Your Percent of sales method accounting allowance for bad debts worksheet images are available in this site. Percent of sales method accounting allowance for bad debts worksheet are a topic that is being searched for and liked by netizens today. You can Get the Percent of sales method accounting allowance for bad debts worksheet files here. Download all free vectors.

If you’re searching for percent of sales method accounting allowance for bad debts worksheet pictures information connected with to the percent of sales method accounting allowance for bad debts worksheet keyword, you have visit the ideal site. Our website frequently gives you hints for refferencing the highest quality video and picture content, please kindly search and find more enlightening video articles and graphics that match your interests.

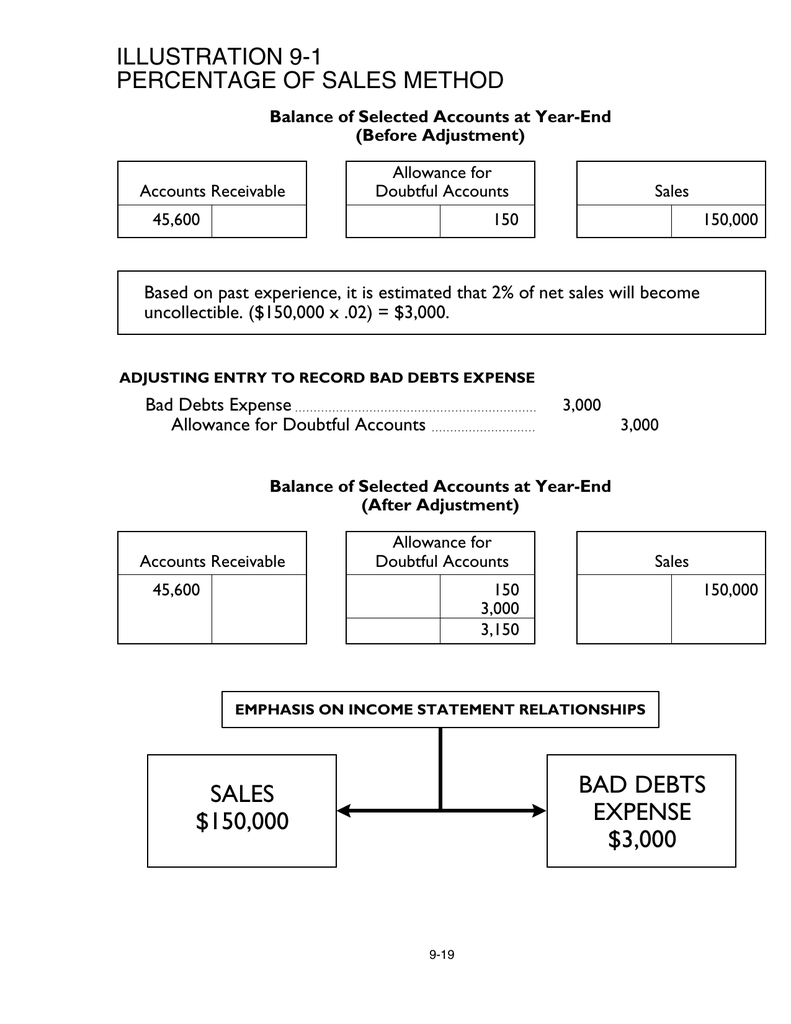

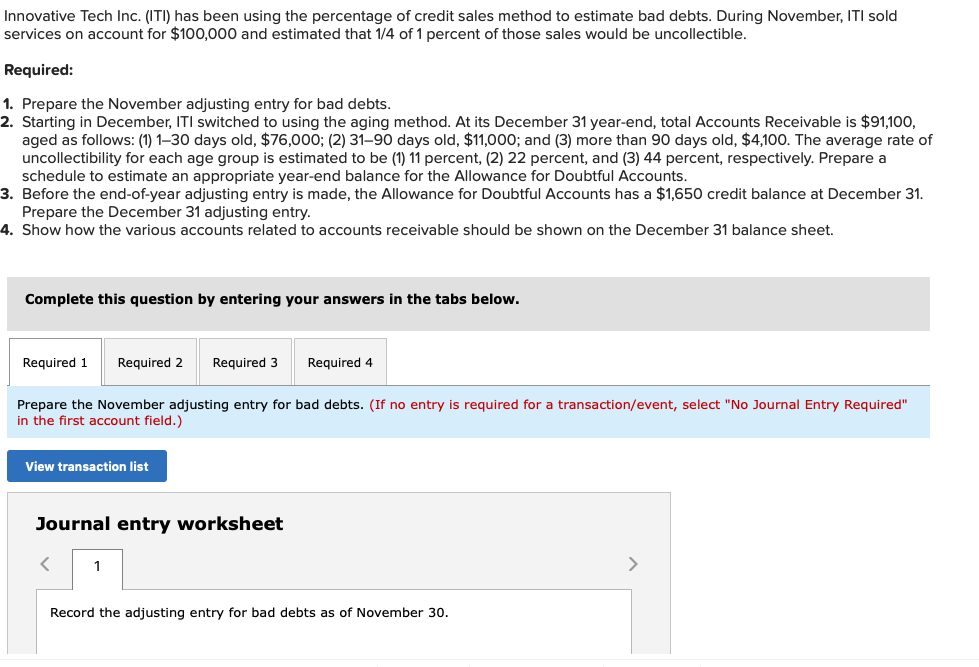

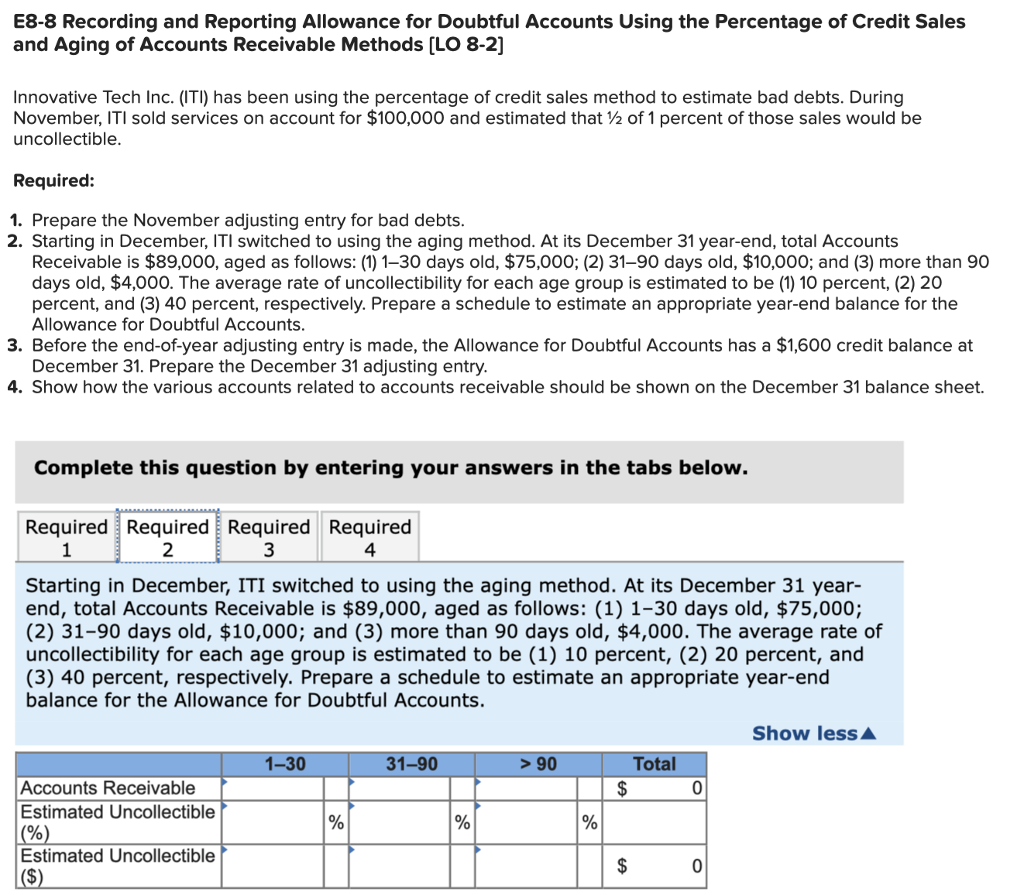

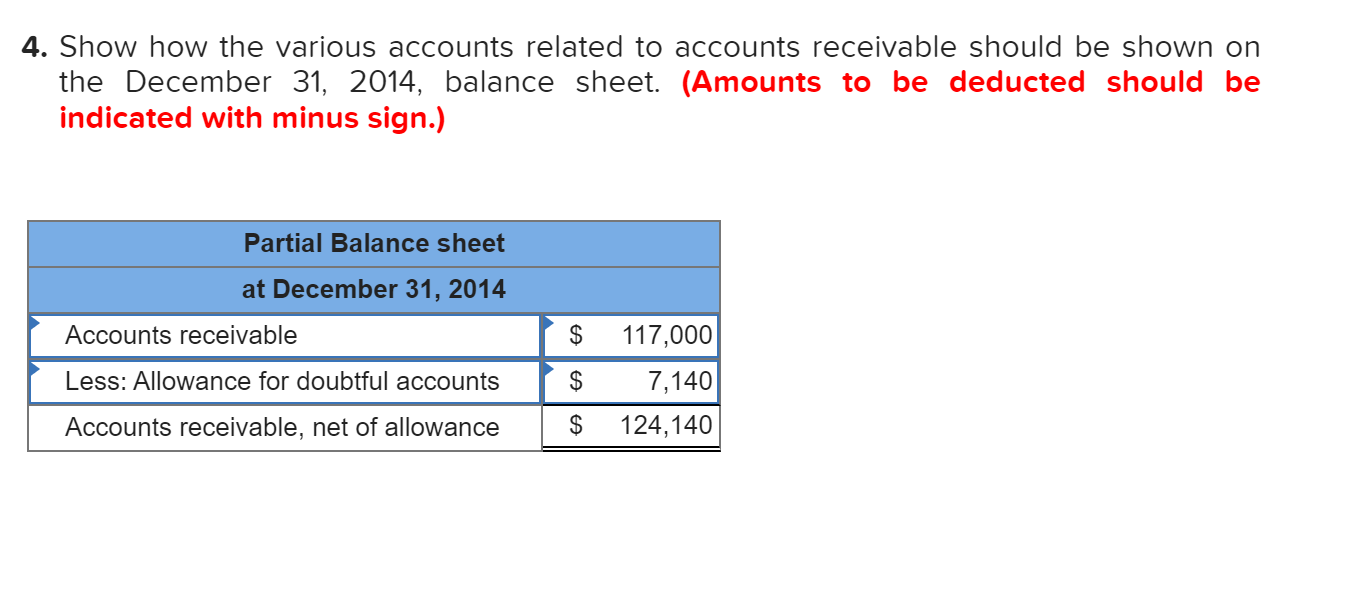

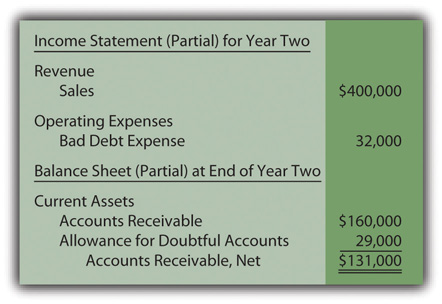

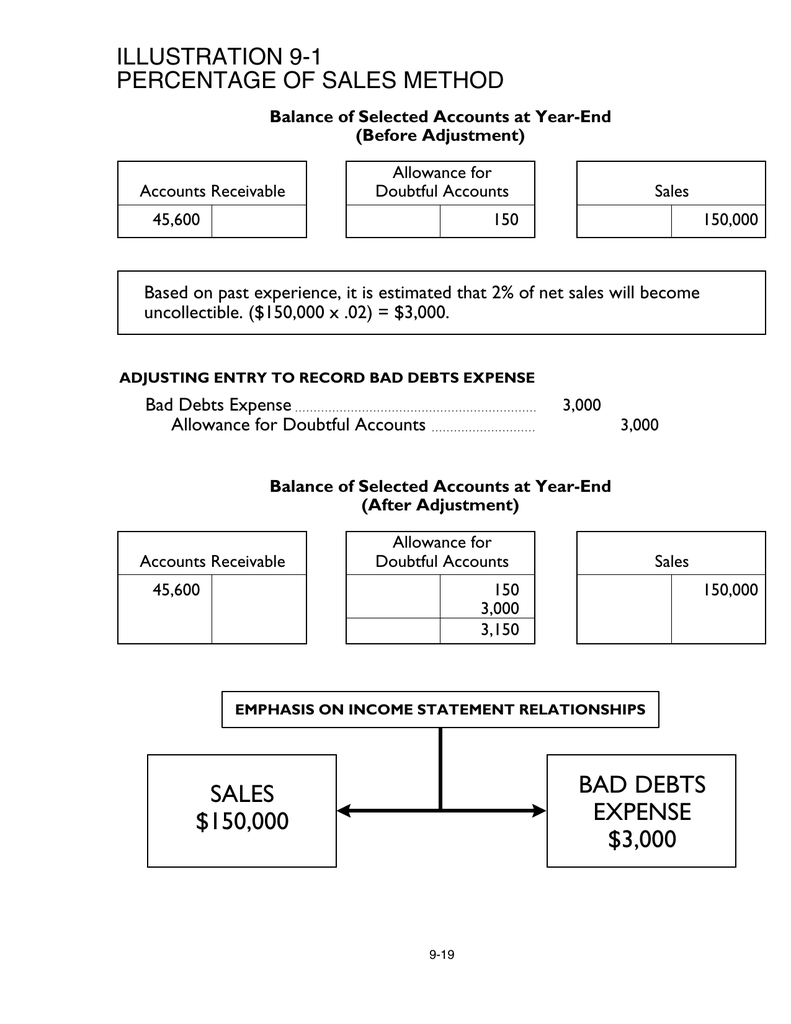

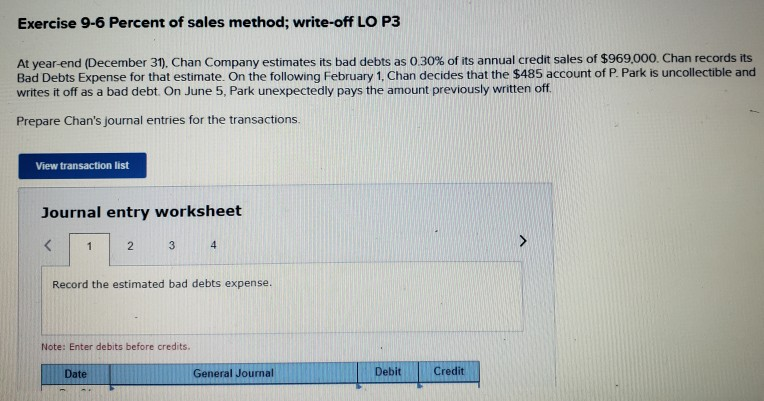

Percent Of Sales Method Accounting Allowance For Bad Debts Worksheet. 164The Branson Company uses the percent of sales method of accounting for uncollectible accounts receivable. How you account for your bad debts will depend upon whether you use the cash basis or the accrual basis of accounting. Learn about percentage-of-sales approach and percentage-of-receivables approach in calculating allowance for doubtful accounts and bad debt expense. The income statement will report the bad debts expense closer to the time of the sale or service and.

Illustration 9 1 Percentage Of Sales Method From studylib.net

Illustration 9 1 Percentage Of Sales Method From studylib.net

The companys management estimates that 3 of net credit sales will be uncollectible for the year 2025. During the current year the following transactions occurred. The other way is the direct write-off method Under the allowance method a company records an adjusting entry at the end of each accounting period for the amount of the losses it. Because you cant know in advance the amount of bad debt youll incur learn how to make an allowance for potential debts. Bad debt expense is used to reflect receivables that a company will be unable to collect. If instead the allowance for uncollectible accounts began with a balance of 10000 in June we would make the following adjusting entry instead.

At December 31 2018 accounts receivable total 44000.

The amount of bad debt expense can be estimated using the accounts receivable aging method or the percentage sales method. Using the allowance method complying with. The balance sheet will report a more realistic net amount of accounts receivable that will actually be turning to cash. Above we assumed that the allowance for doubtful accounts began with a balance of zero. Accounting Learn with flashcards games and more for free. The allowance method is preferred over the direct writeoff method because.

