Your How to do a pension worksheet accounting images are available in this site. How to do a pension worksheet accounting are a topic that is being searched for and liked by netizens now. You can Download the How to do a pension worksheet accounting files here. Find and Download all royalty-free vectors.

If you’re looking for how to do a pension worksheet accounting images information related to the how to do a pension worksheet accounting interest, you have come to the right site. Our website frequently provides you with hints for downloading the maximum quality video and picture content, please kindly hunt and find more enlightening video articles and graphics that match your interests.

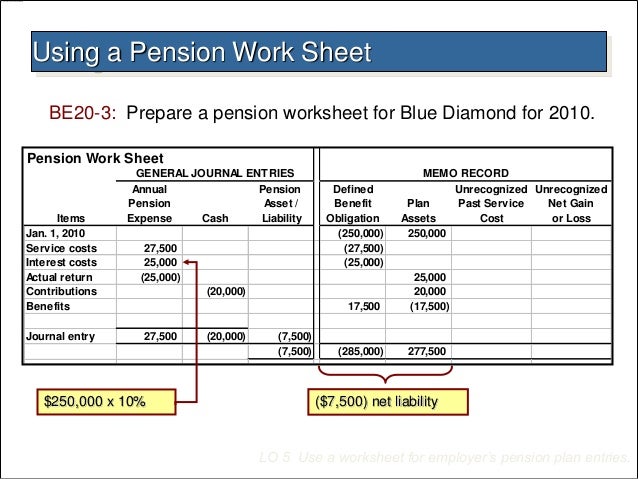

How To Do A Pension Worksheet Accounting. It uses all of the accounts contained in the companys accounting records records adjusting entries and calculates the final numbers to enter on the. Accounting Worksheet An accounting worksheet is large table of data which may be prepared by accountants as an optional intermediate step in an accounting cycle. The best way to learn the concepts is through repetition and working your way through problems. IAS 11 under the IFRS and ASC 715 under the US GAAP offer accounting guidance for pensions.

