Your Worksheet model for deferred income tax accounting images are available in this site. Worksheet model for deferred income tax accounting are a topic that is being searched for and liked by netizens today. You can Find and Download the Worksheet model for deferred income tax accounting files here. Find and Download all free vectors.

If you’re searching for worksheet model for deferred income tax accounting images information related to the worksheet model for deferred income tax accounting keyword, you have pay a visit to the ideal blog. Our site frequently gives you hints for viewing the maximum quality video and image content, please kindly surf and find more informative video articles and images that fit your interests.

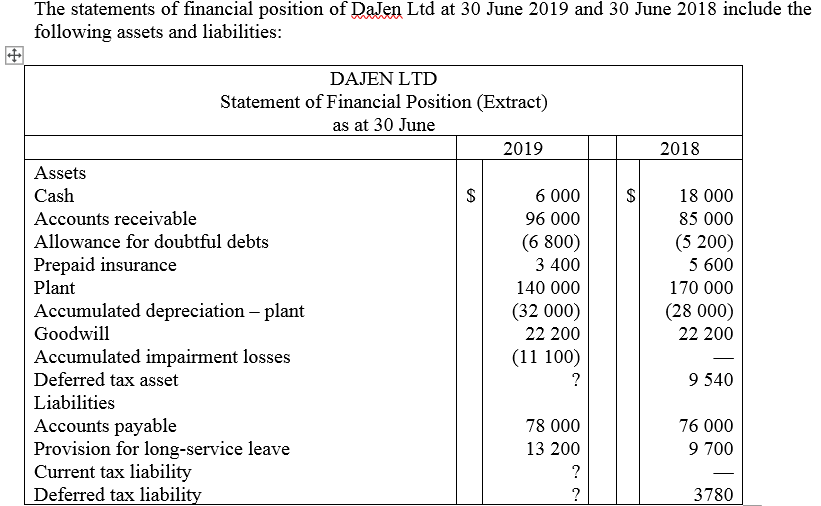

Worksheet Model For Deferred Income Tax Accounting. Tax Effect Accounting Toolkitto derive these balances. Im very proud to publish the first guest post ever in this website written by Professor Robin Joyce FCCA who will explain. Accounting for Income Taxes covers the essential guidelines to be followed when dealing with temporary differences carrybacks and carryforwards and whether to recognize deferred tax. See Six-step approachfor a detailed explanation page 16.

Deferred Income Tax Definition Example How To Calculate From wallstreetmojo.com

Deferred Income Tax Definition Example How To Calculate From wallstreetmojo.com

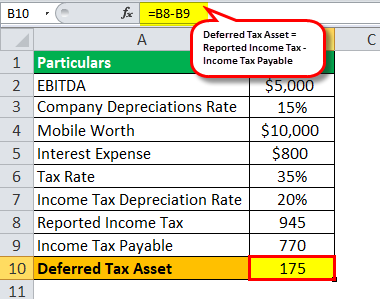

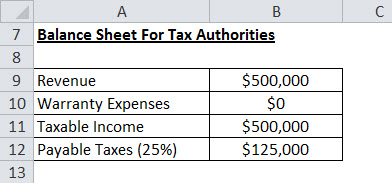

Deferred tax is neither deferred nor tax. Deferred Taxes STEP 16 Alternative Minimum Tax AMT Fully Diluted Shares Outstanding We compute the deferred tax expense or benefit in each period as the difference between the cash taxes payable to tax authorities and the tax expense computed for book accounting purposes in prior steps. Ps income tax rate for all periods is 25 P also has a taxable temporary difference TTD reversing in 2016. But the rules are becoming more challenging as businesses become more complex. We consider some of the more guide. Worksheet 2 caters for those items that reconcile T Total profit or loss item 6 with T Taxable income or loss item 7 other than those items specifically included in item 7.

In addition as the entity does not satisfy the probable test it is unable to recognise a deferred tax asset in relation to some of its tax losses.

