as all withholdings from their pay and any additional taxes owed to the government by the company. Unearned revenue and the receivable are then reduced as tax revenues are received each month. Estimated revenues will be 1000000 and appropriations will be 800000. Mercer County Community College - MCCC - West Windsor NJ.

Source: slideshare.net

Source: slideshare.net

To record transactions accounting system uses double-entry accounting. The City Council of Simpson City voted to establish an internal service fund to account for the citys printing services. Start studying Chapter 5 - Revenue Accounting Governmental Funds. An example of a sales discount is for the buyer to take a 1 discount in exchange for paying within 10 days of the invoice date rather than the normal 30 days also noted on an invoice as 1 10 Net 30 terms. To record transactions accounting system uses double-entry accounting.

Source: elibrary.imf.org

Source: elibrary.imf.org

A sales discount may be offered when the seller is short of cash or if it wants to reduce the recorded amount of its receivables outstanding for other reasons. To record transactions accounting system uses double-entry accounting. Debit refers to the left-hand side and credit refers to the right-hand side of the journal entry or account. Learn vocabulary terms and more with flashcards games and other study tools. Expenditures represent the use or expected use of current financial resources.

Source: chegg.com

Source: chegg.com

To encourage development the. Estimated revenues will be 1000000 and appropriations will be 800000. You have just risen from a three month cryogenic sleep during which you traveled from Earth to Europa the only inhabited moon of Jupiter. Learn faster with spaced repetition. 4-a-4Of the 387201 in delinquent property taxes collected in transaction 4-a-3 85549 had been recorded in the Deferred Inflows of Resources account.

Source: pinterest.com

Source: pinterest.com

This Statement establishes accounting and financial reporting standards for nonexchange transactions involving financial or capital resources for example most taxes grants and private donations. Knowing when and where your money is coming and going is crucial. This entry records the gross wages earned by employees as well as all withholdings from their pay and any additional taxes owed to the government by the company. You have just risen from a three month cryogenic sleep during which you traveled from Earth to Europa the only inhabited moon of Jupiter. The County Road Bridge fund is funded by gas taxes whose use.

Source: pinterest.com

Source: pinterest.com

A sales discount may be offered when the seller is short of cash or if it wants to reduce the recorded amount of its receivables outstanding for other reasons. Start studying Chapter 5 - Revenue Accounting Governmental Funds. Accrual Transactions are recorded in the period in which ¾Revenues are earned title passes services are rendered etc ¾Expenses are incurred goods received services received etc It does not matter. In a nonexchange transaction a government gives or receives value without directly receiving or giving equal value in return. 4-a-4Of the 387201 in delinquent property taxes collected in transaction 4-a-3 85549 had been recorded in the Deferred Inflows of Resources account.

Source: solveaccounting.blogspot.com

Source: solveaccounting.blogspot.com

The City Council of Simpson City voted to establish an internal service fund to account for the citys printing services. Europa has been colonized since the early 2060s. Wakefield Village levies 6255000 in property taxes at the beginning of its fiscal year. There may be an accrued wages entry that is recorded at the end of each accounting period and which is intended to record the amount of wages owed to employees but not yet paid. Mercer County Community College - MCCC - West Windsor NJ.

Source: investopedia.com

Source: investopedia.com

This entry records the gross wages earned by employees as well as all withholdings from their pay and any additional taxes owed to the government by the company. You have just risen from a three month cryogenic sleep during which you traveled from Earth to Europa the only inhabited moon of Jupiter. This entry records the gross wages earned by employees as well as all withholdings from their pay and any additional taxes owed to the government by the company. The City Council of Simpson City voted to establish an internal service fund to account for the citys printing services. To record transactions accounting system uses double-entry accounting.