Ifrs Vs Gaap Accounting Amt Training From amttraining.com

Ifrs Vs Gaap Accounting Amt Training From amttraining.com

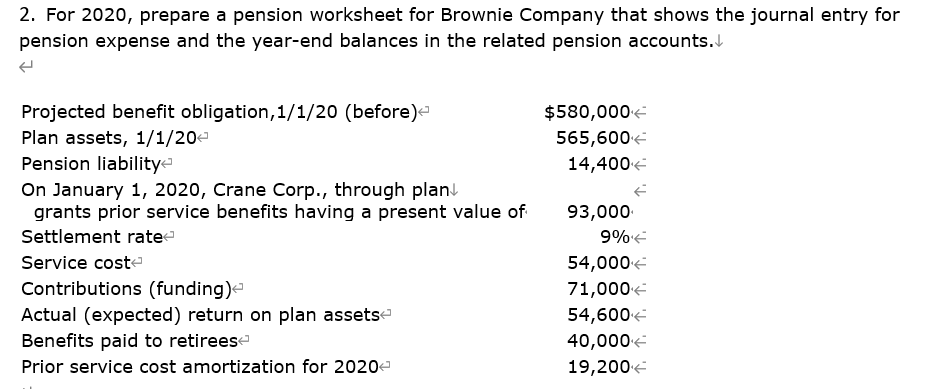

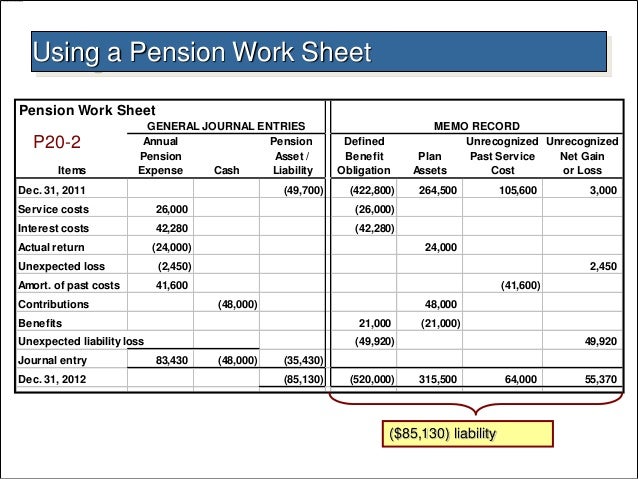

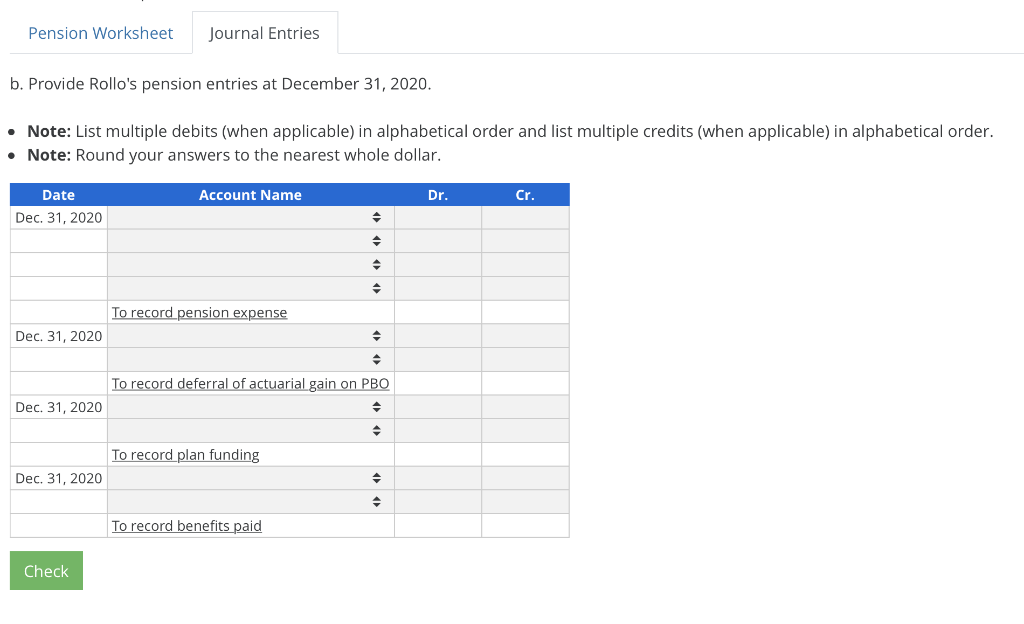

We go through a specific problem from pensions using the workshee to calculate our pension expens and ending balance for our plan assets. If youve got a pension count yourself as one of the lucky ones. The worksheet is a tool for creating a trial balance and an adjusted trial balance. 1The use of a pension entry worksheet is recommended and illustrated by Paul B. IAS 11 under the IFRS and ASC 715 under the US GAAP offer accounting guidance for pensions. This post will help you calculate the value of a pension.

Pensions also known as Defined Benefit plans have.

2 FUNDAMENTALS OF CURRENT PENSION FUNDING AND ACCOUNTING FOR PRIVATE SECTOR PENSION PLANS In general pension plan sponsors are concerned with two primary financial issues. If youve got a pension count yourself as one of the lucky ones. IAS 11 under the IFRS and ASC 715 under the US GAAP offer accounting guidance for pensions. Miller The New Pension Accounting Part 2 Journal of Accountancy February 1987 pp. The best way to learn the concepts is through repetition and working your way through problems. The cash contributions that are made to the pension plan.

Source: amttraining.com

Source: amttraining.com

This video shows how to calculate corridor amortization for pension accounting. A comprehensive example is provided to demonstrate how the corridor is calcu. 2 FUNDAMENTALS OF CURRENT PENSION FUNDING AND ACCOUNTING FOR PRIVATE SECTOR PENSION PLANS In general pension plan sponsors are concerned with two primary financial issues. This post will help you calculate the value of a pension. 34 Liabilities 342 Pensions 34210 Introduction In June 2012 the Governmental Accounting Standards Board GASB issued Statement 68 Accounting and Financial Reporting for PensionsThe GASB also issued Statement 71 Pension Transition for Contributions Made Subsequent to the Measurement Date amends GASB Statement 68.

