Your Self employment income worksheet cash accounting method images are available in this site. Self employment income worksheet cash accounting method are a topic that is being searched for and liked by netizens now. You can Download the Self employment income worksheet cash accounting method files here. Get all free images.

If you’re searching for self employment income worksheet cash accounting method images information linked to the self employment income worksheet cash accounting method keyword, you have come to the right blog. Our website frequently provides you with suggestions for seeing the maximum quality video and image content, please kindly surf and find more enlightening video articles and images that fit your interests.

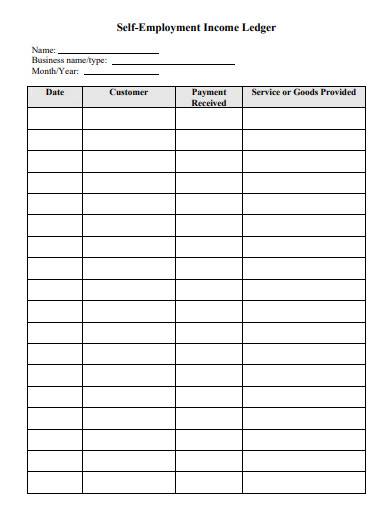

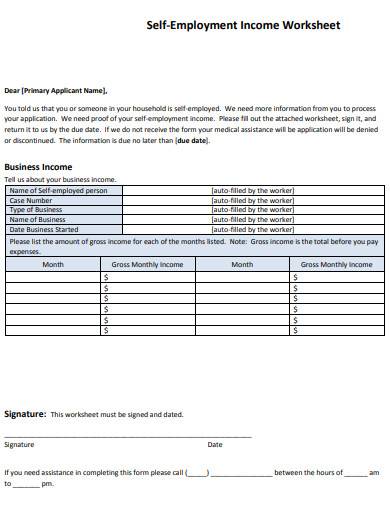

Self Employment Income Worksheet Cash Accounting Method. Depreciation See Line 13 for Actual Depreciation. Cash Accounting Method I understand that I must complete this worksheet to apply for energy assistance. I understand that I may be prosecuted for. Self-Employment Income Cash Accounting - 1 month Income received Gross receipts sales other gains rental income and other income Enter total gross income received from self employment for the full month prior to signing.

Free 10 Bookkeeping Templates For Self Employed In Pdf From sampletemplates.com

Free 10 Bookkeeping Templates For Self Employed In Pdf From sampletemplates.com

PREPARERS INSTRUCTIONS FOR SELF-EMPLOYMENT WORKSHEET The purpose of the Self-employment Worksheet is to provide a method of computing income for individuals whose income is derived from their ownership of a business but who are not salaried by that business. If you currently carry on a designated professional business and use billed-basis accounting the billed-basis accounting method has changed. For more information go to Billed-basis accounting for professionals in Whats new for small businesses and self-employed and changes to the Election to exclude your WIP in Chapter 2 of the guide T4002 Self-employed Business Professional. Go to the Taxes Self-Employment Tax Schedule SE worksheet. Select section 1 - General. Enter line 2 - Use optional method for farm SE income or line 3 - Use optional method for non-farm income.

Self-Employment Income Cash Accounting Income received Gross receipts sales other gains rental income and other income By signing this document you are stating the - I understand that I must complete this worksheet for.