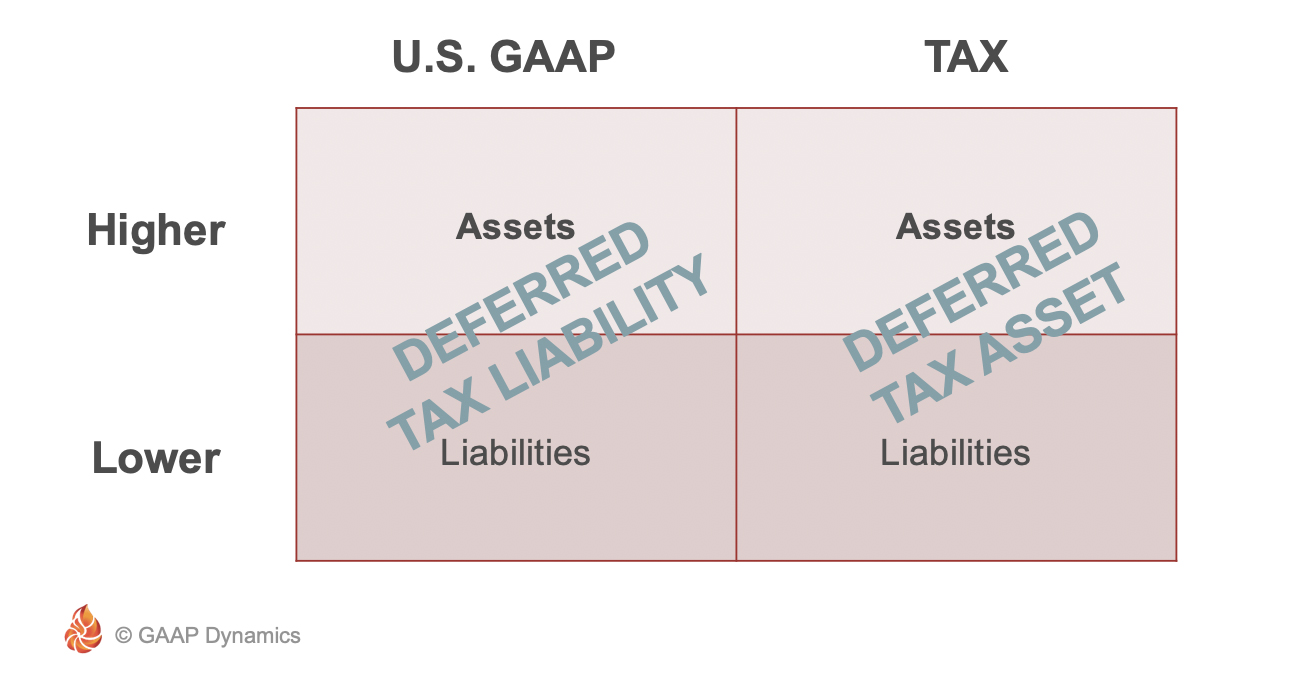

Worksheet 2 caters for those items that reconcile T Total profit or loss item 6 with T Taxable income or loss item 7 other than those items specifically included in item 7. Future tax consequences which give rise to deferred tax assets or deferred tax liabilities AASB 112 adopts a tax-effect method which is based on the assumption that the income tax expense in financial statements is not equal simply to the current tax liability but is also a function of the entitys deferred tax liabilities and deferred tax assets. These reporting variations are due to differences between the accounting standards and tax regulations. The following data were obtained to prepare 1993s worksheet for accounting for deferred income taxes. Gary Kabureck a member of the Board explains what the Board is proposing and why. But the rules are becoming more challenging as businesses become more complex.

Source: gaapdynamics.com

Source: gaapdynamics.com

These reporting variations are due to differences between the accounting standards and tax regulations. These reporting variations are due to differences between the accounting standards and tax regulations. This book incorporates the new tax rates and other impacts of the Tax Cuts and Jobs Act and will assist you in understanding FASB ASC 740Income Taxes and how it establishes guidelines for accounting for income taxes including income tax. IAS 12 prescribes the accounting treatment for income taxes being the accounting for the current and future tax consequences of. A proposal for new income tax accounting principles Temporary difference Approach Method Thresholds Measurement Book-First Balance sheet Partial The same for DTA DTL.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

Im very proud to publish the first guest post ever in this website written by Professor Robin Joyce FCCA who will explain. See Six-step approachfor a detailed explanation page 16. Ps income tax rate for all periods is 25 P also has a taxable temporary difference TTD reversing in 2016. These reporting variations are due to differences between the accounting standards and tax regulations. Deferred Taxes STEP 16 Alternative Minimum Tax AMT Fully Diluted Shares Outstanding We compute the deferred tax expense or benefit in each period as the difference between the cash taxes payable to tax authorities and the tax expense computed for book accounting purposes in prior steps.

