Your Tax effect accounting worksheet australia images are available in this site. Tax effect accounting worksheet australia are a topic that is being searched for and liked by netizens now. You can Download the Tax effect accounting worksheet australia files here. Download all royalty-free photos and vectors.

If you’re looking for tax effect accounting worksheet australia images information linked to the tax effect accounting worksheet australia keyword, you have visit the ideal blog. Our website frequently gives you suggestions for downloading the highest quality video and image content, please kindly hunt and locate more informative video content and graphics that fit your interests.

Tax Effect Accounting Worksheet Australia. Tax-effect accounting in Australia. Current tax The amount of income taxes payable recoverable in respect of the taxable profit tax loss for a period. Accounting profit 80 000 Tax at the applicable rate of 30 24 000 Tax effect of non-deductible promotional expenses CU 90030 270 Increase in DTL resulting from the increase in the tax rate in step 2 above 688 Total income. 8 Endorsed Explanatory Material01 The accounting standards set out in this standard are shown in normal print.

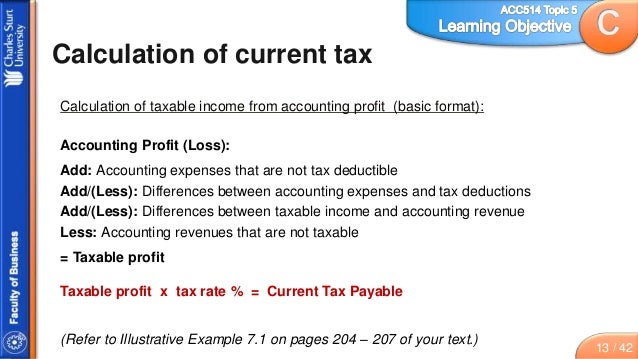

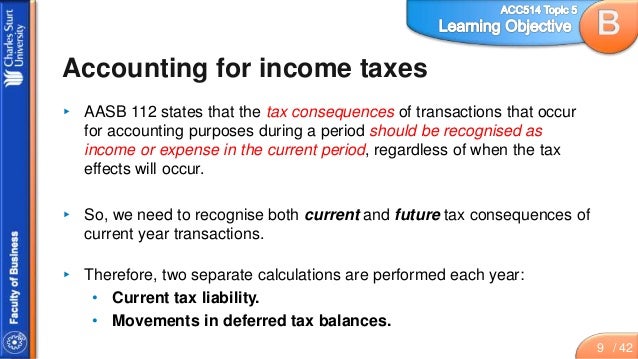

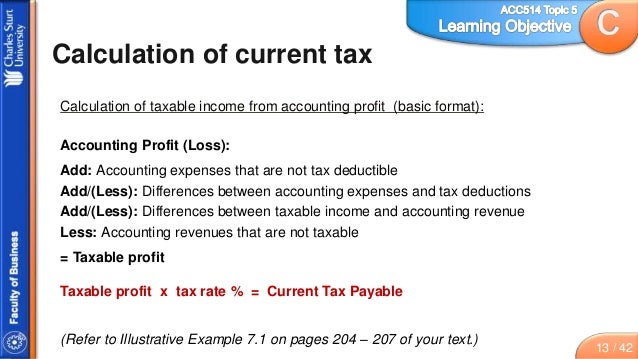

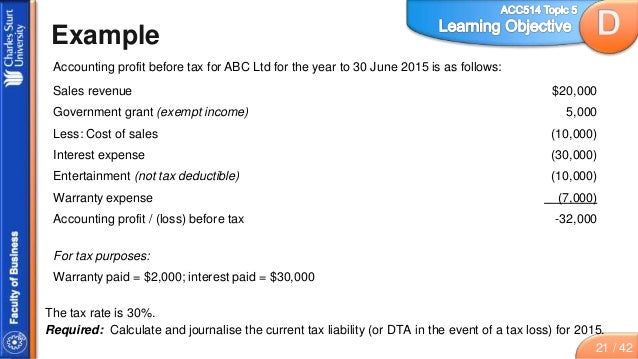

Topic 5 Slides Accounting For Income Tax From slideshare.net

Topic 5 Slides Accounting For Income Tax From slideshare.net

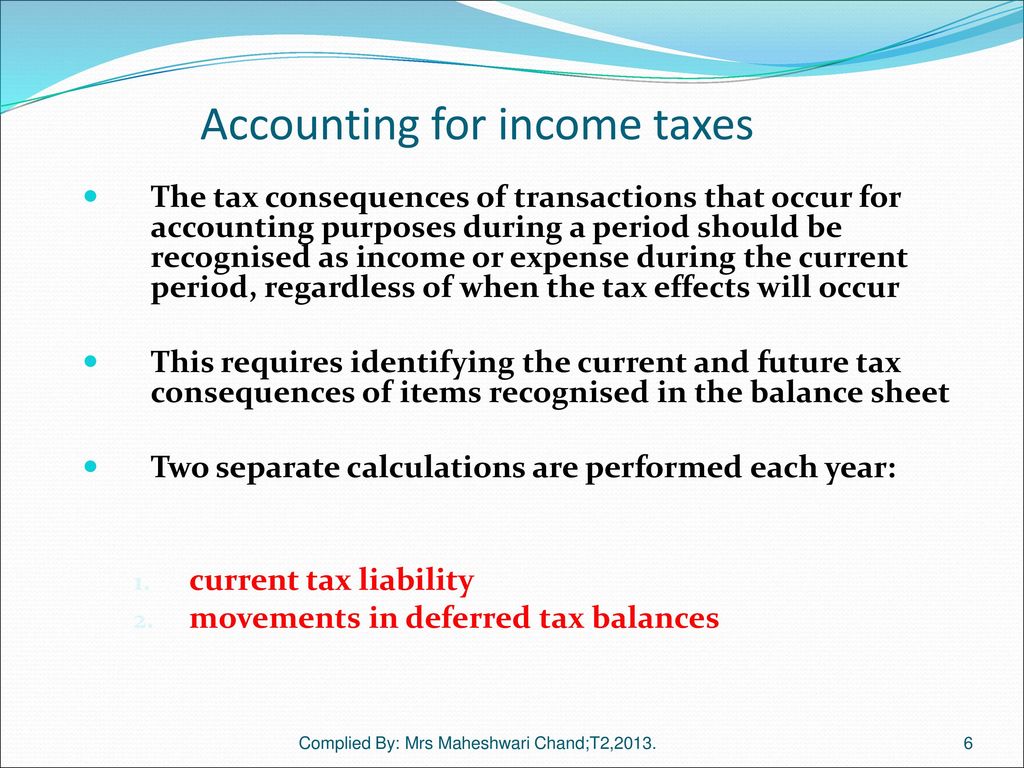

