Your How to fill out accounting worksheet images are ready. How to fill out accounting worksheet are a topic that is being searched for and liked by netizens today. You can Find and Download the How to fill out accounting worksheet files here. Find and Download all free photos and vectors.

If you’re looking for how to fill out accounting worksheet pictures information related to the how to fill out accounting worksheet topic, you have come to the right site. Our site frequently provides you with hints for refferencing the maximum quality video and picture content, please kindly hunt and locate more informative video articles and graphics that fit your interests.

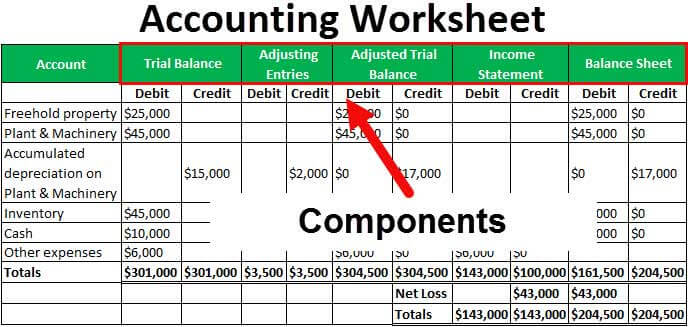

How To Fill Out Accounting Worksheet. Simply enter the amounts in the YELLOW CELLS for each column. Steps of preparing accounting worksheet are explained below. The guidelines below will help you create an e-signature for signing worksheet worksheet accounting blank in Chrome. Finish payroll and create the paycheck in Quickbooks.

Excel Accounting Spreadsheet Templates Making Tax Digital Version Mr Spreadsheet From mrspreadsheet.co.uk

Excel Accounting Spreadsheet Templates Making Tax Digital Version Mr Spreadsheet From mrspreadsheet.co.uk

Click on the link to the document you want to e-sign and select Open in signNow. Type in your business names Row 7. Using your profit and loss statements for the year fill in your total sales on line 1. Type in your current year. From the worksheet Box 1. Steps of preparing accounting worksheet are explained below.

Type in your businesss name- All you set up on this first sheet will auto fill in the rest of the months general ledger worksheets.

The guidelines below will help you create an e-signature for signing worksheet worksheet accounting blank in Chrome. To fill out Line 15 we divide your net total estimated income tax for the year by four. 27 行 It is an informal document. Type in your current year. Finish payroll and create the paycheck in Quickbooks. Then save this payroll as a 001 net check payroll.

Source: pinterest.com

Source: pinterest.com

Name of business organization and preparation date. Name of business organization and preparation date. On line 2 enter any returns your business had. After entering the information scroll to the bottom of the rows to verify the total allowable payroll amount. Will need to repeat for GLs in remaining months.

