Your When doing accounting worksheet adjustment which goes on top images are available. When doing accounting worksheet adjustment which goes on top are a topic that is being searched for and liked by netizens now. You can Find and Download the When doing accounting worksheet adjustment which goes on top files here. Download all free images.

If you’re looking for when doing accounting worksheet adjustment which goes on top pictures information linked to the when doing accounting worksheet adjustment which goes on top keyword, you have pay a visit to the right site. Our site always gives you hints for seeking the maximum quality video and image content, please kindly search and locate more informative video articles and images that fit your interests.

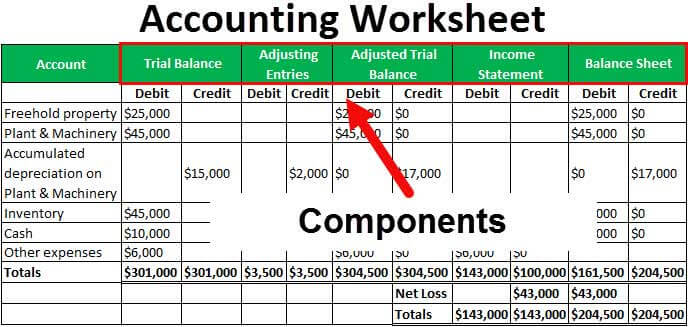

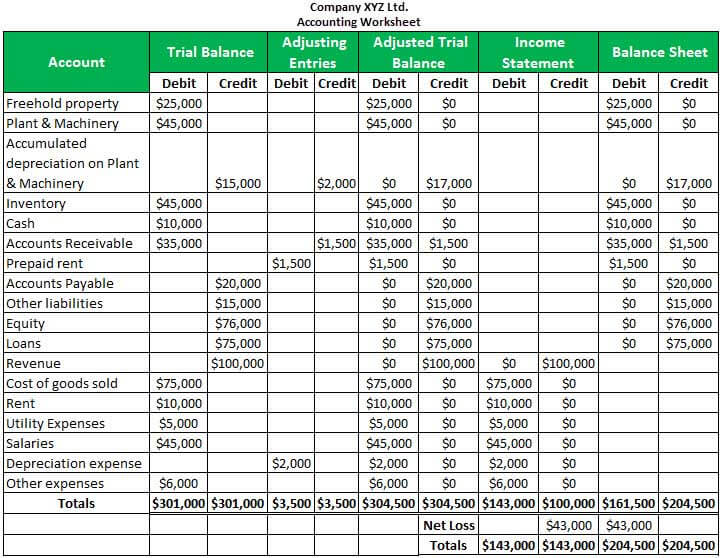

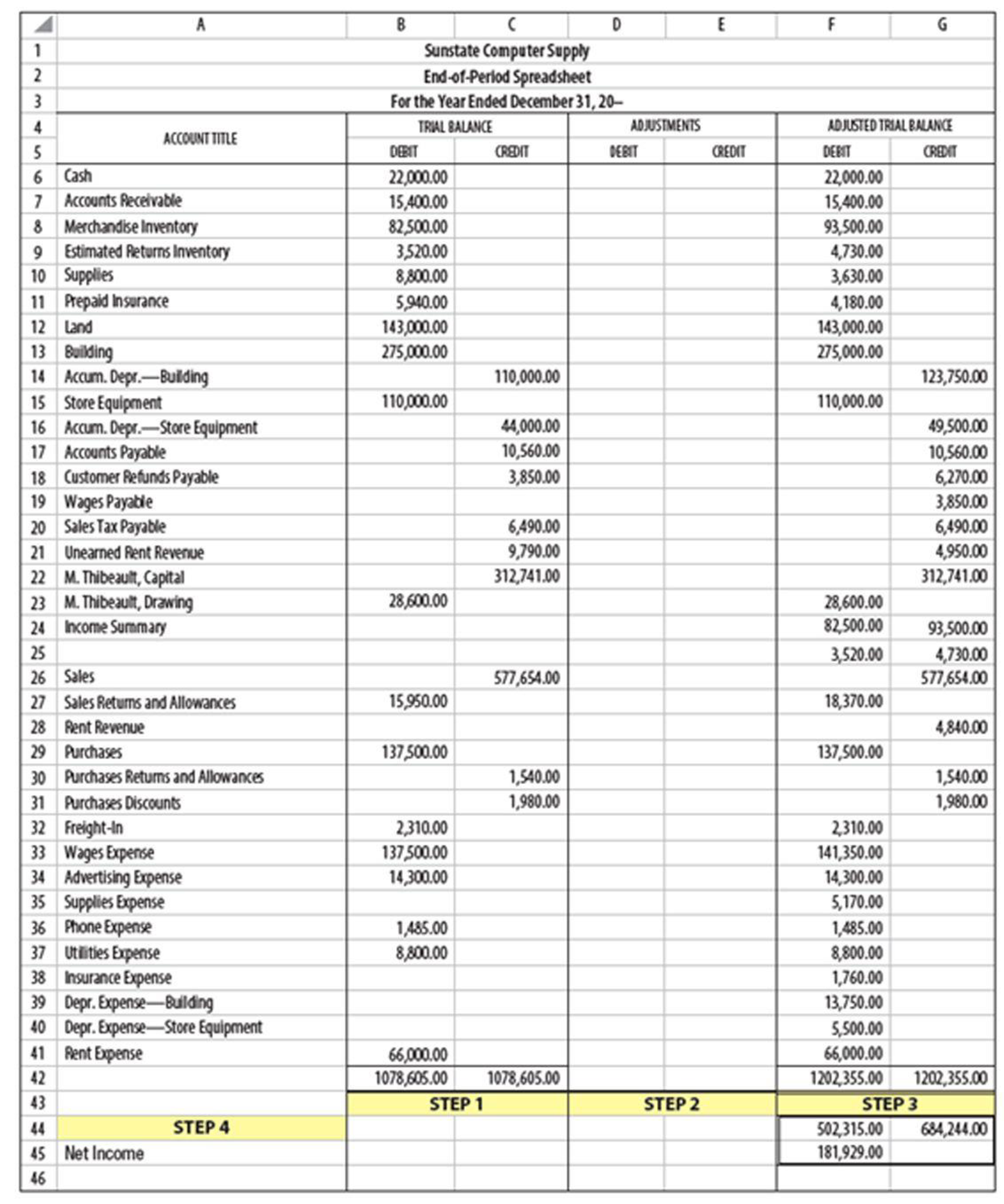

