Your How are office supplies recorded on a worksheet accounting images are available in this site. How are office supplies recorded on a worksheet accounting are a topic that is being searched for and liked by netizens today. You can Find and Download the How are office supplies recorded on a worksheet accounting files here. Get all free photos.

If you’re searching for how are office supplies recorded on a worksheet accounting pictures information related to the how are office supplies recorded on a worksheet accounting topic, you have come to the ideal blog. Our website always provides you with suggestions for refferencing the highest quality video and picture content, please kindly surf and find more informative video articles and graphics that match your interests.

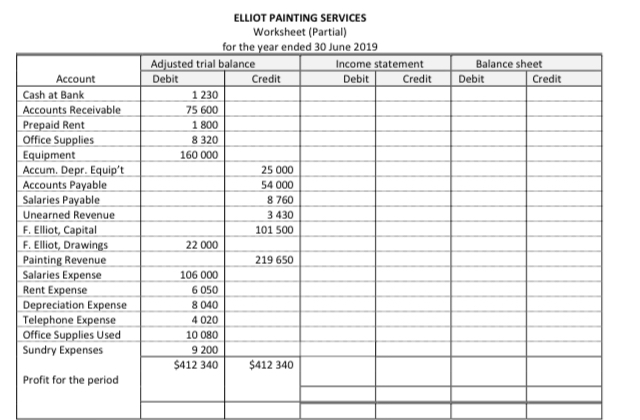

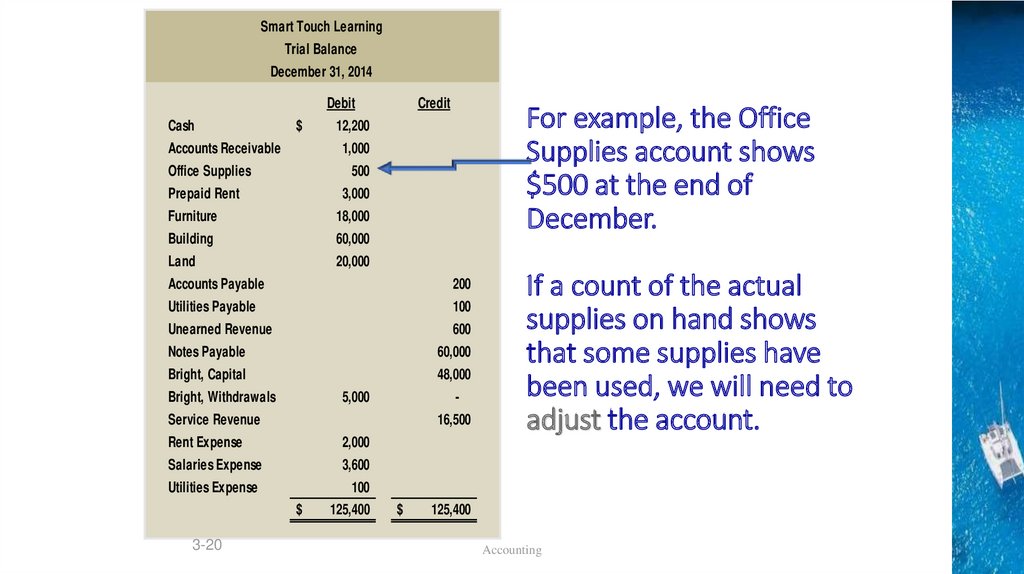

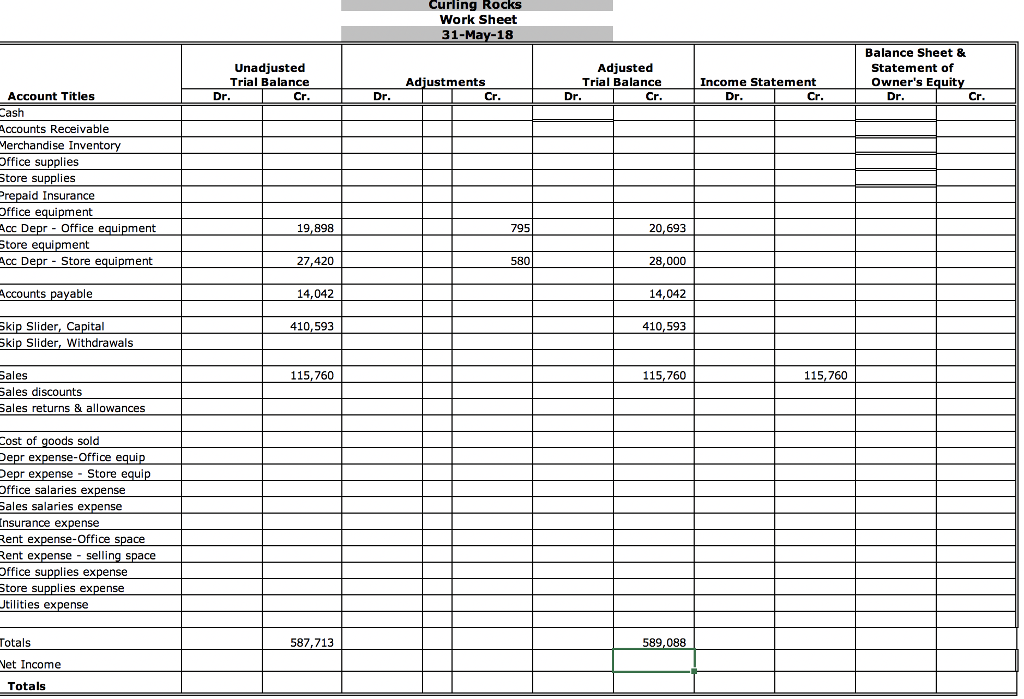

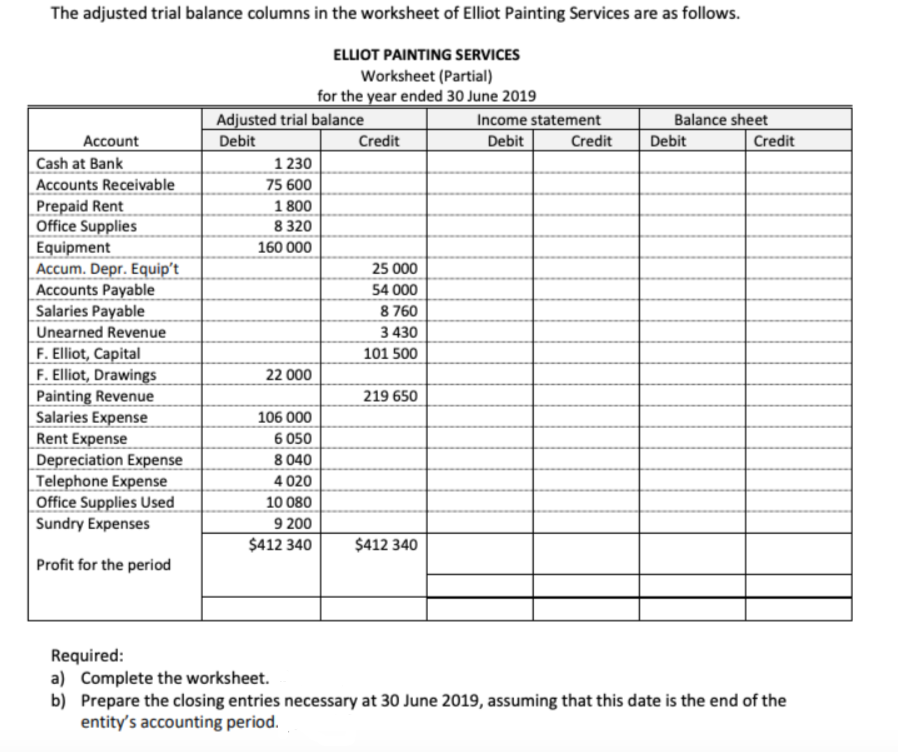

How Are Office Supplies Recorded On A Worksheet Accounting. Only the balances of accounts that are affected by adjustments must be recalculated before they are recorded in the Adjusted Trial Balance section of the worksheet. Q1 The entity paid 12000 for monthly rent. The expense account Supplies Expense is understated. Notice that the adjustment for supplies is based.