Source: yumpu.com

Source: yumpu.com

On June 1 20X4 a school district levies the property taxes for its fiscal year that. Governmental fund revenues are those collected within the year or soon enough thereafter that they can be used to finance current-year expenditures. Learn faster with spaced repetition. 5-a-8 During the year sales taxes were collected in the. 4-a-4Of the 387201 in delinquent property taxes collected in transaction 4-a-3 85549 had been recorded in the Deferred Inflows of Resources account.

Source: templateroller.com

Source: templateroller.com

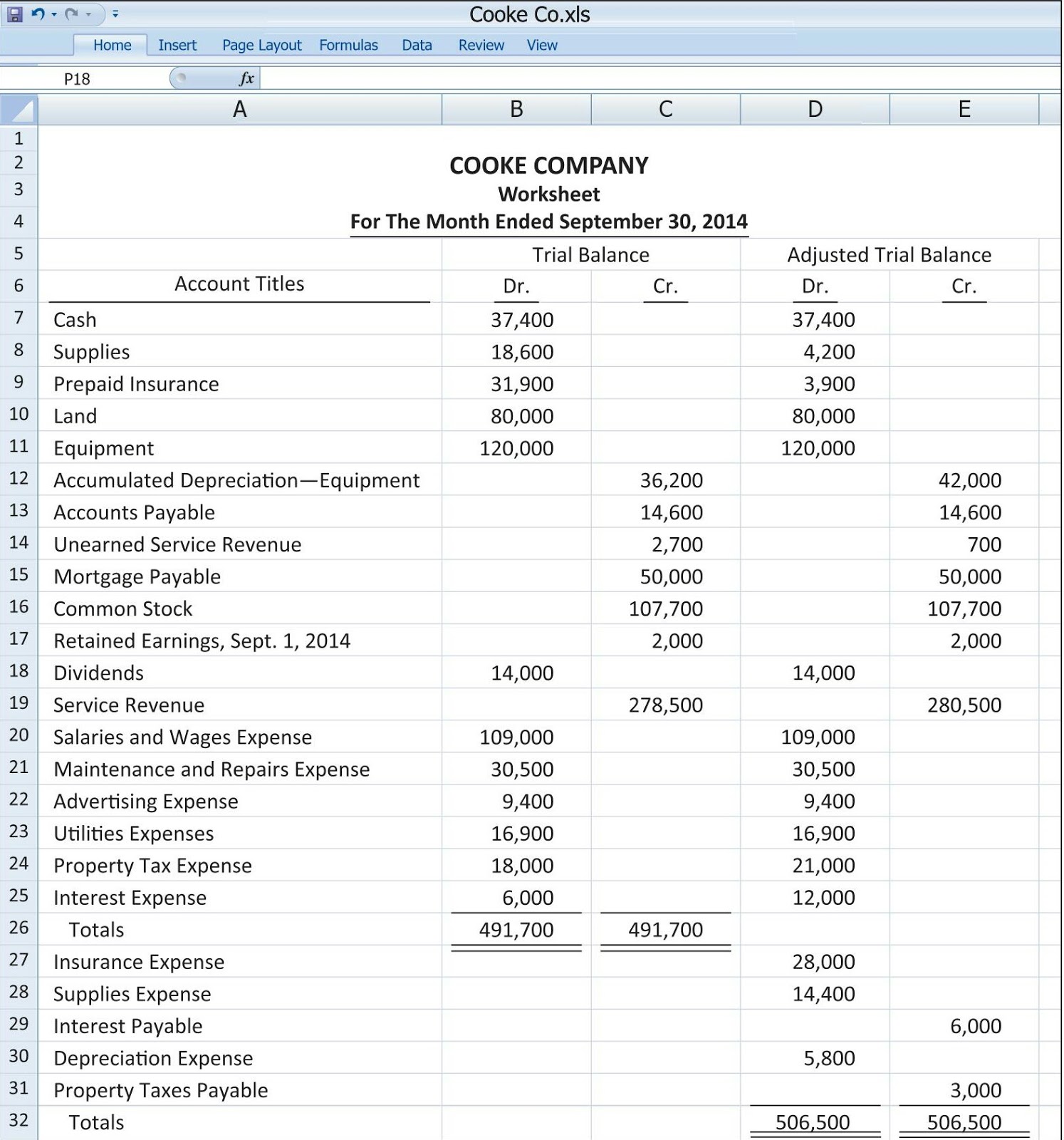

Assume by the end of year 450000 of current taxes have been collected the entry is. A sales discount may be offered when the seller is short of cash or if it wants to reduce the recorded amount of its receivables outstanding for other reasons. Mercer County Community College - MCCC - West Windsor NJ. GOVERNMENTAL ACCOUNTING PRACTICE SET Introduction The date is December 31 2091. We at Accounting Assignments Help provide Final Exam.

