Your Pension worksheet intermediate accounting images are available in this site. Pension worksheet intermediate accounting are a topic that is being searched for and liked by netizens now. You can Download the Pension worksheet intermediate accounting files here. Find and Download all free images.

If you’re searching for pension worksheet intermediate accounting pictures information connected with to the pension worksheet intermediate accounting interest, you have come to the right site. Our website always provides you with hints for seeking the highest quality video and image content, please kindly surf and locate more enlightening video articles and graphics that match your interests.

Pension Worksheet Intermediate Accounting. PENSION WORKSHEET Ilustrasi PT Darvy memiliki informasi sebagai berikut Saldo awal Plan Assets 35000000 Saldo awal Defined Benefit Obligation 35000000 Annual Service Cost 1000000 Discount Rate 10 Actual Return On Plant Assets 10000000 Membayar kontribusi 2000000 Membayar manfaat kepada para pensiunan 1000000 23. The accounting for a defined contribution plan is to charge its contributions to expense as incurred. Accounting for the pension costs and obligations of the employer is the topic of this chapter. Are you a CPA candidate or accounting student.

Pension Accounting Using Worksheet Format Projected Benefit Obligation Plan Assets J E Accts Youtube Accounting Pensions How To Plan From pinterest.com

Pension Accounting Using Worksheet Format Projected Benefit Obligation Plan Assets J E Accts Youtube Accounting Pensions How To Plan From pinterest.com