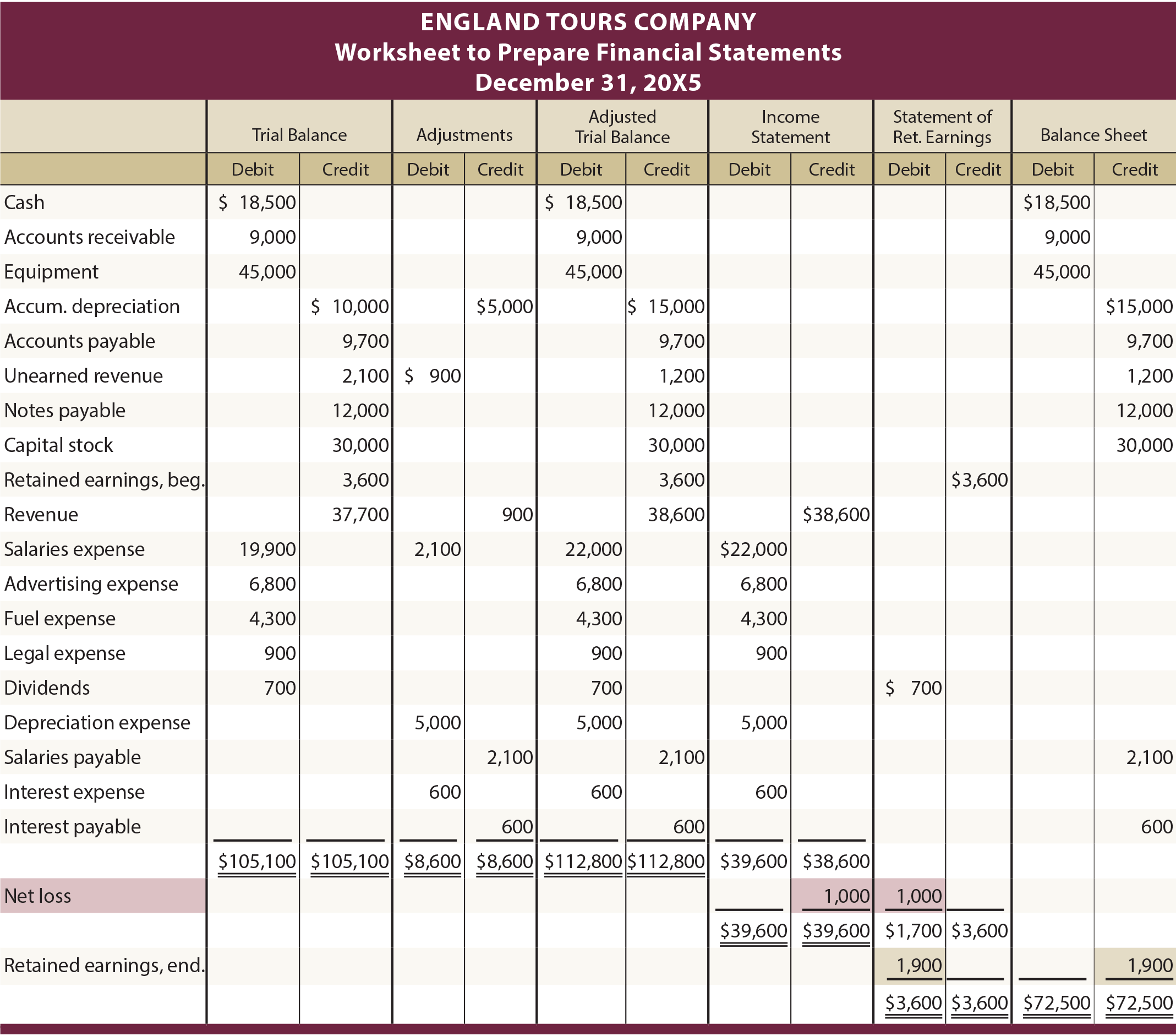

Source: principlesofaccounting.com

Source: principlesofaccounting.com

Log in to your registered account. Find the extension in the Web Store and push Add. Type in your business names Row 7. To fill out Line 15 we divide your net total estimated income tax for the year by four. Label the first and second columns Trial Balance.

Source: pinterest.com

Source: pinterest.com

If your business sells a tangible product fill in your cost of goods sold on line 4. Log in to your registered account. The net number is the owners equity. How do I do a partial worksheet in Accounting. Click on the link to the document you want to e-sign and select Open in signNow.

