Your What is under misc expenses on a worksheet for accounting images are available in this site. What is under misc expenses on a worksheet for accounting are a topic that is being searched for and liked by netizens now. You can Download the What is under misc expenses on a worksheet for accounting files here. Find and Download all royalty-free photos and vectors.

If you’re looking for what is under misc expenses on a worksheet for accounting images information connected with to the what is under misc expenses on a worksheet for accounting keyword, you have pay a visit to the right site. Our site frequently provides you with suggestions for seeing the maximum quality video and image content, please kindly hunt and locate more enlightening video articles and graphics that match your interests.

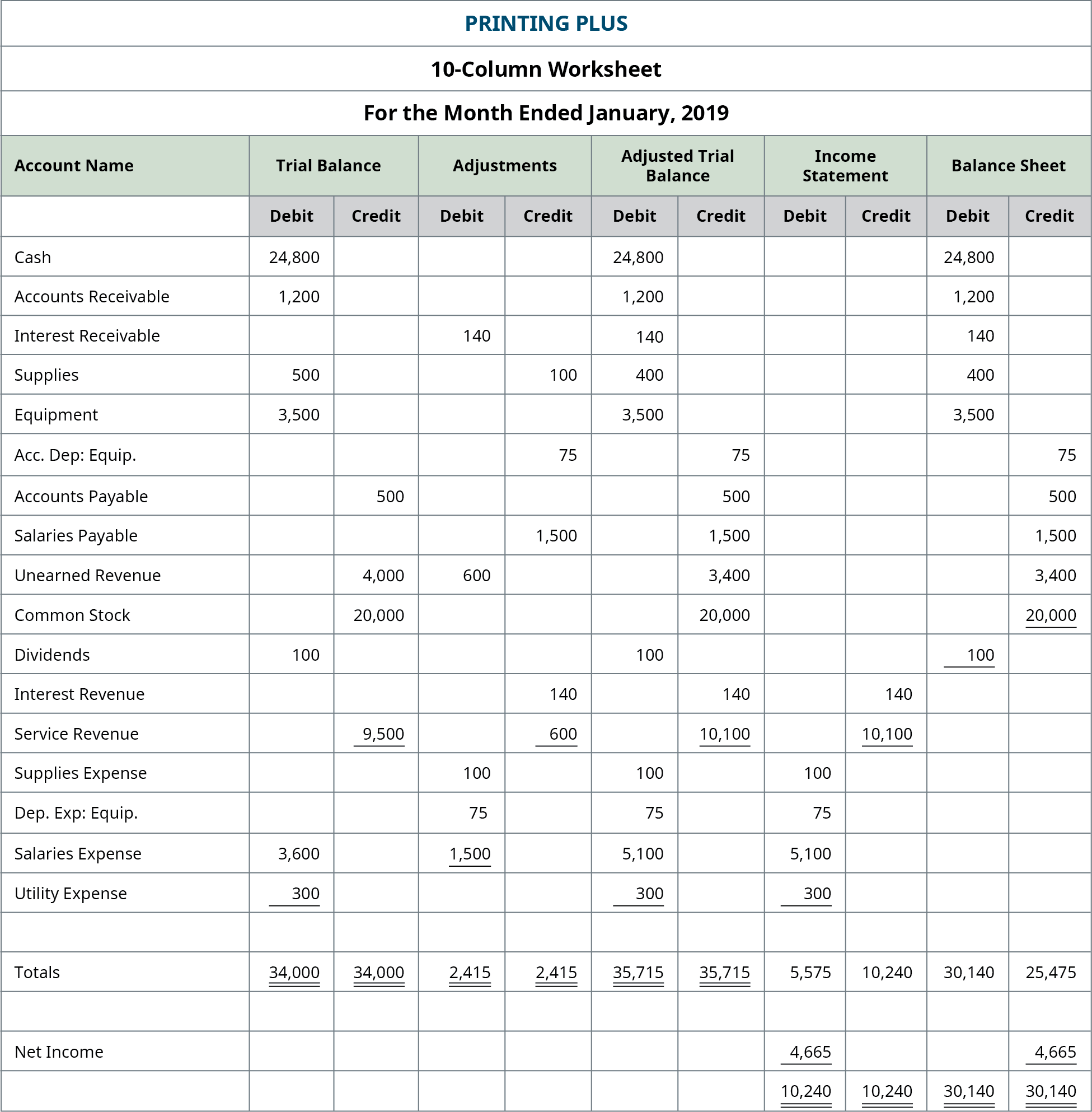

What Is Under Misc Expenses On A Worksheet For Accounting. If you need us to prepare any financial reports please see our list of items we will need under our Accounting tab. You may have others. False The balance of the Merchandise Inventory account that appears in the Trial Balance section of the worksheet represents the stock of goods on hand at the beginning of the current period. Prepaid expenses represent expenditures that have not yet been recorded by a company as an expense but have been paid in advance.

