Your Intermideate accounting pension worksheet images are available in this site. Intermideate accounting pension worksheet are a topic that is being searched for and liked by netizens now. You can Find and Download the Intermideate accounting pension worksheet files here. Find and Download all royalty-free images.

If you’re searching for intermideate accounting pension worksheet images information connected with to the intermideate accounting pension worksheet topic, you have pay a visit to the right blog. Our site frequently gives you hints for downloading the highest quality video and picture content, please kindly search and locate more enlightening video articles and images that fit your interests.

Intermideate Accounting Pension Worksheet. The accounting staff of Usher Inc. 20-124 - Pension Worksheet Howard Corp. Test Bank for Intermediate Accounting Fourteenth Edition 20-44 Pr. Sponsors a defined-benefit pension plan for its employees.

What Does Amortization Mean Accountingcoach Income Statement Doe Balance Sheet From ar.pinterest.com

What Does Amortization Mean Accountingcoach Income Statement Doe Balance Sheet From ar.pinterest.com

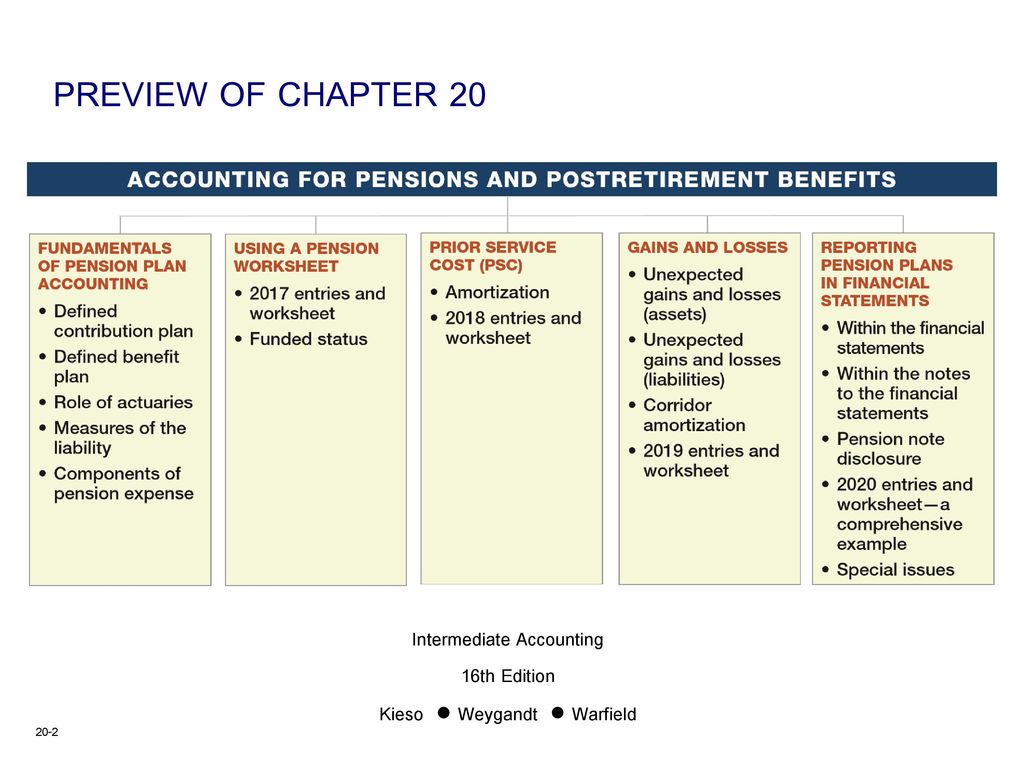

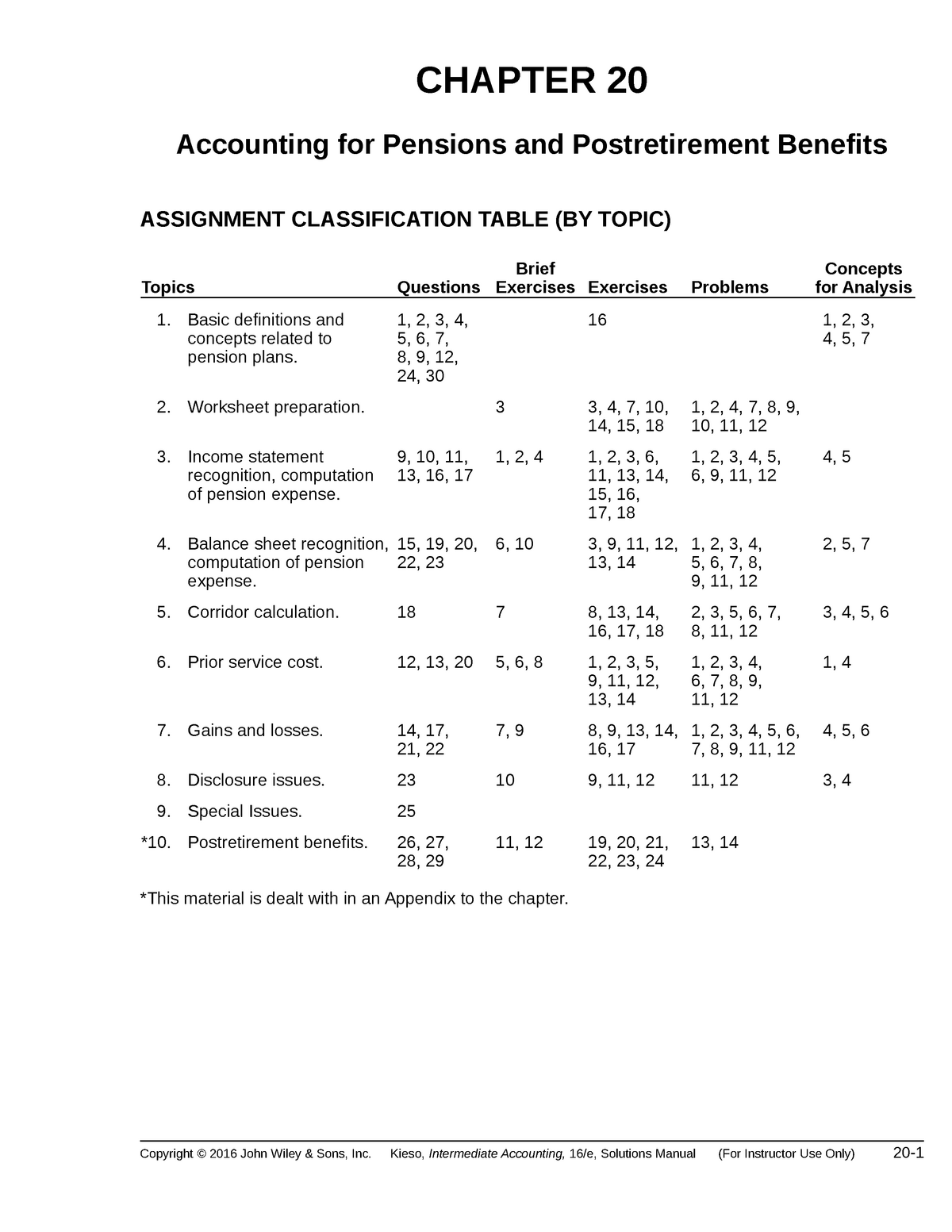

Describe the requirements for reporting pension plans in financial. Explain the accounting and amortization for unexpected gains and losses. On January 1 2013 the following balances related to this plan. Pensions and other post employment benefits nature of pension plans the chapter focuses on the pension plan accounting in the perspective. Use a worksheet for employers pension plan entries. Test Bank for Intermediate Accounting Fourteenth Edition 20-44 Pr.

Explain the accounting for past service costs.

A pension plan is said to be funded when the employer sets funds aside for future pension benefits by making payments to a funding agency that is responsible for accumulating the assets of the pension fund and for making payment to the recipients. Unfortunately several entries in the worksheet are not decipherable. 20-124 - Pension Worksheet Howard Corp. In 2016 the pension expense was 10 million and the company contributed 5 million to the pension plan. Weygandt ISBN 047087399X 9780470873991 Authors Donald E. Use a worksheet for employers pension plan entries.