Source: chegg.com

Source: chegg.com

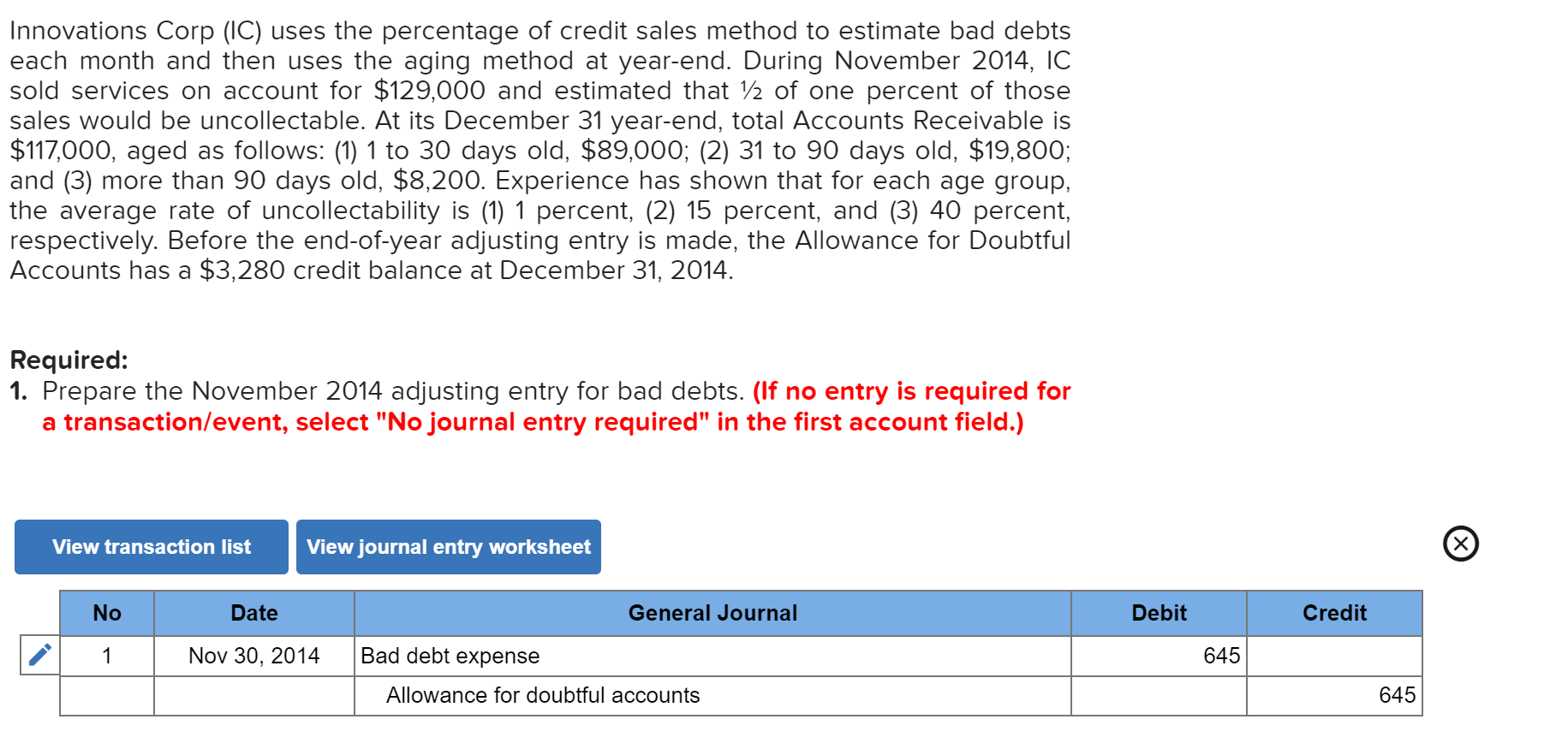

Identify the percent of uncollectible for accounts receivable. Accounting QA Library Accounting for uncollectible accounts using the allowance percent-of-sales and direct write-off methods and reporting receivables on the balance sheet On August 31 2018 Bouquet Floral Supply had a 140000 debit balance in Accounts Receivable and a 55600 credit balance in Allowance for Bad Debts. Chan records its Bad Debts Expense for that estimate. Journalize Fall Wine Tours Bad Debts Expense using the percent-of-sales method. Estimate the balance of the Allowance for Doubtful Accounts using percent of receivables method.