Expense Trackers The Top Six Tools For Small Businesses Bench Accounting Bookkeeping Templates Small Business Bookkeeping Spreadsheet Template From pinterest.com

Expense Trackers The Top Six Tools For Small Businesses Bench Accounting Bookkeeping Templates Small Business Bookkeeping Spreadsheet Template From pinterest.com

Debits and Credits 03. Use this list to help organize your photographer tax preparation. Under the accrual basis of accounting an expense is recorded as noted above when there is a reduction in the value of an asset irrespective of any related cash outflow. Accounting Tutorials Accounting Articles Accounting Tests Accounting Dictionary My Studyboard Join Now How to accrue for and record utility expenses 21. While accounting software wont be much help if bills arent posted to the correct expense account it can go a long way in helping you categorize and track your expenses throughout the year. There are always things like this that come up.

In other What are Prepaid Expenses.

If you need us to prepare any financial reports please see our list of items we will need under our Accounting tab. Seems like these would be a pretty standard expenses in 2016 for my business and cant find it. If these expenses increase in size and usage then the misc. Prepaid expenses represent expenditures that have not yet been recorded by a company as an expense but have been paid in advance. This is a basic list of typical expenses incurred by photographers. O You must issue a 1099-Misc to o Did you.

Source: pinterest.com

Source: pinterest.com

Use this list to help organize your photographer tax preparation. 13 Merchandise inventory account under periodic inventory system is only adjusted at the end of the period - when inventory count had already been done. Developing good record-keeping and accounting habits is essential for 1099 workers. Tax Deductible Expenses for Photographers Photographers. Accounting for Expenses Under cash basis accounting an expense is usually recorded only when a cash payment has been made to a supplier or an employee.

Source: pinterest.com

Source: pinterest.com

Adjustments to Expenses This worksheet provides for adjustments to remove nonallowable expenses and offset nonpatient care revenue Adjustments increase or decrease reimbursable costs equal to the. Even though I budget for a certain amount of miscellaneous expenses it seems like this amount always ends up being larger than what I was expecting it to be. Accounting for Expenses Under cash basis accounting an expense is usually recorded only when a cash payment has been made to a supplier or an employee. In accounting the terms sales and that a company has earned but has yet to receive payment for and the expenses Fixed and Variable Costs Cost is something that can be classified in several ways depending on its nature. In other What are Prepaid Expenses.

Source: pinterest.com

Source: pinterest.com

If these expenses increase in size and usage then the misc. Trying to figure out the best category for softwarecloud expenses website hosting etc. Follow these tips to improve your approach to accounting and position your business for financial success. Developing good record-keeping and accounting habits is essential for 1099 workers. The account Miscellaneous Expenses should be used as the last resort.

Source: pinterest.com

Source: pinterest.com

Even though I budget for a certain amount of miscellaneous expenses it seems like this amount always ends up being larger than what I was expecting it to be. Use this list to help organize your photographer tax preparation. This is a basic list of typical expenses incurred by photographers. 13 Merchandise inventory account under periodic inventory system is only adjusted at the end of the period - when inventory count had already been done. If you need us to prepare any financial reports please see our list of items we will need under our Accounting tab.

Source: pinterest.com

Source: pinterest.com

Under the accrual basis of accounting an expense is recorded as noted above when there is a reduction in the value of an asset irrespective of any related cash outflow. You may have others. 13 Merchandise inventory account under periodic inventory system is only adjusted at the end of the period - when inventory count had already been done. While accounting software wont be much help if bills arent posted to the correct expense account it can go a long way in helping you categorize and track your expenses throughout the year. Definition of Miscellaneous Expense In accounting miscellaneous expense may refer to a general ledger account in which small infrequent transaction amounts are recorded.

Source: pinterest.com

Source: pinterest.com

O You must issue a 1099-Misc to o Did you. An expenditure is recorded at a single point in that have not yet been. False The balance of the Merchandise Inventory account that appears in the Trial Balance section of the worksheet represents the stock of goods on hand at the beginning of the current period. Prepaid expenses represent expenditures that have not yet been recorded by a company as an expense but have been paid in advance. Expense should be given its own account.

Source: pinterest.com

Source: pinterest.com

If these expenses increase in size and usage then the misc. Expense should be given its own account. Use this list to help organize your photographer tax preparation. Businesses keep various types of journals and ledgers for accounting purposes and financial record keeping. The main purpose of a worksheet is that it reduces the likelyhood of forgeting an adjustment and it reveals arithmatic errors.

Source: pinterest.com

Source: pinterest.com

For example the small bank fees would be better record. If you need us to prepare any financial reports please see our list of items we will need under our Accounting tab. Accounting for Expenses Under cash basis accounting an expense is usually recorded only when a cash payment has been made to a supplier or an employee. Note make sure to add link Copies of any 1099-Misc you issued. Expenses TurboTaxs instructions say Supply expenses are incidental items that cost 200 or less or last less than a year - which to me makes it sound like supplies can be virtually anything except inventory or items over 200.