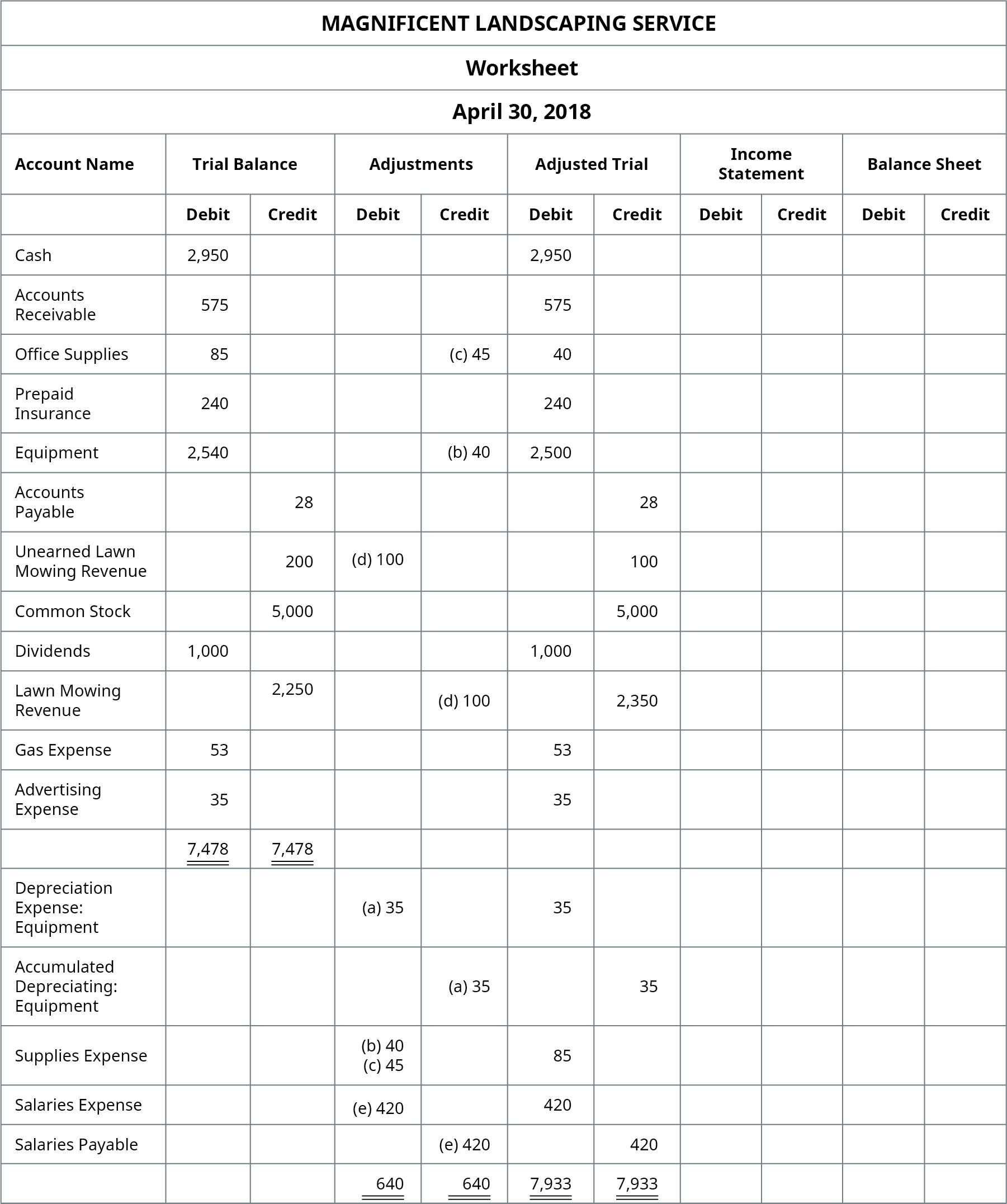

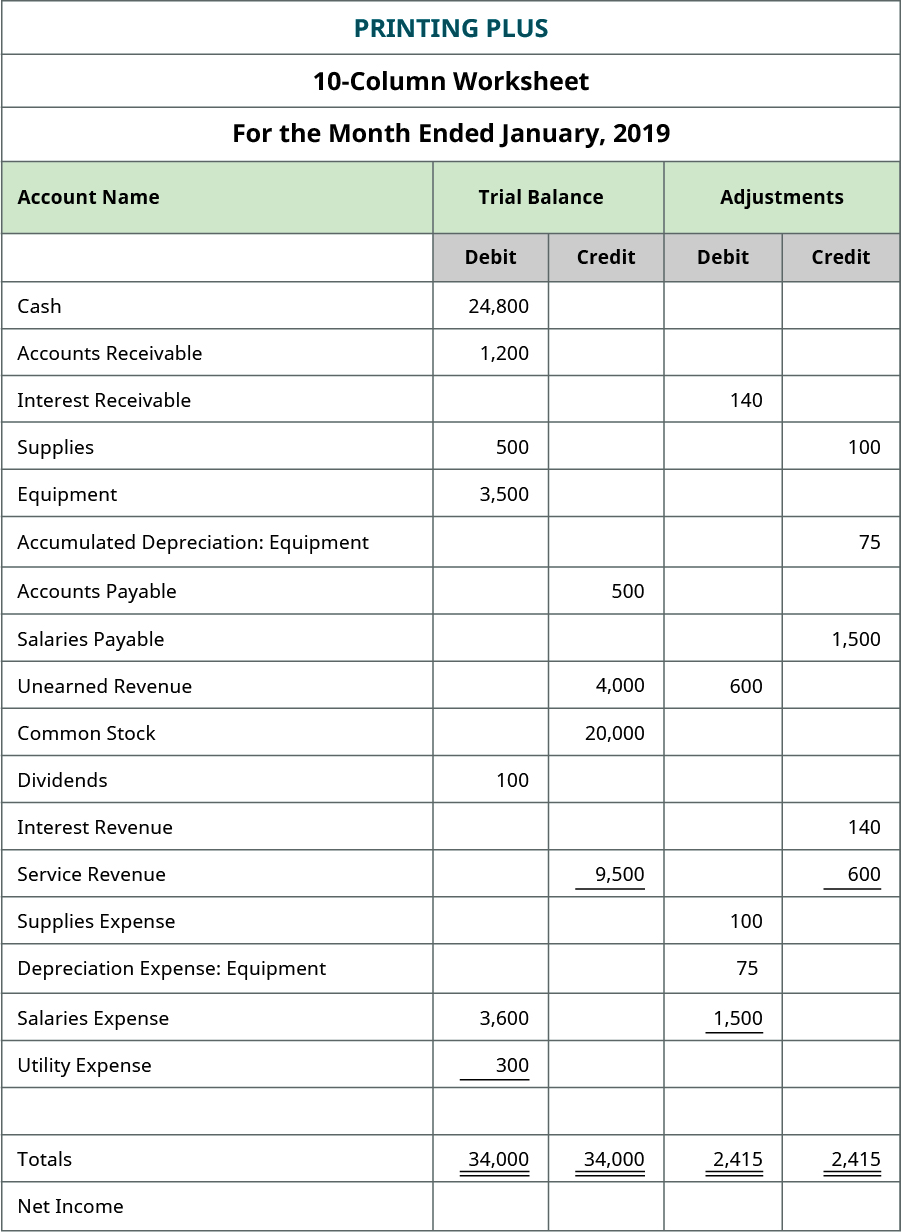

Source: opentextbc.ca

Source: opentextbc.ca

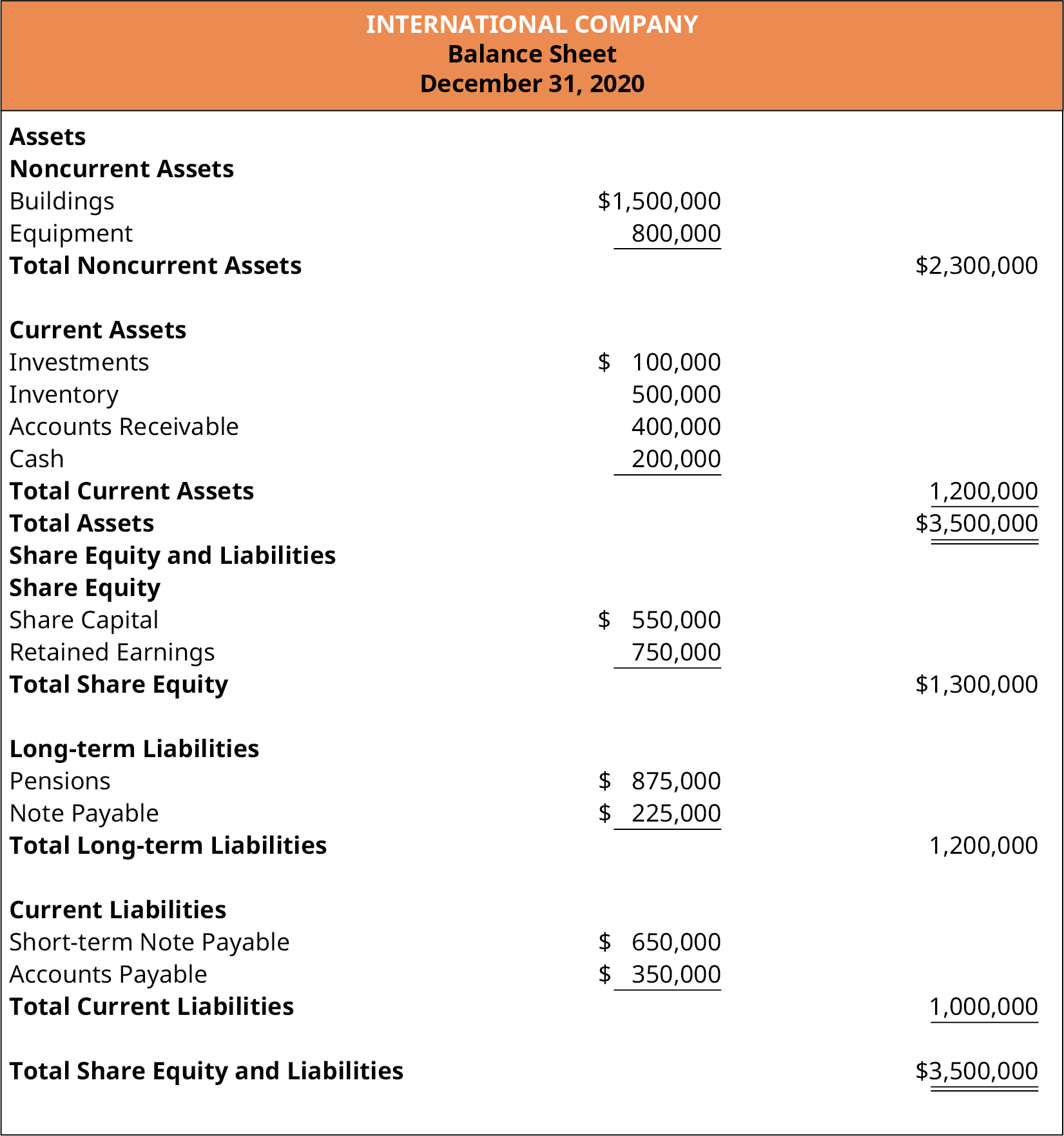