Solved 1 Record The Journal Entries For June 2 Post Th Chegg Com From chegg.com

Solved 1 Record The Journal Entries For June 2 Post Th Chegg Com From chegg.com

At the end of February the balance in the supplies account should be 13. Net income is recorded on the worksheet in the Income Statement Debit column and the Balance Sheet Credit column. In general supplies are considered a current asset until. When supplies are purchased the amount will be debited to Supplies. Supplies is overstated because fewer supplies are actually on hand. At the end of the.

We aspire to facilitate students in terms of getting themselves prepared for studies and interviews.

In financial accounting Financial Accounting Theory Financial Accounting Theory explains the why behind accounting - the reasons why transactions are reported in certain ways. 2600 of the supplies was purchased during the year. Supplies are incidental items that are expected to be consumed in the near future. Gray Electronic Repair Services Unadjusted Trial Balance December 31 2020 Account Title Debit Credit Cash 748000 Accounts Receivable 340000 Service Supplies 150000 Furniture and. The final step in solving an ethical dilemma is to 15. In contrast a double entry accounting system consists of a chart of accounts where every financial transaction is recorded into at least two of the accounts once as a debit and once as a credit.

Source: chegg.com

Source: chegg.com

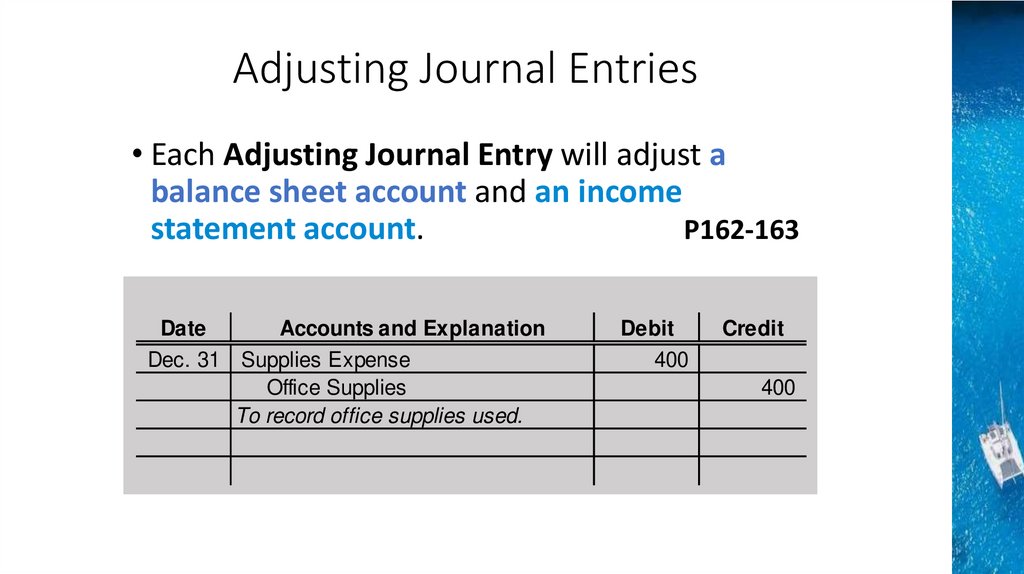

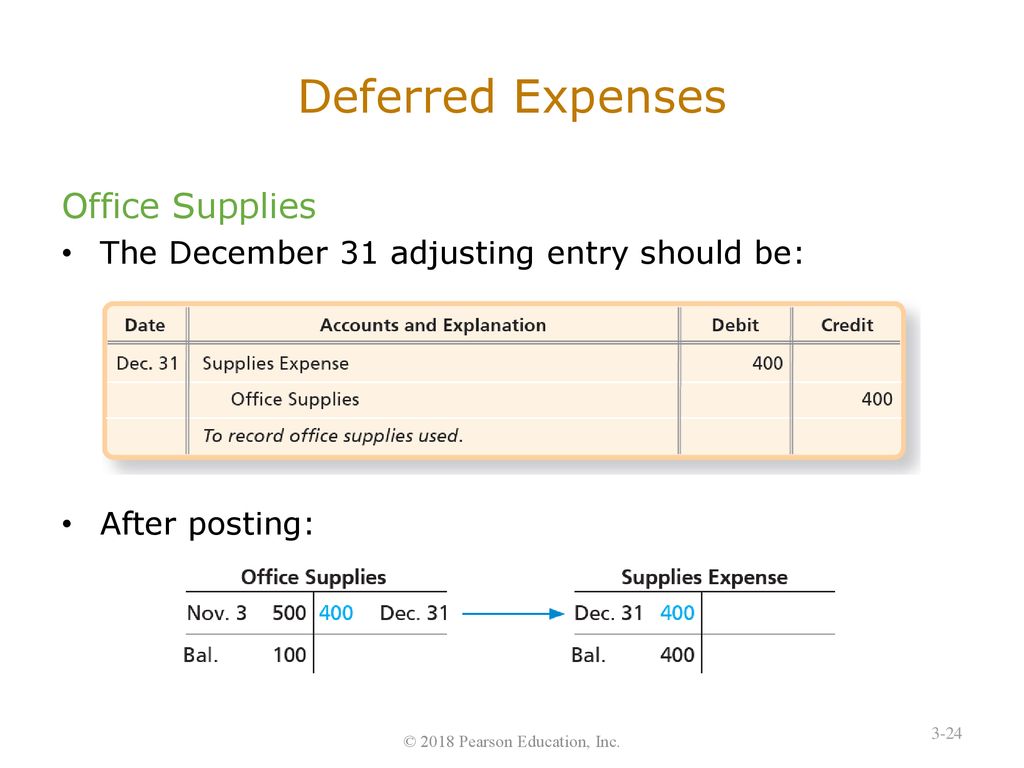

The expense account Supplies Expense is understated. Transactions in a journal are recorded in 14. Notice that the adjustment for supplies is based. 500 of the supplies available. At the end of the accounting period the supplies on hand are counted and the movement recorded as an expense item in the income statement.