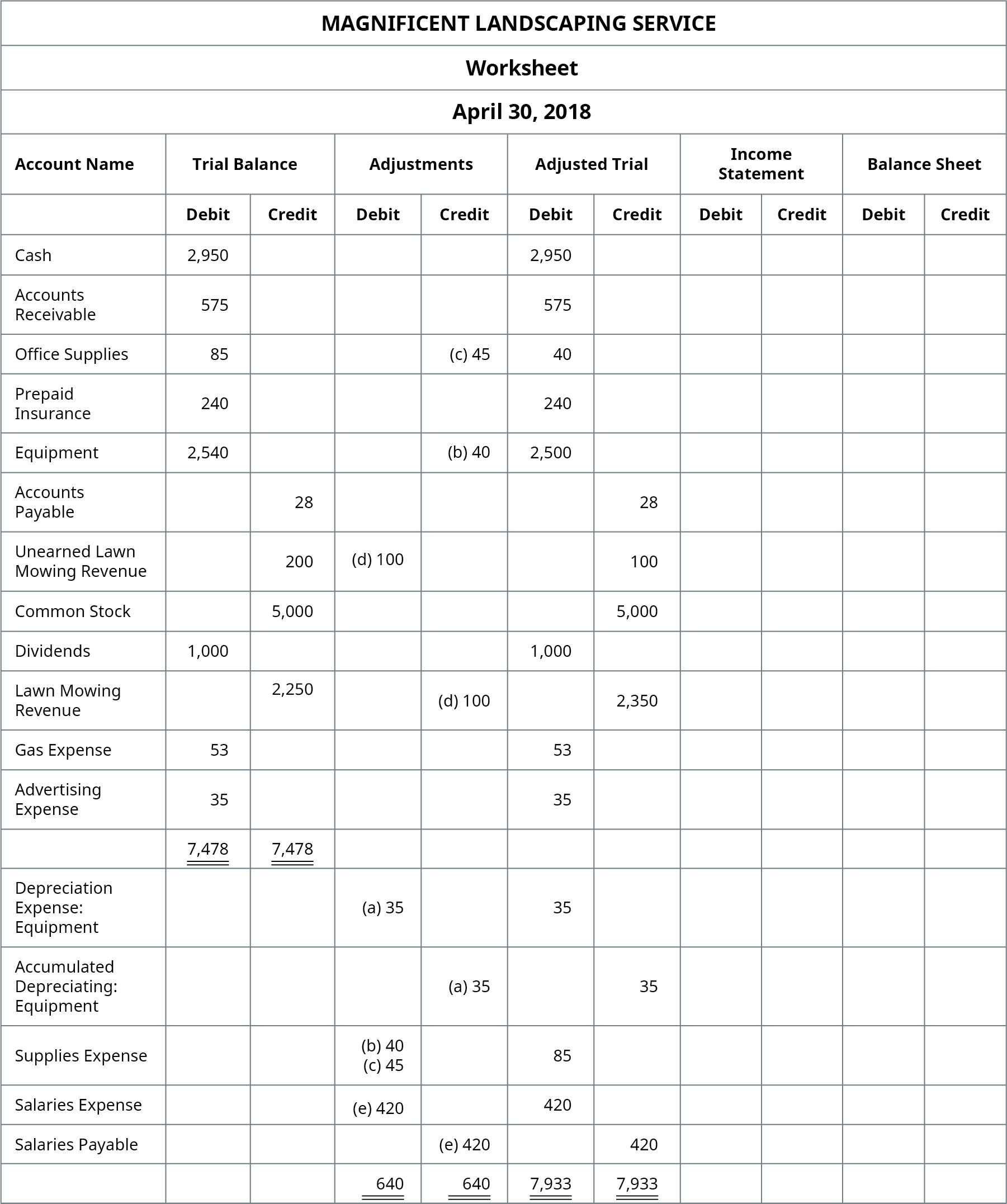

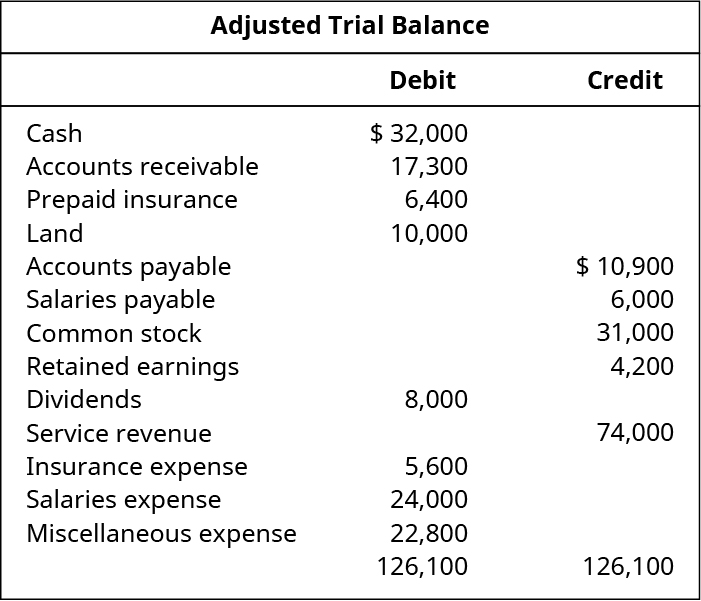

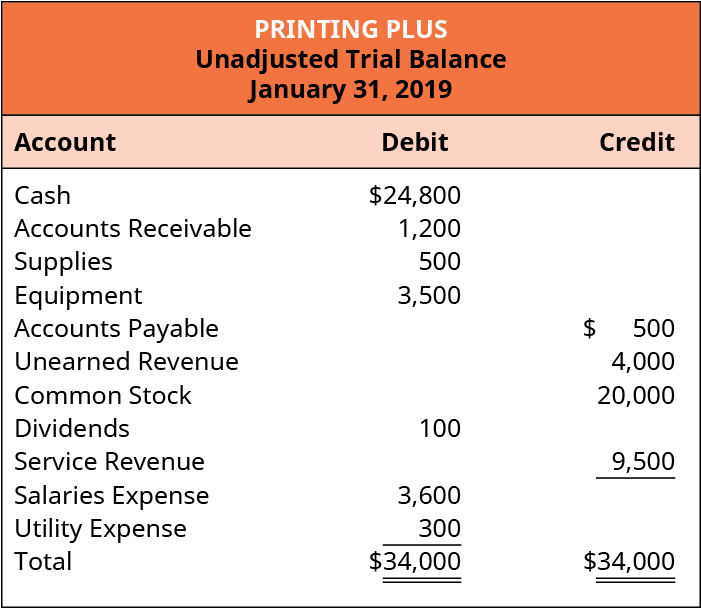

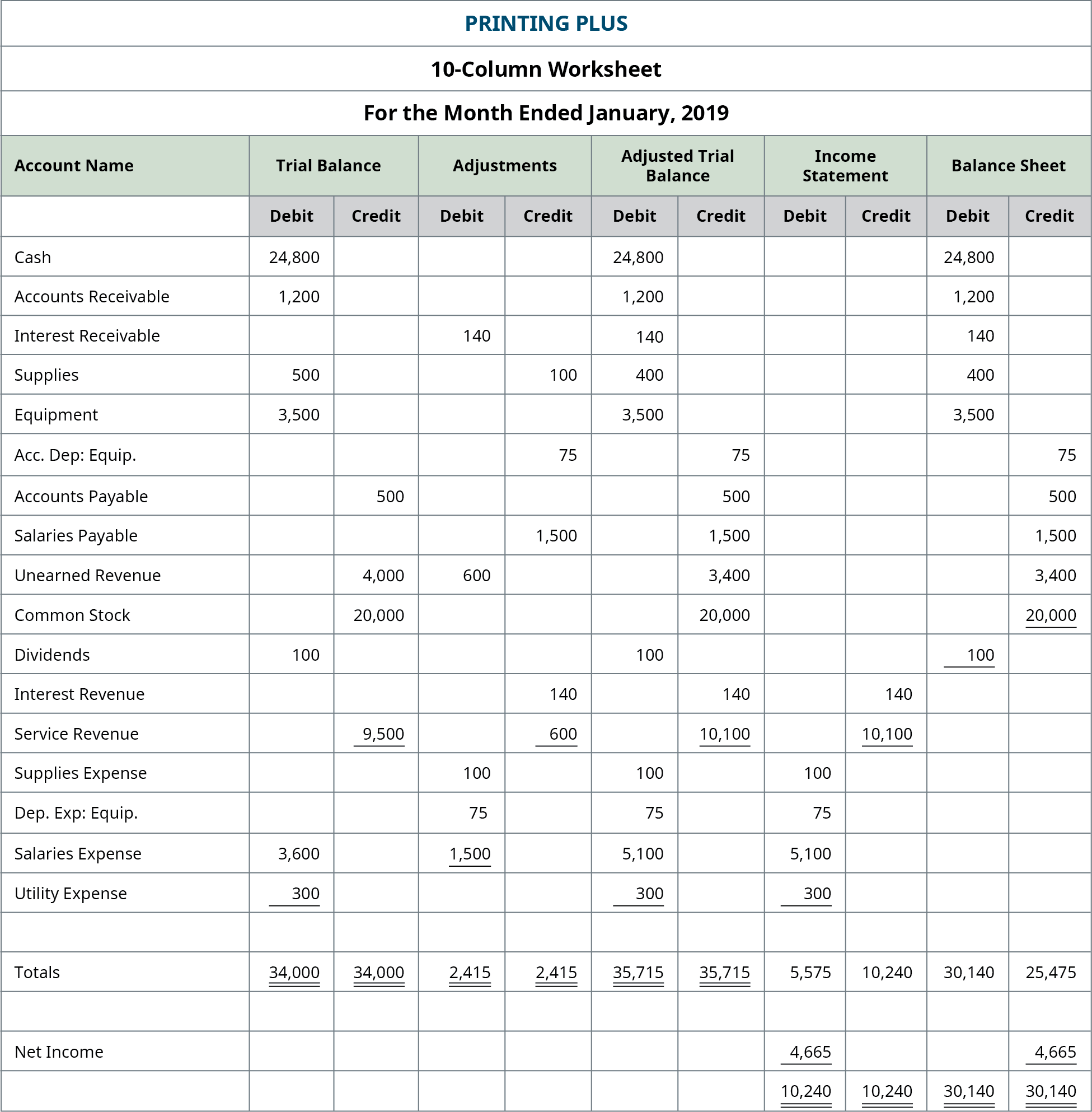

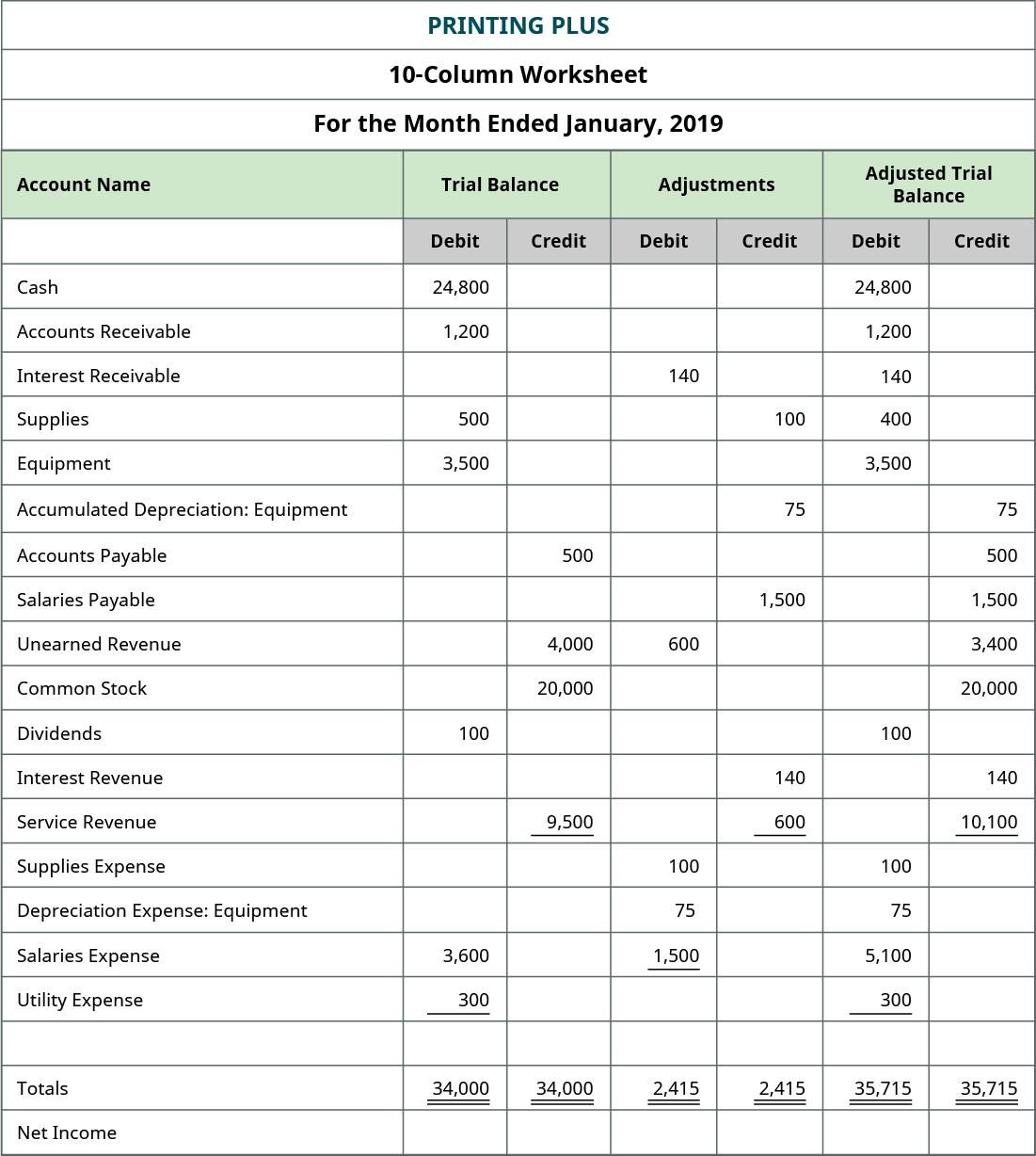

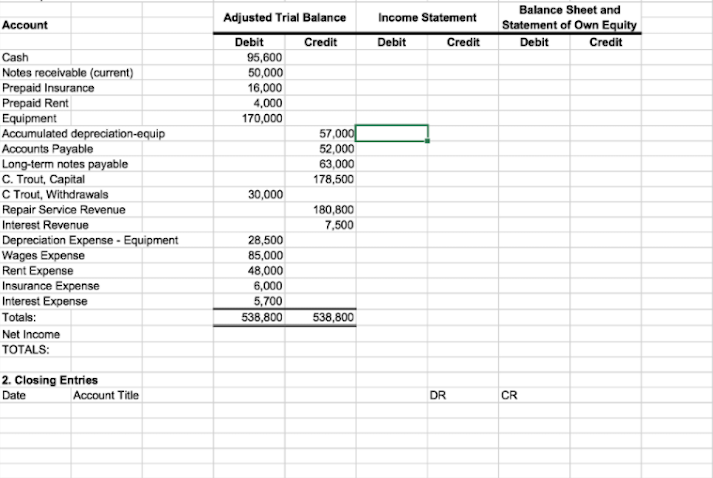

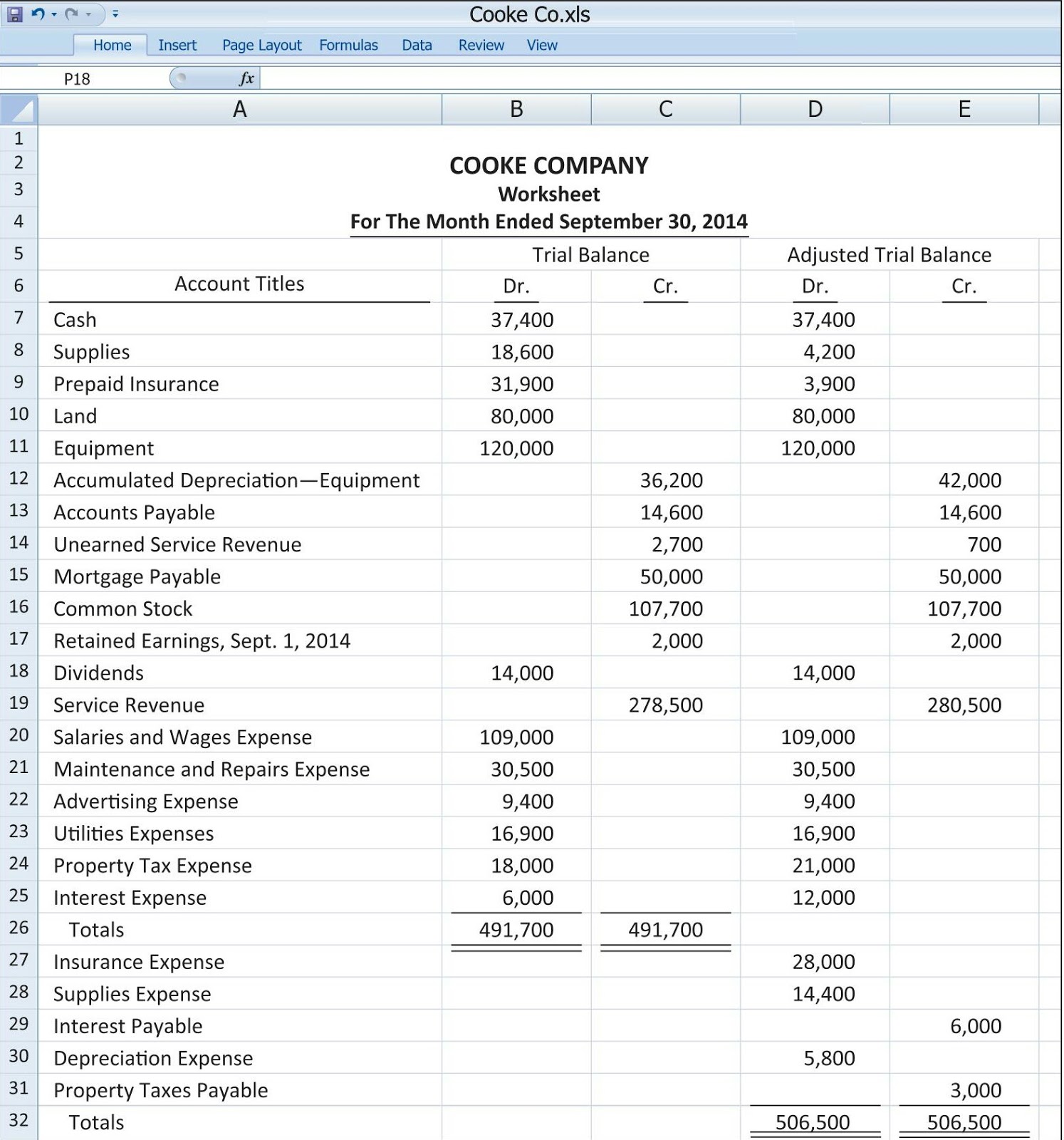

When Doing Accounting Worksheet Adjustment Which Goes On Top. Companies that make up a business combination frequently retain their legal identities as separate operating centers and maintain their own record-keeping. Whenever you record your accounting journal transactions they should be done in real time. The purpose of adjusting entries is to show when the money was officially transferred and to convert your real-time entries to entries that accurately reflect your accrual. The worksheet is a tool for creating a trial balance and an adjusted trial balance.

Adjusted Trial Balance Worksheet Template Trial Balance Worksheet Template Balance Sheet Template From in.pinterest.com

Adjusted Trial Balance Worksheet Template Trial Balance Worksheet Template Balance Sheet Template From in.pinterest.com

Bookkeepers Adjusting entries will play different roles in your life depending on which type of bookkeeping system you have in place. The seller duly records revenue and the buyer simultaneously enters the purchase into its accounts. Thus inventory sales between these companies trigger the independent accounting systems of both parties. Following are some of the most common transactions that are dealt with as. The worksheet is a tool for creating a trial balance and an adjusted trial balance. The balance of Accounts Receivable is increased to 3700 ie.

The worksheet is a tool for creating a trial balance and an adjusted trial balance.