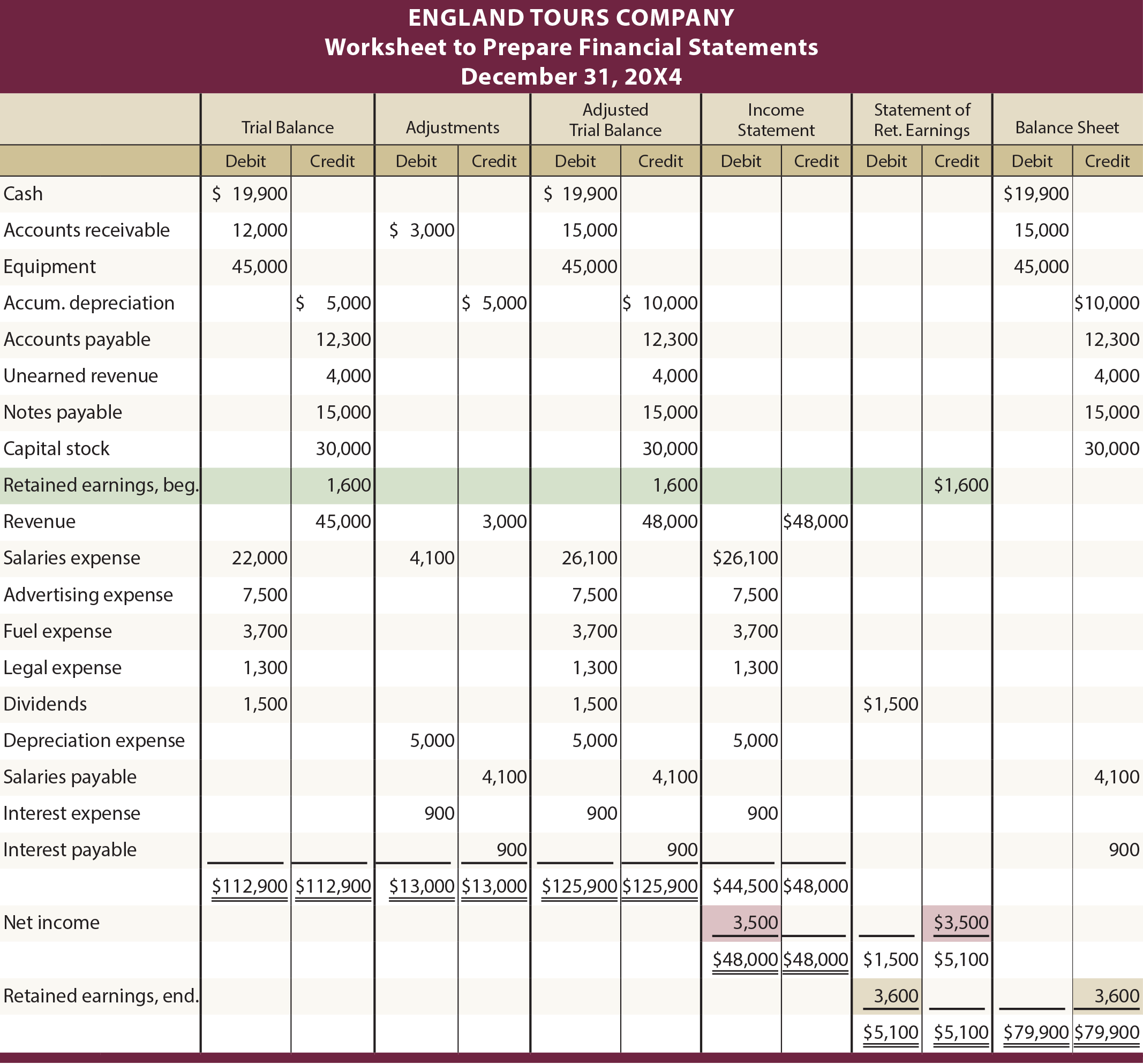

Source: opentextbc.ca

Source: opentextbc.ca

Now the worksheet 1 should populate in your 941 and so you can override the worksheet and override the wages on page 1 back down one penny for the 001 paycheck you just created if that bugs you. Type in your current year. 3 Presentation Accounting P Joshua Baey Benjamin Hoang Joel Martinez. Once each line in the balance sheet is contemplated the ingredients of the cash flow statement will be found. In other words you carefully add up the assets on the left side of the balance sheet and then add up all of the liabilities on the right side of the balance sheet and then subtract the liabilities from the assets.

Source: sampletemplates.com

Source: sampletemplates.com

Simply enter the amounts in the YELLOW CELLS for each column. Starting at the first line near the top right of the page list each of the accounts from the companys complete chart of accounts. Line 2 From the worksheet Box 2. There are seven unnumbered boxes on the left side of the 1099. If your business sells a tangible product fill in your cost of goods sold on line 4.

Source: pinterest.com

Source: pinterest.com

Using your profit and loss statements for the year fill in your total sales on line 1. These boxes ask for information about the payer thats you and recipient thats the contractor you paid during the year. Then save this payroll as a 001 net check payroll. Using your profit and loss statements for the year fill in your total sales on line 1. This table requires you to enter information for employees who were paid an annualized rate of less than or equal to the cap of 10000000 for all pay periods in the date range.

Source: iedunote.com

Source: iedunote.com

Finish payroll and create the paycheck in Quickbooks. Type in your business names Row 7. Starting at the first line near the top right of the page list each of the accounts from the companys complete chart of accounts. In other words you carefully add up the assets on the left side of the balance sheet and then add up all of the liabilities on the right side of the balance sheet and then subtract the liabilities from the assets. Thankfully Form 1099-NEC is a short form.

Source: pinterest.com

Source: pinterest.com

Then subtract line 2 from line 1 and enter this amount on line 3. Log in to your registered account. Name of business organization and preparation date. Type in your current year. This table requires you to enter information for employees who were paid an annualized rate of less than or equal to the cap of 10000000 for all pay periods in the date range.