Source: bartleby.com

Source: bartleby.com

Gray Electronic Repair Services Unadjusted Trial Balance December 31 2020 Account Title Debit Credit Cash 748000 Accounts Receivable 340000 Service Supplies 150000 Furniture and. Supplies is overstated because fewer supplies are actually on hand. 500 of the supplies available. To facilitate the end-of-month accounting and reporting process you will use a worksheet. The cost of the office supplies used up during the accounting period should be recorded in the income statement account Supplies Expense.

Source: chegg.com

Source: chegg.com

Accounting consists of three basic activities which are. 600 debit balance on January 1 2010. 27 行 Accounting Worksheet An accounting worksheet is large table of data which. At the end of the accounting period the supplies on hand are counted and the movement recorded as an expense item in the income statement. The normal accounting for supplies is to charge them to expense when they are purchased using this entry.

The worksheet is a tool used to. 2600 of the supplies was purchased during the year. In financial accounting Financial Accounting Theory Financial Accounting Theory explains the why behind accounting - the reasons why transactions are reported in certain ways. Journal Entry DebitCredit Rent expense 12000 Cashnbs. The worksheet is a tool used to.

Source: slidetodoc.com

Source: slidetodoc.com

At the end of the accounting period the supplies on hand are counted and the movement recorded as an expense item in the income statement. Net income is recorded on the worksheet in the Income Statement Debit column and the Balance Sheet Credit column. Adjustments and The Worksheet. The final step in solving an ethical dilemma is to 15. 27 行 Accounting Worksheet An accounting worksheet is large table of data which.