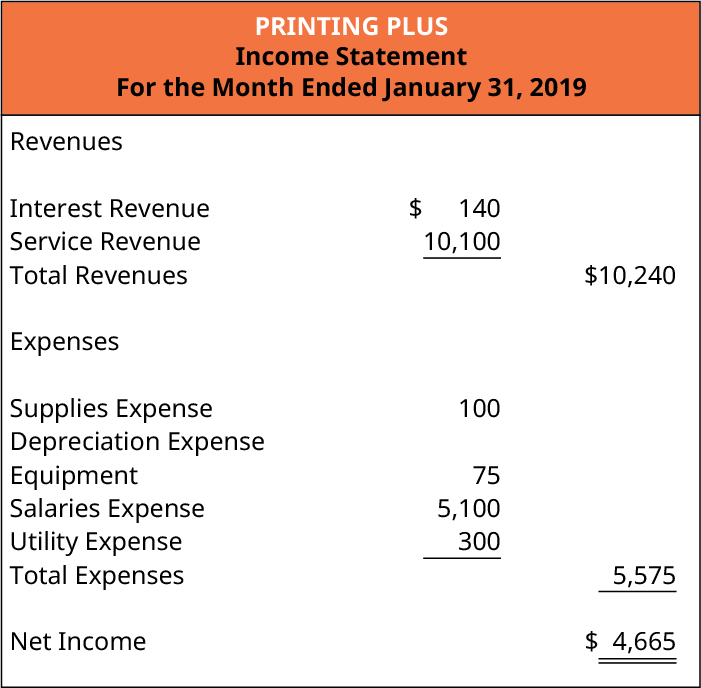

Service Revenue will now be 9850 from the unadjusted balance of 9550. Chart of Accounts 04. Before accounting software people had to do all of their accounting manually using something called the accounting cycle. The purpose of adjusting entries is to show when the money was officially transferred and to convert your real-time entries to entries that accurately reflect your accrual. For example if you have just discovered that you need to change the quantity of items on hand then this is a possible method you can. Following are some of the most common transactions that are dealt with as.

Source: understand-accounting.net

Source: understand-accounting.net

Learn vocabulary terms and more with flashcards games and other study tools. The worksheet is a tool for creating a trial balance and an adjusted trial balance. It uses all of the accounts contained in the companys accounting records records adjusting entries and calculates the final numbers to enter on the. Start studying Accounting Chapter 6. The balance of Accounts Receivable is increased to 3700 ie.

Source: opentextbc.ca

Source: opentextbc.ca

If you do your own bookkeeping using spreadsheets its up to you to handle all the adjusting entries for your books. Inventory Adjustments can be used to modify the value andor quantity of stock in your business. It uses all of the accounts contained in the companys accounting records records adjusting entries and calculates the final numbers to enter on the. All general ledger accounts are listed in the Trial Balance columns of a work sheet even if some accounts do not. Companies that make up a business combination frequently retain their legal identities as separate operating centers and maintain their own record-keeping.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

The purpose of adjusting entries is to show when the money was officially transferred and to convert your real-time entries to entries that accurately reflect your accrual. Adjustment being an accouting transaction which has not yet been journalised theoretically any accounting transaction may have to be adjusted. Bookkeepers Adjusting entries will play different roles in your life depending on which type of bookkeeping system you have in place. The most important part of the accounting cycle is the trial balance a magical document that lets you see all and we mean all of your business financial information in one place create financial statements and automatically detect any mistakes in your accounting. Learn vocabulary terms and more with flashcards games and other study tools.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

Before accounting software people had to do all of their accounting manually using something called the accounting cycle. The seller duly records revenue and the buyer simultaneously enters the purchase into its accounts. Inventory Adjustments can be used to modify the value andor quantity of stock in your business. Chart of Accounts 04. The purpose of adjusting entries is to show when the money was officially transferred and to convert your real-time entries to entries that accurately reflect your accrual.

Source: bartleby.com

Source: bartleby.com

Inventory Adjustments can be used to modify the value andor quantity of stock in your business. For example if you have just discovered that you need to change the quantity of items on hand then this is a possible method you can. Bookkeepers Adjusting entries will play different roles in your life depending on which type of bookkeeping system you have in place. Thus inventory sales between these companies trigger the independent accounting systems of both parties. The worksheet is a tool for creating a trial balance and an adjusted trial balance.

Source: opentextbc.ca

Source: opentextbc.ca

The balance of Accounts Receivable is increased to 3700 ie. 3400 unadjusted balance plus 300 adjustment. The most important part of the accounting cycle is the trial balance a magical document that lets you see all and we mean all of your business financial information in one place create financial statements and automatically detect any mistakes in your accounting. Inventory Adjustments can be used to modify the value andor quantity of stock in your business. Following are some of the most common transactions that are dealt with as.

Source: opentextbc.ca

Source: opentextbc.ca

The balance of Accounts Receivable is increased to 3700 ie. Start studying Accounting Chapter 6. Following are some of the most common transactions that are dealt with as. Learn vocabulary terms and more with flashcards games and other study tools. Whenever you record your accounting journal transactions they should be done in real time.