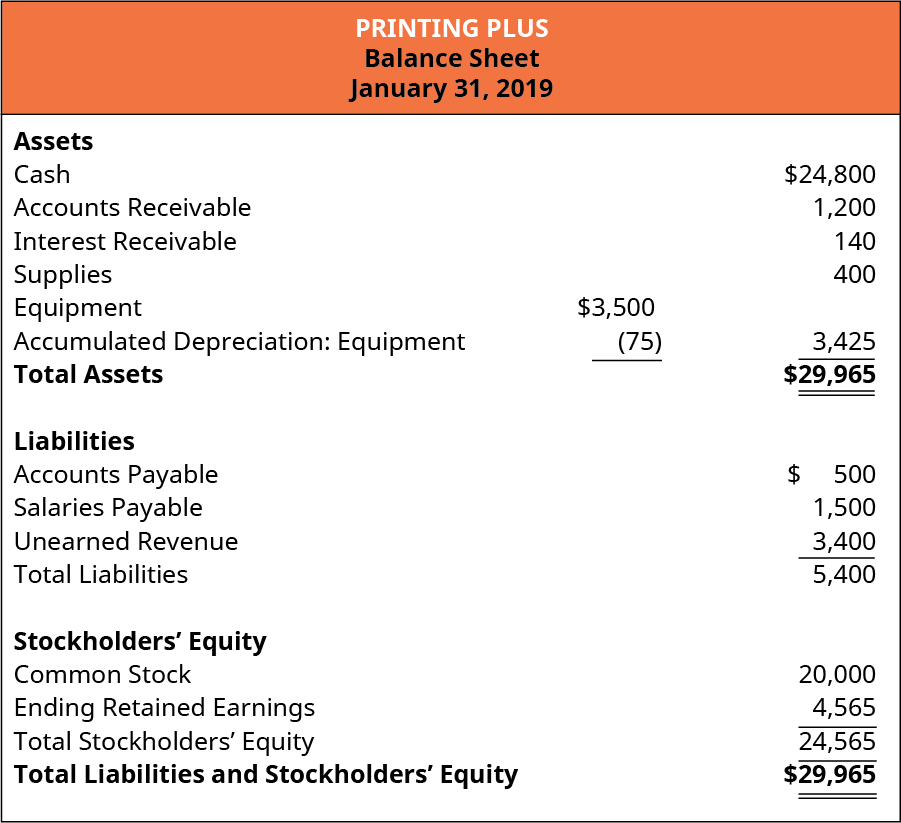

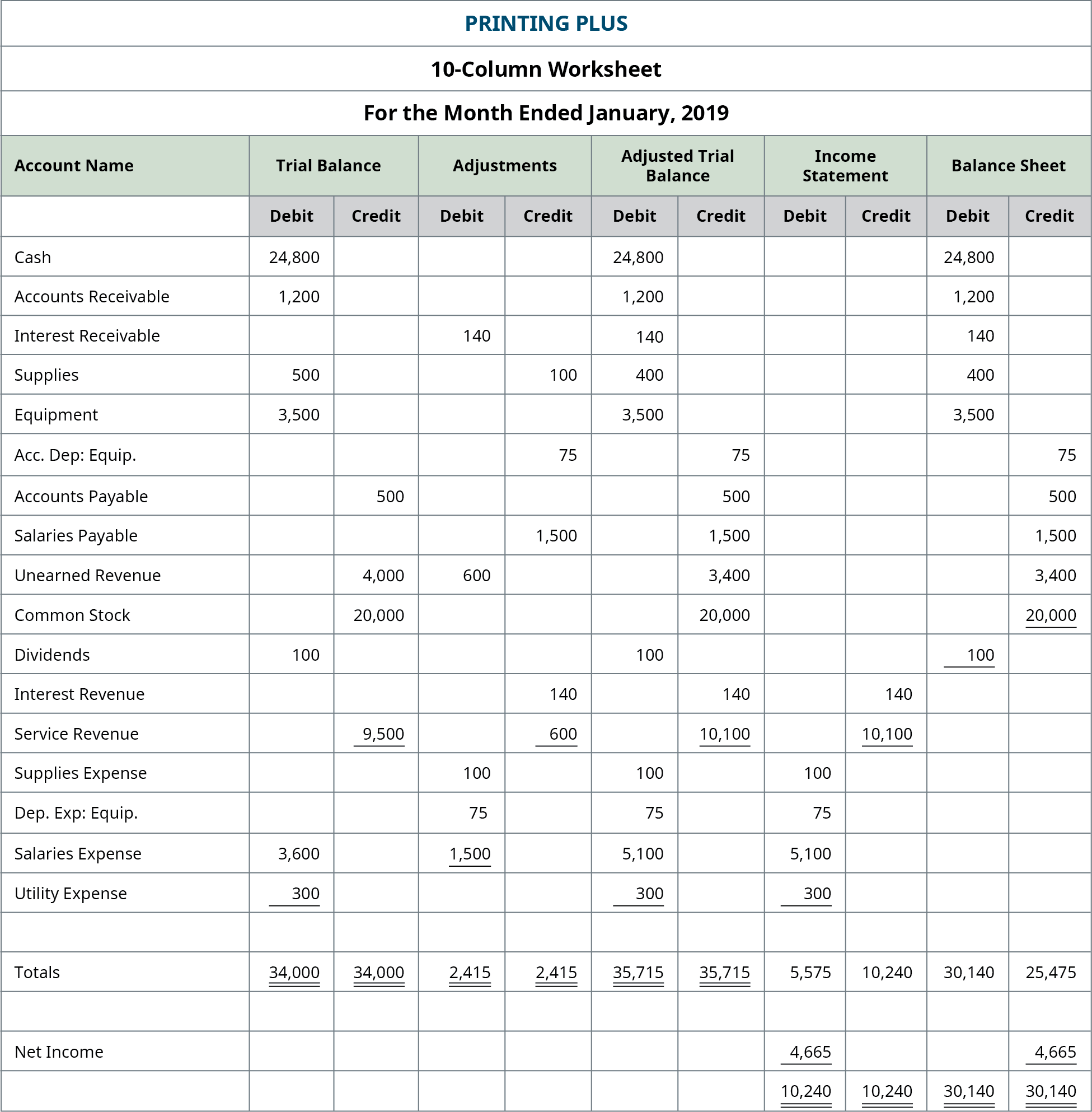

In accounting revenue is the income or increase in net assets1 that an entity has from its normal activities in the case of a business usually from the sale of goods and services to customers. In financial accounting Financial Accounting Theory Financial Accounting Theory explains the why behind accounting - the reasons why transactions are reported in certain ways. Accounting for governmental and nonprofit organizations Help with step by step calculation and explanation 247 from our accounting experts. Governmental Accounting Notes Governmental Unit Journal Entries The budget was adopted by the governmental unit. Learn vocabulary terms and more with flashcards games and other study tools.