Source: clutchprep.com

Source: clutchprep.com

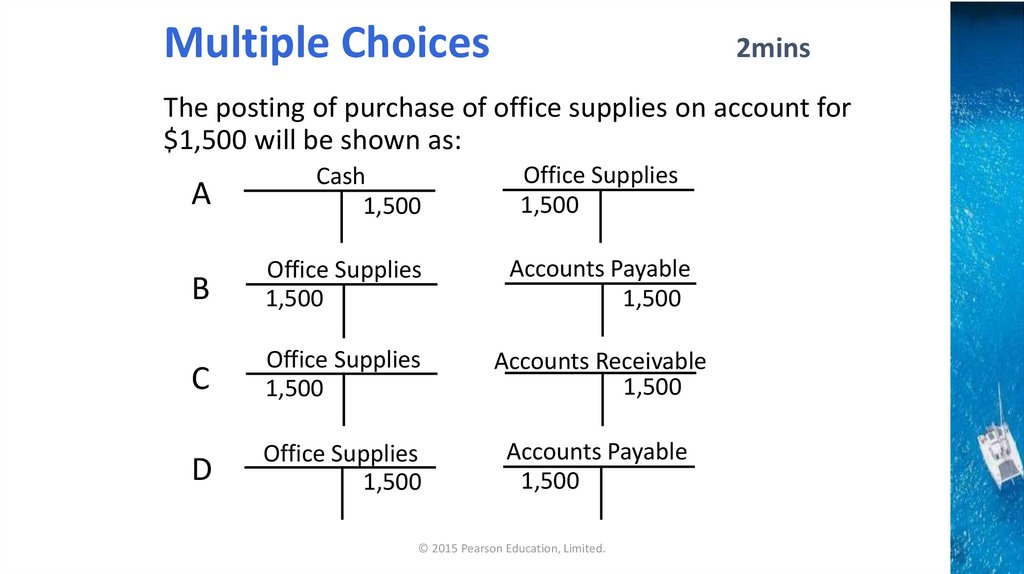

Journal entries are the first step in the accounting cycle and are used to record all business transactions and events in the accounting system. Learn whether office supplies are classified as a current asset or an expense so you can create accurate financial statements for your small business accounting. LEARN BASICS OF ACCOUNTING AT NO COSTOur highly competent professional team is always ready to update Play accounting about latest topics in the field of finance and accounting. Credit supplies- office 2000 In the figure 303 R what is the extension of FITP after adjustments. 600 debit balance on January 1 2010.

Source: double-entry-bookkeeping.com

Source: double-entry-bookkeeping.com

When supplies are purchased the amount will be debited to Supplies. To facilitate the end-of-month accounting and reporting process you will use a worksheet. Notice that the adjustment for supplies is based. Supplies is overstated because fewer supplies are actually on hand. The worksheet is a tool used to.

Source: slideplayer.com

Source: slideplayer.com

Only the balances of accounts that are affected by adjustments must be recalculated before they are recorded in the Adjusted Trial Balance section of the worksheet. Paid Cash for Supplies Journal Entry Example For example suppose a business purchases supplies such as paper towels cleaning products and other consumables for a total amount of 50 and pays for the items with cash. 2600 of the supplies was purchased during the year. Adjustments and The Worksheet. Supplies is overstated because fewer supplies are actually on hand.

The worksheet is a tool used to. The normal accounting for supplies is to charge them to expense when they are purchased using this entry. Journal entries are the first step in the accounting cycle and are used to record all business transactions and events in the accounting system. 500 of the supplies available. This guide will accruals refer to the recording of revenues Sales Revenue Sales revenue is the income received by a company from its sales of goods or the provision of services.