8 Endorsed Explanatory Material01 The accounting standards set out in this standard are shown in normal print. A note in the financial report shall state. Sometimes a simple Microsoft Excel spreadsheet can be more suitable. As accounting teams start working through the transition to the new leasing standard it will be important that tax is represented during the implementation process. This video discusses the difference between a temporary tax difference and a permanent tax difference. Topic 5 slides accounting for income tax 1.

Here we respond to some of the more common questions we are hearing from lessees on the tax effect accounting impact of applying AASB 16 Leases.

Typical questions in a Top 1000 streamlined assurance review At the start of a Streamlined Assurance Review we need to gather the evidence to ensure that you are paying the right amount of tax. Deferred tax assets The amounts of. Income Tax Tax-effect Accounting. Topic 5 slides accounting for income tax 1. Apart from any fair dealing for the purposes of private study research criticism or review. Tax-effect accounting in Australia.

Source: slidetodoc.com

Source: slidetodoc.com

42 Slides by Miranda Dyason adapted from Understanding Australian Accounting Standards instructor resources prepared by Kent Wilson Topic 5. Part A MAGNET LTD Calculation of deferred tax as at 30 June 2013 Carrying Amount Tax Base TTD DTD Assets. This video discusses the difference between a temporary tax difference and a permanent tax difference. A note in the financial report shall state. Determine your starting balances at the beginning of the 2005 financial.