Source: slidetodoc.com

Source: slidetodoc.com

Deferred tax is neither deferred nor tax. Worksheet 2 caters for those items that reconcile T Total profit or loss item 6 with T Taxable income or loss item 7 other than those items specifically included in item 7. Tax Effect Accounting Toolkitto derive these balances. Deferred income tax expense benefit for the reporting period ending March 31 2021 is generally measured in this worksheet as the change in the institutions net deferred tax assets or liabilities during the year-to-date period. Determine your starting balances at the beginning of the 2005 financial.

Deferred tax is neither deferred nor tax. Worksheet 2 caters for those items that reconcile T Total profit or loss item 6 with T Taxable income or loss item 7 other than those items specifically included in item 7. This book incorporates the new tax rates and other impacts of the Tax Cuts and Jobs Act and will assist you in understanding FASB ASC 740Income Taxes and how it establishes guidelines for accounting for income taxes including income tax. Deferred tax accounting involves the application of tax as well as of accounting knowledge. January 1 1993 balances.

Source: accountingclarified.com

Source: accountingclarified.com

What is deferred tax. But the rules are becoming more challenging as businesses become more complex. Future tax consequences which give rise to deferred tax assets or deferred tax liabilities AASB 112 adopts a tax-effect method which is based on the assumption that the income tax expense in financial statements is not equal simply to the current tax liability but is also a function of the entitys deferred tax liabilities and deferred tax assets. The example also shows the tax treatment of hedge accounting for derivatives. It is an accounting measure more specifically an accrual for tax.

Source: gaapdynamics.com

Source: gaapdynamics.com

But the rules are becoming more challenging as businesses become more complex. 30 31 Dec 2015 31 Dec 2016 1 Jul 2015 Expected tax loss on bottom line of tax return. 7 Model for making deferred taxes relevant Table 2. Worksheet 2 caters for those items that reconcile T Total profit or loss item 6 with T Taxable income or loss item 7 other than those items specifically included in item 7. A proposal for new income tax accounting principles Temporary difference Approach Method Thresholds Measurement Book-First Balance sheet Partial The same for DTA DTL.

Source: double-entry-bookkeeping.com

Source: double-entry-bookkeeping.com

Deferred income tax expense benefit for the reporting period ending March 31 2021 is generally measured in this worksheet as the change in the institutions net deferred tax assets or liabilities during the year-to-date period. Accounting for Income Taxes covers the essential guidelines to be followed when dealing with temporary differences carrybacks and carryforwards and whether to recognize deferred tax. It does not contain an exhaustive list of reconciliation items. In addition as the entity does not satisfy the probable test it is unable to recognise a deferred tax asset in relation to some of its tax losses. But the rules are becoming more challenging as businesses become more complex.

Source: gaapdynamics.com

Source: gaapdynamics.com

A proposal for new income tax accounting principles Temporary difference Approach Method Thresholds Measurement Book-First Balance sheet Partial The same for DTA DTL. Deferred tax is neither deferred nor tax. In addition as the entity does not satisfy the probable test it is unable to recognise a deferred tax asset in relation to some of its tax losses. Determination of Income Tax Expense Provision for Deferred Income Tax and Future Income Tax Benefit10 The amount of the income tax expense attributable to the transactions included in the profit and loss account for a. Worksheet 2 caters for those items that reconcile T Total profit or loss item 6 with T Taxable income or loss item 7 other than those items specifically included in item 7.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

In addition as the entity does not satisfy the probable test it is unable to recognise a deferred tax asset in relation to some of its tax losses. 20 Deductible temporary. The future recovery settlement of the carrying amount of assets liabilities that are recognised in. 30 31 Dec 2015 31 Dec 2016 1 Jul 2015 Expected tax loss on bottom line of tax return. See Six-step approachfor a detailed explanation page 16.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