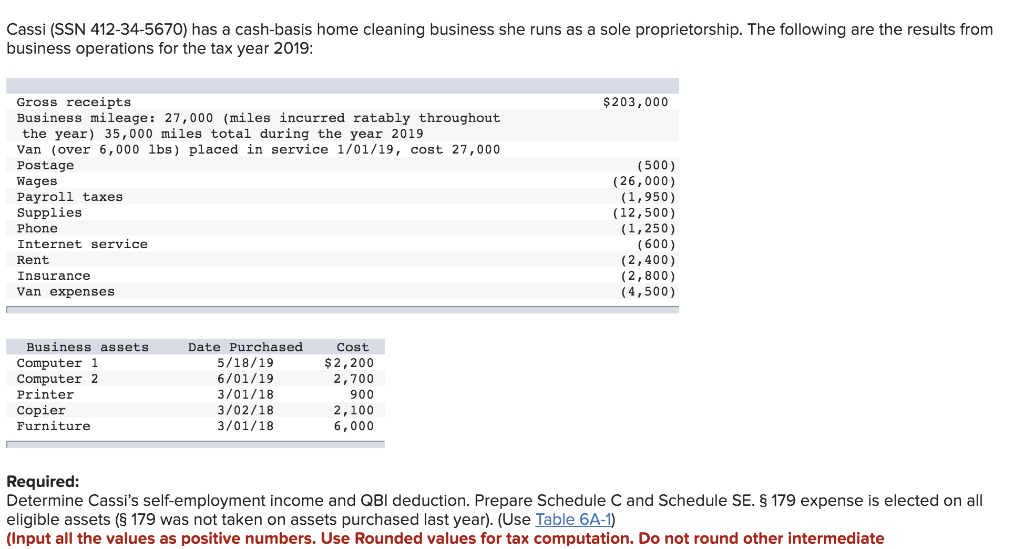

W-2 Income from Self-Employment line 1 d. Why use cash basis If you run a small business cash basis. Depreciation See Line 13 for Actual Depreciation. Title Self Employment Worksheet Farm Cash Accounting Subject energy assistance Author MN Dept of Commerce Last modified by Sandra Seemann Created Date 9132000 62530 PM Other titles SE WS Farm cash acct method. As business owners the goal for self-employed borrowers is to maximize income yet reduce tax liability. Cash Accounting Method Subject energy assistance Author MN Dept of Commerce Last modified by Sandra Seemann Created Date 9132000 62530 PM Other titles SE Income WS SE.

Source: pinterest.com

Source: pinterest.com

PREPARERS INSTRUCTIONS FOR SELF-EMPLOYMENT WORKSHEET The purpose of the Self-employment Worksheet is to provide a method of computing income for individuals whose income is derived from their ownership of a business but who are not salaried by that business. Determining a self-employed borrowers income isnt always straightforward. Farm FFY2017 EAP Policy Manual Chapter 5 Appendix 5D Self-Employment Worksheet for Farm Income. For more information go to Billed-basis accounting for professionals in Whats new for small businesses and self-employed and changes to the Election to exclude your WIP in Chapter 2 of the guide T4002 Self-employed Business Professional. Our cash flow worksheets are the industry standard for excellence in analyzing self-employed borrower income.

Source: chegg.com

Source: chegg.com

Determining a self-employed borrowers income isnt always straightforward. Enter line 2 - Use optional method for farm SE income or line 3 - Use optional method for non-farm income. Self-Employment Income Cash Accounting - 1 month Income received Gross receipts sales other gains rental income and other income Enter total gross income received from self employment for the full month prior to signing. Cash Accounting Method Other Must explain below Please explain Other expense. Some of the worksheets displayed are What is accounting Accounting cheat Accrual work Self employment income cash accounting method Accounting basics Self employment income work cash accounting method Chapter 2 the cash basis of accounting Financial accounting and accounting standards.

Source: pinterest.com

Source: pinterest.com

Self-Employment Income Cash Accounting - 1 month Income received Gross receipts sales other gains rental income and other income Enter total gross income received from self employment for the full month prior to signing. Enter line 2 - Use optional method for farm SE income or line 3 - Use optional method for non-farm income. I declare that this information is true and accurate. Cash Accounting Method Subject energy assistance Author MN Dept of Commerce Last modified by Sandra Seemann Created Date 9132000 62530 PM Other titles SE Income WS SE. Thats why weve developed several self-employed borrower calculators to help you calculate and analyze their assets properly.