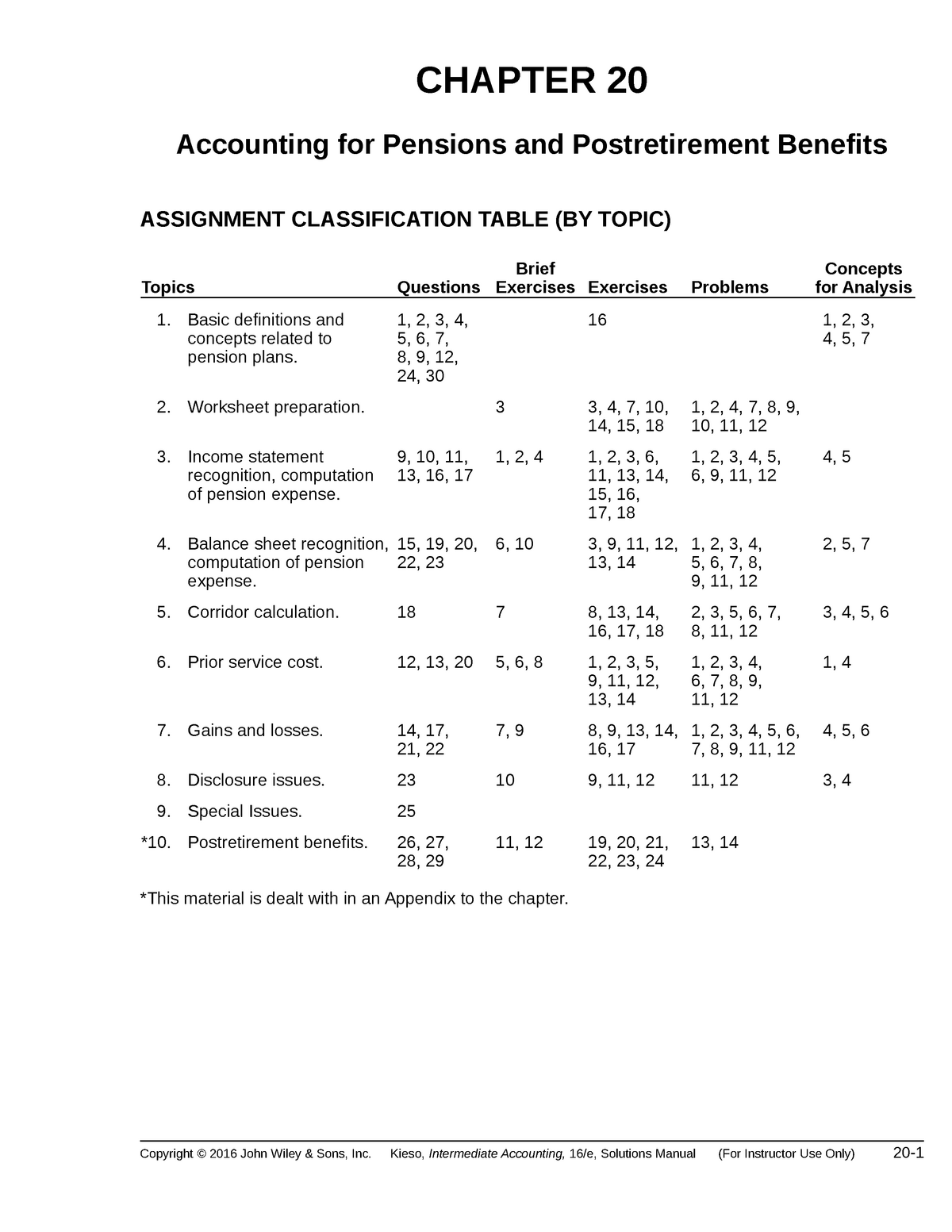

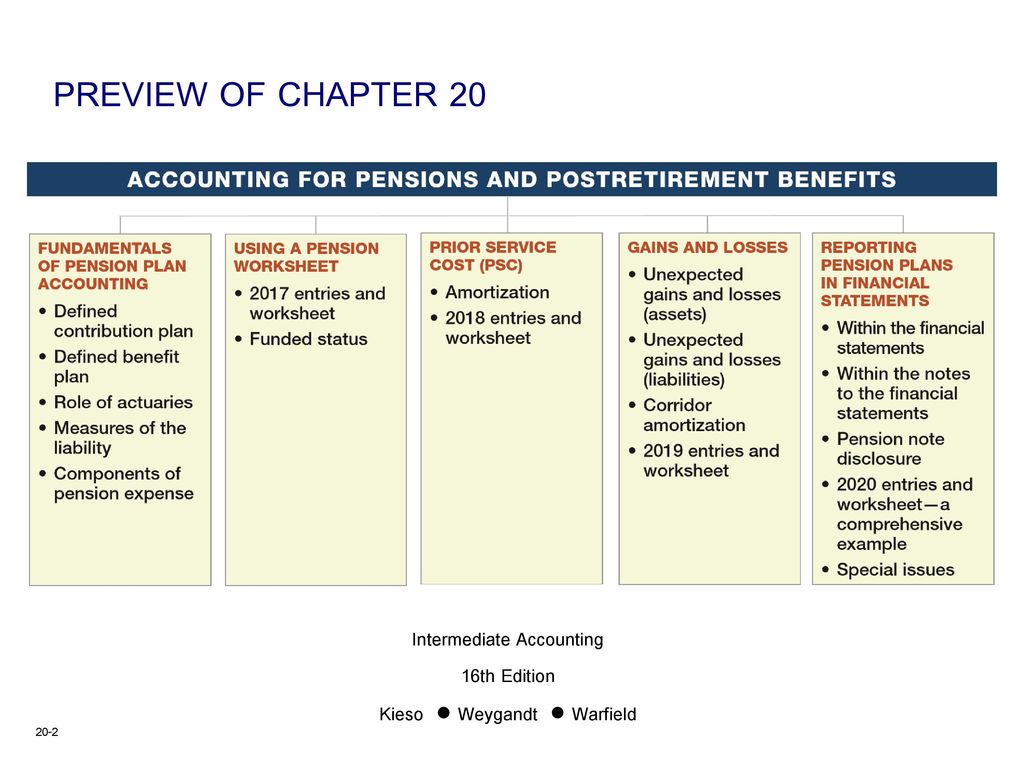

CHAPTER 20 Accounting for Pensions and Postretirement Benefits LEARNING OBJECTIVES After studying this chapter you should be able to. Explain the accounting for 9. Use a worksheet for employers pension plan entries. 20-124 - Pension Worksheet Howard Corp. Basic Format of Pension Worksheet The General Journal Entries columns of the worksheet near the left side determine the entries to record in the formal general ledger accounts. The Memo Record columns on the right side maintain balances in the defined benefit obligation and the plan assets.

Accounting for the pension fund is not.

20-124 - Pension Worksheet Howard Corp. Use a worksheet for employers pension plan entries. At the end of 2016 the fair value of the pension assets and liabilities was 10 million. Accounting for the fund involves identifying receipts as contributions from the employer sponsor income from fund investments and computing the amounts due to individual pension recipients. Fundamentals of Pension Plan Accounting Pension plan is an arrangement whereby an employer provides benefits payments to employees after they retire for services they provided while they were working. This instructional tool presents pension accounting using a worksheet approach where debits equal credits for both the employer and for the plan.

Source: pinterest.com

Source: pinterest.com

Transactions associated with the initiation of the plan through the end of the A 1. In accounting for a pension plan consideration must be given to accounting for the employer and accounting for the pension plan itself. Explain the accounting for 9. Sponsors a defined-benefit pension plan for its employees. Weygandt ISBN 047087399X 9780470873991 Authors Donald E.