Source: opentextbc.ca

Source: opentextbc.ca

Seems like these would be a pretty standard expenses in 2016 for my business and cant find it. While accounting software wont be much help if bills arent posted to the correct expense account it can go a long way in helping you categorize and track your expenses throughout the year. There are always things like this that come up. Prepaid expenses represent expenditures that have not yet been recorded by a company as an expense but have been paid in advance. Under the accrual basis of accounting an expense is recorded as noted above when there is a reduction in the value of an asset irrespective of any related cash outflow.

Source: pinterest.com

Source: pinterest.com

O You must issue a 1099-Misc to o Did you. Developing good record-keeping and accounting habits is essential for 1099 workers. Debits and Credits 03. While accounting software wont be much help if bills arent posted to the correct expense account it can go a long way in helping you categorize and track your expenses throughout the year. Prepaid expenses represent expenditures Expenditure An expenditure represents a payment with either cash or credit to purchase goods or services.

Source: ar.pinterest.com

Source: ar.pinterest.com

Chart of Accounts 04. While accounting software wont be much help if bills arent posted to the correct expense account it can go a long way in helping you categorize and track your expenses throughout the year. Keep proper records Your 1099 form isnt the only form 1099 workers. Accounting for Expenses Under cash basis accounting an expense is usually recorded only when a cash payment has been made to a supplier or an employee. Note make sure to add link Copies of any 1099-Misc you issued.

Source: pinterest.com

Source: pinterest.com

Accounting for Expenses Under cash basis accounting an expense is usually recorded only when a cash payment has been made to a supplier or an employee. Chart of Accounts 04. The main purpose of a worksheet is that it reduces the likelyhood of forgeting an adjustment and it reveals arithmatic errors. This is because the burden is on you not an employer to complete most accounting tasks. 13 Merchandise inventory account under periodic inventory system is only adjusted at the end of the period - when inventory count had already been done.

Source: pinterest.com

Source: pinterest.com

Seems like these would be a pretty standard expenses in 2016 for my business and cant find it. If these expenses increase in size and usage then the misc. Definition of Miscellaneous Expense In accounting miscellaneous expense may refer to a general ledger account in which small infrequent transaction amounts are recorded. Note make sure to add link Copies of any 1099-Misc you issued. Keep proper records Your 1099 form isnt the only form 1099 workers.

Source: pinterest.com

Source: pinterest.com

Accounting Tutorials Accounting Articles Accounting Tests Accounting Dictionary My Studyboard Join Now How to accrue for and record utility expenses 21. Under the accrual basis of accounting an expense is recorded as noted above when there is a reduction in the value of an asset irrespective of any related cash outflow. It seems like Im always struggling over whether to put small expenses under Supplies or Other Misc. In accounting the terms sales and that a company has earned but has yet to receive payment for and the expenses Fixed and Variable Costs Cost is something that can be classified in several ways depending on its nature. 13 Merchandise inventory account under periodic inventory system is only adjusted at the end of the period - when inventory count had already been done.

Source: pinterest.com

Source: pinterest.com

Tax Deductible Expenses for Photographers Photographers. Debits and Credits 03. Use this list to help organize your photographer tax preparation. Definition of Miscellaneous Expense In accounting miscellaneous expense may refer to a general ledger account in which small infrequent transaction amounts are recorded. Sometimes the miscellaneous expenses are unexpected expenses that happen that I wasnt planning on.

Source: pinterest.com

Source: pinterest.com

In other What are Prepaid Expenses. An expenditure is recorded at a single point in that have not yet been. In accounting the terms sales and that a company has earned but has yet to receive payment for and the expenses Fixed and Variable Costs Cost is something that can be classified in several ways depending on its nature. Wait until actual utility bills are received to calculate the accrual amoun. The main purpose of a worksheet is that it reduces the likelyhood of forgeting an adjustment and it reveals arithmatic errors.

Source: pinterest.com

Source: pinterest.com

Follow these tips to improve your approach to accounting and position your business for financial success. Seems like these would be a pretty standard expenses in 2016 for my business and cant find it. There are always things like this that come up. 14 Cost of Goods Sold 200000 - 10000 190000 To get the cost of. Accounting for Expenses Under cash basis accounting an expense is usually recorded only when a cash payment has been made to a supplier or an employee.

Source: pinterest.com

Source: pinterest.com

Adjustments to Expenses This worksheet provides for adjustments to remove nonallowable expenses and offset nonpatient care revenue Adjustments increase or decrease reimbursable costs equal to the. Prepaid expenses represent expenditures Expenditure An expenditure represents a payment with either cash or credit to purchase goods or services. The main purpose of a worksheet is that it reduces the likelyhood of forgeting an adjustment and it reveals arithmatic errors. You may have others. Keep proper records Your 1099 form isnt the only form 1099 workers.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what is under misc expenses on a worksheet for accounting by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.