IAS 12 prescribes the accounting treatment for income taxes being the accounting for the current and future tax consequences of. Tax Effect Accounting Toolkitto derive these balances. The future recovery settlement of the carrying amount of assets liabilities that are recognised in. This book incorporates the new tax rates and other impacts of the Tax Cuts and Jobs Act and will assist you in understanding FASB ASC 740Income Taxes and how it establishes guidelines for accounting for income taxes including income tax. Accounting for Income Taxes covers the essential guidelines to be followed when dealing with temporary differences carrybacks and carryforwards and whether to recognize deferred tax.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

Deferred tax asset 0 Deferred tax liability 4. A complicated accounting model FASB ASC 740 has been around for a while. It is an accounting measure more specifically an accrual for tax. 20 Deductible temporary. Determine your starting balances at the beginning of the 2005 financial.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

These reporting variations are due to differences between the accounting standards and tax regulations. Future tax consequences which give rise to deferred tax assets or deferred tax liabilities AASB 112 adopts a tax-effect method which is based on the assumption that the income tax expense in financial statements is not equal simply to the current tax liability but is also a function of the entitys deferred tax liabilities and deferred tax assets. This book incorporates the new tax rates and other Income Taxes. Deferred Taxes STEP 16 Alternative Minimum Tax AMT Fully Diluted Shares Outstanding We compute the deferred tax expense or benefit in each period as the difference between the cash taxes payable to tax authorities and the tax expense computed for book accounting purposes in prior steps. 20 Deductible temporary.

Source: chegg.com

Source: chegg.com

A proposal for new income tax accounting principles Temporary difference Approach Method Thresholds Measurement Book-First Balance sheet Partial The same for DTA DTL. But the rules are becoming more challenging as businesses become more complex. Its requirements can therefore be challenging and the more complex areas require careful analysis. A proposal for new income tax accounting principles Temporary difference Approach Method Thresholds Measurement Book-First Balance sheet Partial The same for DTA DTL. A complicated accounting model FASB ASC 740 has been around for a while.

Source: gaapdynamics.com

Source: gaapdynamics.com

Deferred tax asset 0 Deferred tax liability 4. 30 31 Dec 2015 31 Dec 2016 1 Jul 2015 Expected tax loss on bottom line of tax return. These reporting variations are due to differences between the accounting standards and tax regulations. 20 Deductible temporary. A complicated accounting model FASB ASC 740 has been around for a while.

Source: footnotesanalyst.com

Source: footnotesanalyst.com

Deferred tax accounting involves the application of tax as well as of accounting knowledge. Determination of Income Tax Expense Provision for Deferred Income Tax and Future Income Tax Benefit10 The amount of the income tax expense attributable to the transactions included in the profit and loss account for a. Accounting for Income Taxes covers the essential guidelines to be followed when dealing with temporary differences carrybacks and carryforwards and whether to recognize deferred tax. But the rules are becoming more challenging as businesses become more complex. The liability is created not due to Company defaulting on its tax liabilities but due to timing mismatch or accounting provisions which causes less tax.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

What is deferred tax. The liability is created not due to Company defaulting on its tax liabilities but due to timing mismatch or accounting provisions which causes less tax. But the rules are becoming more challenging as businesses become more complex. 7 Model for making deferred taxes relevant Table 2. What is deferred tax.

Source: investopedia.com

Source: investopedia.com

Im very proud to publish the first guest post ever in this website written by Professor Robin Joyce FCCA who will explain. The example also shows the tax treatment of hedge accounting for derivatives. Deferred tax is neither deferred nor tax. This book incorporates the new tax rates and other impacts of the Tax Cuts and Jobs Act and will assist you in understanding FASB ASC 740Income Taxes and how it establishes guidelines for accounting for income taxes including income tax. Deferred income tax expense benefit for the reporting period ending March 31 2021 is generally measured in this worksheet as the change in the institutions net deferred tax assets or liabilities during the year-to-date period.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

This book incorporates the new tax rates and other Income Taxes. The example also shows the tax treatment of hedge accounting for derivatives. The liability is created not due to Company defaulting on its tax liabilities but due to timing mismatch or accounting provisions which causes less tax. This book incorporates the new tax rates and other Income Taxes. Deferred tax accounting involves the application of tax as well as of accounting knowledge.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title worksheet model for deferred income tax accounting by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.