Your Worksheet accounting treatment images are available. Worksheet accounting treatment are a topic that is being searched for and liked by netizens today. You can Get the Worksheet accounting treatment files here. Get all free photos.

If you’re searching for worksheet accounting treatment pictures information related to the worksheet accounting treatment interest, you have visit the right blog. Our site frequently provides you with suggestions for refferencing the maximum quality video and picture content, please kindly surf and locate more enlightening video articles and images that fit your interests.

Worksheet Accounting Treatment. Subtractions from T Total profit or loss item 6 not covered by. The pensions accounting treatment for defined benefit plans requires. In item 7 are specified under B Other assessable income and W Non-deductible expenses. Fair value hedge.

Accounting Worksheet Example Worksheets For School Financial Statement Accounting Practices Worksheets From pinterest.com

Accounting Worksheet Example Worksheets For School Financial Statement Accounting Practices Worksheets From pinterest.com

Stay tuned to BYJUS to learn. Use Worksheet 2 to help calculate the total for income-related add-back items at B Other assessable income item 7 and the total for expense-related add-back items at W Non-deductible expenses item 7. Get a profit of Y. Free Download of Basic Accounting Sample Worksheet Template Document available in PDF Google Sheet EXCEL format. Print Liabilities Contingencies. An _____ is a future sacrifice of economic benefit that arises from a past transaction or event.

Determine the fair value of the assets and liabilities of the pension plan at the end of the year Determine the amount of pension expense for the year to be reported on the income statement.

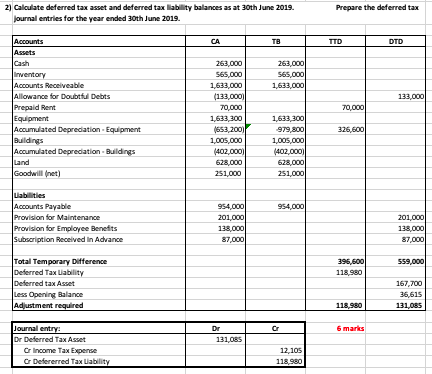

The recognition of a tax liability or tax asset based on the estimated amount of income taxes. Use these Free Templates or Examples to create the Perfect Professional Document or Project. The Accounting Equation Assets Liabilities Owners Equity means that the total assets of the business are always equal to the total liabilities plus equity of the business. Determine the fair value of the assets and liabilities of the pension plan at the end of the year Determine the amount of pension expense for the year to be reported on the income statement. Accounting Treatment- An asset that is fully depreciated and continues to be used in the business will be reported on the balance sheet at its cost along with its accumulated depreciation. The accounting for depreciation requires an ongoing series of entries to charge a fixed asset to expense and eventually to derecognize it.

Source: accountancyknowledge.com

Source: accountancyknowledge.com

For a sole trader the profit for the year is simply transferred to the credit side of the proprietors capital account the double entry is completed by a debit entry in the income. These entries are designed to reflect the ongoing usage of fixed assets over time. Subtractions from T Total profit or loss item 6 not covered by. An _____ is a future sacrifice of economic benefit that arises from a past transaction or event. The pensions accounting treatment for defined benefit plans requires.

Source: iedunote.com

Source: iedunote.com

Fair value hedge. The Accounting Equation Assets Liabilities Owners Equity means that the total assets of the business are always equal to the total liabilities plus equity of the business. These entries are designed to reflect the ongoing usage of fixed assets over time. For example although the accounting treatment under FRS 101 is broadly the same as IFRS there are fewer disclosure. Use these Free Templates or Examples to create the Perfect Professional Document or Project.