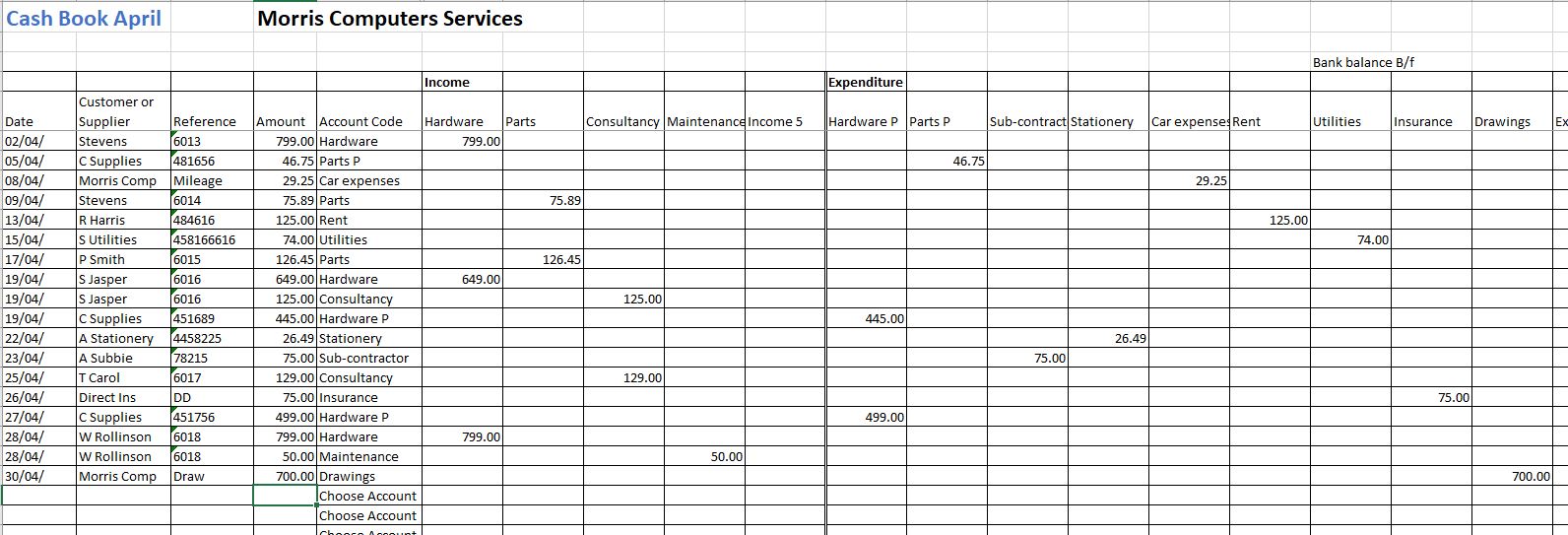

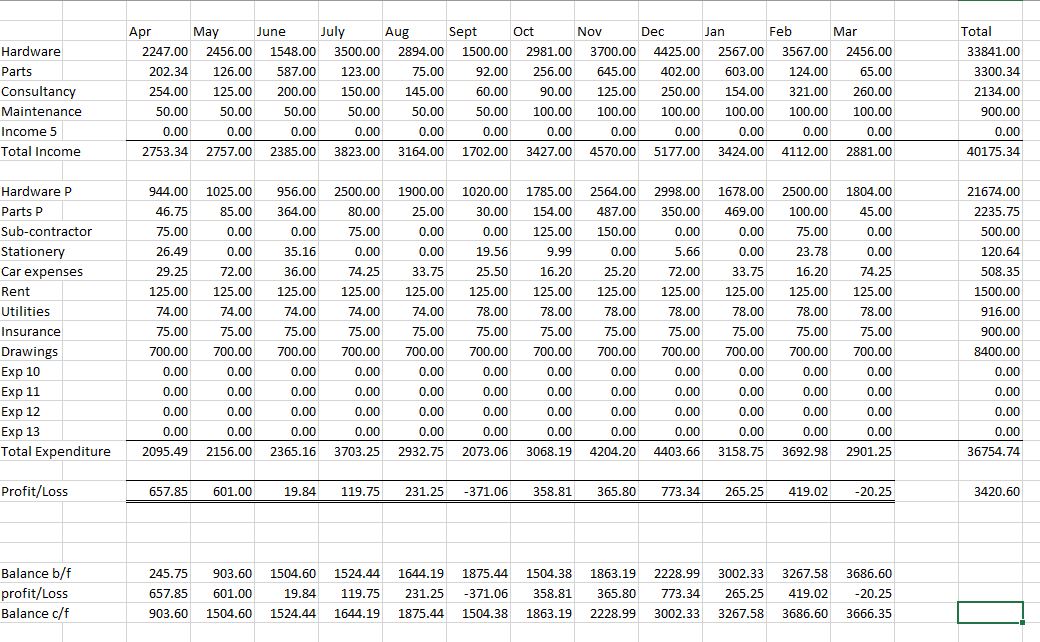

Source: businessaccountingbasics.co.uk

Source: businessaccountingbasics.co.uk

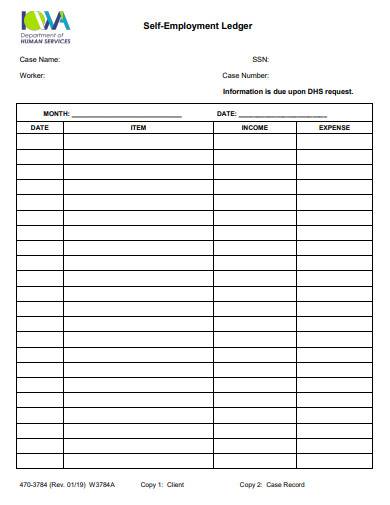

FFY2012 EAP Policy Manual Chapter 5 Appendix 5C Self-Accounting Income Worksheet. SELF-EMPLOYMENT WORKSHEET A. Why use cash basis If you run a small business cash basis. Select section 1 - General. Cash Accounting Method I understand that I must complete this worksheet to apply for energy assistance.