Source: opentextbc.ca

Source: opentextbc.ca

In accounting revenue is the income or increase in net assets1 that an entity has from its normal activities in the case of a business usually from the sale of goods and services to customers. Accounting for governmental and nonprofit organizations Help with step by step calculation and explanation 247 from our accounting experts. The City Council of Simpson City voted to establish an internal service fund to account for the citys printing services. Some companies receive revenue from interest royalties or other fees2. Assume by the end of year 450000 of current taxes have been collected the entry is.

Source: chegg.com

Source: chegg.com

An example of a sales discount is for the buyer to take a 1 discount in exchange for paying within 10 days of the invoice date rather than the normal 30 days also noted on an invoice as 1 10 Net 30 terms. Accrual Transactions are recorded in the period in which ¾Revenues are earned title passes services are rendered etc ¾Expenses are incurred goods received services received etc It does not matter. Property taxes billed but not collected by the end of the fiscal period or within 60 days following the end of the fiscal period should be. Cash 450000 Taxes ReceivableCurrent 450000 Accounting. An example of a sales discount is for the buyer to take a 1 discount in exchange for paying within 10 days of the invoice date rather than the normal 30 days also noted on an invoice as 1 10 Net 30 terms.

Source: pinterest.com

Source: pinterest.com

To encourage development the. Cash 450000 Taxes ReceivableCurrent 450000 Accounting. 5-a-8 During the year sales taxes were collected in the. Assume by the end of year 450000 of current taxes have been collected the entry is. Governmental Accounting Notes Governmental Unit Journal Entries The budget was adopted by the governmental unit.

Source: opentextbc.ca

Source: opentextbc.ca

Assume by the end of year 450000 of current taxes have been collected the entry is. In accounting revenue is the income or increase in net assets1 that an entity has from its normal activities in the case of a business usually from the sale of goods and services to customers. This Statement establishes accounting and financial reporting standards for nonexchange transactions involving financial or capital resources for example most taxes grants and private donations. Governmental Accounting Notes Governmental Unit Journal Entries The budget was adopted by the governmental unit. This amount was recorded as a liability.

Source: opentextbc.ca

Source: opentextbc.ca

For governmental funds property taxes are recorded as a receivable when levied and offset by an unearned revenue. Governmental fund revenues are those collected within the year or soon enough thereafter that they can be used to finance current-year expenditures. Additionally 7540 of the interest and penalties collected in 4-a-3. A sales discount may be offered when the seller is short of cash or if it wants to reduce the recorded amount of its receivables outstanding for other reasons. This Statement establishes accounting and financial reporting standards for nonexchange transactions involving financial or capital resources for example most taxes grants and private donations.

Source: opentextbc.ca

Source: opentextbc.ca

Learn vocabulary terms and more with flashcards games and other study tools. Mercer County Community College - MCCC - West Windsor NJ. We at Accounting Assignments Help provide Final Exam. Governmental Accounting Notes Governmental Unit Journal Entries The budget was adopted by the governmental unit. There may be an accrued wages entry that is recorded at the end of each accounting period and which is intended to record the amount of wages owed to employees but not yet paid.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Assume by the end of year 450000 of current taxes have been collected the entry is. An example of a sales discount is for the buyer to take a 1 discount in exchange for paying within 10 days of the invoice date rather than the normal 30 days also noted on an invoice as 1 10 Net 30 terms. Expenditures represent the use or expected use of current financial resources. Double-entry implies that transactions are always recorded using two sides debit and credit. Learn faster with spaced repetition.

Source: investopedia.com

Source: investopedia.com

There may be an accrued wages entry that is recorded at the end of each accounting period and which is intended to record the amount of wages owed to employees but not yet paid. Government Accounting Accounting is an important function of any business. Governmental fund revenues are those collected within the year or soon enough thereafter that they can be used to finance current-year expenditures. Governmental Accounting Notes Governmental Unit Journal Entries The budget was adopted by the governmental unit. To record transactions accounting system uses double-entry accounting.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title governmental accounting taxes billed collected recorded worksheet by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.