Source: slideplayer.com

Source: slideplayer.com

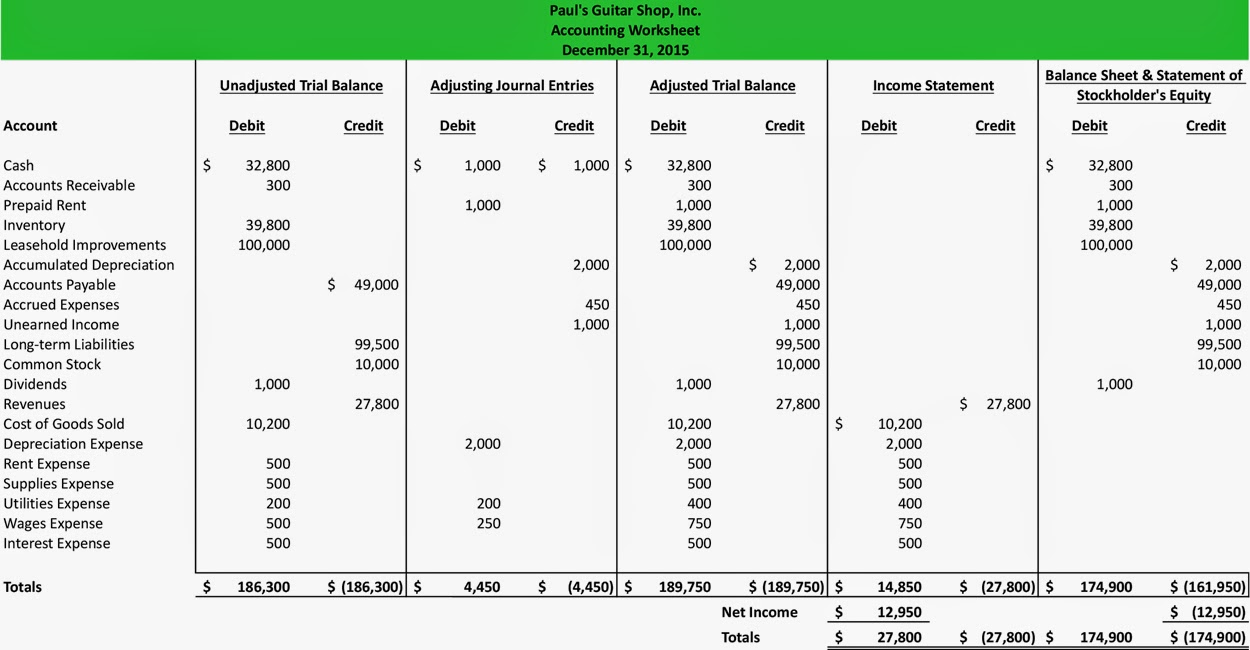

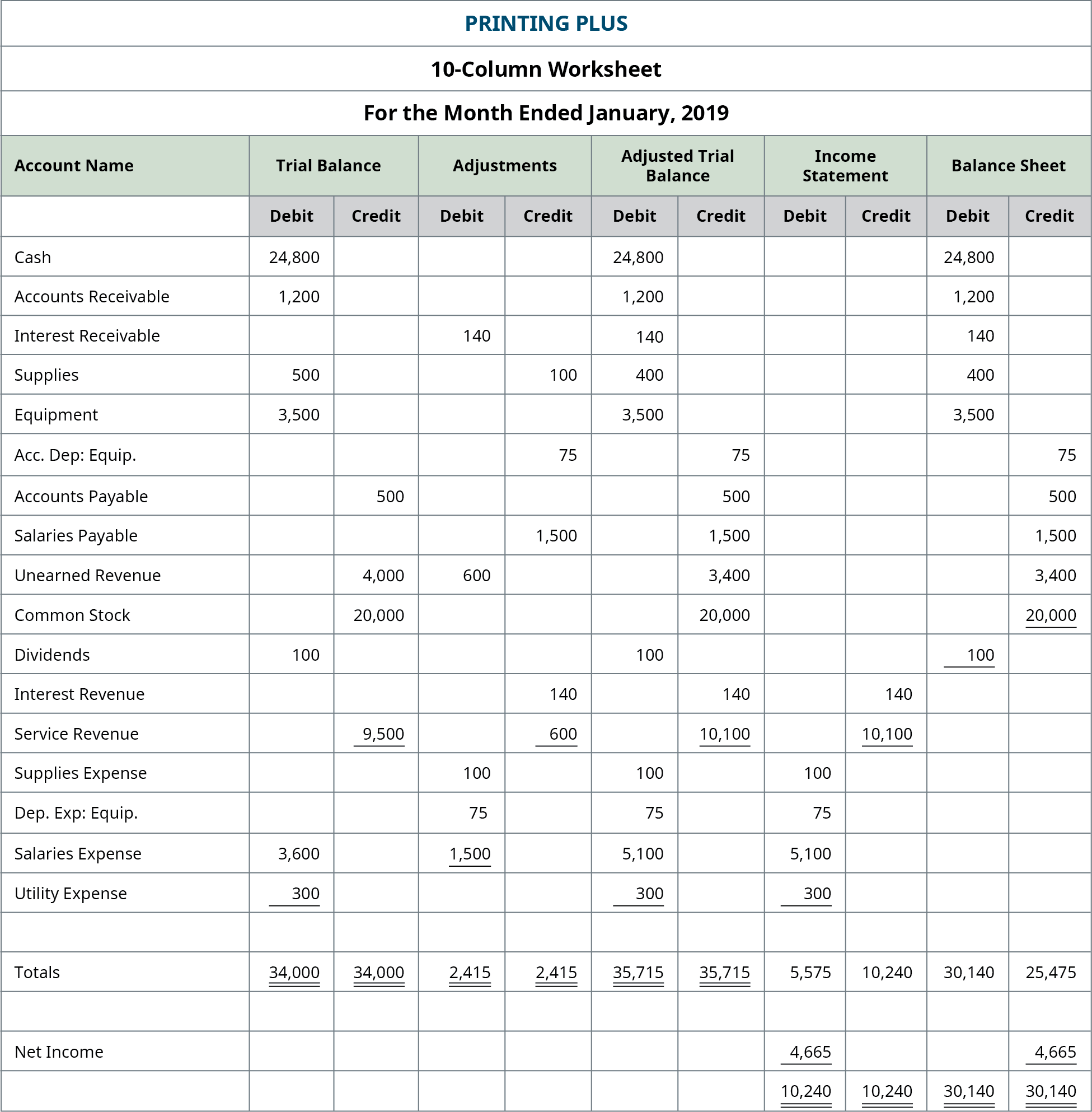

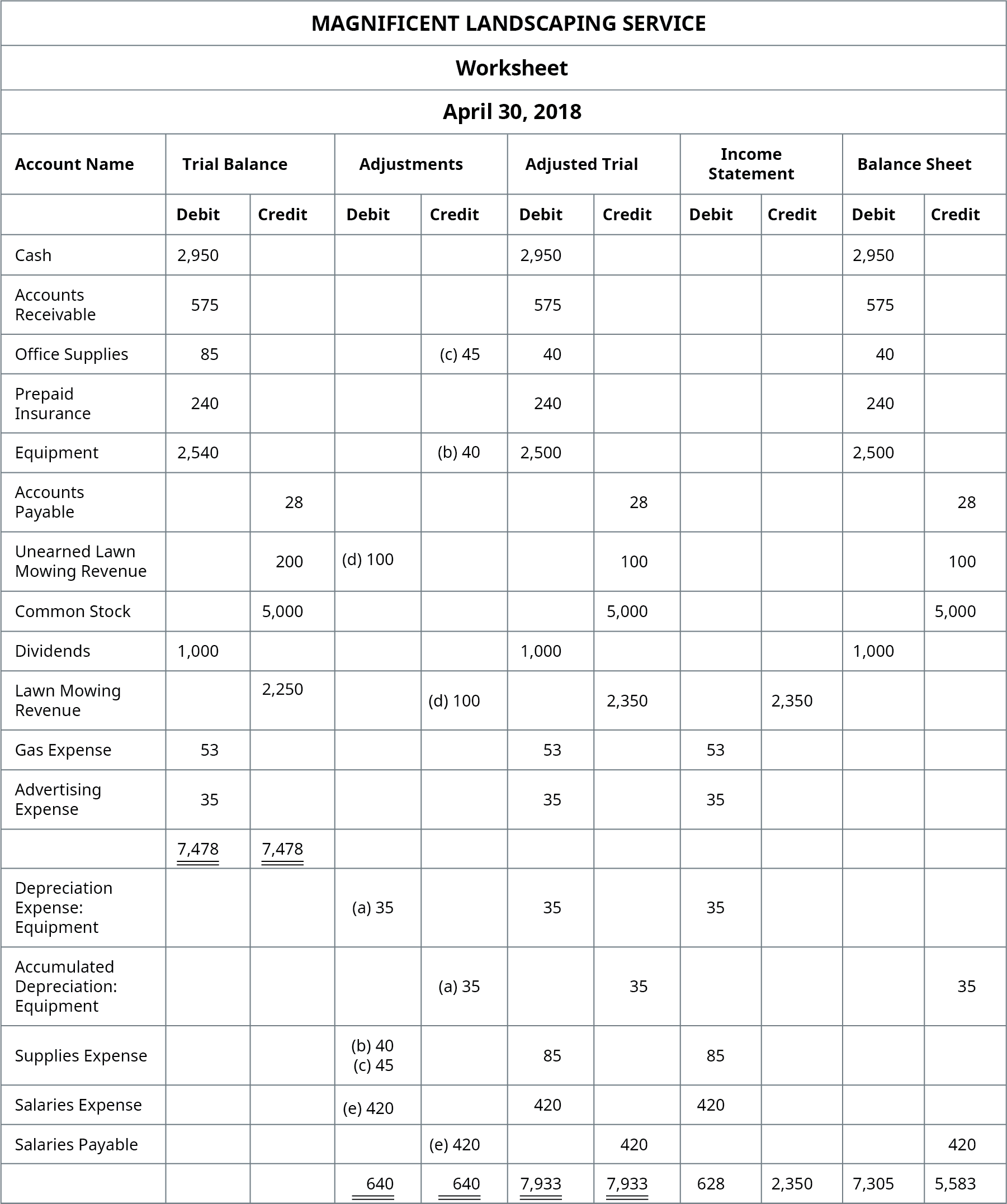

Get a profit of Y. Accounting for qualifying hedging relationships There are three types of hedging relationships. Accounting Worksheet Example We have already covered how Bobs financial statements were prepared and presented. The first party agrees to buy an asset from the second at a specified future date for a price specified immediately. The recognition of a tax liability or tax asset based on the estimated amount of income taxes.