Source: pinterest.com

Source: pinterest.com

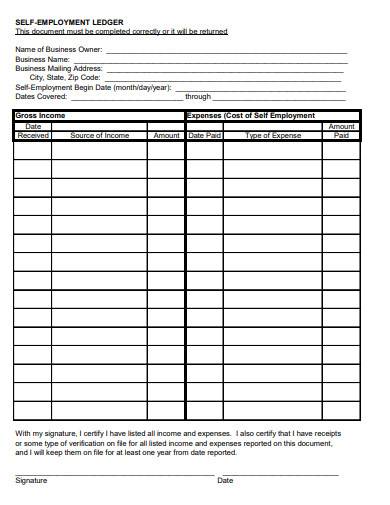

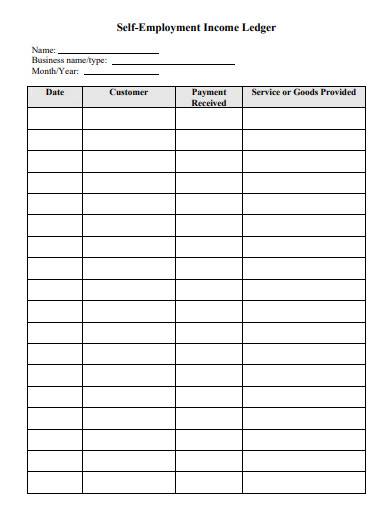

BUSINESS OWNERS NAME B. If you currently carry on a designated professional business and use billed-basis accounting the billed-basis accounting method has changed. Farm FFY2017 EAP Policy Manual Chapter 5 Appendix 5D Self-Employment Worksheet for Farm Income. Our cash flow worksheets are the industry standard for excellence in analyzing self-employed borrower income. BUSINESS OWNERS NAME B.

Source: e-file.com

Source: e-file.com

Select section 1 - General. Cash basis and accrual basis. Self-Employment Income Cash Accounting Income received Gross receipts sales other gains rental income and other income Office use only. Other Rental Income Worksheet IRS Form 8825 Worksheet 1. PREPARERS INSTRUCTIONS FOR SELF-EMPLOYMENT WORKSHEET The purpose of the Self-employment Worksheet is to provide a method of computing income for individuals whose income is derived from their ownership of a business but who are not salaried by that business.

Source: pinterest.com

Source: pinterest.com

I declare that this information is true and accurate. Other Rental Income Worksheet IRS Form 8825 Worksheet 1. Showing top 8 worksheets in the category - Cash Method Accounting. Title Self Employment Worksheet Farm Cash Accounting Subject energy assistance Author MN Dept of Commerce Last modified by Sandra Seemann Created Date 9132000 62530 PM Other titles SE WS Farm cash acct method. Cash Accounting Method Other Must explain below Please explain Other expense.

Source: pinterest.com

Source: pinterest.com

Enter line 2 - Use optional method for farm SE income or line 3 - Use optional method for non-farm income. Self-Employment Income Cash Accounting - 1 month By signing this document you are stating the following. Cash Accounting Method Self-Employment Income. BUSINESS OWNERS NAME B. Divide Total Gross Income by the number of months the business wasthe past.

Source: pinterest.com

Source: pinterest.com

Determining a self-employed borrowers income isnt always straightforward. As business owners the goal for self-employed borrowers is to maximize income yet reduce tax liability. Divide Total Gross Income by the number of months the business wasthe past. Our cash flow worksheets are the industry standard for excellence in analyzing self-employed borrower income. Other Rental Income Worksheet IRS Form 8825 Worksheet 1.

Source: pinterest.com

Source: pinterest.com

For more information go to Billed-basis accounting for professionals in Whats new for small businesses and self-employed and changes to the Election to exclude your WIP in Chapter 2 of the guide T4002 Self-employed Business Professional. Cash Accounting Method I understand that I must complete this worksheet to apply for energy assistance. Divide Total Gross Income by the number of months the business wasthe past. BUSINESS OWNERS NAME B. W-2 Income from Self-Employment line 1 d.