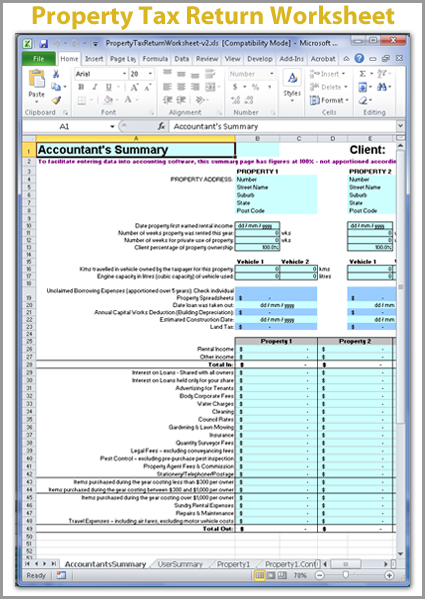

Spreadsheets for record keeping Its not always necessary to purchase and install complicated accounting package programs when starting up a business. Part A MAGNET LTD Calculation of deferred tax as at 30 June 2013 Carrying Amount Tax Base TTD DTD Assets. Our 2019 Tax Effect Accounting TEA webinar series presented by Alistair Hutson Corporate Tax Partner has been specifically designed for financial and tax professionals involved in the preparation or review of TEA balances. Deferred tax assets The amounts of. 2012 Problem question 613.

Source: studocu.com

Source: studocu.com

Australia Accounting Audit Corporate Compliance Governance Financial Planning Financial Reporting Income Tax Indirect Tax Practice Management Superannuation Trusts Browse all products New Zealand Accounting Tax. As a public practitioner you will find a wealth of information relevant resources and technical guides to help you run your business according to best practice standards. Determine your starting balances at the beginning of the 2005 financial. 2012 Problem question 613. Spreadsheets for record keeping Its not always necessary to purchase and install complicated accounting package programs when starting up a business.

Current tax The amount of income taxes payable recoverable in respect of the taxable profit tax loss for a period. Accounting for SMSF income tax transactions tax effect accounting for SMSF may have two separate effects. See Six-step approachfor a detailed explanation page 16. This will also have tax effect accounting impacts. Accounting profit 80 000 Tax at the applicable rate of 30 24 000 Tax effect of non-deductible promotional expenses CU 90030 270 Increase in DTL resulting from the increase in the tax rate in step 2 above 688 Total income.

Source: slideshare.net

Source: slideshare.net

Here we respond to some of the more common questions we are hearing from lessees on the tax effect accounting impact of applying AASB 16 Leases. Our 2019 Tax Effect Accounting TEA webinar series presented by Alistair Hutson Corporate Tax Partner has been specifically designed for financial and tax professionals involved in the preparation or review of TEA balances. Current tax consequences which give rise to a current tax liability for income tax payable to the ATO Future tax consequences which give. Access tools for branding that will help promote. 2012 Problem question 613.

Source: slidetodoc.com

Source: slidetodoc.com

Such income tax expense shall be calculated on the pre-tax accounting resultprofit or loss adjusted for permanent differences if any by using the liability method of tax-effect accounting. This video discusses the difference between a temporary tax difference and a permanent tax difference. Amended by AASB 1025 para. Australia Accounting Audit Corporate Compliance Governance Financial Planning Financial Reporting Income Tax Indirect Tax Practice Management Superannuation Trusts Browse all products New Zealand Accounting Tax. Such income tax expense shall be calculated on the pre-tax accounting resultprofit or loss adjusted for permanent differences if any by using the liability method of tax-effect accounting.

Sometimes a simple Microsoft Excel spreadsheet can be more suitable. Accounting profit Profit or loss for a period before deducting tax expense. Here we respond to some of the more common questions we are hearing from lessees on the tax effect accounting impact of applying AASB 16 Leases. The endorsed explanatory material is printed. Accounting for income 2.

Source: slideshare.net

Source: slideshare.net

Here we respond to some of the more common questions we are hearing from lessees on the tax effect accounting impact of applying AASB 16 Leases. Current tax The amount of income taxes payable recoverable in respect of the taxable profit tax loss for a period. As accounting teams start working through the transition to the new leasing standard it will be important that tax is represented during the implementation process. Here we respond to some of the more common questions we are hearing from lessees on the tax effect accounting impact of applying AASB 16 Leases. As a public practitioner you will find a wealth of information relevant resources and technical guides to help you run your business according to best practice standards.

Source: slidetodoc.com

Source: slidetodoc.com

To make the transition to the new accounting. Parts A and B. Here we respond to some of the more common questions we are hearing from lessees on the tax effect accounting impact of applying AASB 16 Leases. Get the right tools and help manage the rate. 8 Endorsed Explanatory Material01 The accounting standards set out in this standard are shown in normal print.