Source: slideplayer.com

Source: slideplayer.com

With a pension you wont be forced to lower your safe withdrawal rate in retirement like those of use who dont have pensions. If youve got a pension count yourself as one of the lucky ones. The accounting for a defined contribution plan is to charge its contributions to expense as incurred. See what you know about accounting for post-retirement benefit expenses by using the quizworksheet combo. A comprehensive example is provided to demonstrate how the corridor is calcu.

Source: slideshare.net

Source: slideshare.net

When going through the quiz youll need to know about different types of retirement plans. 2 FUNDAMENTALS OF CURRENT PENSION FUNDING AND ACCOUNTING FOR PRIVATE SECTOR PENSION PLANS In general pension plan sponsors are concerned with two primary financial issues. IAS 11 under the IFRS and ASC 715 under the US GAAP offer accounting guidance for pensions. With a pension you wont be forced to lower your safe withdrawal rate in retirement like those of use who dont have pensions. This video shows how to calculate corridor amortization for pension accounting.

Source: youtube.com

Source: youtube.com

The worksheet is a tool for creating a trial balance and an adjusted trial balance. With a pension you wont be forced to lower your safe withdrawal rate in retirement like those of use who dont have pensions. A comprehensive example is provided to demonstrate how the corridor is calcu. 34 Liabilities 342 Pensions 34210 Introduction In June 2012 the Governmental Accounting Standards Board GASB issued Statement 68 Accounting and Financial Reporting for PensionsThe GASB also issued Statement 71 Pension Transition for Contributions Made Subsequent to the Measurement Date amends GASB Statement 68. The accounting for a defined contribution plan is to charge its contributions to expense as incurred.

Source: slideshare.net

Source: slideshare.net

2 FUNDAMENTALS OF CURRENT PENSION FUNDING AND ACCOUNTING FOR PRIVATE SECTOR PENSION PLANS In general pension plan sponsors are concerned with two primary financial issues. 2 FUNDAMENTALS OF CURRENT PENSION FUNDING AND ACCOUNTING FOR PRIVATE SECTOR PENSION PLANS In general pension plan sponsors are concerned with two primary financial issues. This post will help you calculate the value of a pension. 34 Liabilities 342 Pensions 34210 Introduction In June 2012 the Governmental Accounting Standards Board GASB issued Statement 68 Accounting and Financial Reporting for PensionsThe GASB also issued Statement 71 Pension Transition for Contributions Made Subsequent to the Measurement Date amends GASB Statement 68. 1The use of a pension entry worksheet is recommended and illustrated by Paul B.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Miller The New Pension Accounting Part 2 Journal of Accountancy February 1987 pp. If youve got a pension count yourself as one of the lucky ones. This post will help you calculate the value of a pension. About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features. The best way to learn the concepts is through repetition and working your way through problems.

