Your Intermediate accounting pension worksheet images are ready in this website. Intermediate accounting pension worksheet are a topic that is being searched for and liked by netizens today. You can Find and Download the Intermediate accounting pension worksheet files here. Find and Download all free images.

If you’re searching for intermediate accounting pension worksheet images information related to the intermediate accounting pension worksheet topic, you have come to the right site. Our site always provides you with hints for seeing the maximum quality video and image content, please kindly search and locate more informative video articles and images that fit your interests.

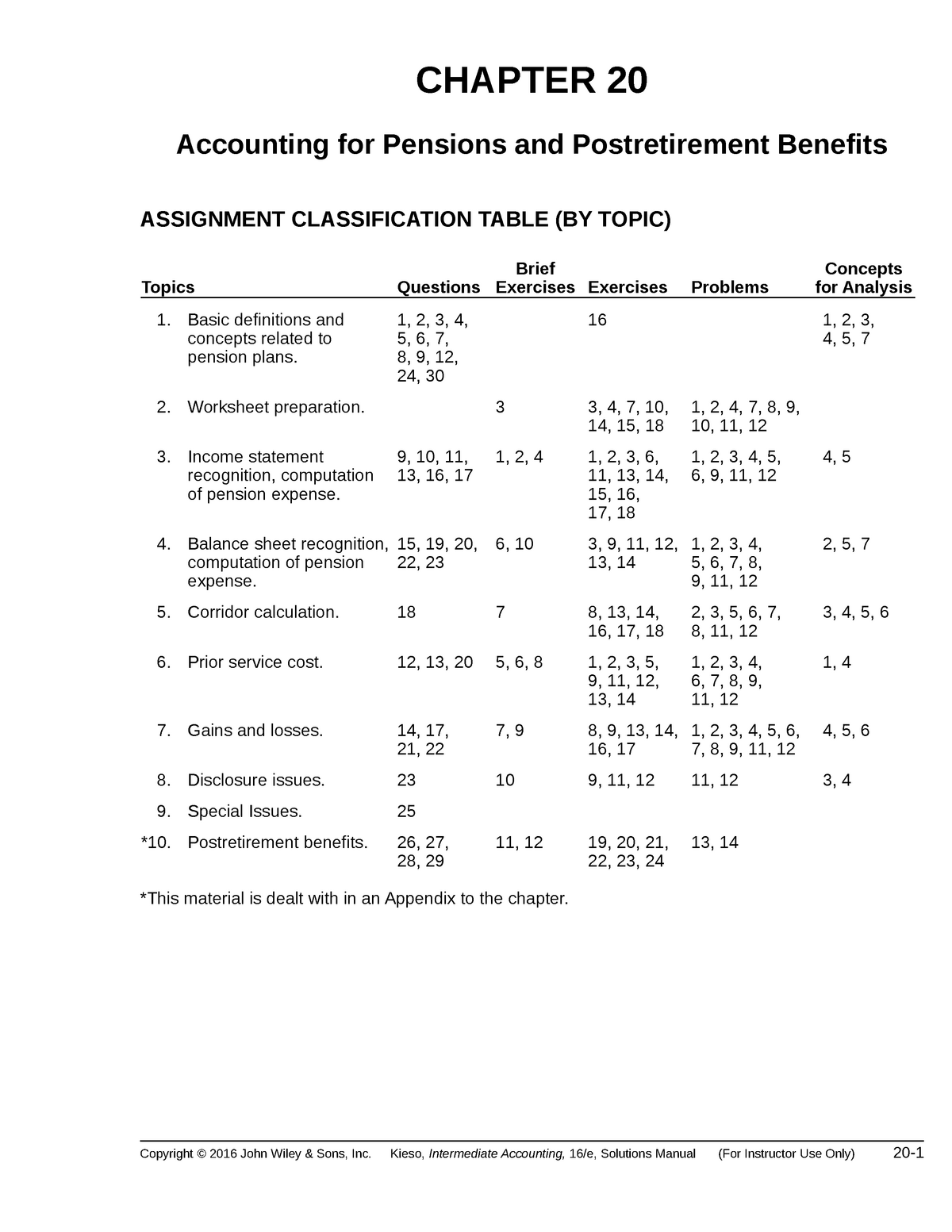

Intermediate Accounting Pension Worksheet. Sponsors a defined-benefit pension plan for its employees. The Memo Record columns on the right side maintain balances in the defined benefit obligation and the plan assets. Explain the accounting and amortization for unexpected gains and losses. Use a worksheet for employers pension plan entries.