Source:

Source:

PENSION WORKSHEET 22 23. The accounting staff of Usher Inc. Sponsors a defined-benefit pension plan for its employees. Explain the accounting for past service costs. See what you know about accounting for post-retirement benefit expenses by using the quizworksheet combo.

Source: co.pinterest.com

Source: co.pinterest.com

If the Phys-273-Notes - Lecture notes 1-12 Operations and Supply Chain. About This Quiz Worksheet Use this worksheetquiz to determine what you know about intermediate financial accounting concepts and related terminology. Lets see how pension accounting. Youll be tested on key points like the. Explain the accounting for past service costs.

Source: youtube.com

Source: youtube.com

At the end of 2016 the fair value of the pension assets and liabilities was 10 million. PENSION WORKSHEET Ilustrasi PT Darvy memiliki informasi sebagai berikut Saldo awal Plan Assets 35000000 Saldo awal Defined Benefit Obligation 35000000 Annual Service Cost 1000000 Discount Rate 10 Actual Return On Plant Assets 10000000 Membayar kontribusi 2000000 Membayar manfaat kepada para pensiunan 1000000 23. Pensions and other post employment benefits nature of pension plans the chapter focuses on the pension plan accounting in the perspective. Explain the accounting for remeasurements. Describe the accounting and amortization of prior service costs.

Source: slideplayer.com

Source: slideplayer.com

20-124 - Pension Worksheet Howard Corp. Pensions and other post employment benefits nature of pension plans the chapter focuses on the pension plan accounting in the perspective. Lets see how pension accounting. Explain the accounting for past service costs. About This Quiz Worksheet Use this worksheetquiz to determine what you know about intermediate financial accounting concepts and related terminology.

Source: pinterest.com

Source: pinterest.com

Describe the accounting and amortization of prior service costs. Degree Worksheet 2020-2021 Communications ACCT 2033 Intro to Financial Accounting ENG 1003 Composition I ENG 1013 Composition II ACCT 2133 Intro to Managerial Accounting COMS 1203 Oral Communications ACCT 3003 Intermediate Accounting I Mathematics MATH 1023 College Algebra ACCT 3053 Cost Accounting Sciences ACCT 4013 Tax Accounting I. A pension plan is said to be funded when the employer sets funds aside for future pension benefits by making payments to a funding agency that is responsible for accumulating the assets of the pension fund and for making payment to the recipients. PENSION WORKSHEET Ilustrasi PT Darvy memiliki informasi sebagai berikut Saldo awal Plan Assets 35000000 Saldo awal Defined Benefit Obligation 35000000 Annual Service Cost 1000000 Discount Rate 10 Actual Return On Plant Assets 10000000 Membayar kontribusi 2000000 Membayar manfaat kepada para pensiunan 1000000 23. Explain the accounting and amortization for unexpected gains and losses.

Source: slideplayer.com

Source: slideplayer.com

Use a worksheet for employers pension plan entries. In 2016 the pension expense was 10 million and the company contributed 5 million to the pension plan. About This Quiz Worksheet Use this worksheetquiz to determine what you know about intermediate financial accounting concepts and related terminology. Explain the accounting and amortization for unexpected gains and losses. Unfortunately several entries in the worksheet are not decipherable.

Source: pinterest.com

Source: pinterest.com

Explain the accounting and amortization for unexpected gains and losses. Lets see how pension accounting. Has prepared the following pension worksheet. PENSION WORKSHEET 22 23. On January 1 2013 the following balances related to this plan.

Source: pinterest.com

Source: pinterest.com

Lets see how pension accounting. See what you know about accounting for post-retirement benefit expenses by using the quizworksheet combo. Degree Worksheet 2020-2021 Communications ACCT 2033 Intro to Financial Accounting ENG 1003 Composition I ENG 1013 Composition II ACCT 2133 Intro to Managerial Accounting COMS 1203 Oral Communications ACCT 3003 Intermediate Accounting I Mathematics MATH 1023 College Algebra ACCT 3053 Cost Accounting Sciences ACCT 4013 Tax Accounting I. At the end of 2016 the fair value of the pension assets and liabilities was 10 million. Describe the requirements for reporting pension plans in financial.