Source: ppt-online.org

Source: ppt-online.org

Paid Cash for Supplies Journal Entry Example For example suppose a business purchases supplies such as paper towels cleaning products and other consumables for a total amount of 50 and pays for the items with cash. At the end of the. Journal Entry DebitCredit Rent expense 12000 Cashnbs. As business events occur throughout the accounting period journal entries are recorded. The cost of the office supplies used up during the accounting period should be recorded in the income statement account Supplies Expense.

Source: double-entry-bookkeeping.com

Source: double-entry-bookkeeping.com

Only the balances of accounts that are affected by adjustments must be recalculated before they are recorded in the Adjusted Trial Balance section of the worksheet. How Are Office Supplies Recorded in Office Accounting. Purchased office supplies costing 17600 on account. Net income is recorded on the worksheet in the Income Statement Debit column and the Balance Sheet Credit column. The simplest type of accounting system involves simply making a list of income and expenses recorded when a cash transaction occursthats called single entry or cash accounting.

Source: double-entry-bookkeeping.com

Source: double-entry-bookkeeping.com

Journal Entry DebitCredit Rent expense 12000 Cashnbs. Credit supplies- office 2000 In the figure 303 R what is the extension of FITP after adjustments. Accounting consists of three basic activities which are. In general supplies are considered a current asset until. How is the adjusting entry to Supplies- office recorded on a multi-column trial balance worksheet In the adjustment column debit supplies expense office 2000.

Source: ppt-online.org

Source: ppt-online.org

Learn whether office supplies are classified as a current asset or an expense so you can create accurate financial statements for your small business accounting. Net income is recorded on the worksheet in the Income Statement Debit column and the Balance Sheet Credit column. The final step in solving an ethical dilemma is to 15. In this case you will complete the accounting cycle Illustration 3-6 page3-8 for one month for a new company. 27 行 Accounting Worksheet An accounting worksheet is large table of data which.

Source: chegg.com

Source: chegg.com

Journal Entry DebitCredit Rent expense 12000 Cashnbs. The simplest type of accounting system involves simply making a list of income and expenses recorded when a cash transaction occursthats called single entry or cash accounting. Financial AccountingAccounting Concepts and Principals Accounting Ratios Cash Book Adjusting. The office supplies account had Rs. Only the balances of accounts that are affected by adjustments must be recalculated before they are recorded in the Adjusted Trial Balance section of the worksheet.

Source: bartleby.com

Source: bartleby.com

Notice that the adjustment for supplies is based. Jan 14 Paid wages. 2600 of the supplies was purchased during the year. Suppose in the above example the beginning supplies on hand were 1200 and the ending supplies on hand were 900 then the supplies expense for the period would be calculated as follows. At the end of February the balance in the supplies account should be 13.

Source: ppt-online.org

Source: ppt-online.org

At the end of the accounting period the supplies on hand are counted and the movement recorded as an expense item in the income statement. Jan 13 Provided services to its customers and received 28500 in cash. Only the balances of accounts that are affected by adjustments must be recalculated before they are recorded in the Adjusted Trial Balance section of the worksheet. The expense account Supplies Expense is understated. Supplies are incidental items that are expected to be consumed in the near future.

Source: slideplayer.com

Source: slideplayer.com

This guide will accruals refer to the recording of revenues Sales Revenue Sales revenue is the income received by a company from its sales of goods or the provision of services. We aspire to facilitate students in terms of getting themselves prepared for studies and interviews. The expense account Supplies Expense is understated. If you own a small business office supplies are among the business expenses you should keep track of. Jan 13 Paid the accounts payable on the office supplies purchased on January 4.

Source: slidetodoc.com

Source: slidetodoc.com

Prepare a journal entry to record this transaction. Jan 13 Paid the accounts payable on the office supplies purchased on January 4. In this case you will complete the accounting cycle Illustration 3-6 page3-8 for one month for a new company. In contrast a double entry accounting system consists of a chart of accounts where every financial transaction is recorded into at least two of the accounts once as a debit and once as a credit. At the end of the.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title how are office supplies recorded on a worksheet accounting by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.