Source: iedunote.com

Source: iedunote.com

Oxford Academy Per. These boxes ask for information about the payer thats you and recipient thats the contractor you paid during the year. Now the worksheet 1 should populate in your 941 and so you can override the worksheet and override the wages on page 1 back down one penny for the 001 paycheck you just created if that bugs you. To that end consider the value of a worksheet for preparing the statement of cash flows. After entering the information scroll to the bottom of the rows to verify the total allowable payroll amount.

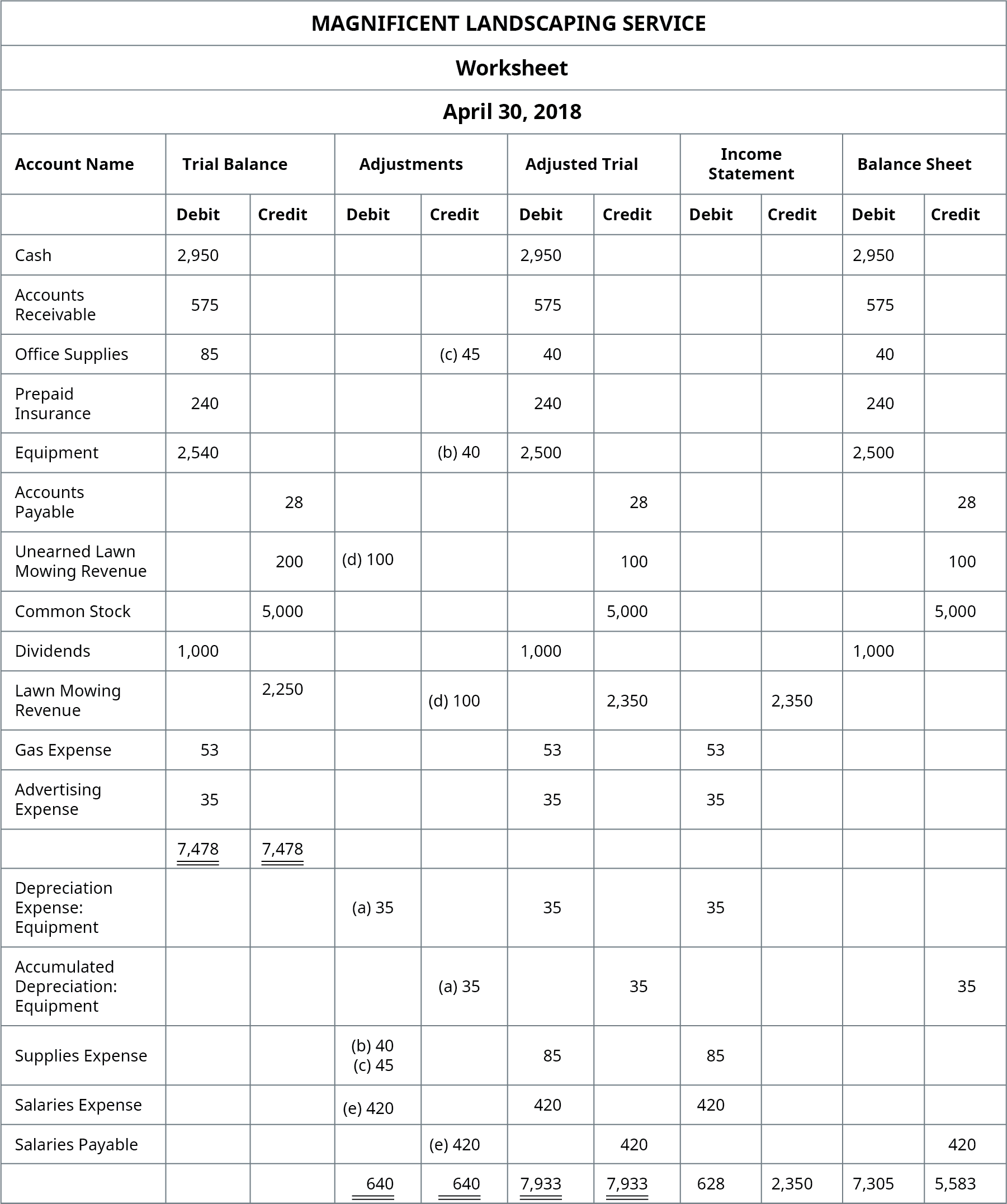

Source: principlesofaccounting.com

Source: principlesofaccounting.com

Then subtract line 2 from line 1 and enter this amount on line 3. Input payroll data into the spreadsheet. The net number is the owners equity. Simply enter the amounts in the YELLOW CELLS for each column. Thankfully Form 1099-NEC is a short form.