Source: studocu.com

Source: studocu.com

Distinguish between accounting for the employers pension plan and accounting for. Use a worksheet for employers pension plan entries. The Memo Record columns on the right side maintain balances in the defined benefit obligation and the plan assets. Describe the accounting and amortization of prior service costs. Are you a CPA candidate or accounting student.

Source: studylib.net

Source: studylib.net

Explain the accounting for past service costs. PENSION WORKSHEET 22 23. IFRS Edition Essential IFRS references Volume 2 of Intermediate Accounting Jerry J. Are you a CPA candidate or accounting student. Use a worksheet for employers pension plan entries.

Source: co.pinterest.com

Source: co.pinterest.com

- Selection from Intermediate Accounting 15th Edition Book. Transactions associated with the initiation of the plan through the end of the A 1. This instructional tool presents pension accounting using a worksheet approach where debits equal credits for both the employer and for the plan. Lets see how pension accounting. - Selection from Intermediate Accounting 15th Edition Book.

Source: slideplayer.com

Source: slideplayer.com

The best way to learn the concepts is through repetition and working your way through problems. Accounting for the pension costs and obligations of the employer is the topic of this chapter. - Selection from Intermediate Accounting 15th Edition Book. At the end of 2016 the fair value of the pension assets and liabilities was 10 million. Describe the requirements for reporting pension plans in financial statements.

Source: youtube.com

Source: youtube.com

Fundamentals of Pension Plan Accounting Pension plan is an arrangement whereby an employer provides benefits payments to employees after they retire for services they provided while they were working. - Selection from Intermediate Accounting 15th Edition Book. Explain the accounting and amortization for unexpected gains and losses. PENSION WORKSHEET Ilustrasi PT Darvy memiliki informasi sebagai berikut Saldo awal Plan Assets 35000000 Saldo awal Defined Benefit Obligation 35000000 Annual Service Cost 1000000 Discount Rate 10 Actual Return On Plant Assets 10000000 Membayar kontribusi 2000000 Membayar manfaat kepada para pensiunan 1000000 23. Weygandt ISBN 047087399X 9780470873991 Authors Donald E.

Source: slidetodoc.com

Source: slidetodoc.com

In accounting for a pension plan consideration must be given to accounting for the employer and accounting for the pension plan itself. Accounting for the fund involves identifying receipts as contributions from the employer sponsor income from fund investments and computing the amounts due to individual pension recipients. Lets see how pension accounting. PENSION WORKSHEET Ilustrasi PT Darvy memiliki informasi sebagai berikut Saldo awal Plan Assets 35000000 Saldo awal Defined Benefit Obligation 35000000 Annual Service Cost 1000000 Discount Rate 10 Actual Return On Plant Assets 10000000 Membayar kontribusi 2000000 Membayar manfaat kepada para pensiunan 1000000 23. IFRS Edition Essential IFRS references Volume 2 of Intermediate Accounting Jerry J.

Source: slideshare.net

Source: slideshare.net

Explain the accounting for 9. 20-124 - Pension Worksheet Howard Corp. Accounting for the fund involves identifying receipts as contributions from the employer sponsor income from fund investments and computing the amounts due to individual pension recipients. Describe the requirements for reporting pension plans in financial statements. Describe the accounting and amortization of prior service costs.

Source: pinterest.com

Source: pinterest.com

Test Bank for Intermediate Accounting Fourteenth Edition 20-44 Pr. Accounting for the fund involves identifying receipts as contributions from the employer sponsor income from fund investments and computing the amounts due to individual pension recipients. The accounting for a defined contribution plan is to charge its contributions to expense as incurred. CHAPTER 20 Accounting for Pensions and Postretirement Benefits LEARNING OBJECTIVES After studying this chapter you should be able to. In 2016 the pension expense was 10 million and the company contributed 5 million to the pension plan.

Source: slideshare.net

Source: slideshare.net

PENSION WORKSHEET Ilustrasi PT Darvy memiliki informasi sebagai berikut Saldo awal Plan Assets 35000000 Saldo awal Defined Benefit Obligation 35000000 Annual Service Cost 1000000 Discount Rate 10 Actual Return On Plant Assets 10000000 Membayar kontribusi 2000000 Membayar manfaat kepada para pensiunan 1000000 23. PENSION WORKSHEET Ilustrasi PT Darvy memiliki informasi sebagai berikut Saldo awal Plan Assets 35000000 Saldo awal Defined Benefit Obligation 35000000 Annual Service Cost 1000000 Discount Rate 10 Actual Return On Plant Assets 10000000 Membayar kontribusi 2000000 Membayar manfaat kepada para pensiunan 1000000 23. Transactions associated with the initiation of the plan through the end of the A 1. PENSION WORKSHEET 22 23. Are you a CPA candidate or accounting student.