Source: pinterest.com

Source: pinterest.com

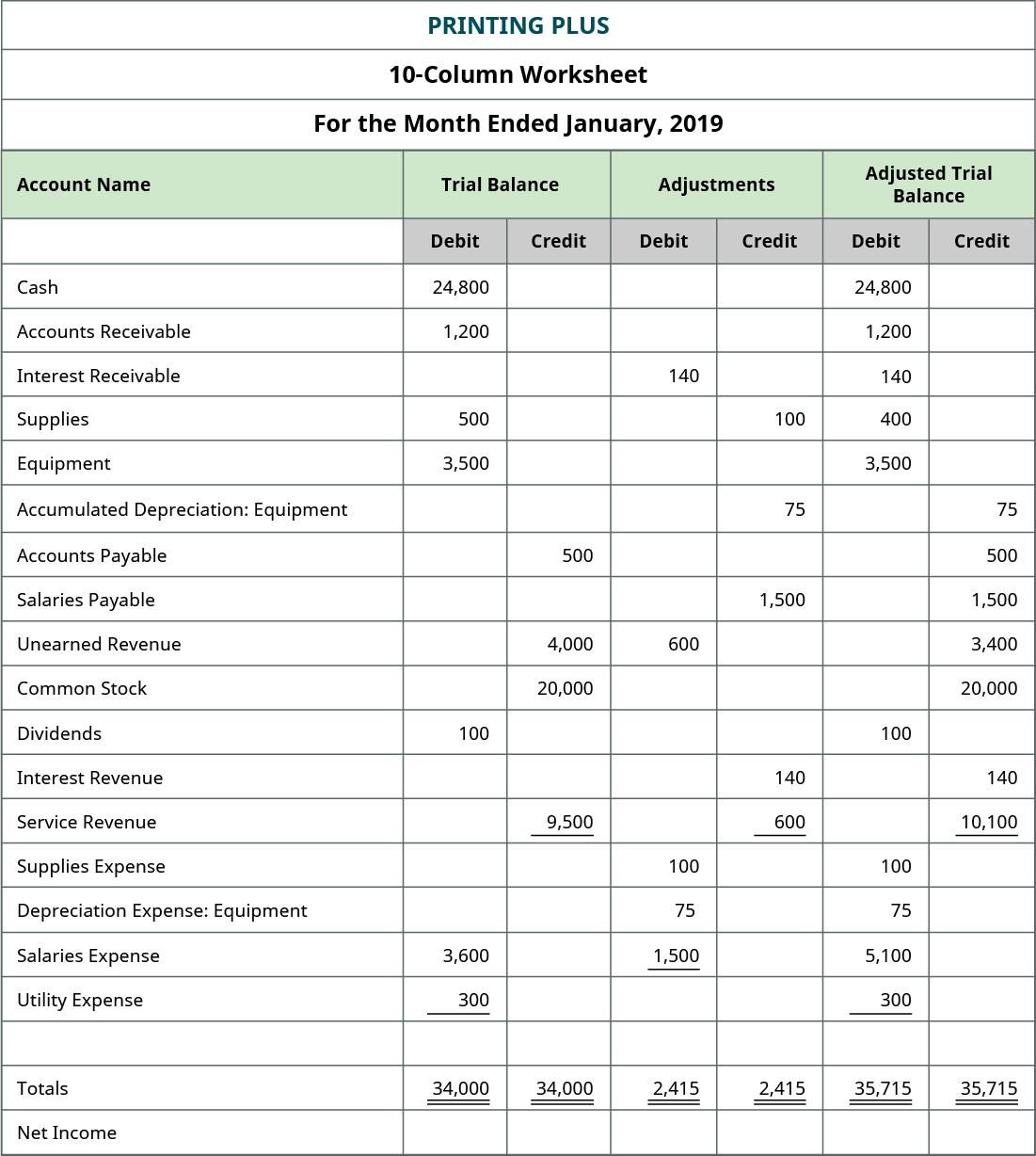

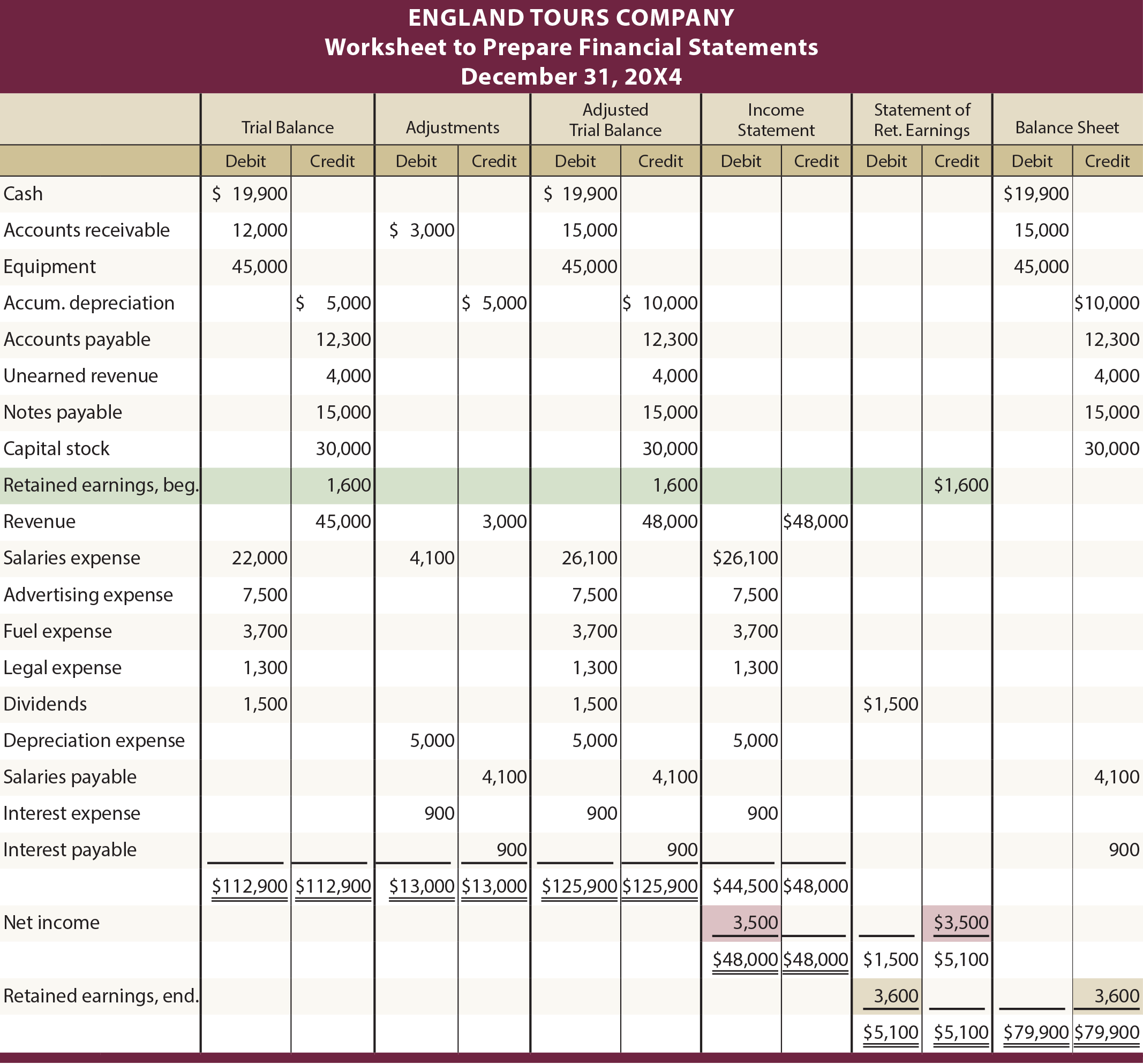

Accounting Worksheet Example We have already covered how Bobs financial statements were prepared and presented. Entries Disclosures Treatment Worksheet 1. The next step for Bobs bookkeeper is to create an accounting worksheet to ensure that all of it ties together. The first party agrees to buy an asset from the second at a specified future date for a price specified immediately. In item 7 are specified under B Other assessable income and W Non-deductible expenses.

Source: accountancyknowledge.com

Source: accountancyknowledge.com

An _____ is a future sacrifice of economic benefit that arises from a past transaction or event. For a sole trader the profit for the year is simply transferred to the credit side of the proprietors capital account the double entry is completed by a debit entry in the income. In addition the various accounting standards have different disclosure requirements. Fair value hedge. Take a quick interactive quiz on the concepts in Accounting Treatment for Uncertainty in Income Taxes or print the worksheet to practice offline.

Source: accountancyknowledge.com

Source: accountancyknowledge.com

And it is easier said and done. Accounting for qualifying hedging relationships There are three types of hedging relationships. These practice questions will help you master the. Accounting Treatment- An asset that is fully depreciated and continues to be used in the business will be reported on the balance sheet at its cost along with its accumulated depreciation. For example although the accounting treatment under FRS 101 is broadly the same as IFRS there are fewer disclosure.