Source: slidetodoc.com

Source: slidetodoc.com

See Six-step approachfor a detailed explanation page 16. Topic 5 slides accounting for income tax 1. Amended by AASB 1025 para. 3 DICLARAllOH I certify that this thesis does not incorporate without acknowledgment any material previously submitted for a degree or diploma in any institution of higher person except Alan. Part A MAGNET LTD Calculation of deferred tax as at 30 June 2013 Carrying Amount Tax Base TTD DTD Assets.

Source: slideplayer.com

Source: slideplayer.com

Here we respond to some of the more common questions we are hearing from lessees on the tax effect accounting impact of applying AASB 16 Leases. Part A MAGNET LTD Calculation of deferred tax as at 30 June 2013 Carrying Amount Tax Base TTD DTD Assets. Tax effect accounting workbook presentation 1500 non member price shopping_cart Add to cart Disclaimer These materials are copyright. Here we respond to some of the more common questions we are hearing from lessees on the tax effect accounting impact of applying AASB 16 Leases. Access tools for branding that will help promote.

Source: slideshare.net

Source: slideshare.net

Spreadsheets for record keeping Its not always necessary to purchase and install complicated accounting package programs when starting up a business. Income Tax Tax-effect Accounting. Here we respond to some of the more common questions we are hearing from lessees on the tax effect accounting impact of applying AASB 16 Leases. Tax Effect Accounting Toolkitto derive these balances. Deferred tax assets The amounts of.

Tax Effect Accounting Toolkitto derive these balances. Current tax consequences which give rise to a current tax liability for income tax payable to the ATO Future tax consequences which give. 3 DICLARAllOH I certify that this thesis does not incorporate without acknowledgment any material previously submitted for a degree or diploma in any institution of higher person except Alan. Get the right tools and help manage the rate. Thomson Reuters Australia simplifies the lives of tax and accounting professionals as we deliver the most comprehensive solutions to you.

Source: slidetodoc.com

Source: slidetodoc.com

Such income tax expense shall be calculated on the pre-tax accounting resultprofit or loss adjusted for permanent differences if any by using the liability method of tax-effect accounting. Current tax The amount of income taxes payable recoverable in respect of the taxable profit tax loss for a period. Our 2019 Tax Effect Accounting TEA webinar series presented by Alistair Hutson Corporate Tax Partner has been specifically designed for financial and tax professionals involved in the preparation or review of TEA balances. Tax effect accounting workbook presentation 1500 non member price shopping_cart Add to cart Disclaimer These materials are copyright. This video discusses the difference between a temporary tax difference and a permanent tax difference.

Source: slideplayer.com

Source: slideplayer.com

Embrace technology to future proof your practice. The endorsed explanatory material is printed. 2012 Problem question 613. Accounting for income 2. 8 Endorsed Explanatory Material01 The accounting standards set out in this standard are shown in normal print.

Parts A and B. Extra tax-effect 1 Deferred tax worksheet and adjusting entries Leo et al. Tax differences arise because book income income co. Accounting for SMSF income tax transactions tax effect accounting for SMSF may have two separate effects. Here we respond to some of the more common questions we are hearing from lessees on the tax effect accounting impact of applying AASB 16 Leases.

Source: bantacs.com.au

Source: bantacs.com.au

3 DICLARAllOH I certify that this thesis does not incorporate without acknowledgment any material previously submitted for a degree or diploma in any institution of higher person except Alan. As a public practitioner you will find a wealth of information relevant resources and technical guides to help you run your business according to best practice standards. In our first request for. Thomson Reuters Australia simplifies the lives of tax and accounting professionals as we deliver the most comprehensive solutions to you. Amended by AASB 1025 para.

Source: slidetodoc.com

Source: slidetodoc.com

Accounting for income 2. Income Tax Tax-effect Accounting. Apart from any fair dealing for the purposes of private study research criticism or review. 3 DICLARAllOH I certify that this thesis does not incorporate without acknowledgment any material previously submitted for a degree or diploma in any institution of higher person except Alan. Tax effect accounting workbook presentation 1500 non member price shopping_cart Add to cart Disclaimer These materials are copyright.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title tax effect accounting worksheet australia by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.