Source: in.pinterest.com

Source: in.pinterest.com

The allowance method usually refers to one of the two ways for reporting bad debts expense that results from a company selling goods or services on credit. The allowance for doubtful debts of the company had a credit balance of 1418 on December 31 20X0. At December 31 2018 accounts receivable total 44000. The allowance method of accounting for Bad Debts involves estimating uncollectible accounts at the end of each period. Bad debt expense is used to reflect receivables that a company will be unable to collect.

Source: chegg.com

Source: chegg.com

If instead the allowance for uncollectible accounts began with a balance of 10000 in June we would make the following adjusting entry instead. The allowance for doubtful debts of the company had a credit balance of 1418 on December 31 20X0. The allowance for bad debts account has credit balance of 2000 before the adjusting entry for bad debts. Because you cant know in advance the amount of bad debt youll incur learn how to make an allowance for potential debts. Industry experience suggests that bad debts will amount to 3 of net credit sales.

Source: chegg.com

Source: chegg.com

Accounting Learn with flashcards games and more for free. If instead the allowance for uncollectible accounts began with a balance of 10000 in June we would make the following adjusting entry instead. The income statement will report the bad debts expense closer to the time of the sale or service and. The company estimated that 3 of its credit sales will end up uncollected. Above we assumed that the allowance for doubtful accounts began with a balance of zero.

Source: chegg.com

Source: chegg.com

Accounting Learn with flashcards games and more for free. For example a business may assign a 5 percent probability of default on debts that are under 90 days old and 10 percent on debts older than 90 days. The income statement will report the bad debts expense closer to the time of the sale or service and. The debit to bad debts expense would report credit losses of 50000 on the companys June income statement. Start studying Accounting Chapter 8.

Source: chegg.com

Source: chegg.com

The amount of bad debt expense can be estimated using the accounts receivable aging method or the percentage sales method. How you account for your bad debts will depend upon whether you use the cash basis or the accrual basis of accounting. If instead the allowance for uncollectible accounts began with a balance of 10000 in June we would make the following adjusting entry instead. The amount of bad debt expense can be estimated using the accounts receivable aging method or the percentage sales method. The allowance method usually refers to one of the two ways for reporting bad debts expense that results from a company selling goods or services on credit.

Source: study.com

Source: study.com

The allowance for bad debts account has credit balance of 2000 before the adjusting entry for bad debts. The other way is the direct write-off method Under the allowance method a company records an adjusting entry at the end of each accounting period for the amount of the losses it. Start studying Accounting Chapter 8. Because you cant know in advance the amount of bad debt youll incur learn how to make an allowance for potential debts. At the end of 2010 their unadjusted trial balance shows an accounts receivable balance of 400000.

Source: chegg.com

Source: chegg.com

Assume a 0 existing balance in Allowance for Doubtful Accounts. Based on this calculation the allowance method estimates that of the credit sales of 65000 an amount of 1625 will become uncollectible at some point in the future. If you use the cash basis you recognize income only when a payment is received. The amount of bad debt expense can be estimated using the accounts receivable aging method or the percentage sales method. The allowance method usually refers to one of the two ways for reporting bad debts expense that results from a company selling goods or services on credit.

Source: 2012books.lardbucket.org

Source: 2012books.lardbucket.org

Net credit sales for the year amounted to 280000. The allowance for doubtful debts of the company had a credit balance of 1418 on December 31 20X0. The companys management estimates that 3 of net credit sales will be uncollectible for the year 2025. At December 31 2018 accounts receivable total 44000. The allowance method of accounting for Bad Debts involves estimating uncollectible accounts at the end of each period.