Source: wikiaccounting.com

Source: wikiaccounting.com

The first party agrees to buy an asset from the second at a specified future date for a price specified immediately. Use Worksheet 2 to help calculate the total for income-related add-back items at B Other assessable income item 7 and the total for expense-related add-back items at W Non-deductible expenses item 7. It as simple as it sounds. The pensions accounting treatment for defined benefit plans requires. These practice questions will help you master the.

Source: onlineaccountreading.blogspot.com

Source: onlineaccountreading.blogspot.com

Use these Free Templates or Examples to create the Perfect Professional Document or Project. The recognition of a tax liability or tax asset based on the estimated amount of income taxes. These practice questions will help you master the. Accounting Treatment- An asset that is fully depreciated and continues to be used in the business will be reported on the balance sheet at its cost along with its accumulated depreciation. The pensions accounting treatment for defined benefit plans requires.

Source: opentextbc.ca

Source: opentextbc.ca

The Accounting Equation Assets Liabilities Owners Equity means that the total assets of the business are always equal to the total liabilities plus equity of the business. Use these Free Templates or Examples to create the Perfect Professional Document or Project. For a sole trader the profit for the year is simply transferred to the credit side of the proprietors capital account the double entry is completed by a debit entry in the income. For example although the accounting treatment under FRS 101 is broadly the same as IFRS there are fewer disclosure. And it is easier said and done.