Source: slideshare.net

Source: slideshare.net

CHAPTER 20 Accounting for Pensions and Postretirement Benefits LEARNING OBJECTIVES After studying this chapter you should be able to. Are you a CPA candidate or accounting student. Describe the accounting and amortization of prior service costs. This instructional tool presents pension accounting using a worksheet approach where debits equal credits for both the employer and for the plan. Test Bank for Intermediate Accounting Fourteenth Edition 20-44 Pr.

Source: pinterest.com

Source: pinterest.com

Intermediate Accounting IFRS 2nd Edition Kieso Weygandt and Warfield 20 20-4 5. CHAPTER 20 Accounting for Pensions and Postretirement Benefits LEARNING OBJECTIVES After studying this chapter you should be able to. Use a worksheet for employers pension plan entries. Describe the accounting and amortization of prior service costs. At the end of 2016 the fair value of the pension assets and liabilities was 10 million.

Source: pinterest.com

Source: pinterest.com

Use a worksheet for employers pension plan entries. Accounting for the fund involves identifying receipts as contributions from the employer sponsor income from fund investments and computing the amounts due to individual pension recipients. 20-124 - Pension Worksheet Howard Corp. In accounting for a pension plan consideration must be given to accounting for the employer and accounting for the pension plan itself. Transactions associated with the initiation of the plan through the end of the A 1.

Source: pinterest.com

Source: pinterest.com

Intermediate Accounting IFRS 2nd Edition Kieso Weygandt and Warfield 20 20-4 5. Basic Format of Pension Worksheet The General Journal Entries columns of the worksheet near the left side determine the entries to record in the formal general ledger accounts. Accounting for the pension costs and obligations of the employer is the topic of this chapter. Fundamentals of Pension Plan Accounting Pension plan is an arrangement whereby an employer provides benefits payments to employees after they retire for services they provided while they were working. Accounting for the pension fund is not.

Source: pinterest.com

Source: pinterest.com

Here is a summary of the relevant costs associated with a defined benefit pension plan which sum to the net periodic pension. At the end of 2016 the fair value of the pension assets and liabilities was 10 million. Test Bank for Intermediate Accounting Fourteenth Edition 20-44 Pr. Use a worksheet for employers pension plan entries. Explain the accounting and amortization for unexpected gains and losses.

Source: ar.pinterest.com

Source: ar.pinterest.com

Describe the accounting and amortization of prior service costs. In accounting for a pension plan consideration must be given to accounting for the employer and accounting for the pension plan itself. PENSION WORKSHEET Ilustrasi PT Darvy memiliki informasi sebagai berikut Saldo awal Plan Assets 35000000 Saldo awal Defined Benefit Obligation 35000000 Annual Service Cost 1000000 Discount Rate 10 Actual Return On Plant Assets 10000000 Membayar kontribusi 2000000 Membayar manfaat kepada para pensiunan 1000000 23. In 2016 the pension expense was 10 million and the company contributed 5 million to the pension plan. Basic Format of Pension Worksheet The General Journal Entries columns of the worksheet near the left side determine the entries to record in the formal general ledger accounts.

Source: slidetodoc.com

Source: slidetodoc.com

Basic Format of Pension Worksheet The General Journal Entries columns of the worksheet near the left side determine the entries to record in the formal general ledger accounts. In accounting for a pension plan consideration must be given to accounting for the employer and accounting for the pension plan itself. Transactions associated with the initiation of the plan through the end of the A 1. Lets see how pension accounting. PENSION WORKSHEET Ilustrasi PT Darvy memiliki informasi sebagai berikut Saldo awal Plan Assets 35000000 Saldo awal Defined Benefit Obligation 35000000 Annual Service Cost 1000000 Discount Rate 10 Actual Return On Plant Assets 10000000 Membayar kontribusi 2000000 Membayar manfaat kepada para pensiunan 1000000 23.

Source: slideshare.net

Source: slideshare.net

Pension accounting can be a bit complicated due to the terminology employed and the deferred recognition of gains and losses. Transactions associated with the initiation of the plan through the end of the A 1. Describe the requirements for reporting pension plans in financial statements. Test Bank for Intermediate Accounting Fourteenth Edition 20-44 Pr. Intermediate accounting 2 Preview text Chapter 19.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title pension worksheet intermediate accounting by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.