Source: slidetodoc.com

Source: slidetodoc.com

At the end of 2016 the fair value of the pension assets and liabilities was 10 million. Pension Worksheet2014 General Journal Entries Memo Record Items Annual Pension Expense Cash OCIPrior Service Cost Pension Asset Liability Projected Benefit Obligation Plan Assets Balance Dec. Unfortunately several entries in the worksheet are not decipherable. If the Phys-273-Notes - Lecture notes 1-12 Operations and Supply Chain. About This Quiz Worksheet Use this worksheetquiz to determine what you know about intermediate financial accounting concepts and related terminology.

Source: pinterest.com

Source: pinterest.com

The Memo Record columns on the right side maintain balances in the defined benefit obligation and the plan assets. Weygandt ISBN 047087399X 9780470873991 Authors Donald E. In 2016 the pension expense was 10 million and the company contributed 5 million to the pension plan. Use a worksheet for employers pension plan entries. At the end of 2016 the fair value of the pension assets and liabilities was 10 million.

Source: slidetodoc.com

Source: slidetodoc.com

20-124 - Pension Worksheet Howard Corp. Explain the accounting and amortization for unexpected gains and losses. About This Quiz Worksheet Use this worksheetquiz to determine what you know about intermediate financial accounting concepts and related terminology. 20-124 - Pension Worksheet Howard Corp. A pension plan is said to be funded when the employer sets funds aside for future pension benefits by making payments to a funding agency that is responsible for accumulating the assets of the pension fund and for making payment to the recipients.

Source: slidetodoc.com

Source: slidetodoc.com

In 2016 the pension expense was 10 million and the company contributed 5 million to the pension plan. See what you know about accounting for post-retirement benefit expenses by using the quizworksheet combo. Lets see how pension accounting. Describe the requirements for reporting pension plans in financial. Describe the accounting and amortization of prior service costs.

Source: slideplayer.com

Source: slideplayer.com

When going through the quiz youll need to know about different types of retirement plans. Youll be tested on key points like the. Use a worksheet for employers pension plan entries. Explain the accounting and amortization for unexpected gains and losses. Lets see how pension accounting.

Source: pinterest.com

Source: pinterest.com

20-124 - Pension Worksheet Howard Corp. Basic Format of Pension Worksheet The General Journal Entries columns of the worksheet near the left side determine the entries to record in the formal general ledger accounts. Youll be tested on key points like the. Describe the requirements for reporting pension plans in financial. If the Phys-273-Notes - Lecture notes 1-12 Operations and Supply Chain.

Source: slideplayer.com

Source: slideplayer.com

PENSION WORKSHEET Ilustrasi PT Darvy memiliki informasi sebagai berikut Saldo awal Plan Assets 35000000 Saldo awal Defined Benefit Obligation 35000000 Annual Service Cost 1000000 Discount Rate 10 Actual Return On Plant Assets 10000000 Membayar kontribusi 2000000 Membayar manfaat kepada para pensiunan 1000000 23. Youll be tested on key points like the. Explain the accounting for past service costs. Pensions and other post employment benefits nature of pension plans the chapter focuses on the pension plan accounting in the perspective. On January 1 2013 the following balances related to this plan.

Source: studocu.com

Source: studocu.com

Has prepared the following pension worksheet. Lets see how pension accounting. The company has asked your assistance in completing the worksheet and. Pensions and other post employment benefits nature of pension plans the chapter focuses on the pension plan accounting in the perspective. When going through the quiz youll need to know about different types of retirement plans.

Source: ar.pinterest.com

Source: ar.pinterest.com

Lets see how pension accounting. When going through the quiz youll need to know about different types of retirement plans. At the end of 2016 the fair value of the pension assets and liabilities was 10 million. Describe the requirements for reporting pension plans in financial statements. Pensions and other post employment benefits nature of pension plans the chapter focuses on the pension plan accounting in the perspective.

Source: pinterest.com

Source: pinterest.com

The company has asked your assistance in completing the worksheet and. The Memo Record columns on the right side maintain balances in the defined benefit obligation and the plan assets. The company has asked your assistance in completing the worksheet and. Sponsors a defined-benefit pension plan for its employees. About This Quiz Worksheet Use this worksheetquiz to determine what you know about intermediate financial accounting concepts and related terminology.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title intermideate accounting pension worksheet by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.