Source: pinterest.com

Source: pinterest.com

Stay tuned to BYJUS to learn. Use these Free Templates or Examples to create the Perfect Professional Document or Project. The accounting for depreciation requires an ongoing series of entries to charge a fixed asset to expense and eventually to derecognize it. It as simple as it sounds. Subtractions from T Total profit or loss item 6 not covered by.

Source: chegg.com

Source: chegg.com

The accounting for depreciation requires an ongoing series of entries to charge a fixed asset to expense and eventually to derecognize it. An _____ is a future sacrifice of economic benefit that arises from a past transaction or event. Fair value hedge. In addition the various accounting standards have different disclosure requirements. It as simple as it sounds.

Source: iedunote.com

Source: iedunote.com

The first party agrees to buy an asset from the second at a specified future date for a price specified immediately. The Accounting Equation Assets Liabilities Owners Equity means that the total assets of the business are always equal to the total liabilities plus equity of the business. Stay tuned to BYJUS to learn. In addition the various accounting standards have different disclosure requirements. It as simple as it sounds.

Source: opentextbc.ca

Source: opentextbc.ca

These entries are designed to reflect the ongoing usage of fixed assets over time. Accounting Treatment- An asset that is fully depreciated and continues to be used in the business will be reported on the balance sheet at its cost along with its accumulated depreciation. The next step for Bobs bookkeeper is to create an accounting worksheet to ensure that all of it ties together. An accounting worksheet can simply be defined as a tool that helps bookkeepers and accountants to complete the accounting cycle and prepare year-end reports in a manner similar to unadjusted trial balances adjusting journal entries as well as year-end financial statements. Accounting for qualifying hedging relationships There are three types of hedging relationships.

Source: pinterest.com

Source: pinterest.com

In item 7 are specified under B Other assessable income and W Non-deductible expenses. Print Liabilities Contingencies. In item 7 are specified under B Other assessable income and W Non-deductible expenses. Determine the fair value of the assets and liabilities of the pension plan at the end of the year Determine the amount of pension expense for the year to be reported on the income statement. These practice questions will help you master the.

Source: opentextbc.ca

Source: opentextbc.ca

The next step for Bobs bookkeeper is to create an accounting worksheet to ensure that all of it ties together. Use Worksheet 2 to help calculate the total for income-related add-back items at B Other assessable income item 7 and the total for expense-related add-back items at W Non-deductible expenses item 7. It as simple as it sounds. Fair value hedge. In item 7 are specified under B Other assessable income and W Non-deductible expenses.

Source: accountancyknowledge.com

Source: accountancyknowledge.com

These entries are designed to reflect the ongoing usage of fixed assets over time. A hedge of the exposure to changes in fair value of a recognised asset or liability or an unrecognised firm commitment or a component of any such item that is attributable to a particular risk and could affect profit or loss or OCI in the case of an equity instrument designated as. These practice questions will help you master the. Print Liabilities Contingencies. 44116821 Accounting Treatment 44116822 Depreciation 4411683 Extraordinary and Casualty Losses 44116831 Interplay of IRC 162 and IRC 165 for Casualty Repair Expenses 44116832 Single Identifiable 441.

Source: iedunote.com

Source: iedunote.com

And it is easier said and done. The first party agrees to buy an asset from the second at a specified future date for a price specified immediately. And it is easier said and done. Stay tuned to BYJUS to learn. 44116821 Accounting Treatment 44116822 Depreciation 4411683 Extraordinary and Casualty Losses 44116831 Interplay of IRC 162 and IRC 165 for Casualty Repair Expenses 44116832 Single Identifiable 441.

Source: principlesofaccounting.com

Source: principlesofaccounting.com

For example although the accounting treatment under FRS 101 is broadly the same as IFRS there are fewer disclosure. Take a quick interactive quiz on the concepts in Accounting Treatment for Uncertainty in Income Taxes or print the worksheet to practice offline. An _____ is a future sacrifice of economic benefit that arises from a past transaction or event. The recognition of a tax liability or tax asset based on the estimated amount of income taxes. Free Download of Basic Accounting Sample Worksheet Template Document available in PDF Google Sheet EXCEL format.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title worksheet accounting treatment by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.