Source: slideplayer.com

Source: slideplayer.com

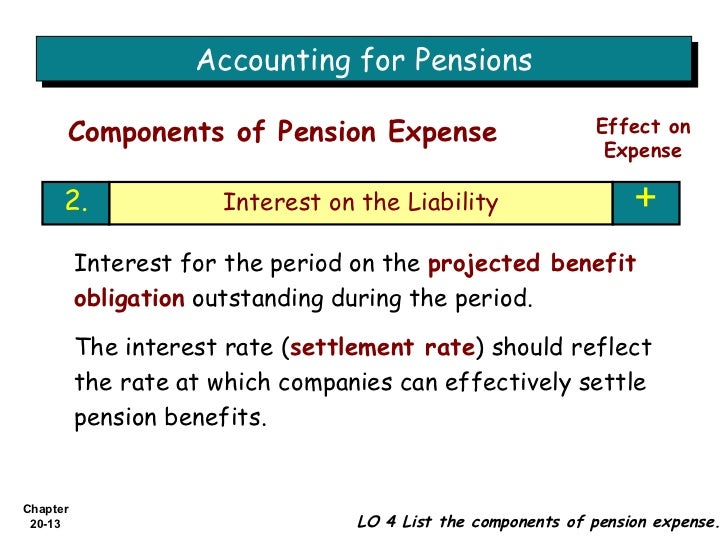

Here is a summary of the relevant costs associated with a defined benefit pension plan which sum to the net periodic pension. This video shows how to calculate corridor amortization for pension accounting. 34 Liabilities 342 Pensions 34210 Introduction In June 2012 the Governmental Accounting Standards Board GASB issued Statement 68 Accounting and Financial Reporting for PensionsThe GASB also issued Statement 71 Pension Transition for Contributions Made Subsequent to the Measurement Date amends GASB Statement 68. Accounting Worksheet An accounting worksheet is large table of data which may be prepared by accountants as an optional intermediate step in an accounting cycle. This post will help you calculate the value of a pension.

Source: chegg.com

Source: chegg.com

Pension accounting can be a bit complicated due to the terminology employed and the deferred recognition of gains and losses. Pensions also known as Defined Benefit plans have. If youve got a pension count yourself as one of the lucky ones. Pension Funding the cash contributions that are made to the pension plan. The cash contributions that are made to the pension plan.

Source: slideshare.net

Source: slideshare.net

Pension accounting can be a bit complicated due to the terminology employed and the deferred recognition of gains and losses. 2 FUNDAMENTALS OF CURRENT PENSION FUNDING AND ACCOUNTING FOR PRIVATE SECTOR PENSION PLANS In general pension plan sponsors are concerned with two primary financial issues. Pensions also known as Defined Benefit plans have. We go through a specific problem from pensions using the workshee to calculate our pension expens and ending balance for our plan assets. With a pension you wont be forced to lower your safe withdrawal rate in retirement like those of use who dont have pensions.

Source: journalofaccountancy.com

Source: journalofaccountancy.com

This post will help you calculate the value of a pension. IAS 11 under the IFRS and ASC 715 under the US GAAP offer accounting guidance for pensions. This video shows how to calculate corridor amortization for pension accounting. Here is a summary of the relevant costs associated with a defined benefit pension plan which sum to the net periodic pension. We go through a specific problem from pensions using the workshee to calculate our pension expens and ending balance for our plan assets.

Source: slideplayer.com

Source: slideplayer.com

IAS 11 under the IFRS and ASC 715 under the US GAAP offer accounting guidance for pensions. It uses all of the accounts contained in the companys accounting records records adjusting entries and calculates the final numbers to enter on the. IAS 11 under the IFRS and ASC 715 under the US GAAP offer accounting guidance for pensions. Pension Funding the cash contributions that are made to the pension plan. Pensions also known as Defined Benefit plans have.

Source: slideshare.net

Source: slideshare.net

Corporations are required to recognize pension expense on the income statement and their pension assetliability which equals the difference between projected benefit obligation and plan assets on the balance sheet. With a pension you wont be forced to lower your safe withdrawal rate in retirement like those of use who dont have pensions. A comprehensive example is provided to demonstrate how the corridor is calcu. 2 FUNDAMENTALS OF CURRENT PENSION FUNDING AND ACCOUNTING FOR PRIVATE SECTOR PENSION PLANS In general pension plan sponsors are concerned with two primary financial issues. Miller The New Pension Accounting Part 2 Journal of Accountancy February 1987 pp.

Source: amttraining.com

Source: amttraining.com

Pension accounting can be a bit complicated due to the terminology employed and the deferred recognition of gains and losses. The accounting for a defined contribution plan is to charge its contributions to expense as incurred. When going through the quiz youll need to know about different types of retirement plans. Miller The New Pension Accounting Part 2 Journal of Accountancy February 1987 pp. Here is a summary of the relevant costs associated with a defined benefit pension plan which sum to the net periodic pension.