Source: businessaccountingbasics.co.uk

Source: businessaccountingbasics.co.uk

I declare that this information is true and accurate. Cash Accounting Method Other Must explain below Please explain Other expense. MAIN BUSINESS ACTIVITY CASH. Depreciation See Line 13 for Actual Depreciation. Cash Accounting Method Subject energy assistance Author MN Dept of Commerce Last modified by Sandra Seemann Created Date 9132000 62530 PM Other titles SE Income WS SE.

Source: sampletemplates.com

Source: sampletemplates.com

Determining a self-employed borrowers income isnt always straightforward. Self-Employment Income Cash Accounting Income received Gross receipts sales other gains rental income and other income By signing this document you are stating the - I understand that I must complete this worksheet for. Some of the worksheets displayed are What is accounting Accounting cheat Accrual work Self employment income cash accounting method Accounting basics Self employment income work cash accounting method Chapter 2 the cash basis of accounting Financial accounting and accounting standards. Why use cash basis If you run a small business cash basis. Determining a self-employed borrowers income isnt always straightforward.

Source: sampletemplates.com

Source: sampletemplates.com

Showing top 8 worksheets in the category - Cash Method Accounting. As business owners the goal for self-employed borrowers is to maximize income yet reduce tax liability. Thats why weve developed several self-employed borrower calculators to help you calculate and analyze their assets properly. Self-Employment Income Cash Accounting Income received Gross receipts sales other gains rental income and other income By signing this document you are stating the - I understand that I must complete this worksheet for. - I understand that I must complete this worksheet for my application for energy assistance.

Source: pinterest.com

Source: pinterest.com

PREPARERS INSTRUCTIONS FOR SELF-EMPLOYMENT WORKSHEET The purpose of the Self-employment Worksheet is to provide a method of computing income for individuals whose income is derived from their ownership of a business but who are not salaried by that business. I understand that I may be prosecuted for. Enter line 2 - Use optional method for farm SE income or line 3 - Use optional method for non-farm income. Thats why weve developed several self-employed borrower calculators to help you calculate and analyze their assets properly. W-2 Income from Self-Employment line 1 d.

Source: pinterest.com

Source: pinterest.com

Go to the Taxes Self-Employment Tax Schedule SE worksheet. PREPARERS INSTRUCTIONS FOR SELF-EMPLOYMENT WORKSHEET The purpose of the Self-employment Worksheet is to provide a method of computing income for individuals whose income is derived from their ownership of a business but who are not salaried by that business. Cash Accounting Method Other Must explain below Please explain Other expense. Self-Employment Qualifications for Cash Basis Accounting There are two basic forms of accounting. Self-Employment Income Cash Accounting - 1 month Income received Gross receipts sales other gains rental income and other income Enter total gross income received from self employment for the full month prior to signing.

Source: sampletemplates.com

Source: sampletemplates.com

Go to the Taxes Self-Employment Tax Schedule SE worksheet. For more information go to Billed-basis accounting for professionals in Whats new for small businesses and self-employed and changes to the Election to exclude your WIP in Chapter 2 of the guide T4002 Self-employed Business Professional. As business owners the goal for self-employed borrowers is to maximize income yet reduce tax liability. Cash basis and accrual basis. Cash basis is a way to work out your income and expenses for your Self Assessment tax return if youre a sole trader or partner.

Source: sampletemplates.com

Source: sampletemplates.com

Title Self Employment Worksheet Farm Cash Accounting Subject energy assistance Author MN Dept of Commerce Last modified by Sandra Seemann Created Date 9132000 62530 PM Other titles SE WS Farm cash acct method. Cash Accounting Method I understand that I must complete this worksheet to apply for energy assistance. Thats why weve developed several self-employed borrower calculators to help you calculate and analyze their assets properly. Why use cash basis If you run a small business cash basis. FFY2012 EAP Policy Manual Chapter 5 Appendix 5C Self-Accounting Income Worksheet.

Source: smallbusinesstoolbox.uk

Source: smallbusinesstoolbox.uk

Thats why weve developed several self-employed borrower calculators to help you calculate and analyze their assets properly. Thats why weve developed several self-employed borrower calculators to help you calculate and analyze their assets properly. Why use cash basis If you run a small business cash basis. For more information go to Billed-basis accounting for professionals in Whats new for small businesses and self-employed and changes to the Election to exclude your WIP in Chapter 2 of the guide T4002 Self-employed Business Professional. Go to the Taxes Self-Employment Tax Schedule SE worksheet.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title self employment income worksheet cash accounting method by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.