Source: chegg.com

Source: chegg.com

As you can see when bad debts are written off ie in 20X3 in our example. Identify the percent of uncollectible for credit sales. Bad debt expense Credit sales for the period x Estimated uncollectible Bad debt expense 65000 x 25 Bad debt expense 1625. During the current year the following transactions occurred. The other way is the direct write-off method Under the allowance method a company records an adjusting entry at the end of each accounting period for the amount of the losses it.

Source: studylib.net

Source: studylib.net

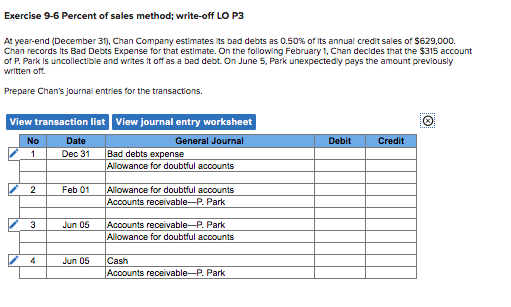

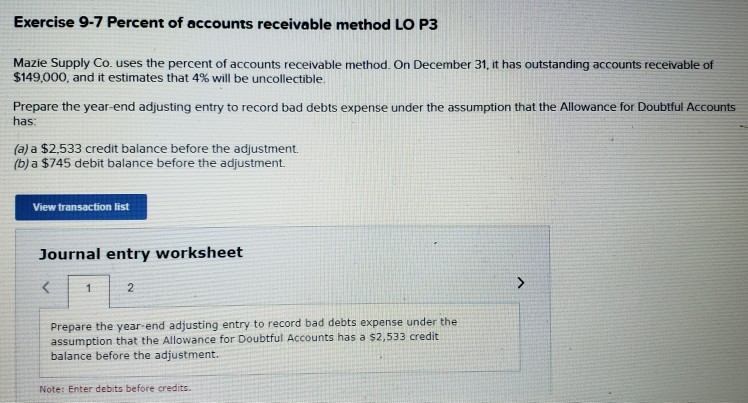

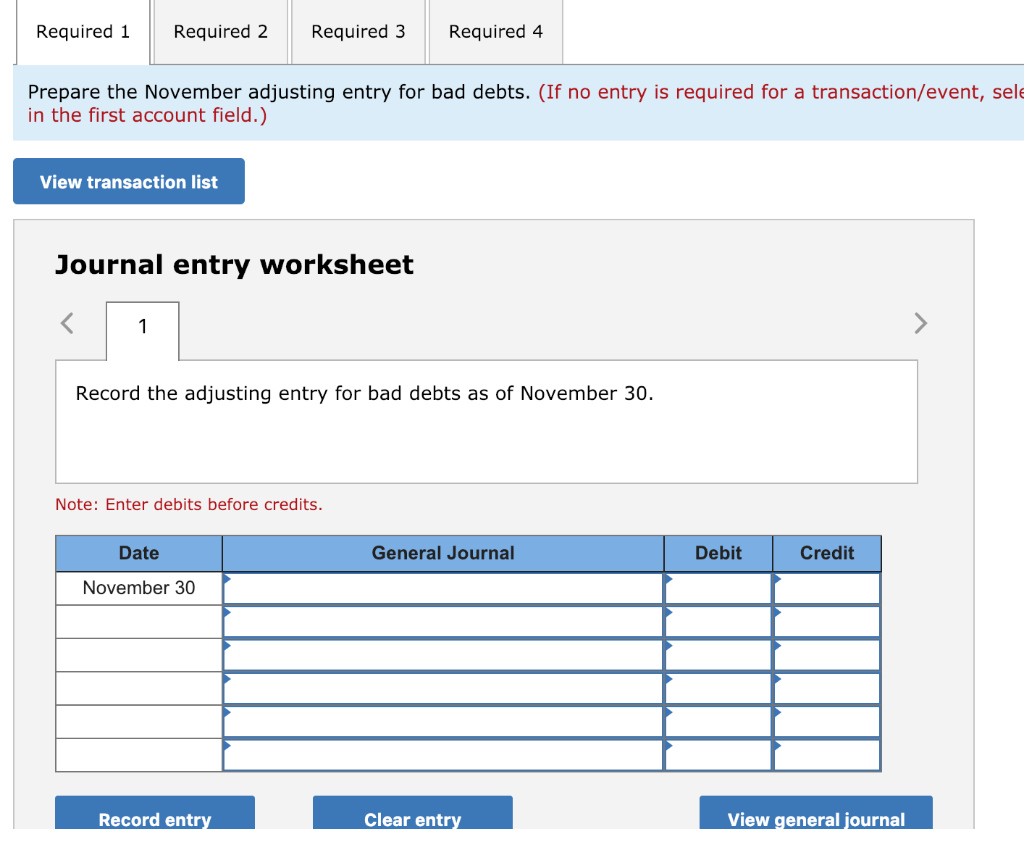

Identify the percent of uncollectible for credit sales. Above we assumed that the allowance for doubtful accounts began with a balance of zero. Exercise 9-6 Percent of sales method. The allowance method usually refers to one of the two ways for reporting bad debts expense that results from a company selling goods or services on credit. 163The Links Company uses the percent of sales method of accounting for uncollectible accounts receivable.

Identify the percent of uncollectible for accounts receivable. The amount of bad debt expense can be estimated using the accounts receivable aging method or the percentage sales method. Exercise 9-6 Percent of sales method. Answer of Using the allowance percent-of sales method for bad debts On February 28 Big Mountain Ski Equipment had a 25500 debit balance in Accounts. Chan records its Bad Debts Expense for that estimate.

Source: chegg.com

Source: chegg.com

Because you cant know in advance the amount of bad debt youll incur learn how to make an allowance for potential debts. Credit sales of Company A during the year ended December 31 20X0 were 304930. The allowance method of accounting for Bad Debts involves estimating uncollectible accounts at the end of each period. The debit to bad debts expense would report credit losses of 50000 on the companys June income statement. Answer of Using the allowance percent-of sales method for bad debts On February 28 Big Mountain Ski Equipment had a 25500 debit balance in Accounts.

Source: chegg.com

Source: chegg.com

The allowance method of accounting for Bad Debts involves estimating uncollectible accounts at the end of each period. The allowance method is preferred over the direct writeoff method because. Write-off LO P3 At year-end December 31 Chan Company estimates its bad debts as 030 of its annual credit sales of 969000. Identify the percent of uncollectible for credit sales. During the current year the following transactions occurred.