Source: slideplayer.com

Source: slideplayer.com

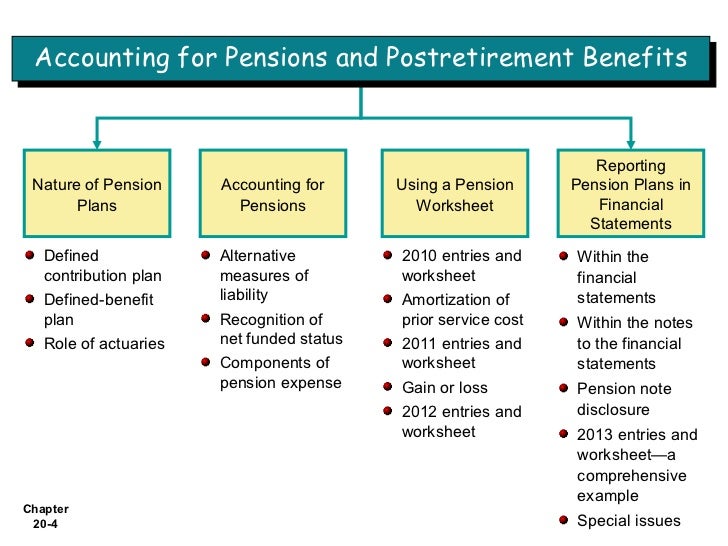

Accounting Worksheet An accounting worksheet is large table of data which may be prepared by accountants as an optional intermediate step in an accounting cycle. 2 FUNDAMENTALS OF CURRENT PENSION FUNDING AND ACCOUNTING FOR PRIVATE SECTOR PENSION PLANS In general pension plan sponsors are concerned with two primary financial issues. It is more valuable than you realize with interest rates plummeting to near all-time lows. Chapter 20 Accounting for Pensions and Postretirement Benefits 201. Here is a summary of the relevant costs associated with a defined benefit pension plan which sum to the net periodic pension.

Source: slideplayer.com

Source: slideplayer.com

IAS 11 under the IFRS and ASC 715 under the US GAAP offer accounting guidance for pensions. Here is a summary of the relevant costs associated with a defined benefit pension plan which sum to the net periodic pension. The main purpose of a worksheet is that it reduces the likelyhood of forgeting an adjustment and it reveals arithmatic errors. Corporations are required to recognize pension expense on the income statement and their pension assetliability which equals the difference between projected benefit obligation and plan assets on the balance sheet. 2 FUNDAMENTALS OF CURRENT PENSION FUNDING AND ACCOUNTING FOR PRIVATE SECTOR PENSION PLANS In general pension plan sponsors are concerned with two primary financial issues.

Source: slideshare.net

Source: slideshare.net

Corporations are required to recognize pension expense on the income statement and their pension assetliability which equals the difference between projected benefit obligation and plan assets on the balance sheet. When going through the quiz youll need to know about different types of retirement plans. About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features. Pension Funding the cash contributions that are made to the pension plan. It uses all of the accounts contained in the companys accounting records records adjusting entries and calculates the final numbers to enter on the.

Source: chegg.com

Source: chegg.com

Corporations are required to recognize pension expense on the income statement and their pension assetliability which equals the difference between projected benefit obligation and plan assets on the balance sheet. 1The use of a pension entry worksheet is recommended and illustrated by Paul B. Pensions also known as Defined Benefit plans have. The accounting for a defined contribution plan is to charge its contributions to expense as incurred. If youve got a pension count yourself as one of the lucky ones.

Source: transtutors.com

Source: transtutors.com

With a pension you wont be forced to lower your safe withdrawal rate in retirement like those of use who dont have pensions. 2 FUNDAMENTALS OF CURRENT PENSION FUNDING AND ACCOUNTING FOR PRIVATE SECTOR PENSION PLANS In general pension plan sponsors are concerned with two primary financial issues. The best way to learn the concepts is through repetition and working your way through problems. Pension Funding the cash contributions that are made to the pension plan. If youve got a pension count yourself as one of the lucky ones.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title how to do a pension worksheet accounting by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.