Register For This Cpe Course Packed With Useful Tips And Practical Guidance You Can Apply Immediately How To Apply Helpful Hints Guidance From co.pinterest.com

Register For This Cpe Course Packed With Useful Tips And Practical Guidance You Can Apply Immediately How To Apply Helpful Hints Guidance From co.pinterest.com

On January 1 2013 the following balances related to this plan. On January 1 2012 the following balances related to this plan. PENSION WORKSHEET 22 23. IFRS Edition Essential IFRS references Volume 2 of Intermediate Accounting Jerry J. Plan assets market-related value 270000 Projected benefit obligation 360000 Pension. Distinguish between accounting for the employers pension plan and accounting for.

Describe the requirements for reporting pension plans in financial statements.

Explain the accounting for 9. Acc423 Intermediate Accounting Week 5 Individual Assignment P20-4a E20-7 E22-19 P22-6 P20-4a Pension Expense Journal Entries The following information related to the pension plan is available for 2012 and 2013. IFRS Edition Essential IFRS references Volume 2 of Intermediate Accounting Jerry J. A pension plan is said to be funded when the employer sets funds aside for future pension benefits by making payments to a funding agency that is responsible for accumulating the assets of the pension fund and for making payment to the recipients. Intermediate Accounting Volume 2 Kieso PDF If youve been asking this question for too long or for some time youre about to get the much needed answer to it not only can you download intermediate accounting volume 2 kieso book in PDF format for free on this Stuvera site you can also download intermediate accounting volume 2 kieso book PDF and other accounting PDF books on this same. PENSION WORKSHEET Ilustrasi PT Darvy memiliki informasi sebagai berikut Saldo awal Plan Assets 35000000 Saldo awal Defined Benefit Obligation 35000000 Annual Service Cost 1000000 Discount Rate 10 Actual Return On Plant Assets 10000000 Membayar kontribusi 2000000 Membayar manfaat kepada para pensiunan 1000000 23.

Source: slideplayer.com

Source: slideplayer.com

Intermediate Accounting P20-8 Comprehensive 2-Year Worksheet Lemke Company sponsors a defined-benefit pension plan for its employees. Intermediate Accounting Volume 2 Kieso PDF If youve been asking this question for too long or for some time youre about to get the much needed answer to it not only can you download intermediate accounting volume 2 kieso book in PDF format for free on this Stuvera site you can also download intermediate accounting volume 2 kieso book PDF and other accounting PDF books on this same. 20-124 - Pension Worksheet Howard Corp. Distinguish between accounting for the employers pension plan and accounting for. - Selection from Intermediate Accounting 15th Edition Book.

Source: pinterest.com

Source: pinterest.com

In accounting for a pension plan consideration must be given to accounting for the employer and accounting for the pension plan itself. On January 1 2013 the following balances related to this plan. 20-124 - Pension Worksheet Howard Corp. Intermediate Accounting P20-8 Comprehensive 2-Year Worksheet Lemke Company sponsors a defined-benefit pension plan for its employees. Describe the requirements for reporting pension plans in financial statements.

Source: pinterest.com

Source: pinterest.com

In accounting for a pension plan consideration must be given to accounting for the employer and accounting for the pension plan itself. PENSION WORKSHEET Ilustrasi PT Darvy memiliki informasi sebagai berikut Saldo awal Plan Assets 35000000 Saldo awal Defined Benefit Obligation 35000000 Annual Service Cost 1000000 Discount Rate 10 Actual Return On Plant Assets 10000000 Membayar kontribusi 2000000 Membayar manfaat kepada para pensiunan 1000000 23. Intermediate Accounting P20-12 Pension Worksheet Cramer Corp. Explain the accounting for past service costs. Sponsors a defined-benefit pension plan for its employees.