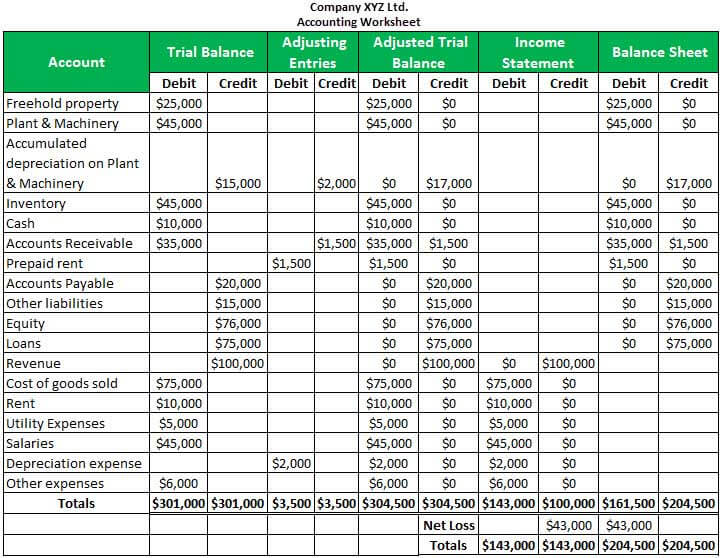

Source: wallstreetmojo.com

Source: wallstreetmojo.com

Then save this payroll as a 001 net check payroll. Will need to repeat for GLs in remaining months. Log in to your registered account. And thats the amount youll enter on slips. Finish payroll and create the paycheck in Quickbooks.

Source: calamityjanetheshow.com

Source: calamityjanetheshow.com

- Answered by a verified Business Tutor - Answered by a verified Business Tutor We use cookies to give you the best possible experience on. Steps of preparing accounting worksheet are explained below. After entering the information scroll to the bottom of the rows to verify the total allowable payroll amount. To fill out Line 15 we divide your net total estimated income tax for the year by four. Starting at the first line near the top right of the page list each of the accounts from the companys complete chart of accounts.

Source: pinterest.com

Source: pinterest.com

Thankfully Form 1099-NEC is a short form. The next column is considered the first column of the worksheet. Label the first and second columns Trial Balance. And thats the amount youll enter on slips. Type in your businesss name- All you set up on this first sheet will auto fill in the rest of the months general ledger worksheets.

Source: sumnermuseumdc.org

Source: sumnermuseumdc.org

From the worksheet Box 1. At the beginning of the worksheet the name of the organization for which worksheet is prepared is to be written in the bold form and also the date of preparation of the worksheet is to be mentioned. The worksheet examines the change in each balance sheet account and relates it to any cash flow statement impacts. To fill out Line 15 we divide your net total estimated income tax for the year by four. Simply enter the amounts in the YELLOW CELLS for each column.

Source: mrspreadsheet.co.uk

Source: mrspreadsheet.co.uk

Then subtract line 2 from line 1 and enter this amount on line 3. Line 2 From the worksheet Box 2. After entering the information scroll to the bottom of the rows to verify the total allowable payroll amount. Type in your business names Row 7. If your business sells a tangible product fill in your cost of goods sold on line 4.

Source: iedunote.com

Source: iedunote.com

How do I do a partial worksheet in Accounting. The net number is the owners equity. Using your profit and loss statements for the year fill in your total sales on line 1. To that end consider the value of a worksheet for preparing the statement of cash flows. Line 3 From the worksheet Box 3.

Source: calamityjanetheshow.com

Source: calamityjanetheshow.com

Will need to repeat for GLs in remaining months. The next column is considered the first column of the worksheet. Once each line in the balance sheet is contemplated the ingredients of the cash flow statement will be found. Then save this payroll as a 001 net check payroll. This table requires you to enter information for employees who were paid an annualized rate of less than or equal to the cap of 10000000 for all pay periods in the date range.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

Oxford Academy Per. Now the worksheet 1 should populate in your 941 and so you can override the worksheet and override the wages on page 1 back down one penny for the 001 paycheck you just created if that bugs you. Type in your business names Row 7. If all your employees were paid at least 75 of their original pay between January 1 and March 31 check the box and enter 0. Line 2 From the worksheet Box 2.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title how to fill out accounting worksheet by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.