Source: clutchprep.com

Source: clutchprep.com

Using the allowance method complying with. Learn about percentage-of-sales approach and percentage-of-receivables approach in calculating allowance for doubtful accounts and bad debt expense. At the end of 2010 their unadjusted trial balance shows an accounts receivable balance of 400000. If instead the allowance for uncollectible accounts began with a balance of 10000 in June we would make the following adjusting entry instead. It provides better matching of expenses and revenues on the Income Statement and ensures that receivables are stated at their cash net realizable value on the Balance Sheet.

Source: chegg.com

Source: chegg.com

The debit to bad debts expense would report credit losses of 50000 on the companys June income statement. The amount of bad debt expense can be estimated using the accounts receivable aging method or the percentage sales method. Journalize Fall Wine Tours Bad Debts Expense using the percent-of-sales method. For example a business may assign a 5 percent probability of default on debts that are under 90 days old and 10 percent on debts older than 90 days. Accounting for Bad Debts.

Source: pinterest.com

Source: pinterest.com

The amount of bad debt expense can be estimated using the accounts receivable aging method or the percentage sales method. Credit sales of Company A during the year ended December 31 20X0 were 304930. Identify the percent of uncollectible for credit sales. Using the allowance method complying with. Assume a 0 existing balance in Allowance for Doubtful Accounts.

Source: chegg.com

Source: chegg.com

164The Branson Company uses the percent of sales method of accounting for uncollectible accounts receivable. The company uses the allowance method to account for uncollectibles. Accounting QA Library Accounting for uncollectible accounts using the allowance percent-of-sales and direct write-off methods and reporting receivables on the balance sheet On August 31 2018 Bouquet Floral Supply had a 140000 debit balance in Accounts Receivable and a 55600 credit balance in Allowance for Bad Debts. Start studying Accounting Chapter 8. Bad debt can be reported on financial statements using the direct write-off method or the allowance method.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title percent of sales method accounting allowance for bad debts worksheet by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.