Source: slideplayer.com

Source: slideplayer.com

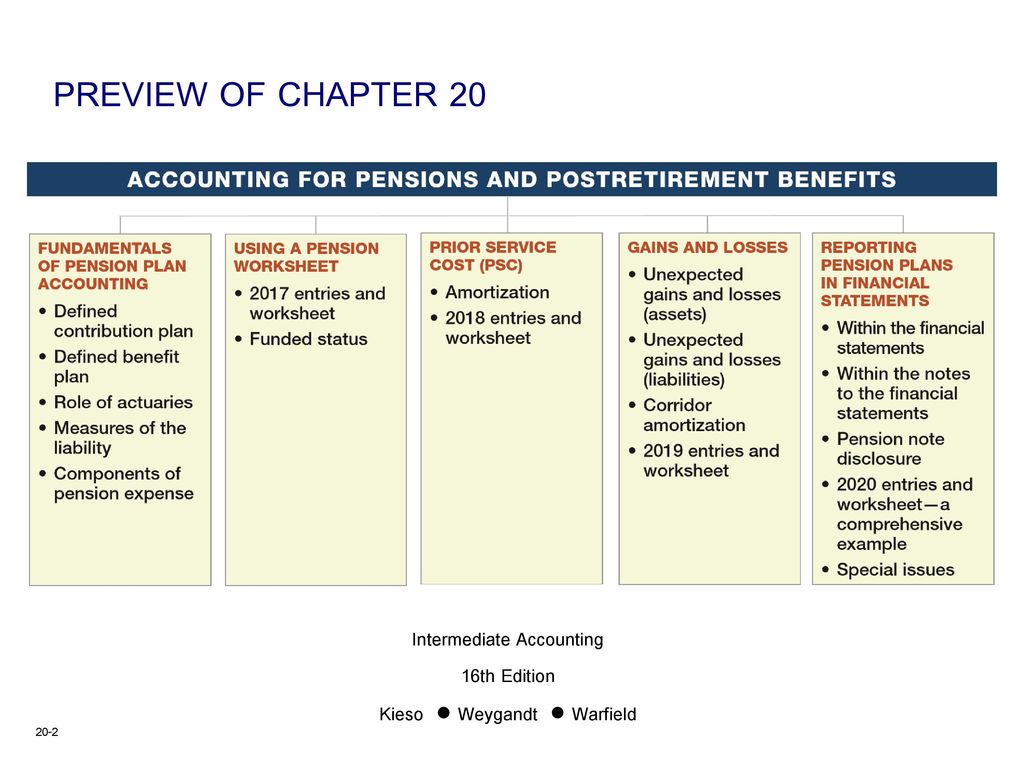

- Selection from Intermediate Accounting 15th Edition Book. Intermediate Accounting P20-8 Comprehensive 2-Year Worksheet Lemke Company sponsors a defined-benefit pension plan for its employees. Sponsors a defined-benefit pension plan for its employees. CHAPTER 20 Accounting for Pensions and Postretirement Benefits LEARNING OBJECTIVES After studying this chapter you should be able to. 20-124 - Pension Worksheet Howard Corp.

Source: slideplayer.com

Source: slideplayer.com

Intermediate Accounting IFRS 2nd Edition Kieso Weygandt and Warfield 20 20-4 5. Upholding industry standards this edition incorporates new data analytics content and up-to-date coverage of leases revenue recognition financial. Sponsors a defined-benefit pension plan for its employees. PENSION WORKSHEET 22 23. 20-124 - Pension Worksheet Howard Corp.

Source: pinterest.com

Source: pinterest.com

20-124 - Pension Worksheet Howard Corp. PENSION WORKSHEET 22 23. Intermediate Accounting Volume 2 Kieso PDF If youve been asking this question for too long or for some time youre about to get the much needed answer to it not only can you download intermediate accounting volume 2 kieso book in PDF format for free on this Stuvera site you can also download intermediate accounting volume 2 kieso book PDF and other accounting PDF books on this same. Use a worksheet for employers pension plan entries. In accounting for a pension plan consideration must be given to accounting for the employer and accounting for the pension plan itself.

Source: pinterest.com

Source: pinterest.com

This is the unbound loose-leaf version of Intermediate Accounting 17th Edition Volume 2. - Selection from Intermediate Accounting 15th Edition Book. This book is written by industry thought leaders Kieso Weygandt and Warfield and is developed around one simple proposition. Sponsors a defined-benefit pension plan for its employees. Distinguish between accounting for the employers pension plan and accounting for.

Source: ar.pinterest.com

Source: ar.pinterest.com

In accounting for a pension plan consideration must be given to accounting for the employer and accounting for the pension plan itself. The Memo Record columns on the right side maintain balances in the defined benefit obligation and the plan assets. Sponsors a defined-benefit pension plan for its employees. PENSION WORKSHEET Ilustrasi PT Darvy memiliki informasi sebagai berikut Saldo awal Plan Assets 35000000 Saldo awal Defined Benefit Obligation 35000000 Annual Service Cost 1000000 Discount Rate 10 Actual Return On Plant Assets 10000000 Membayar kontribusi 2000000 Membayar manfaat kepada para pensiunan 1000000 23. 2010 2011 Projected benefit obligation January 1.