Source: opentextbc.ca

Source: opentextbc.ca

Learn vocabulary terms and more with flashcards games and other study tools. Whenever you record your accounting journal transactions they should be done in real time. 27 行 Accounting Worksheet An accounting worksheet is large table of data which. For example if you have just discovered that you need to change the quantity of items on hand then this is a possible method you can. The purpose of adjusting entries is to show when the money was officially transferred and to convert your real-time entries to entries that accurately reflect your accrual.

Source: understand-accounting.net

Source: understand-accounting.net

Following are some of the most common transactions that are dealt with as. If youre using an accrual accounting system money doesnt necessarily change hands at that time of the accounting entry. Bookkeepers Adjusting entries will play different roles in your life depending on which type of bookkeeping system you have in place. Companies that make up a business combination frequently retain their legal identities as separate operating centers and maintain their own record-keeping. 3400 unadjusted balance plus 300 adjustment.

Source: angellanto.wixsite.com

Source: angellanto.wixsite.com

The seller duly records revenue and the buyer simultaneously enters the purchase into its accounts. The balance of Accounts Receivable is increased to 3700 ie. Whenever you record your accounting journal transactions they should be done in real time. 3400 unadjusted balance plus 300 adjustment. Companies that make up a business combination frequently retain their legal identities as separate operating centers and maintain their own record-keeping.

Source: chegg.com

Source: chegg.com

3400 unadjusted balance plus 300 adjustment. Following are some of the most common transactions that are dealt with as. 27 行 Accounting Worksheet An accounting worksheet is large table of data which. Companies that make up a business combination frequently retain their legal identities as separate operating centers and maintain their own record-keeping. Before accounting software people had to do all of their accounting manually using something called the accounting cycle.

Source: opentextbc.ca

Source: opentextbc.ca

Service Revenue will now be 9850 from the unadjusted balance of 9550. The balance of Accounts Receivable is increased to 3700 ie. Inventory Adjustments can be used to modify the value andor quantity of stock in your business. All general ledger accounts are listed in the Trial Balance columns of a work sheet even if some accounts do not. Before accounting software people had to do all of their accounting manually using something called the accounting cycle.

The balance of Accounts Receivable is increased to 3700 ie. Adjustment being an accouting transaction which has not yet been journalised theoretically any accounting transaction may have to be adjusted. The worksheet is a tool for creating a trial balance and an adjusted trial balance. Following are some of the most common transactions that are dealt with as. All general ledger accounts are listed in the Trial Balance columns of a work sheet even if some accounts do not.

Source: opentextbc.ca

Source: opentextbc.ca

If youre using an accrual accounting system money doesnt necessarily change hands at that time of the accounting entry. Inventory Adjustments can be used to modify the value andor quantity of stock in your business. Start studying Accounting Chapter 6. All general ledger accounts are listed in the Trial Balance columns of a work sheet even if some accounts do not. The balance of Accounts Receivable is increased to 3700 ie.

Source: in.pinterest.com

Source: in.pinterest.com

Learn vocabulary terms and more with flashcards games and other study tools. The most important part of the accounting cycle is the trial balance a magical document that lets you see all and we mean all of your business financial information in one place create financial statements and automatically detect any mistakes in your accounting. All general ledger accounts are listed in the Trial Balance columns of a work sheet even if some accounts do not. Following are some of the most common transactions that are dealt with as. Thus inventory sales between these companies trigger the independent accounting systems of both parties.

Source: fool.com

Source: fool.com

Following are some of the most common transactions that are dealt with as. If you do your own bookkeeping using spreadsheets its up to you to handle all the adjusting entries for your books. 27 行 Accounting Worksheet An accounting worksheet is large table of data which. Service Revenue will now be 9850 from the unadjusted balance of 9550. Thus inventory sales between these companies trigger the independent accounting systems of both parties.

Source: solveaccounting.blogspot.com

Source: solveaccounting.blogspot.com

All general ledger accounts are listed in the Trial Balance columns of a work sheet even if some accounts do not. The balance of Accounts Receivable is increased to 3700 ie. Thus inventory sales between these companies trigger the independent accounting systems of both parties. Whenever you record your accounting journal transactions they should be done in real time. Before accounting software people had to do all of their accounting manually using something called the accounting cycle.

Source: opentextbc.ca

Source: opentextbc.ca

The worksheet is a tool for creating a trial balance and an adjusted trial balance. Start studying Accounting Chapter 6. If youre using an accrual accounting system money doesnt necessarily change hands at that time of the accounting entry. 27 行 Accounting Worksheet An accounting worksheet is large table of data which. The most important part of the accounting cycle is the trial balance a magical document that lets you see all and we mean all of your business financial information in one place create financial statements and automatically detect any mistakes in your accounting.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title when doing accounting worksheet adjustment which goes on top by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.