Source: studocu.com

Source: studocu.com

- Selection from Intermediate Accounting 15th Edition Book. On January 1 2012 the following balances related to this plan. Kieso intermediate accounting solution manual kieso intermediate accounting solution manual. Upholding industry standards this edition incorporates new data analytics content and up-to-date coverage of leases revenue recognition financial. Distinguish between accounting for the employers pension plan and accounting for.

Source:

Source:

- Selection from Intermediate Accounting 15th Edition Book. Distinguish between accounting for the employers pension plan and accounting for. Sponsors a defined-benefit pension plan for its employees. PENSION WORKSHEET Ilustrasi PT Darvy memiliki informasi sebagai berikut Saldo awal Plan Assets 35000000 Saldo awal Defined Benefit Obligation 35000000 Annual Service Cost 1000000 Discount Rate 10 Actual Return On Plant Assets 10000000 Membayar kontribusi 2000000 Membayar manfaat kepada para pensiunan 1000000 23. We go through a specific problem from pensions using the workshee to calculate our pension expens and ending balance for our plan assets.

Source: co.pinterest.com

Source: co.pinterest.com

On January 1 2012 the following balances related to this plan. PENSION WORKSHEET 22 23. Explain the accounting for 9. Explain the accounting and amortization for unexpected gains and losses. Distinguish between accounting for the employers pension plan and accounting for.

Source: slidetodoc.com

Source: slidetodoc.com

2010 2011 Projected benefit obligation January 1. On January 1 2013 the following balances related to this plan. Explain the accounting for past service costs. Explain the accounting for 9. 20-124 - Pension Worksheet Howard Corp.

Source: pinterest.com

Source: pinterest.com

The Memo Record columns on the right side maintain balances in the defined benefit obligation and the plan assets. IFRS Edition Essential IFRS references Volume 2 of Intermediate Accounting Jerry J. Distinguish between accounting for the employers pension plan and accounting for. Upholding industry standards this edition incorporates new data analytics content and up-to-date coverage of leases revenue recognition financial. Explain the accounting for past service costs.

Source: youtube.com

Source: youtube.com

On January 1 2012 the following balances related to this plan. Use a worksheet for employers pension plan entries. Intermediate Accounting IFRS 2nd Edition Kieso Weygandt and Warfield 20 20-4 5. CHAPTER 20 Accounting for Pensions and Postretirement Benefits LEARNING OBJECTIVES After studying this chapter you should be able to. A pension plan is said to be funded when the employer sets funds aside for future pension benefits by making payments to a funding agency that is responsible for accumulating the assets of the pension fund and for making payment to the recipients.

Source: slidetodoc.com

Source: slidetodoc.com

Explain the accounting for 9. Sponsors a defined-benefit pension plan for its employees. This is the unbound loose-leaf version of Intermediate Accounting 17th Edition Volume 2. Distinguish between accounting for the employers pension plan and accounting for. We go through a specific problem from pensions using the workshee to calculate our pension expens and ending balance for our plan assets.

Source: slideplayer.com

Source: slideplayer.com

Explain the accounting for past service costs. Test Bank for Intermediate Accounting Fourteenth Edition 20-44 Pr. Distinguish between accounting for the employers pension plan and accounting for. Plan assets market-related value 270000 Projected benefit obligation 360000 Pension. PENSION WORKSHEET Ilustrasi PT Darvy memiliki informasi sebagai berikut Saldo awal Plan Assets 35000000 Saldo awal Defined Benefit Obligation 35000000 Annual Service Cost 1000000 Discount Rate 10 Actual Return On Plant Assets 10000000 Membayar kontribusi 2000000 Membayar manfaat kepada para pensiunan 1000000 23.

Source: slidetodoc.com

Source: slidetodoc.com

Plan assets market-related value 270000 Projected benefit obligation 360000 Pension. CHAPTER 20 Accounting for Pensions and Postretirement Benefits LEARNING OBJECTIVES After studying this chapter you should be able to. This is the unbound loose-leaf version of Intermediate Accounting 17th Edition Volume 2. Sponsors a defined-benefit pension plan for its employees. The following data relate to the operation of the plan for the years 2010 and 2011.

Source: pinterest.com

Source: pinterest.com

IFRS Edition Essential IFRS references Volume 2 of Intermediate Accounting Jerry J. CHAPTER 20 Accounting for Pensions and Postretirement Benefits LEARNING OBJECTIVES After studying this chapter you should be able to. Plan assets market-related value 270000 Projected benefit obligation 360000 Pension. Upholding industry standards this edition incorporates new data analytics content and up-to-date coverage of leases revenue recognition financial. Use a worksheet for employers pension plan entries.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title intermediate accounting pension worksheet by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.